During 2021 & 2022, I have spent much of my time researching and scaling into a selected group of Companies with exposure to the Electric Vehicle (EV) market. As a result, I have a mini portfolio of lithium miners, battery recyclers, and battery manufacturers in the EV supply chain and lithium miners. However, I am mindful of the problems ahead for the widespread adoption and transition from fossil-driven vehicles to EVs, so even though governments, policymakers, and interfering busybodies at the World Economic Forum and the United Nations seem to guarantee a significant degree of success for my investments, it is not quite so simple. There are many hurdles to jump, some trickier than beaches brook.

There is an element of clown-world policies that do not make environmental sense and make the argument for EV adoption nonsensical in some cases. However, as investors, we must adapt to market dynamics to take advantage of the situation, subject to our moral code.

I could start with the bear pressure brought to bear on some of the lithium miners, which has seen some of my holdings, except for ioneer limited, pushed into negative territory until recently. However, I have discussed the short-selling activity in previous articles.

In this article, I want to focus on the EV market and infrastructure and discuss the confusing picture emerging related to the exorbitant costs of the EV Compared to fossil-driven vehicles and busting the myth EVs are an affordable, cheap-to-run alternative the governments of the world would have us believe. It is a complex undertaking that investors need to grasp to make informed decisions. The drive to EV adoption is bonkers, bordering on clown-world as government agencies worldwide make up policies.

Although I am invested in the long term, I am also aware the EV market is showing signs all is not well, and perhaps the market is already in trouble; thus, much of the anticipated growth may take longer to materials if it does. This should not be confused with the value of the Company specific to the lithium markets, as the lithium spot price and investor demand for the shares will eventually govern these.

Let us look at the pros and cons of EV adoption before we go any further.

Benefits of adopting EVs

1. Reduced Environmental Impact (I am not convinced): Electric vehicles produce zero tailpipe emissions, meaning they are much better for the environment than traditional fossil-powered cars. This reduces air pollution and greenhouse gas emissions, helping to combat climate change.

2. Lower Fuel Costs (I am not convinced): Electric vehicles are much more efficient than their gasoline counterparts, meaning they require less energy to travel the same distance. This translates to significantly lower fuel costs for electric vehicle owners.

3. Reduced Maintenance Costs: Electric vehicles require less maintenance than fossil powered-powered cars, as they have fewer moving parts and require less frequent oil changes.

4. Improved Performance: Electric vehicles are much more powerful than fossil powered -powered cars, providing a smoother and more responsive driving experience.

5. Tax Credits and Incentives: Many governments offer incentives for electric vehicle owners, such as tax credits or access to carpool lanes.

And so, the negatives of adopting EVs

1. Cost: Electric vehicles are typically more expensive than their internal combustion engine counterparts.

2. Range: Electric vehicles often have a shorter range than traditional vehicles, meaning you may need to plan your trips more carefully or invest in a charging station at home.

3. Charging Time: Charging an electric vehicle can take several hours, depending on the size of the battery and the type of charging station.

4. Limited Availability: Electric vehicles are still relatively new, so the selection of models and parts is limited.

5. Environmental Impact: While electric vehicles produce no emissions, the electricity used to power them may come from sources that are not environmentally friendly.

Hunger games

Perhaps you have seen memes of Tesla drivers suffering long queues waiting for a vacant charge-point at service stations around the UK; indeed, it was not limited to the UK, the USA, and especially California, where the first videos and memes were generated first circulated on social media. A growth in Tesla sales has resulted in scenes like The Hunger Games, where there is a race to beat the Tesla in front of the charge point. This is not exclusive to Tesla drivers – similar scenes can be seen at the shopping centres and your local Sainsbury’s or Tesco’s, for example. There are clear examples of EV charging angst ICE drivers do not suffer now. Unless there is a rapid change in the public charging infrastructure, wide adoption will be slower than the activists seem to be screaming for.

Gross Mis selling

One of the major selling points of an EV was the cost reduction of running an EV compared to a fossil fuel vehicle, and of course, you were told you would be saving the planet. This a bogus claim because lithium, cobalt and nickel are not easily mined without environmental harm. Hydrologists warn that mines could drain vital ecosystems and deprive Indigenous communities of precious water. With the demand for Lithium estimated to be $42 billion to meet the 2030 Demand, the greater the potential harm. Moreover, wind and solar capacity are many years, if ever, capable of serving our energy needs without fossil fuels or nuclear adoption increasing dramatically, or we are thrown back into the dark ages and walk or cycle everywhere. Fifteen-minute cities, anyone!

What of the costs of EVs?

The average price of a family EV compared to the ICE version can be more than £10,000 today. The lower end of the EV market is still bonkers. A Honda E costs £37,000 while the Vauxhall Corsa is £32,000. Essentially, the greater the battery range, the higher the vehicle cost.

The huge price difference is due to the costs of an EV is the battery installed in the vehicle’s underbody. It accounts for about one-third of the purchase price. However, some analysts predict this will decline, and EV v ICE will reach parity between 2022 and 2024. Uhm – Wishful thinking!

In addition to the disconnect between the cost of an ICE compared to EV, the cost of living has harmed EV sales and ICE, hence why second-hand cars are holding higher valuations. EV sales in the UK jumped in December 2022 to 33% of the total car sales, which compares to c6% for the year. However, UK EV sales have been revised to 280,000 fully electric cars and vans in 2025, down from previous estimates of 360,000. Do not think this is just UK-related and or related to Brexit. Europe predicted EV sales of 12 million, 1 million less than previous estimates, and likely to reduce further without government incentives.

In another blow to EV sales, Paul Philpott, UK chief executive of Kia, a South Korean car company, said it had no immediate plans for a mass-market electric product. Due to the cost of the battery component, the fear must be for governments is the smaller entry point mass market is neglected by the mass market, and the concentration for motor manufacturers is the high-end market, which is much smaller. Still, the profit margins remain high, and of course, the is a lot more disposable money sloshing around the market. For now, it appears the public is keeping hold of their petrol and diesel vehicles for longer, pushing up the value of second-hand vehicles.

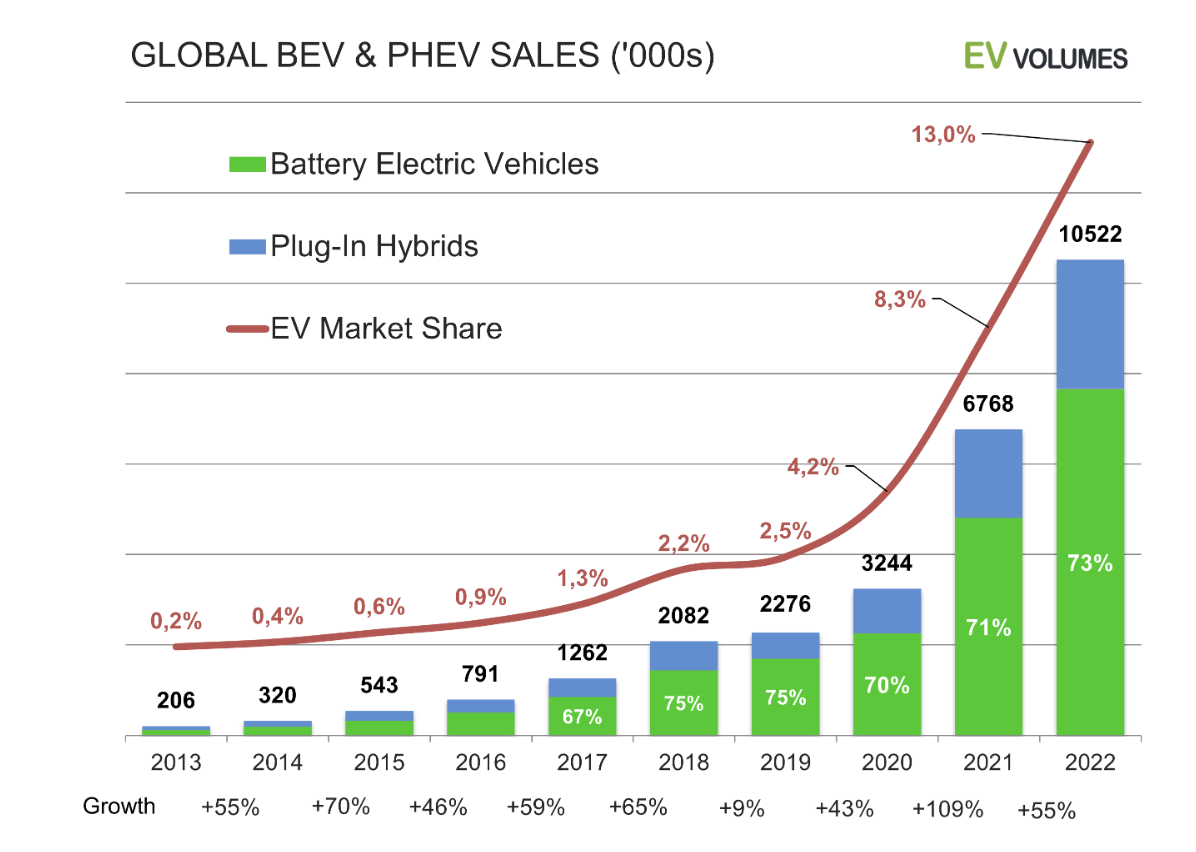

While global demand for EVs is on a steep upward trend, be it from a very low base, there are signs all is not well in the EV market.

Battery costs

In 2010, the battery costs were still around £600 per kilowatt hour (kWh); by 2015, they were only £300. Currently, a battery only costs a good £100 per kilowatt hour. Some analysts predict a further reduction in battery costs, all the while when the demand for EV batteries and their limited recourses increase due to finite supply chains. Sure, they will be an increase in lithium capacity as more mines come onstream; but they take a lot of time and money; all the while, EV demand is expected to increase, but perhaps not at the pace hoped for or predicted.

Hard rock lithium mining, which is gaining relevance, requires geological surveys and drilling through rock, which can increase costs and often result in higher grades. Current hard rock projects require an average of 3-4 years of capital expenditures before production and an average mine life of 16 years.

Even as more mines come onstream, motor manufacturers are expected to close production to ICE vehicles and produce 100% EV, which may push raw materials such as lithium, cobalt and nickel prices even higher.

Electric Shock

In addition to the forecourt costs of an EV being significantly more than an ICE, the cost of charging an EV is exploding. The energy costs have increased dramatically due to the pressure to deny new licenses for fossil fuel drilling, which has seen a reduction in investment in this area; additionally, “Bidenomics” has created a perfect storm, not helped by the war in Ukraine and restriction to Russian gas and oil has created a supply/demand which pushed prices to record levels for most of 2022. However, there are signs these pressures are easing.

According to a RAC report on 10 January 2023, the cost of rapid charging an EV was up 50% in eight months – but those who do most of their charging at home still get greater value. Even so, a typical charge point installation at home is c£1000 upwards, subject to how quickly it recharges.

Using a rapid charger, the average price paid by UK drivers is said to be 74.79p per kilowatt hour. That is an increase of 47% cent from the May 2022 average of 50.97p.

Drivers relying on these chargers pay an average of £38.29 today for an 80% charge, £20.42 more than those charging at home.

It’s equivalent to 20p per mile for the cost of electricity, says the RAC. So, a petrol car that achieves 40 miles to the gallon would cost 17p per mile, a diesel doing the same economy 20p per mile.

EV Price Crash

News circulating around the second-hand EV forecourts are a worry for the resale value of EVs. Nobody wants them, or the problems that come with them as an unwanted package. The new EV sales market saw a cost reduction across the board of the top ten.

- Jaguar I-Pace led the price drops with average prices down 15.6% year on year

- Even EVs that saw price increases year on year were down compared with December

- On average, used EVs fell by 2.1% in January, according to Auto Trader

- Tesla Model S (down 6%YoY and 3% month on month

- Tesla Model X 12.8% YoY and 3.9% month on month

- Audi e-tron SUV down 7.4% YoY and 2.2 per cent month on month

Building Electric Capacity

First, building the charging infrastructure or system for reliable electric charging is expensive, which increases as demand grows, and what of the reliable, uninterrupted supply? Thinking globally, this is more complicated than you may think. Considering the metals required, such as exotic materials, such as magnets, rare earth materials, cobalt, copper, nickel, and lithium, will drive up demand and costs. The world supply chains do not have the capacity at the scale needed. This creates a cost-effect problem, which harms scale and costs and likely puts the electric grid at risk of under capacity wherever it may be. California recently requested EV drivers not to charge their vehicles due to capacity constraints. Therefore, it is unreliable at scale without nuclear as the backbone because wind and solar are not viable options, and electric storage is not available and may not be for decades, if ever. IMHO, we are not too far from an electricity grid crisis, which impacts us at a domestic and business level, so we need to move slower if we are to transition from fossil fuels as the backbone of the industry, at least.

Will Lithium be cost-effective?

Supply chains will dictate the spot price as demand for lithium increases with the expected wider adoption of EVs. We are seeing this happen at a very early stage of the EV demand transition. For example, lithium prices boomed 442.8% in 2021 and ended 2022 up 72.5% as EV sales continued to account for a larger share of total vehicle sales worldwide. However, as I have illustrated, there are plenty of hurdles to jump. In some cases, the drop on the opposite side may be too dangerous for society, environmentally and economically.

Macro GDP Report

The markets will prove to be a key driver, for which the indications are not looking favourable. If we use the bell weather nation, the USA for this, it is looking dire, as key indicators are looking scary.

If I start with the confusing fear & greed index, often referred to as the VIX, it is currently at greed, between 50 and 75 points trending towards extreme greed. How can this be, you may ask when economic data is suggesting we are heading for a recession? It is because the market likes to see big corporations laying off staff, and we have seen this trend across many retail, and tech sectors, for example. This has prompted HWI and sophisticated traders to take positions in these sectors in anticipation of a recovery in the depressed share prices. However, there is some troubling data coming out of the USA we should pay close attention to, because it is very likely to be worse in the UK, but, for the purposes of this summary, I will stay with the USA data.

The latest figures from the Bureau of Economic Analysis show that the US economy was projected to grow by 2.9% in the fourth quarter of last year and 2.1% in 2022. Business investment grew only 1.4% in the fourth quarter, but it was almost entirely inventory growth. Non-residential investment, a key driver of future economic growth, was up only 0.7%.

Meanwhile, residential investment fell 26.7%, as consumers were unable to afford the combination of higher home prices, higher interest rates and falling real incomes. No wonder home ownership affordability has fallen to the lowest level in that metric’s history. US GDP grew at a 2.9% pace in the fourth quarter as the economy cooled.

But the rise in inventories, which accounted for half of GDP growth in the fourth quarter, is not a good sign either.

The most troubling detail in the GDP report is the sharp decline in real disposable income, which is set to fall by more than $1 trillion in 2022. For context, this is the second-largest percentage decline in real disposable income ever recorded, trailing only 1932, the worst year of the Great Depression.

More pain for the working classes as Bidenomics continues with federal non-defence spending rose 11.2% in the fourth quarter, another example of politicians feeding the federal budget while starving the family budget.

Elric Langton of Small Company Champion & Lemming Investor Research Newsletter

Twitter: @LEMMINGINVESTOR

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.