The “End of Global Trade” Week

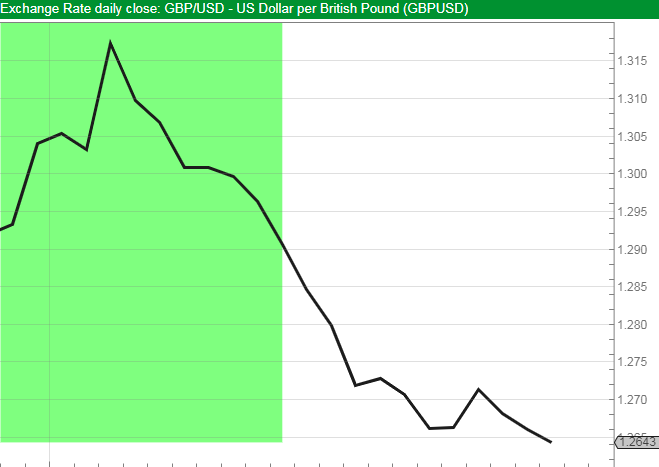

Last week the talk moved from politics to trade wars. Consensus seems to be that the trade war between the US and China is set to continue for a while. With the UK political situation causing uncertainty which slows management decision making processes there is reason to worry that GDP growth could slow from its recent intergalactic pace of 0.5% in Q1 2019. Neither has the political situation in the UK helped the value of Sterling in May.

Trade Wars

I think it was GCSE economics where we learn that trade barriers hurt both sides. History bears it out. In the wake of the 1929 stock market crash President Hoover signed into law the “Smoot-Hawley” Act which sought to raise import duties by on average 20%. Europe duly retaliated with tariffs of their own and the result was a 67% drop in trade with Europe. It has been since WW2 and the formation of the General Agreement on Tariffs and Trade (the forerunner of the WTO) that countries have generally accepted that tariffs hinder economic prosperity for both sides.

Recession to Follow?

There are several market indicators of forthcoming recessions. Morgan Stanley on 13 May warned us that US/China tariffs could tip the US into recession. Given stubbornly low inflation globally and cost pressures starting to bite it certainly does seem likely that extra costs from tariffs are likely to eat into companies’ margins giving rise to the risk of earnings downgrades for export driven businesses. The Morgan Stanley note came out on the day that China hike tariffs on $60bn of US exports. It is possible the tariffs may also impact top line sales in the US as well as eating into corporate profit margins.

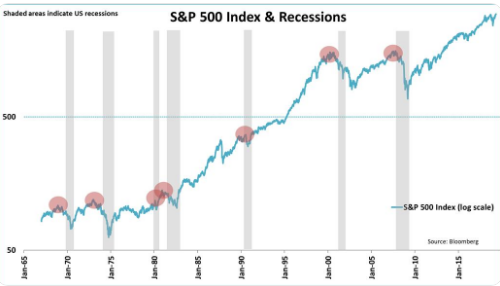

The stock market highs usually precede recessions as this chart, going back to 1965, illustrates:

Source: Bloomberg

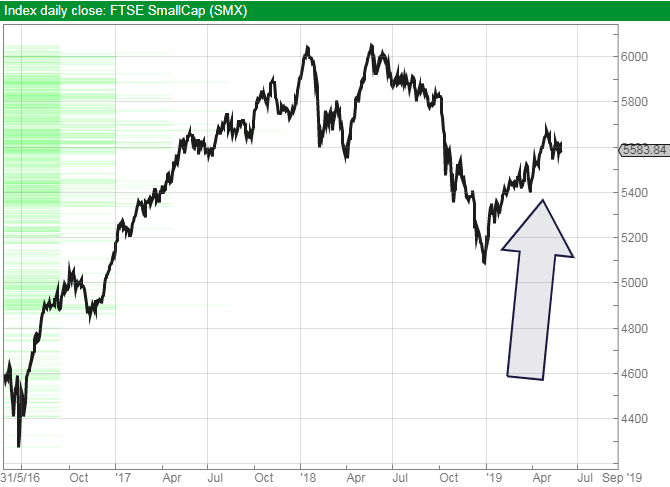

It is just possible this nervousness over international trade is what has caused the Small cap stocks to outperform the large cap stocks in May:

FTSE 100

FTSE Small Cap

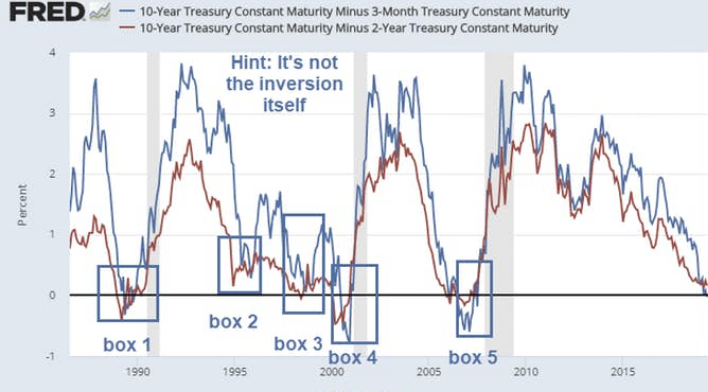

The other indicator of forthcoming recession is usually the bond markets. A downward sloping yield curve anticipates declining rates as the economy falters. The chart below shows the 10-year US Treasury yield minus the 2 year. So, when it goes below zero, we have a downward sloping yield curve – and that is looking very close at the moment. It’s at levels not seen since 2008.

Source: Real Investment Advice

Effect on markets

The divergence of the stock market from the bond market is an indicator of recession as well as the historical evidence of the effect of trade barriers has on global trade. But it is important to distinguish between markets and profits. It is easy to sell everything in fear of recession and head for the summer hills. The fact that interest rates are at 0.75% means there is a lot of cheap money to support valuations. It is the flow of this cheap money that has raised market valuations over the current cycle and if we head for a recession the likelihood of a downward move to 0.5% becomes increasingly likely which serves to support market valuations. We have no previous experience of these low rates. They haven’t been as low as the previous 0.5% since 1694 when the Bank of England was founded.

However, there will be profit warnings. And the market appetite will move from growth stocks to reliable stocks that are sometimes termed “quality stocks”. At the same time the larger companies that tend to be exposed to more international trade will underperform domestic companies which tend to be smaller. So, we need good old-fashioned UK smaller companies exposed to predictable earnings streams.

Portfolio Construction

Statistically quality companies out-perform growth companies in a recession. I found myself changing my view on Funding Circle last week, which is a hugely expensive growth company that has already fallen 43% from its IPO price last September as the early warning bell goes for a recession in the form of poorly performing loans. In this instance the shares can fall a very long way when coming from the stratospheric IPO valuation of 440p per share. Having reported £50m of losses for the year to December 2018 it is not expected to report profits until 2021 and at the newly depressed share price of 238p trades at 4.1X sales. Let’s remember how far bubble stocks can fall.

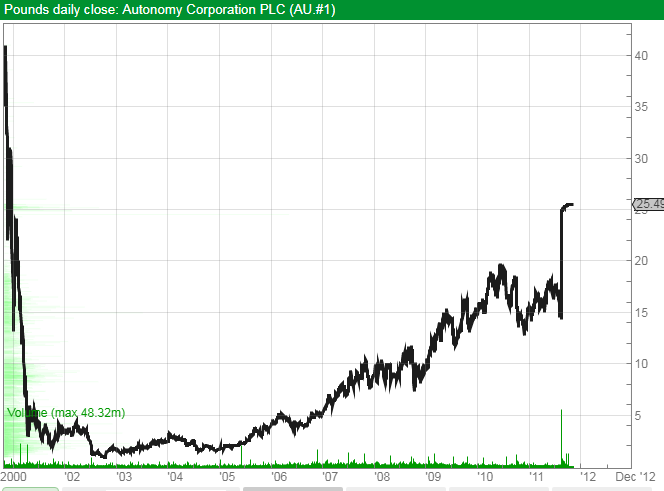

I recall meeting with Autonomy in my days as a fund manager when it came to IPO as a small cap stock. The ride was exciting until it wasn’t. Eventually it was acquired by Hewlett Packard in 2011 when at a price 37% below where the shares had traded in the bubble years. The Sharepad chart shows it well.

So, this is a time to not be shy of pruning bubble like expensive stocks even though they are off their highs. It is important to maintain a sell discipline and back your own judgement. But what we need to own in a recession is those quality resilient stocks. These are generally high ROE stocks. Terry Smith may call them “quality” whereas Anthony Cross might call them stocks with “economic advantage”. Lindsell Train may call them “Brands”. They all have a high return on capital due to some competitive advantage they possess.

Sectors

Sin stocks such as alcohol, gambling, tobacco and weapons manufacturers are traditionally deemed to recession proof but with the world moving to a more ethical investment approach it could be they face headwinds and so “it may be different this time”. One stock that comes to mind from the 2007 Global Financial Crisis that proved to be very resilient is a meat processor which being involved in the food industry saw no change to its earnings and having come to market in 2007 I recall it sailing through the crisis while all the stocks around it were decimated. Hilton Foods is in the food packaging sector which is a resilient sector.

Stocks

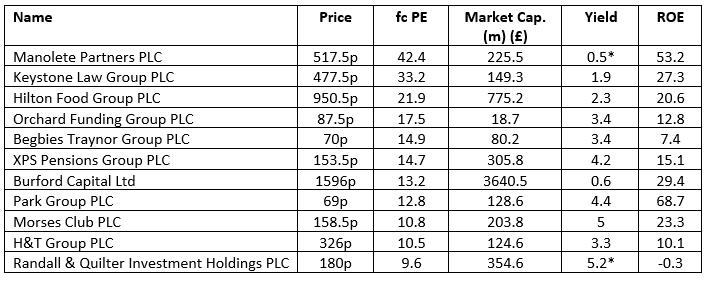

Stocks that I have known and loved (mostly) that I would call resilient are shown below:

(* Based on forecast data.)

Source: Sharepad

There are lots of useful tools on Sharepad for investors to do their own research in the companies listed here but I will take a look at 3 of them. Both Manolete Partners and Begbies Traynor are direct plays on the insolvency market while Hilton Foods is one that has a great track record.

Manolete Partners PLC (MANO)

Share Price 517.5p

Mkt Cap £225.5m

History

Having come to market in December 2018 at 175p/share the stock has rapidly built a fan club climbing to 517p today providing almost 200% return for IPO investors in around 6 months. There are good reasons such as the high ROCE as it is the only vehicle with the expertise to undertake insolvency litigation. This is rather like a very specialised Burford litigation funder for insolvency markets. Upgrades since IPO have helped and with access to funding from stock markets it looks well placed to become a lot larger company.

Investment Case

The company was founded in 2009 by Steve Cooklin, the current CFO. By investing in litigation cases and sharing the proceeds with the insolvent estate it makes fabulous returns. Since 2012 with the worst ROI over a year has been 154% and in the year before IPO it made 366% ROI. On IPO in December the company raised £16m of new money to further invest in cases and announced strong interim results to September shortly after IPO when the number of live cases was up 65%. In February an unscheduled trading update said that trading had been strong and operating profit growth was expected to be 70%.

Estimates

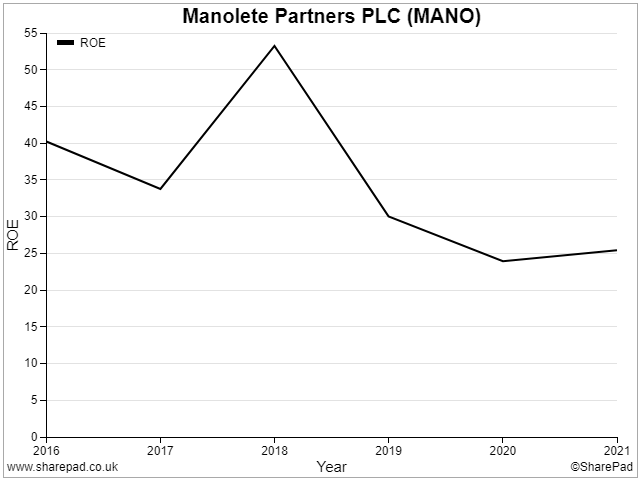

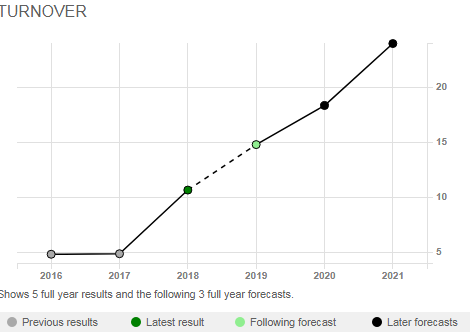

Forecasts look for continued strong revenue growth to 2021 with Profit before tax expected to grow 77% over the forthcoming two years to March 2021.

Valuation

The now high valuation is forward looking. On the 2021 earnings estimate of 21.4p the PE is 24X. The dividend pay-out ratio is low at 20% as the return on reinvesting the profits in the business is high. As a result, the dividend yield is below 1% even in 2021. As this company is an investment business it may be more appropriate to value it on a price/book value basis. Post IPO the net asset value of the company was £25m. The forecast ROE is 30%. So, if we expected a 10% return on our money, we might pay 3X the equity value on the balance sheet. At £221m the shares are trading at a lofty 8.8X equity value. By 2021 the net asset value is estimated to have increased to £42.6m in which case it is trading on 5.2X. This suggests the market price is anticipating higher earnings than are forecast currently, which does appear likely given recent trends.

Threats

Typically, with highly rated stocks markets can start to ignore risks. Having only started up in 2009 this company has the field to itself at the moment but it is conceivable that seeing such strong returns available potential competitors will be eyeing up this area. Burford is an experienced litigator and they could well set up a specialist insolvency division. Competition would likely result in more competitive pricing of cases and so reducing ROI. I checked Manolete out with an ex colleague at Deloitte who is in insolvency who confirmed that the insolvency practitioners regard this as a very expensive form of finance.

Personal View

This is one of those shares that the rules of supply and demand in stock markets has meant the shares have become expensive. They now look like they are discounting all the good news but ignoring the competitive threats. Instead let’s take a look at a more modestly valued play on insolvency markets.

Begbies Traynor Group PLC (BEG)

Share Price 70p

Mkt Cap £80.2m

History

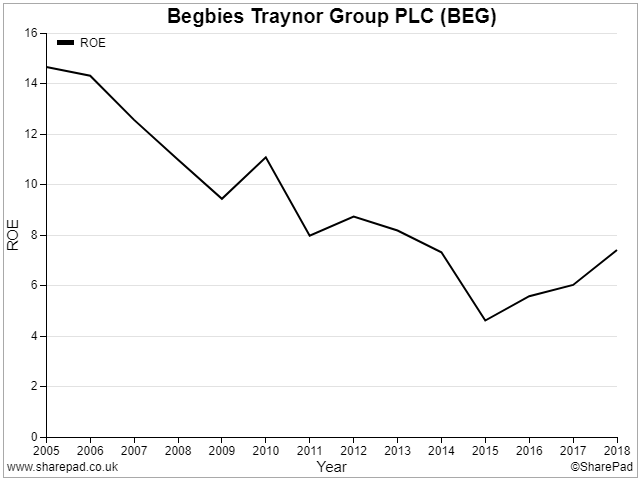

This company is an insolvency practitioner which ought to benefit in a recession. The problem they have is there haven’t been enough insolvencies. As business levels have been slow while debtor books are long the ROE has declined over recent years so the company has diversified into corporate finance and property services which earn higher ROE’s. The company now has 75 UK offices and is formed in 3 divisions of Begbies Traynor (insolvency) BTG Advisory (corporate finance) and Eddisons (property services). The founder chairman, Rick Traynor, owns 24% of the company.

Investment Case

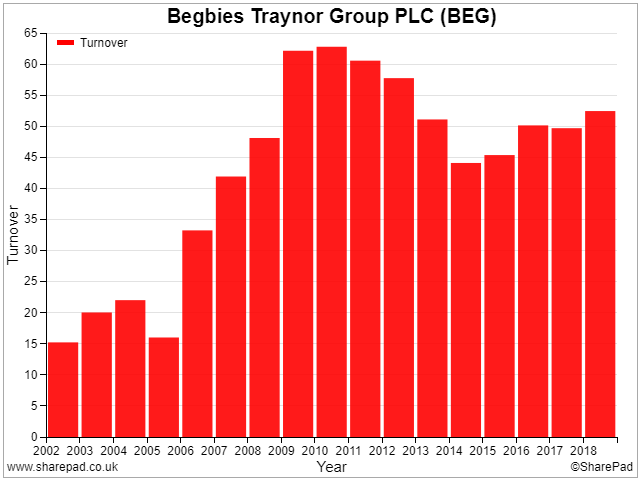

Since the financial crisis the company has posted modest revenue growth (see below). This has combined with a reducing ROE as debtor days can often be in excess of 6 months in this business. The trading update on 7 May 2019 however guided that the last quarter to April 2019 had been strong and the company now expects results to be “comfortably ahead of expectations”.

With this lack of turnover growth over recent years from the core insolvency business the company has acquired businesses in property services and corporate finance which acquisitions have been made at higher ROI’s than the core business. This will also serve to diversify the company’s business. The benefits are starting to be seen through improving ROE.

Estimates

There is only one forecast out for Begbies which is from the house broker so we should read that as estimates that are guided by the company. To April 2019 they anticipate 10.7% revenue growth to £60.2m. As margins improve the Profit before tax is expected to increase 26.7% to £7.1m. Net debt is expected to be £6.1m which is a modest amount in my view. Going forward into 2020 and 2021 PBT is expected to grow 19% and 8% respectively which rather looks like a fade rate that management have assumed in order not to give themselves too high a hurdle to jump. I find myself wondering if we are in a new world of repeating upgrades for this company.

Valuation

The 4.7p EPS forecast for the year to April 19 is soon to be an historic number. For the year to April 2020 the multiple drops to 12.5X. The dividend pay-out ratio is 55% so the 2.6p dividend provides a 3.8% yield. I find myself thinking that when the market sees 26% PBT growth on results it may feel that 12.5X multiple is low.

Personal View

In the event of a recession the revenue history chart shows us what can happen to revenues here. In the meantime, self-help is improving the ROE. This could well be an interesting defensive stock.

Hilton Food Group PLC (HFG)

Share Price 950.5p

Mkt Cap £775.2m

History

After floating in 2007 it sailed through the financial crisis suffering no downgrades at all. The business owns a number of meat and fish packaging facilities in the UK and Europe as well as Australia where it packages products for the large supermarkets, cooperating very closely with their customers. In the UK they service Tesco, Australia is Woolworths and in Europe Albert Heijn, Ahold, Rimi and Coop Danmark are amongst their customer base. The head office is in Huntingdon. Over recent years they have made a number of acquisitions as well as extending their product ranges to include sandwiches, pizzas, ready meals and soups.

Investment Case

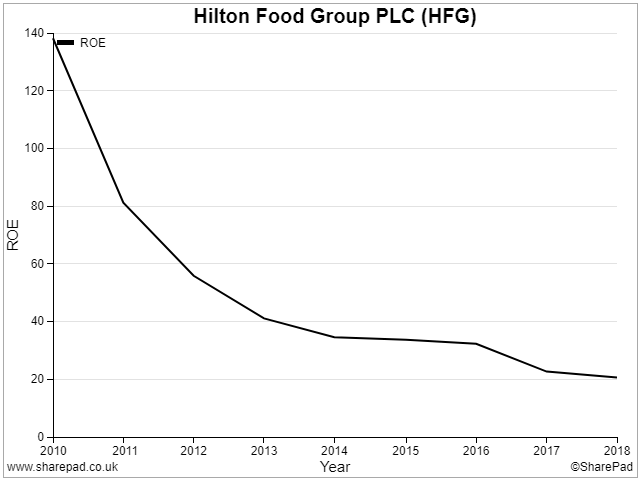

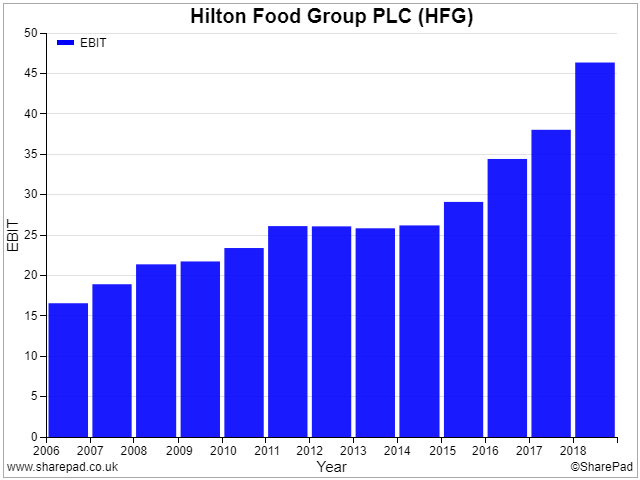

The track record of growth is strong. The chart below shows the strong growth during the financial crisis although it went a little flat from 2011 to 2014 which I may speculate coincided with Tesco woes. Suffice to say the company does not look economically cyclical. However, what does look concerning is that the profit growth has been improving while the ROE has been declining.

The state-of-the-art processing facilities required to meet the demands of the high street supermarkets requires a lot of capex. The March results show the company spent £80m on acquisitions last year while reporting operating profit of £48.7m. Forecasts show expected capex in the next two years is expected to be above £70m. So, while the ROE is admirably in excess of 20% there are reasons to worry that it could continue to decline going forward.

Gross debt in the March results was £114m although cash balances brought net debt down to £26.8m. Sharepad forecasts show this increasing to £94.9m by the end of 2020.

Estimates

Profit before tax growth is estimated to be 8.6% in the current year accelerating to 13.3% in the following year as the results on investments feed through.

Valuation

The shares trade at 22.5X the December 2019 earnings estimate. A 50% pay-out ratio provides a 22.3p dividend which equates to a yield of 2.3% at the current price.

Personal View

This is not a cyclical business as food is something people continue to buy in a recession. However, the increase in capex and acquisitions is sometimes a sign that a company is running out of road. Investors pre-occupation with growth can lead growth companies to get re rated while they frequently ignore declining ROE. This was the case with Tesco before it went wrong and the warning signs are there for this one.

Summary

I believe all of these businesses to have resilient business models in the event of a recession. Litigation and arguments happen in a recession while insolvencies rise, insurance and pensions become increasingly necessary purchases so rates rise while the sub-prime loan customer is, as the companies once told me “permanently in a recession”. Investors frequently own businesses in recessions that are based on the resilience of the top line but when times are hard companies can frequently buy top line growth. It is important to pay due regard to ROE because – as the market adage goes “it may be different this time”.

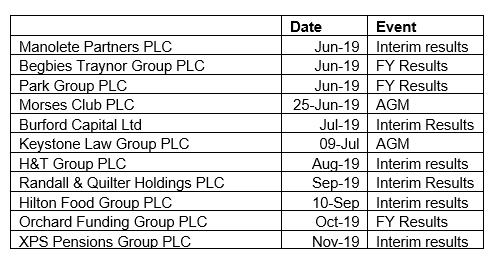

Upcoming Events

Jeremy Grime.

Weekly Commentary: 03/06/19

The “End of Global Trade” Week

Last week the talk moved from politics to trade wars. Consensus seems to be that the trade war between the US and China is set to continue for a while. With the UK political situation causing uncertainty which slows management decision making processes there is reason to worry that GDP growth could slow from its recent intergalactic pace of 0.5% in Q1 2019. Neither has the political situation in the UK helped the value of Sterling in May.

Trade Wars

I think it was GCSE economics where we learn that trade barriers hurt both sides. History bears it out. In the wake of the 1929 stock market crash President Hoover signed into law the “Smoot-Hawley” Act which sought to raise import duties by on average 20%. Europe duly retaliated with tariffs of their own and the result was a 67% drop in trade with Europe. It has been since WW2 and the formation of the General Agreement on Tariffs and Trade (the forerunner of the WTO) that countries have generally accepted that tariffs hinder economic prosperity for both sides.

Recession to Follow?

There are several market indicators of forthcoming recessions. Morgan Stanley on 13 May warned us that US/China tariffs could tip the US into recession. Given stubbornly low inflation globally and cost pressures starting to bite it certainly does seem likely that extra costs from tariffs are likely to eat into companies’ margins giving rise to the risk of earnings downgrades for export driven businesses. The Morgan Stanley note came out on the day that China hike tariffs on $60bn of US exports. It is possible the tariffs may also impact top line sales in the US as well as eating into corporate profit margins.

The stock market highs usually precede recessions as this chart, going back to 1965, illustrates:

Source: Bloomberg

It is just possible this nervousness over international trade is what has caused the Small cap stocks to outperform the large cap stocks in May:

FTSE 100

FTSE Small Cap

The other indicator of forthcoming recession is usually the bond markets. A downward sloping yield curve anticipates declining rates as the economy falters. The chart below shows the 10-year US Treasury yield minus the 2 year. So, when it goes below zero, we have a downward sloping yield curve – and that is looking very close at the moment. It’s at levels not seen since 2008.

Source: Real Investment Advice

Effect on markets

The divergence of the stock market from the bond market is an indicator of recession as well as the historical evidence of the effect of trade barriers has on global trade. But it is important to distinguish between markets and profits. It is easy to sell everything in fear of recession and head for the summer hills. The fact that interest rates are at 0.75% means there is a lot of cheap money to support valuations. It is the flow of this cheap money that has raised market valuations over the current cycle and if we head for a recession the likelihood of a downward move to 0.5% becomes increasingly likely which serves to support market valuations. We have no previous experience of these low rates. They haven’t been as low as the previous 0.5% since 1694 when the Bank of England was founded.

However, there will be profit warnings. And the market appetite will move from growth stocks to reliable stocks that are sometimes termed “quality stocks”. At the same time the larger companies that tend to be exposed to more international trade will underperform domestic companies which tend to be smaller. So, we need good old-fashioned UK smaller companies exposed to predictable earnings streams.

Portfolio Construction

Statistically quality companies out-perform growth companies in a recession. I found myself changing my view on Funding Circle last week, which is a hugely expensive growth company that has already fallen 43% from its IPO price last September as the early warning bell goes for a recession in the form of poorly performing loans. In this instance the shares can fall a very long way when coming from the stratospheric IPO valuation of 440p per share. Having reported £50m of losses for the year to December 2018 it is not expected to report profits until 2021 and at the newly depressed share price of 238p trades at 4.1X sales. Let’s remember how far bubble stocks can fall.

I recall meeting with Autonomy in my days as a fund manager when it came to IPO as a small cap stock. The ride was exciting until it wasn’t. Eventually it was acquired by Hewlett Packard in 2011 when at a price 37% below where the shares had traded in the bubble years. The Sharepad chart shows it well.

So, this is a time to not be shy of pruning bubble like expensive stocks even though they are off their highs. It is important to maintain a sell discipline and back your own judgement. But what we need to own in a recession is those quality resilient stocks. These are generally high ROE stocks. Terry Smith may call them “quality” whereas Anthony Cross might call them stocks with “economic advantage”. Lindsell Train may call them “Brands”. They all have a high return on capital due to some competitive advantage they possess.

Sectors

Sin stocks such as alcohol, gambling, tobacco and weapons manufacturers are traditionally deemed to recession proof but with the world moving to a more ethical investment approach it could be they face headwinds and so “it may be different this time”. One stock that comes to mind from the 2007 Global Financial Crisis that proved to be very resilient is a meat processor which being involved in the food industry saw no change to its earnings and having come to market in 2007 I recall it sailing through the crisis while all the stocks around it were decimated. Hilton Foods is in the food packaging sector which is a resilient sector.

Stocks

Stocks that I have known and loved (mostly) that I would call resilient are shown below:

(* Based on forecast data.)

Source: Sharepad

There are lots of useful tools on Sharepad for investors to do their own research in the companies listed here but I will take a look at 3 of them. Both Manolete Partners and Begbies Traynor are direct plays on the insolvency market while Hilton Foods is one that has a great track record.

Manolete Partners PLC (MANO)

Share Price 517.5p

Mkt Cap £225.5m

History

Having come to market in December 2018 at 175p/share the stock has rapidly built a fan club climbing to 517p today providing almost 200% return for IPO investors in around 6 months. There are good reasons such as the high ROCE as it is the only vehicle with the expertise to undertake insolvency litigation. This is rather like a very specialised Burford litigation funder for insolvency markets. Upgrades since IPO have helped and with access to funding from stock markets it looks well placed to become a lot larger company.

Investment Case

The company was founded in 2009 by Steve Cooklin, the current CFO. By investing in litigation cases and sharing the proceeds with the insolvent estate it makes fabulous returns. Since 2012 with the worst ROI over a year has been 154% and in the year before IPO it made 366% ROI. On IPO in December the company raised £16m of new money to further invest in cases and announced strong interim results to September shortly after IPO when the number of live cases was up 65%. In February an unscheduled trading update said that trading had been strong and operating profit growth was expected to be 70%.

Estimates

Forecasts look for continued strong revenue growth to 2021 with Profit before tax expected to grow 77% over the forthcoming two years to March 2021.

Valuation

The now high valuation is forward looking. On the 2021 earnings estimate of 21.4p the PE is 24X. The dividend pay-out ratio is low at 20% as the return on reinvesting the profits in the business is high. As a result, the dividend yield is below 1% even in 2021. As this company is an investment business it may be more appropriate to value it on a price/book value basis. Post IPO the net asset value of the company was £25m. The forecast ROE is 30%. So, if we expected a 10% return on our money, we might pay 3X the equity value on the balance sheet. At £221m the shares are trading at a lofty 8.8X equity value. By 2021 the net asset value is estimated to have increased to £42.6m in which case it is trading on 5.2X. This suggests the market price is anticipating higher earnings than are forecast currently, which does appear likely given recent trends.

Threats

Typically, with highly rated stocks markets can start to ignore risks. Having only started up in 2009 this company has the field to itself at the moment but it is conceivable that seeing such strong returns available potential competitors will be eyeing up this area. Burford is an experienced litigator and they could well set up a specialist insolvency division. Competition would likely result in more competitive pricing of cases and so reducing ROI. I checked Manolete out with an ex colleague at Deloitte who is in insolvency who confirmed that the insolvency practitioners regard this as a very expensive form of finance.

Personal View

This is one of those shares that the rules of supply and demand in stock markets has meant the shares have become expensive. They now look like they are discounting all the good news but ignoring the competitive threats. Instead let’s take a look at a more modestly valued play on insolvency markets.

Begbies Traynor Group PLC (BEG)

Share Price 70p

Mkt Cap £80.2m

History

This company is an insolvency practitioner which ought to benefit in a recession. The problem they have is there haven’t been enough insolvencies. As business levels have been slow while debtor books are long the ROE has declined over recent years so the company has diversified into corporate finance and property services which earn higher ROE’s. The company now has 75 UK offices and is formed in 3 divisions of Begbies Traynor (insolvency) BTG Advisory (corporate finance) and Eddisons (property services). The founder chairman, Rick Traynor, owns 24% of the company.

Investment Case

Since the financial crisis the company has posted modest revenue growth (see below). This has combined with a reducing ROE as debtor days can often be in excess of 6 months in this business. The trading update on 7 May 2019 however guided that the last quarter to April 2019 had been strong and the company now expects results to be “comfortably ahead of expectations”.

With this lack of turnover growth over recent years from the core insolvency business the company has acquired businesses in property services and corporate finance which acquisitions have been made at higher ROI’s than the core business. This will also serve to diversify the company’s business. The benefits are starting to be seen through improving ROE.

Estimates

There is only one forecast out for Begbies which is from the house broker so we should read that as estimates that are guided by the company. To April 2019 they anticipate 10.7% revenue growth to £60.2m. As margins improve the Profit before tax is expected to increase 26.7% to £7.1m. Net debt is expected to be £6.1m which is a modest amount in my view. Going forward into 2020 and 2021 PBT is expected to grow 19% and 8% respectively which rather looks like a fade rate that management have assumed in order not to give themselves too high a hurdle to jump. I find myself wondering if we are in a new world of repeating upgrades for this company.

Valuation

The 4.7p EPS forecast for the year to April 19 is soon to be an historic number. For the year to April 2020 the multiple drops to 12.5X. The dividend pay-out ratio is 55% so the 2.6p dividend provides a 3.8% yield. I find myself thinking that when the market sees 26% PBT growth on results it may feel that 12.5X multiple is low.

Personal View

In the event of a recession the revenue history chart shows us what can happen to revenues here. In the meantime, self-help is improving the ROE. This could well be an interesting defensive stock.

Hilton Food Group PLC (HFG)

Share Price 950.5p

Mkt Cap £775.2m

History

After floating in 2007 it sailed through the financial crisis suffering no downgrades at all. The business owns a number of meat and fish packaging facilities in the UK and Europe as well as Australia where it packages products for the large supermarkets, cooperating very closely with their customers. In the UK they service Tesco, Australia is Woolworths and in Europe Albert Heijn, Ahold, Rimi and Coop Danmark are amongst their customer base. The head office is in Huntingdon. Over recent years they have made a number of acquisitions as well as extending their product ranges to include sandwiches, pizzas, ready meals and soups.

Investment Case

The track record of growth is strong. The chart below shows the strong growth during the financial crisis although it went a little flat from 2011 to 2014 which I may speculate coincided with Tesco woes. Suffice to say the company does not look economically cyclical. However, what does look concerning is that the profit growth has been improving while the ROE has been declining.

The state-of-the-art processing facilities required to meet the demands of the high street supermarkets requires a lot of capex. The March results show the company spent £80m on acquisitions last year while reporting operating profit of £48.7m. Forecasts show expected capex in the next two years is expected to be above £70m. So, while the ROE is admirably in excess of 20% there are reasons to worry that it could continue to decline going forward.

Gross debt in the March results was £114m although cash balances brought net debt down to £26.8m. Sharepad forecasts show this increasing to £94.9m by the end of 2020.

Estimates

Profit before tax growth is estimated to be 8.6% in the current year accelerating to 13.3% in the following year as the results on investments feed through.

Valuation

The shares trade at 22.5X the December 2019 earnings estimate. A 50% pay-out ratio provides a 22.3p dividend which equates to a yield of 2.3% at the current price.

Personal View

This is not a cyclical business as food is something people continue to buy in a recession. However, the increase in capex and acquisitions is sometimes a sign that a company is running out of road. Investors pre-occupation with growth can lead growth companies to get re rated while they frequently ignore declining ROE. This was the case with Tesco before it went wrong and the warning signs are there for this one.

Summary

I believe all of these businesses to have resilient business models in the event of a recession. Litigation and arguments happen in a recession while insolvencies rise, insurance and pensions become increasingly necessary purchases so rates rise while the sub-prime loan customer is, as the companies once told me “permanently in a recession”. Investors frequently own businesses in recessions that are based on the resilience of the top line but when times are hard companies can frequently buy top line growth. It is important to pay due regard to ROE because – as the market adage goes “it may be different this time”.

Upcoming Events

Jeremy Grime.