Before I go any further, let me just state that I am not here to say “I told you so”.

But whenever I have lost money on a share, I have always found going back to see where I went wrong to be very instructive.

In fact, trying to spot the warning signs from any share that has collapsed — albeit with full hindsight — can often help us avoid the next great investment disaster.

Could we have spotted Patisserie’s fraud using SharePad?

Perhaps the most spectacular share collapse of the year has been that of Patisserie Holdings (CAKE), the owner of the Patisserie Valerie chain of cake shops.

I am sure you already know the grim story.

To recap, during October the firm confessed to “significant, and potentially fraudulent, accounting irregularities and therefore a potential material mis-statement of the Company’s accounts.”

The shares — which had traded at 429p and supported a £440m market cap — have been suspended ever since.

An emergency £15m was then raised by shareholders at 50p a share, while a further £10m was loaned to Patisserie by group boss Luke Johnson.

Before the fraud came to light, Patisserie said its net cash was £28m. Now the group estimates net debt might be £10m.

So, the obvious question:

Could we have spotted Patisserie’s fraud using SharePad?

To be frank, I am not quite sure.

In a minute, I will present a collection of charts that may have signalled all was not well.

But first, let me provide some thoughts on what has occurred to date.

“One of the last of my stocks I expected to have this problem”

By far the most remarkable feature of Patisserie’s fraud was that nobody saw it coming.

Generally speaking, companies that eventually own up to accounting irregularities do give warning signs well in advance.

True, the signs do not always indicate the business is a dead-cert fraud…

…but typically, the signs show something not being quite right and, at the very least, the accounts end up suffering a very unfavourable restatement.

From my stock-market experience, the common traits of fraud-prone shares include:

* Foreign businesses and operations (e.g. where trouble can hide easily through a different language, culture and geography);

* Significant acquisitions (e.g. to cover up problems and confuse observers)

* Awful cash conversion (e.g. stock going unsold, invoices not being paid, and/or the aggressive capitalisation of costs);

* Questionable financing (e.g. the use of high-cost debt despite substantial cash balances)

Patisserie did not really exhibit any of those four traits.

Instead, the chain was a familiar brand on the high street, little acquisition activity had taken place, cash generation appeared fine (although see my working-capital charts below) while you had to look very hard at the accounts to have any mild inkling of ‘questionable financing’.

Regarding this ‘questionable financing’, Patisserie boasted cash of £28m and no debt — and yet the chain operated an overdraft:

Patisserie has since admitted to operating hidden overdrafts. However, the accounting note above hardly suggests the books were forged.

Institutional investors certainly never spotted any irregularities. Citywire quotes one fund manager as saying:

“I must admit, [Patisserie] is one of the last of my stocks I expected to have this problem.”

According to Citywire, the manager in question ran “the best performing fund in the Investment Association’s UK Smaller Companies sector over three years, up 71% over that period.”

So, this particular City investor knew a lot about successful stock-picking, but even he still missed the fraud. As did you, me and everyone else.

In short, the obvious ‘red flags’ were just not there for Patisserie.

(Amazingly enough, nobody has since emerged from the shadows with proof of having predicted the problems!)

Too male, too chummy, too distracted, too hands-off

The following SharePad revenue and profit charts emphasise why Patisserie was liked by investors:

The SharePad Summary was filled with green numbers, too:

Note the decent growth projections on the second row and the robust margin and return on equity numbers on the bottom row.

So, were there any clear-cut warnings?

Well, an expert panel was assembled at the recent Mello London investor event to examine the available evidence.

The panel consisted of an audit expert, a corporate-governance expert, a cake-retail expert and an accounting expert.

I attended the discussion… and in terms of unmissable red flags, the findings were not exactly a Soviet May Day parade.

The panel’s general conclusion about Patisserie’s management was that its members were:

* too male: women represented 70% of Patisserie’s customers but 0% of the board;

* too chummy: the executives had all worked together in previous ventures (some of which had failed);

* too distracted: boss Luke Johnson had directorships at many other businesses, and wrote a newspaper column, and;

* too hands-off: the executives all possessed financial backgrounds but lacked shop-floor retail/baking expertise.

To me at least, the panel’s verdict suggested Patisserie’s board might well have lost its way due to complacency and competition — but no more.

Certainly, the shortcomings would not have pinpointed a business that had overstated its net cash position by almost £40m.

A cross between a coffee shop and a restaurant

Patisserie’s high operating margin was the only solid suggestion from the expert panel of something not being quite right.

In isolation, the cake chain’s ability to convert sales into profit appeared great:

An EBIT (or operating) margin of 15%-plus suggested Patisserie’s premium cakes were indeed an attractive money-spinner.

However, Patisserie’s margin was well above the level seen at other mainstream food and drink outlets. I have used Greggs, Restaurant Group and JD Wetherspoon as quoted comparisons:

Margins at these three comparisons have converged at approximately 8%.

(The expert panel highlighting margins was not a surprise. After revealing the fraud, Patisserie then admitted its margin for 2019 would be less than 10%).

The panel’s accounting expert cited margins at comparable private companies, too.

I have checked the accounts of two similar unquoted businesses — Bettys & Taylors of Harrogate and Caffe Nero — and found their operating margins to be 9%:

I must admit, evaluating these sector margins should have prompted some questions about exactly how Patisserie earned its impressive high-street profits.

For what it is worth, Patisserie’s flotation document cited the chain’s position as a hybrid coffee-shop/casual-dining operator for the robust profitability:

But did Patisserie’s appealing margin ever suggest a £40m black hole? I am not entirely convinced.

The figures were always negative but should have been positive

I have studied Patisserie using SharePad for more clues about whether the fraud could have been detected beforehand.

Alas, I have been unable to compile an ‘explosive dossier’ that could have blown the lid on all of the irregularities.

In fact, I have uncovered only one other part of the accounts — working capital — where further questions should have been raised.

For the last six years, Patisserie reported negative working-capital cash movements:

However, my three comparisons each mostly reported positive movements:

That distinction looks odd.

The likes of Patisserie really should enjoy positive working-capital movements. That’s because customers pay on the spot while suppliers of ingredients and so on can be paid weeks or months later.

In simple accounting terms, outstanding receivables or debtors (e.g. payments owed by customers) should be low while outstanding trade payables or creditors (e.g. payments owed to suppliers) should be high.

The green and red bars show the striking difference

Further SharePad investigation leads me to the next four balance-sheet charts.

The green bars show year-end receivables (or debtors) while the red bars show year-end current liabilities (which are mostly trade payables and other creditors).

The difference between Patisserie and the other three companies is striking:

A very close look at Patisserie’s working capital

Let me delve deeper into Patisserie’s working capital.

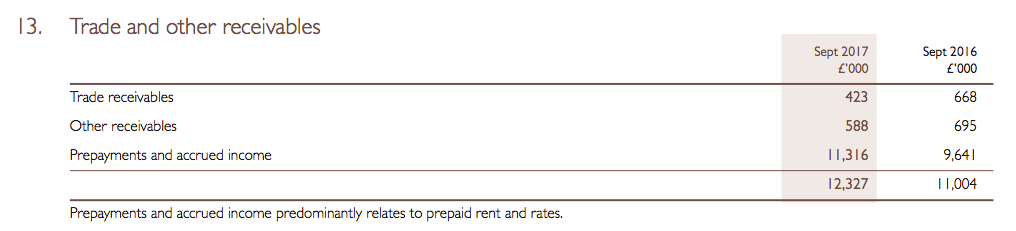

First, a look at Patisserie’s receivables (or debtors) note:

The main entry represents advance rent and rates payments. The £12m total does not appear to be an obvious danger sign, but the following SharePad chart shows the entry to be unusually high when compared to sales:

Next, a look at Patisserie’s payables (or creditors) note:

I can only assume the main entry here represents payments owed to suppliers.

Again, the £5m total does not appear to be an obvious danger sign — but the following SharePad chart shows the figure to be unusually low when compared to sales:

Comparing Patisserie’s payables note to that of Greggs (shown below) is informative:

You can see Greggs carries significant entries for ‘Other payables’ and ‘Accruals and deferred income’ — and similar entries are contained within the books of Restaurant Group and JD Wetherspoon, too.

Patisserie showed no such material entries — which now seems odd with the benefit of hindsight.

Let’s round off the working-capital study with a check on inventory (or stock) levels against sales:

Patisserie’s inventory levels were much higher than those of the three comparisons.

Patisserie’s inventories note is shown below:

Total stock was £6m and the stock amount charged to the income statement was £23m.

As such, the balance sheet carried approximately three months’ worth of ingredients on standby — which for a “fast moving” retail business now looks odd with the benefit of hindsight.

We may all have to use SharePad just that little bit more

So, there you go — not quite the grand exposé that we were all hoping for.

I have to admit, the fact nobody had even suggested Patisserie’s accounts looked a little peculiar — let alone potentially fraudulent — does worry me.

I mean, how many other shares are currently hiding fabricated numbers?

For now, I can only say that this particular fraud appears to have been very well conducted. As I say, nobody saw it coming. The eventual truth of what actually happened will be fascinating to hear.

Still, at least I have picked up some useful lessons from this exercise.

Certainly, there is a strong argument to check any company against similar operators using SharePad.

With the benefit of hindsight, comparing Patisserie’s margins and working-capital profile should have directed some searching questions to the cake chain’s management.

Unfortunately, I am not sure such comparisons would have alerted you to a 100% fraud.

For what it is worth, I never looked at Patisserie because:

* I was never going to be a customer;

* I was unconvinced about the demand for the chain’s premium cakes outside of major cities, and;

* the valuation was never an obvious bargain.

But had I studied the accounts, would I have spotted the peculiarities? I really don’t know.

Until next time, I wish you happy and profitable investing with SharePad.

Maynard Paton

Disclosure: Maynard does not own any share mentioned in the article.

How to create your own financial charts with SharePad

All the charts presented in this article were created using SharePad. You can create your own custom SharePad charts by following our comprehensive guide and video tutorial.

For example, to create this debtor and current liabilities chart…

…just follow the steps in the guide using these instructions:

Step 1: choose Single scale:

Step 2: select Copy this setting and enter a relevant name when asked:

Step 3: select Instrument or List as required:

(Make sure that the share or list (filter or portfolio) you require is displayed in the List view on the left of the screen)

Step 4: select Data:

The Add/edit data items menu should appear:

Click Edit to change the existing items.

The Edit data item menu should appear:

For the first data item, click Select… and then within the Financial tab at the top and Balance sheet section in the left-hand menu, choose Debtors:

Click OK, and the earlier Edit data item menu should re-appear:

Style should be set to Bars and Dual scale side should be set to Left.

Colour can be set to your choice. Then click OK.

Then repeat the exercise for Current liabilities:

Your Add/edit data items menu should eventually look like this:

You can then fine-tune your chart by following Steps 5 and beyond within this comprehensive guide!

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.