Recent flotation Bytes Technology has joined bigger rivals Softcat and Computacenter on the stock market. Richard wants to know what it does differently.

In my last article I introduced Marks Electrical, a company that had recently floated that might be an exception that proves the rule that Initial Public Offerings (IPOs) make terrible investments.

The reason for my sunny disposition was that, unlike many IPOs, Marks Electrical is an established profitable business with a coherent strategy.

Bytes Technology is another established, profitable business that has floated recently. It sells software and hardware to businesses and the public sector. Its main rival is probably Softcat, a company that I have written about before. They have another listed rival in Computacenter (another I have previously profiled). Computacenter focuses more on enterprise customers (the biggest) and probably for that reason it is more international. Bytes’ and Softcat’s meat and drink are small and medium-sized businesses, although Softcat has international offices, largely serving its UK customers.

These companies do not just sell hardware and software, they help organisations decide what they need and bundle it up, replacing many relationships with one, saving them aggro and perhaps money in the process.

IT industry portal Channelweb says Computacenter is the biggest UK IT reseller by revenue, but only by a smidgen. Softcat is the second biggest. Bytes Software Services, a subsidiary of Bytes, comes in at number eight. The company’s other subsidiary is Phoenix Software, which it acquired in 2017. Phoenix is 21st in the list of top resellers.

Bytes Software Services supplies businesses in the main, while Phoenix specialises in the public sector.

It would be unwise and, frankly, difficult to ignore Softcat in any analysis of Bytes because the companies are so similar, partly by intent. In May 2018 Channelweb asked ten resellers which companies they respected the most.

Neil Murphy, then managing director and now chief executive of Bytes nominated Softcat.

“… they have stuck to their guns, they play to their strength, they’ve had great leadership over the last 10 to 15 years and they have great financial controls as a business. We always try to compare ourselves to Softcat. They have set the bar high and we want to try to be as successful as they are. They’re a good model for us to try to emulate.

They have done a good job in broadening out their portfolio, and their services portfolio as well, and they have expanded in a well-planned and well-thought-out way which has been hugely successful. You look at their figures and they’re nothing but impressive. I’m dead jealous!

…There is no one successful model – but Softcat does have a successful model. It depends on the leadership, the quality of the staff, and the culture of the organisation. They have a very strong culture and we like to think our culture is strong too.”

With an endorsement like that, you may be wondering why we should be interested in Bytes when we could take a bite out of Softcat. Perhaps Bytes is improving on the model it admires so much, and maybe it can tell us a bit more about that model than we can learn from Softcat, which has a really exceptional record of profitable organic growth.

Bytes vs Softcat vs Computacenter

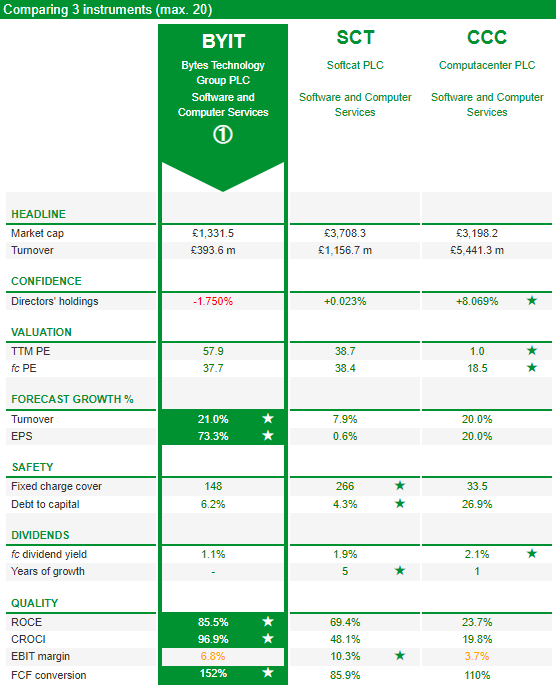

Here is a quick comparison of the three resellers in SharePad:

Source: SharePad > Compare. I have reduced the number of financial items being compared from the SharePad defaults to focus on the most important.

As you can see SharePad picks Bytes as the winner, based simply on the fact that it has the best statistics for five items and Softcat and Computacenter win four times each (count the stars). SharePad stresses this is not a recommendation, it is an ad-hoc comparison.

Many of the statistics require interpretation too.

Turnover is not the only measure of an IT reseller’s sales performance because generally it only includes the net income earned from software, it does not include the cost of software paid to Microsoft or Amazon, say, by the reseller. That is because software is rarely supplied as a physical product so the reseller does not take ownership of it. It acts as an agent of the software vendor who supplies it as a service over the Internet. Were we to use the gross invoiced income, Bytes would be a bigger business in comparison to the other two because it sells a higher proportion of software in comparison to hardware. It still would not be much more than a third of the size of Softcat though.

The dramatic growth in Earnings Per Share (EPS) predicted for Bytes is mostly the result of costs relating to the IPO and the acquisition of Phoenix, both of which suppressed profit in its most recent financial year. The IPO costs are one-off costs that should be ignored in determining how the business has performed. The acquisition costs relate to the amortisation of acquired intangibles, a historical cost that does not impact the ongoing profitability of Bytes’ operations.

Adding back these costs to profit increases the last reported profit (EPS goes from a reported 8.52p to an adjusted 13.07p) and makes the growth in profit forecast for the current year look less impressive. If the forecasts are right, EPS will increase from 13.07p to 14.7p (12.5%).

This is still better than Softcat which barely expects to grow profit at all. But this win may be illusory because the two companies have different reporting periods and their performance has been distorted by the pandemic. Resellers experienced a boom during the lockdowns last year and earlier this year as customers sought to mobilise their staff from home. They also saved money selling remotely rather than wining and dining customers in person. Since Softcat’s current year started after the end of the lockdowns, forecast costs and revenues are likely to have normalised somewhat, while there may still be some lockdown effect in Bytes’ performance during the current year.

I am uncertain about declaring Bytes the winner in terms of growth especially considering we are only looking at growth over one year. The long-term perspective may well be different. Bytes was founded in 1982 and Softcat in 1995, yet Softcat is the bigger business.

Since exceptional costs deflated Bytes’ profit in its last reported financial year, the profitability measures, Return on Capital Employed (ROCE), Cash Return on Capital Invested (CROCI) and EBIT margin (Earnings Before Interest and Tax margin), are also understated in the table. Bytes is a remarkably profitable business at the moment, even compared to the high standard set by Softcat.

This almost certainly relates to the relatively small proportion of hardware it sells, which earns resellers lower profit margins and ties capital up in stock.

Culture wars

A basic analysis like this cannot declare a winner, although taking the analysis further back in time it seems Computacenter is the least attractive business, which probably explains its lower valuation. Computacenter’s customers are much bigger. They may require less advice because they have more sophisticated IT capabilities, and they may be able to drive a harder bargain on the commodity hardware and software they are buying.

Narrowing the focus to Bytes and Softcat, the two companies are following the same strategy, which is to supply the technologies their customers want, currently cloud services, cyber security, data and asset management, and then win more customers and sell more to each of them. Since the bigger of the two, Softcat, reckons it has about 4% of its addressable market, they should have plenty of room to grow.

While this strategy has the virtue of simplicity, it does not differentiate the businesses from each other. This is hardly surprising given Mr Murphy’s admiration for Softcat but I wonder what is to stop a customer going from one to the other and how many other Softcat imitators there are out there that could potentially take their business?

Both companies have the same answer: their cultures. They both strive to be fun-filled places to work, where well-trained successful account managers receive large incentives to solve customers’ problems and earn their loyalty.

Judging by employee and customer satisfaction ratings published by the companies and external organisations like Glassdoor, the recruitment site, both companies have excellent cultures.

Bytes sees scale as an advantage in itself. A bigger company can recruit more staff, train them to sell a broader range of products from more vendors and take a bigger share of each customer’s business. Here though, Softcat is winning. Not only is it bigger, but it already has approximately 200 vendors to Bytes’ 100. Perhaps this is why Bytes is keener on acquisitions.

I am stumped. The reason I was attracted to Marks Electrical is it told me what it does differently. Bytes is telling me what it does that is the same.

Richard Beddard

–

Postscript:

There is another reason I find the competitive landscape of software resellers perplexing. Their biggest suppliers are huge corporations. The first time I bought Microsoft Office, it came on a CD in a box and I still remember it cost £369.95! The last time I bought Microsoft Office it came bundled on a laptop bought directly from Microsoft and now Microsoft just bills me every year.

To consumers at least, software and hardware companies are increasingly selling direct. The requirements of businesses are more sophisticated and Softcat does not mention the risk of disintermediation in its annual report. Bytes discloses that a move to “direct vendor resale” would make resellers “less relevant”, but it does not say whether it is happening, only that it might because vendors are consolidating. In mitigation, it says it is constantly seeking new emerging suppliers.

As technology marches on it seems ironic that one of the last bastions of the personal sale will be the industry that sells the means of automating so many other businesses, yet that is what the resellers’ strategies seem to assume.

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.