Elric Langton continues his energy exploration in the second part of his look at the electric-vehicle revolution with the focus switching from battery manufacturers to miners.

Hopefully, you have already read the first instalment of “how to play the electric-vehicle revolution,” which provided a broad spectrum of companies which I believe offer exciting long-term capital growth prospects through exposure to servicing the EV revolution. There is a caveat with these types of investments, which is be mindful of technology changes, because new technology has a habit of picking up pace, and often changes direction. Moreover, not all EV batteries are the same in structure, element composition, etc. Both Nickle and Cobalt also have a part to play in EV and energy storage batteries.

I have discussed the transition from ICE to EVs. Initially, I offered a brief overview of supply chain issues, capacity, and more importantly, for you and me, various ways to invest. In addition, as pressure to combat climate change grows, the US government has declared lithium as be critical to economic and national security and has prioritised development of US lithium metal processing and refining capacity.

I highlighted several companies of interest that service the EV battery supply chain from mining to the physical charge points. In this second part, I will discuss a few miners of lithium, most of which are ASX listed, but also NASDAQ and NYSE and of course, AIM.

Lithium is currently produced from hard rock or brine mines. Australia is the world’s biggest supplier, with production from hard rock mines. Argentina, Chile, China, and the USA are mainly producing it from salt lakes.

Over the past decade or so, lithium related companies have seen a surge in interest from investors, but this is nothing new because lithium-ion has been incorporated in a range of devices powered by batteries, most notably, smart phones, tablets, and laptop’s, etc. I am sure there will be investors sitting on the side-lines thinking the lithium craze is a bubble to be avoided. This would be a curious observation given the future demand which is not likely to go away any time soon. However, there is a basket of lithium companies that have seen their share values increase dramatically during 2021 and continue in 2022. And as each of these companies approaches production it is likely the share price will react accordingly.

There is no doubt lithium-ion batteries demand is surging and due to bottlenecks in the supply chain there is a global supply shortage of the metal, with western countries racing to develop new mines and Salt Lakes to compete with China and security concerns over the supply.

Supply & Demand

There have been some speculation large motor manufacturers are sniffing around lithium miners in an effort to secure long-term demand, so, do not be surprised if we see some M&A activity between miners and motor manufactures.

Most of the world’s lithium reserves are found in brines – natural saltwater deposits. The conventional process for extracting lithium from brines requires large evaporation ponds that are environmentally damaging, slow to start up, and vulnerable to weather. So, it is no surprise to see the Nevada Desert features a lot. This conventional process suffers from low lithium recovery, low product purity, and is ineffective for most new brine discoveries with lower grades of lithium. Lithium producers are seeking new extraction methods. This is where Lilac Solutions comes into play. Lilac has partnered with Lake Resources (more on Lake later), has developed lithium extraction technology designed to absorb lithium from brine resources. Its technology is based on the ion-exchange theory that facilitates the production of lithium from brine resources with minimal cost and low environmental footprint, enabling lithium producers to accelerate project development, boost lithium recovery, streamline operations and unlock new resources.

As my readers will be aware, the environmental footprint of a company has become very important, so much so, companies are being measured by a system called Environmental, Social Governance (ESG). Project financing is becoming increasingly tied to ESG credentials and that investors, debt providers, and off-takers and their customers are demanding that new lithium projects adhere to strict ESG standards. It is particularly important for natural resource companies, but ESG is affecting all our lives in way many of us are not aware of. ESG could well become the new credit score for us all.

Global lithium carbonate equivalent production more than doubled in the last four years to 82,000 metric tons in 2020, up from a low base of 38,000 metric tons in 2016. This trend is continuing with estimates for December at 485,000 tonnes in 2021, growing to 615,000 tonnes in 2022 and 821,000 tonnes in 2023, according to Australia’s Department of Industry. Even with a more conservative outlook by Credit Suisse analysts, there forecast for 2022 output at 588,000 tonnes, and 2023 at 736,000 tonnes, and forecast demand outpacing supply growth, with demand at 689,000 tonnes in 2022 and 902,000 tonnes in 2023, with about two-thirds of that for electric vehicle batteries, we can see there is no chance of a let up in the steep demand.

As of March 2021, there were 200 battery Giga factories expected to come on stream by 2030, 122 of those are already operational. As more Gigafactory factories come on stream, the price of lithium-ion battery prices falls allowing EVs to compete more aggressively with ICE powered vehicles. Since 2013, battery costs have fallen 80% with a volume-weighted average of $137/kWh in 2020. This is helping with EV demand; thus, the price of batteries is likely to be more favourable over time as more capacity comes on stream.

Obviously, this is only going to increase as EV demand, and power-station production and power storage see growth which suggests the boom in demand for lithium-ion batteries is likely to continue to grow, and so does the opportunity for investors.

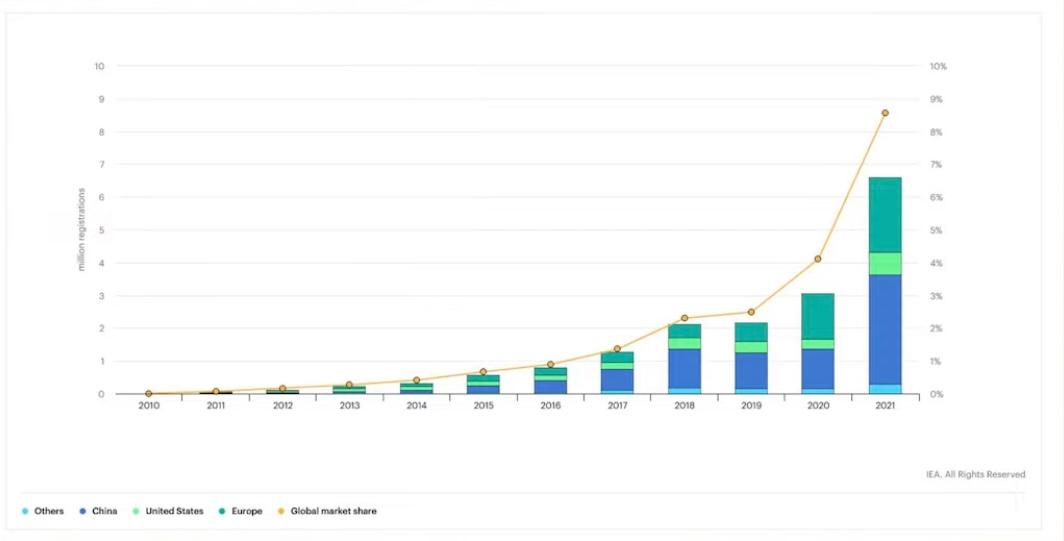

Recent research from BloombergNEF forecasts that electric vehicle sales will hit 8.5 million (10% of new car sales) by 2025. If you want to invest in the lithium industry, you have three options: Purchase shares in a specific company or buy an exchange-traded fund that represents several companies in the industry, or an EV battery recycler. I intend to do all three.

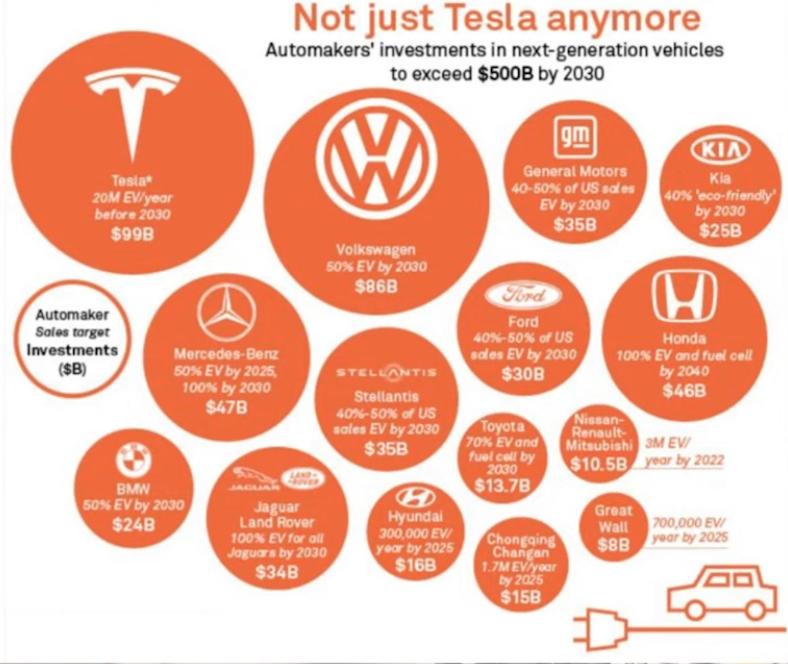

The EV market is expected to see a significant surge in demand as ICE vehicles effectively become obsolete. Tesla is leading this charge, but as you can see, the worlds largest car manufacturers are hot on Tesla’s tire tracks. This will create a problem for many because there are not enough resources to go around, hence why I have been producing a broad overview covering battery manufacturers, battery recyclers, miners and charge point installers.

There is no shortage of Lithium miners to choose from – I have selected a few that I find interesting for various reasons, therefore offer a summary I hope you find interesting. They are at different stages of their life, and therefore investment grades differ, but all could benefit from the EV revolution for years to come.

The first of my watch list of miners is a well-established Philadelphia USA based Livent Corporation (NYSE: LTHM). The company was established almost 80-years ago. It produces battery-grade lithium compounds, including butyllithium, and purity lithium metal which is used in various performance applications. The company’s low-cost lithium carbonate production comes from brine resources in Argentina. Livent also operates downstream lithium hydroxide conversion plants in the United States and China and has a 25% stake in a fully integrated Canadian lithium project.

Livent has been extracting Lithium Brine at Salar del Hombre Muerto for more than 20 years. The company claims it is one of the lowest-cost resources globally for Lithium Carbonate (current capacity of 18,000 tons) and Lithium Chloride production (9,000 tons).

Currently producing qualified battery grade Lithium Hydroxide in both the U.S. (current capacity 10,000 mt) and China (15,000 mt).

Livent has been selling lithium compounds that are applicable to several industrial end markets. About 55% of their sales revenue comes from lithium hydroxide, lithium-ion batteries for EVs, as well as energy storage systems, e-bikes and power tools. So, while my other picks are yet to develop a commercial product, and are therefore riskier, Livent is a safer bet, and well placed for the obvious demand we are seeing for Lithium batteries, hence why Livent is planning to treble production capacity in Argentina over the next three years.

The first phase: Expansion capacity of 20,000 mt planned for commercial production in Q1 & 4 2023.

Bessemer City: Hydroxide expansion capacity 5,000 mt and commercial production by Q3 2022, and phase two a further 20,000 mt expansion is anticipated by 2025.

There have been geopolitical risks doing business in Argentina in prior years, but these risks are in the past. Argentina is in desperate need for US$ for its struggling economics, and therefore is very welcoming for business development.

I produced a detailed editorial on Livent Corp last week.

Atlantic Lithium Limited (AIM: ALL, OTCQX: ALLIF) is a fully funded Australia-based lithium exploration company – Formerly known as Iron Ridge Resources. The company owns an extensive portfolio of exploration and development assets providing exploration. Before I continue, I should give the CEO, Vincent Mascolo a mention – the founding father of the company passed away quite suddenly as announced on 10 March. Atlantic has since announced Chief Operating Officer, Mr Len Kolff, will be appointed to the Board of Directors and as the Company’s Chief Executive Officer, on an interim basis, subject to the completion of normal regulatory due diligence.

Atlantic is unique in the lithium industry because its flagship Ewoyaa Project in Ghana is fully funded for production, so there should not be any dilution concerns for the project.

Ewoyaa is a significant lithium pegmatite discovery that should play a major role in the supply chain for all things lithium. The Company also owns a portfolio of exploration and development assets providing significant exploration upside across both Ghana and Cote d’Ivoire covering 560 square kilometres (km2) and 774km2 tenure across Ghana and Cote d’Ivoire respectively, comprising under-explored and highly prospective licenses.

In March the company announced its Ewoyaa lithium deposit within the Cape Coast Lithium Portfolio in Ghana, West Africa has significant Mineral Resource Estimate (MRE) upgrade to 30.1Mt at 1.26% Li2O, which represents a 42% increase in resources at Ewoyaa.

The increase of the Resource to support an estimated 12-year mine life and to convert >80% of the previous resource from Inferred to Indicated status. With the commencement of additional resource, and exploration drilling along strike and at depth, the company says it is confident of further resource upgrades.

AVZ Minerals Ltd (ASX: AVZ) is an Australia-based mineral exploration company that explores and develops iron ore, base metals, and rare earth metals blocks in Namibia. The company holds an interest in the Manono Extension lithium, tin, and tantalum project located in the southern Democratic Republic of Congo (DRC) where it recently provided an update on its core Manono Project. As part of that update, the company said it had increased its shareholding in Manono to 75% as well as received ‘DPEM approval’ from the local government.

Manono lithium project is an open pit mine located 500km north of Lubumbashi in the Democratic Republic of Congo (DRC). The mine is owned jointly by AVZ Minerals (60%), La Congolaise D’exploitation Miniere (30%), and Dathomir Mining Resources (10%). The contingency cost of the project is estimated to be $36m.

AVZ holds two granted exploration permits for the extension of the Manono project, namely SW and NW extension targets. The mine is expected to produce 440,000 tonnes per annum (tpa) at a minimum of 5.8% Li2O concentrate over its mine life of 20 years. The annual throughput rate is anticipated to be two million tonnes per annum (Mtpa) of pegmatite.

In September 2021, AVZ Minerals secured $240m in funding from Suzhou CATH Energy Technologies, a private equity firm jointly owned by Pei Zhenhua and Contemporary Amperex Technology (CATL), to develop the Manono project in exchange for a 24% equity stake in a multi-faceted joint venture to develop the Manono Project.

The company has committed to investing $25M to advance its drilling program at Roche Dure and early works program for the Manono Lithium and Tin Project using funds received from the recent A$75M capital raising. The $A25M investment will assist in maintaining the achievement of the Manono Project timetable. It will also fund an extension drilling program at Roche Dure, with the potential to significantly expand the previously reported JORC mineral resource and ore reserves.

Core Lithium Ltd (ASX: CXO) is a lithium exploration company with copper deposits in Northern Territory and South Australia. Its projects include Finniss Lithium Project was awarded Major Project Status for its copper, zinc, and lead project located just 25 kilometers from Darwin Port. Core leads Australian peers with lowest lithium transport emissions in Finniss greenhouse gas assessment.

Core is expected to report on the Finniss Lithium Project in Q2 where it is expected to extract its first battery-grade lithium concentrate in the fourth quarter of 2022.

Core previously reported targeted diamond drilling at Carlton bearing the positive outcomes that as anticipated. “The Carlton deposit is a key component of the under-construction Finniss Project.

Core has confirmed excellent lithium recoveries in its final phase of Dense Media Separation (DMS) test work results show a 6% lithium oxide concentrate can be produced with very low impurities at an overall recovery of 71% at Li20 concentrate. These results prove the robust metallurgy of the BP33 deposit within Core’s Finniss Lithium Project is capable of producing lithium fines and Feldspar by-products.

Lake Resources NL (ASX: LKE) (FRA: LK1) (OTCMKTS: LLKKF) is an Australia-based company, which is engaged in exploring and developing lithium brine projects in Argentina. The Company’s projects include Kachi Project, Cauchari Project, Olaroz Project, Paso Project and Catamarca Pegmatite project.

Lake high purity lithium flagship is the Kachi Project in Argentina is on-track to start production in 2024. Lake has a total of five projects covering 2,200 square kilometres in a prime location within the Lithium Triangle in Argentina, where 40% of the world’s lithium is produced. Kachi covers 70,000 hectares over a Salt Lake, with a large indicated and inferred resource of 4.4 million tonnes lithium carbonate equivalent (LCE).

In recent news, Lake has signed a non-binding MoU with Ford to supply offtake of approximately 25,000 tpa of lithium from the Kachi. This follows a similar agreement with a major Japanese partner, Hanwa Co., Ltd., to provide for an offtake of up to 25,000 tpa lithium carbonate over 10 years (option to extend additional 10 years), with a minimum of 15,000 tpa LCE, which means 100% of Kachi’s production has been signed up.

Investors are waiting for a Definitive Feasibility Study (DFS) to be complete, which is expected in Q2 2022. There is speculation there could be an upwards revision of the inferred resource, thus increase in target production.

For transparency, I own shares in Morella, Ioneer, Lake Resources, and Core Lithium, all listed on the Australian ASX. I also have a holding in AIM-listed Atlantic Lithium

Elric Langton of Small Company Champion

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.