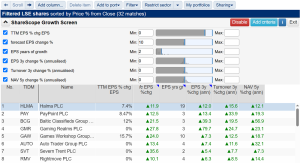

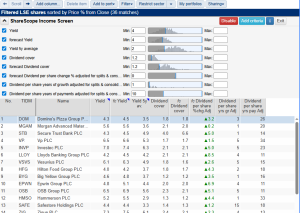

Looking to build reliable cash flow with ShareScope? We’ve created this Income Stock Screening Guide to go with our off-the-shelf Income Screen to help you learn how to spot them. It’s designed to highlight the key signals we believe matter when searching for sustainable, high-quality income. ShareScope subscribers can apply this screen at the click of a button […]