In this editorial, Elric of Small Company Champion discusses how ESG will impact our lives, our investments, and Corporates’ role in the implementation and consequences of attempts to bypass ESG and one Small Company that is helping fund managers navigate and build wealth through the use of AI.

Regular readers of Small Company Champion will be aware I have written about AI. and ESG when discussing companies we think have a store of value in the future. Both AI and ESG are vital components that are taking control of our lives, and big decisions are being made, often without our knowledge – in some cases, we are waking up to the impact of ESG in particular. You may find some of my comments concerning, good because it is essential to discuss what is developing before us. We must be fully aware of what governments and big corporations have planned for us all and how it will affect our living standards and investment decisions against the fund manager’s role in our pensions.

There is an exciting future, but not all in the garden is rosy!

Without getting too political – we have seen the constantly rising cost of energy at home and the forecourts – the impact of inflation. These are not direct consequences of Putin v Ukraine but poorly handled ESG goals by the USA administration’s eagerness to rush through their green policies, followed by the UK Government, to a lesser extent. Moreover, using the war as cover, an excuse to point the blame elsewhere. “You will own nothing (by 2030) and be happy!”

I agree we need to take care of our planet, so I believe the green revolution developing EVs is a great idea if only to preserve a finite fossil resource we take for granted. I am sure many of us have chased the oil rig pipe-dream of black gold riches through our investment hobbies. Still, these are becoming a thing of the past as more influential bodies steer investors away from investing in fossil-related energy. Unfortunately, it was the small caps Companies that suffered first. Obtaining funding has become more problematic, but the big blue-chip Corporations are in the cross-airs. They know it, too, because they are seeking to adapt to the move away from fossil fuel, to a supporting role in the EV infrastructures, in some cases.

Many institutions are adopting AI in investment funds, but getting information on this isn’t easy.

However, we do know AI and ESG go hand-in-glove. The money flooding into ESG initiatives is growing YoY, has the backing of governments, and is influenced by the USA s SEC. However, the globally recognised IFRS accounting standard the USA is yet to adopt.

Greenwashing is a crime.

The pace of changing investment environment is startling – getting caught cooking the ESG data is a severe offence and requires a finely tuned PR machine to help reclaim some lost credibility. Deutsche Bank has signalled to all its suppliers that a big shake-up is on the horizon. All companies with contracts over €500,000 that service the bank, supply or service it must undergo an ESG assessment, which requires a minimum standard ESG score. Deutsche Bank is not the first to bow to highly influential power-brokers; it will not be the last, and the world of finance is taking steps to ride the ESG wagon.

Diana Rose, head of research at INSIG, took the time to explain how the regulatory landscape in the investment and corporate world is changing. But unfortunately, some companies and fund managers may not be ready for the ESG pitfalls.

The regulatory landscape is changing fast, as you say. We believe that Insig AI is in a powerful position to support financial institutions at this time and going forward, as regulation is set to keep tightening in the US, Europe and UK. There are two aspects to greenwashing as I see it – corporate and financial – the regulators are gaining traction in clamping down on both, and Insig’s offering is relevant to both.

Firstly, the financial side. Hot off the back of the SEC issuing a $1.5m fine to BNY Mellon Investment Adviser for misleading investors on their ESG funds last month, over here in Europe, 50 officers from the German police and financial regulator BaFin raided the DWS’s offices in Frankfurt. Having been brewing since last year’s whistle-blower came out, the pain was felt at the very top of the business, with the Chief Exec resigning the next day.

These investigations may be the first of their kind, but they absolutely won’t be the last. Indeed, Goldman Sachs is apparently next in line for being landed in hot water. The SEC’s green-washing task force is on a mission, and the reputations of financial institutions are on the line.

What constitutes green-washing is still being worked out as ‘ESG integration’ and ‘ESG assessment’ have been open to interpretation to date. For example, BNY Mellon got into trouble for claiming they’d put a more significant number of funds through an ESG process than they had. As more cases come to light, I expect to see more around the quality and transparency of the ESG process itself and funds forced to back out of ESG labels or up their game.

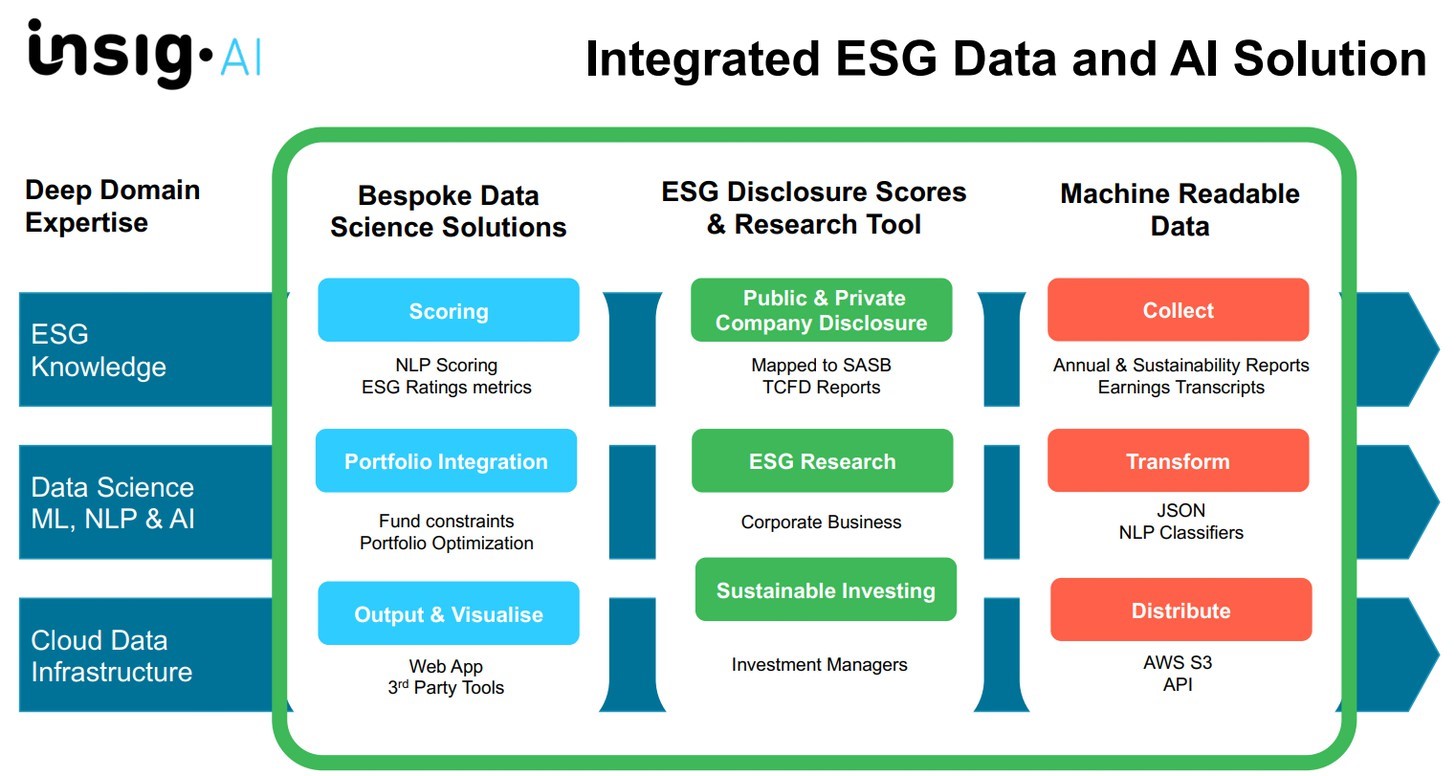

This is where Insig AI’s technology tools support investors in future-proofing their ESG strategies from increasing scrutiny and rising expectations. Our bespoke solutions centre around sophisticated modelling of ESG data to bring auditability and structure to justify ESG-based decisions. Our ESG Research Tool equips investment managers and their teams of ESG analysts with AI-enabled powers. This helps them go beyond relying on 3rd party ESG scores and build their own proprietary analysis methods. The tool complements other data sources such as rating providers and takes the researcher to the source of fundamental ESG evidence – corporate disclosures.

This leads us to the other side of green-washing – corporate. In April, the SEC charged mining company Vale with making misleading claims around dam safety ahead of a 2019 dam collapse which did devastating social and environmental harm. In addition, the SEC accused Vale of false claims in their publicly disclosed sustainability reports and misleading investors.

“Many investors rely on ESG disclosures like those contained in Vale’s annual sustainability reports and other public filings to make informed investment decisions,” said Gurbir Grewal, director of the SEC’s division of enforcement, at the time of the charge. “By allegedly manipulating those disclosures, Vale compounded the social and environmental harm caused by the Brumadinho dam’s tragic collapse and undermined investors’ ability to evaluate the risks posed by Vale’s securities.” (extract taken from FT’s Sustainable Views)

Insig AI’s ESG Research Tool is a unique and powerful weapon for identifying green-washing (as well as positive leadership on ESG issues) and holding companies accountable. This is reasonable due diligence as part of a financial institution’s ESG assessment process to protect themselves and justify decisions. But it is also relevant for investors to take an active approach to engagement and stewardship. Many experts hold stewardship as the gold standard and potentially ‘the future direction’ of meaningful and profitable ESG investment.

The ESG Research Tool combines a centralised, complete database of corporate reports and ESG documents since 2015, with ESG expert-trained AI tools to surface relevant disclosures around 15 ESG issues and a powerful search engine. Comparing a company’s peer group disclosures over time is key in understanding a company’s ESG profile.

For example, is the Company leading or lagging its peers in aligning with leading frameworks such as the TCFD, or is it reporting one year against previous commitments and targets? These sorts of insight are prohibitively difficult to gain manually by sifting through mountains of reports. Instead, the Research Tool can instantly surface meaningful, comparable disclosures from a high level down to comparing reports and even sentence by sentence.

When we designed our approach to tackling the challenges in ESG assessment, we recognised that the lack of regulation allowed investors to adopt a huge range of approaches and methods as they rushed into the space. It’s a fast-evolving and competitive space filled with no perfect or complete solution, and this is partly why both investment and corporate green-washing have been able to happen. We’ve designed our tools believing that robust ESG assessment and research methods based on the best available evidence are going to be needed more and more and that our products can serve financial institutions as they keep up with and look to get ahead of investor demands and regulation.

How many index funds focus on ESG investing?

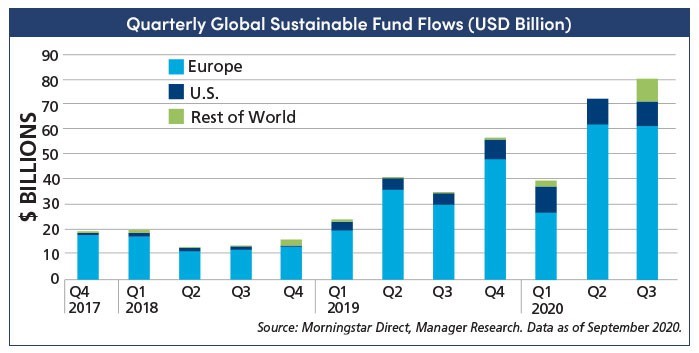

The financial research firm said that as of the end of the second quarter of 2020, 534 index funds focused on sustainability, worth over $250 billion. In the US, which has lagged Europe in ESG investing, assets in sustainable index funds have quadrupled in the last three years, and the UK represent 20% of the total.

Global ESG assets are on track to exceed $53 trillion by 2025, representing over a third of the $140.5 trillion projected total assets under management. A perfect storm created by the pandemic and the green recovery in the US, EU and China will likely reveal how ESG can help assess new financial risks and harness capital markets. Source: Bloomberg

How did Europe’s ESG ETFs grow in 2020?

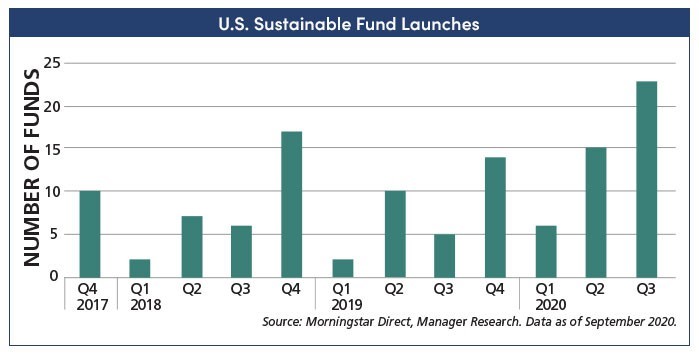

According to Morningstar, the region’s ESG mutual funds and ETFs hit the $1.1 trillion milestones in 2020, accounting for almost 10% of total European fund assets. Growth was spurred by both client demand and an unprecedented level of product development, with 330 ESG funds launched during the year through 3Q — more than 100 a quarter.

According to research by Charles Stanley in February 2020, almost half of UK investors (48%) expect to increase their ESG investments over the next three years. Furthermore, one in six UK investors (17%) plan to increase their ESG investments significantly.

Insig AI is the market-leading platform for aggregating and analysing ESG company information for better and quicker responsible investment decisions and portfolio optimisation.”

The graph below demonstrates recent trends for Global Sustainable Funds in $s

How does ESG Investing perform?

“The average outperformance of sustainable funds in the first quarter globally has also helped alleviate some investors’ concerns about a potential return trade-off in sustainable strategies.”

ESG investing growth has been attributed to Millennials. But Allianz research suggests that there is broad-based interest with 71% of Gen Xers and 69% of Boomers agreeing with 81% of Millennials that “ESG is not just an investment strategy to feel good about, but one that makes long-term financial sense.”3

The asset management community has responded to this interest by launching new products adhering to ESG investing principles, including 53 sustainable funds in the U.S. through the third quarter of 2020 – Morningstar.

I believe the Company will almost certainly benefit from ESG control as an era of green-washing clampdown becomes more focused on corporations’ deceptive behaviour comes under scrutiny. However, the Company reinvented itself last year, and some investors struggle to understand the seemingly complex nature of what the Company does. It is a very early stage of commercialising its proprietary technology, but there are signs it is building momentum.

Insig Chairman Richard Bernstein explained it to me: “preventing green-washing is Insig’s sweet spot. Our machine learning tools can home in on the detail of what has been disclosed, not only against its peer group over time?”

Richard continues, As ESG standards have been raised, directors of both funds and companies might conclude that access to Insig AI’s ESG scoring and data is an insurance policy to protect against litigation and wrongdoing. Whilst these bodies can easily afford a $10 million fine, the reputational damage to both a corporation and its executives is to be avoided at all costs.

Insig AI has built a platform where its machine learning technology can be applied to areas including fraud detection as well as ESG. Currently, the focus is on ESG. An example of ESG’s importance was lit bold when EV maker Tesla was dumped out of the S&P 500 this month. Who would have thought? Not me!

What was Tesla’s ESG crime?

Diana Rose explained, In a nutshell, S&P explained that “while Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens”.

There are a few areas where it got a black mark – in summary; a lack of a low-carbon strategy, fines relating to emissions and waste, racism and poor working conditions in a factory in California, codes of business conduct, and handling of an investigation into the safety of its driver-assistance technology. Of course, some Musk supporters claim this is a politically motivated hack, but the less ventured in the regard, the better.

Tesla’s index relegation has severe consequences and knock-on effects on investors, index funds, pensions, etc. However, I believe INSIG AI has significant potential for the future as more financial institutions adopt its proprietary AI designed to help Corporations navigate the complex minefield of ESG, where being ESG an and compliant Company is no longer an excuse for complacency. Large corporations are being forced to look under the bonnet of their suppliers and partners by scoring them, just like we are credit scored before a loan, which is having a dramatic impact on businesses, investing and our lives are impacted by good and not so good, lighter bank accounts.

Are you still with me!

ESG has been described as a gravy train built on net-zero goals, and ESG is the vehicle of choice designed to take us for a green revolutionary ride. That destination is fiscal poverty control by big corporations and governments if they continue as they are today without appropriate planning. It is difficult to argue otherwise as we see our living costs rise faster than I can remember.

I will give you a tip, or should I say, heads up. I am already a shareholder in Insig AI (INSG). I plan to add to my modest holding because it is exceptionally well placed to reap significant rewards from the ESG phenomena.

I used to think ESG was just another standard for more ethical investing and being a good person by respecting the environment and people and the rule of law. But, if you believe this, you are just as wrong as I learned.

ESG is becoming a standard against which corporations and we, the people, will be measured. But, of course, we are familiar with the drive to net-zero (turkeys voting for Christmas), and the battle against natural resources, be they oil, gas, or clean gas, is frowned upon, and god forbid we go nuclear. But, of course, we can’t keep burning wood or coal. So, what is the answer? Wind, solar? Good luck with that!

2020 witnessed a surge in EV, the spin suitable for the environment. But wait, where does the electricity come from, and what of the increased capacity needed to achieve government targets?

Good luck with that as well! Never mind this; you have bigger things to be concerned about. Oh really, do you care to get on with it!

As I said, ESG will be a standard we are all judged and measured. And if we do not comply with it, guess what? We pay higher taxes or are refused a loan, mortgage, or higher interest rates. Oh, stop it, you conspiracy nut-job!

The Importance of ESG.

If you are still with me, you are about to get a shock unless you are already ahead of me. I have already claimed that ESG will play a significant role in our lives. I said we would be measured. It needs explaining, but I warn you, you will not like it. I will concern myself with the Environmental aspect because Social and Governance will take me down the rabbit hole of wokeism and the antisocial minefield. But I do speak the truth.

We are fast approaching a time when our eco-footprint will be measured; this includes the energy we use, the water we consume and the land we own or rent. We will be punished if we do not comply with the government and extensive corporation ESG policies. Think of it as another credit score. A bad credit score equals higher interest rates, or worse!

More institutional investors are using ESG scores in their investment strategies, and the consequences of a poor rating can be significant. If, for instance, a company receives a poor rating from one ESG data provider, it may be considered an unsustainable asset by investors and excluded from their investment portfolio, relegated from an investment index – ask Elon Musk and Tesla; investors!

INSIG could be one of those little unknown Companies operating under the radar that benefits from the clampdown of green-washing. On the other hand, it could be a godsend to its partners; make no mistake. Insig AI platform aggregates and analysing ESG company information for better and quicker responsible investment decisions and portfolio optimisation. Not only will corporations be seeking assurances from their partners and Companies that service them in any way comply with ESG, but others will also be seeking to use Insig’s AI to maximise their investment opportunities.

We have heard sound-bites from Davos and, more recently, COP26. These events are strategy meetings held by governments and business elites who dream up new ways to put their hands in our pockets to maximise their wealth and power. The hypocrisy of it all it!

Banks and investment firms will use ESG scores to determine what businesses have access to capital and other necessary services like insurance. Do not be fooled into thinking it ends there; it does not. These ESG metrics will also be turned on us. Our eco-footprint will be measured too, and it will be the difference between you getting a loan or mortgage or not. Perhaps a higher interest rate. Yes, yet another tax. There do seem to mount up, do they not?

Are you aware it has already started

ESG scores will not just impact businesses. For example, Merril Lynch already provides an ESG score for individual clients’ investment portfolios. “The purpose behind each person being assigned an individual ESG score is to help reward actions that will help move the world towards sustainability. While there are not currently any downsides to having an ESG score, regardless of how high or how low, there will come a time when too low of a score can result in denials for loans or services, similar to the way credit scores currently function.”

“For now, ESG scores for individuals are used as a tracking tool for companies to monitor behaviour. However, for those who have already started using ESG scores as part of their business model, some people with good scores may notice lucrative offers, easier loan terms, and even targeted packages designed to reward green or sustainable behaviours.”

The actual term for this is not ESG; it is Stakeholder Capitalism – but what is it?

It is not investors, not you or I. Stakeholders are code for governments, businesses, banks, and institutions. It is a system whereby companies are forced to prioritise climate, and social justice causes oversupply, demand, and profit. Essentially, the free market where we are free to spend our hard-earned on products and services we want is coming to an end. We do not realise it yet. We are becoming the product; the mark is probably the better term. We are being manipulated into buying products we do not need, like EVs, EV chargers, solar panels, and environmental products whose only purpose is to incorporate higher taxation to save a planet.

Although ESG metrics are not currently a required part of financial reports for publicly traded companies, many companies proudly include them in their reported statements or a separately issued document. These companies are falling into line because they know the direction of travel and will benefit from government policies; you and I will ultimately pay the price.

Even though there is no requirement to include sustainability goals, corporations are falling over themselves to prove how ESG compliant they are. A quick search on the internet offers a clue. Janet Yellen – USA. State Treasurer: G20 speech: “Over the last several years, ESG investing has increased tremendously. ESG fund assets have grown from $10 billion in 2015 to $246 billion in 2021.” “Similarly, sustainability-linked debt issuances have grown at an annualised rate of 60% over the last eight years.”

“While we have been discussing ESG principles and indicators for infrastructure in the G20, the private sector has launched ESG infrastructure initiatives. I commend these efforts and urge greater collaboration between governments and private sector initiatives as we further identify and refine the metrics most useful for promoting infrastructure investment. We should work together.” Full speech. Do not worry; it will not cost you the $880,000 she usually charges for an address. Does anyone remember the climate Paris agreement of 2015? Buried in the contract was this little beauty.

Article 2.1(c) of the Paris agreement mandates country parties to “make financial flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development.” The scramble for ESG-focused business development and investing will only go one way for the foreseeable future. After that, it will be a survival of the biggest bank balances, which means ESGcompliance big corporations will get even more significant because they have the financial wherewithal to lobby governments and influence decision-makers.

Well done if you got to the end.

Elric Langton of Small Company Champion