Regular readers will be aware I have written at length on the Electric Vehicle (EV) transition from the Internal Combustion Engine (ICE) to switch to “perceived” green energy alternatives, an effort designed to save the planet and kill off the use of fossil fuels. I agree with the trend to switch from fossil fuels to alternative energy sources, not least because fossil fuels are finite resources. However, I will say nothing of the weaponisation of natural resources, which took a nasty turn with sabotaging the Nord Stream pipelines in the Baltic.

In this, my third episode on the topic of EVs and Lithium, we are going to look at the market trend for EVs, the ever-changing battery technology, battery options, and the supply chains needed for greater demand for the switch from ICE to EV; and the problems ahead, which is a far more complex endeavour than one may imagine, which makes it a tricky area for investors to navigate. In addition, if you are seeking a green investment proposition, it is even more complicated if you, as an investor guided by your moral obligation to invest in Companies that care for the planet. From the outset, perhaps EV-related Companies are not for you; EVs may have a big part in the green revolution, but they are not the green transport we are led to believe by Government bodies. People need to ask a simple question: Where does the electricity used to charge the vehicle come from? It is an incorrect perception the EV trend is a greener alternative to ICE – at this stage; it is essentially a myth because most of the global electricity’s primary source of energy is coal, not solar or wind – nuclear, yes, but nowhere near the levels of coal, solar or wind combined.

The eagerness to transition from ICE to EVs has created larger mining sector, a sector which is seeing M&A activity as Corporations jostle for supplies for their demand. It will not be easy navigating the sector. Moreover, investing in Lithium related Companies is not one for those of a nervous disposition, it has been a very volatile sector, but one that has been very profitable for investors over the last 12-18 months.

For the most part, I have discussed lithium batteries and mining Companies mining lithium and battery recycling Companies. However, there are alternatives to Lithium. For example, did you know sodium-ion batteries are a thing? Well, it is. Historically battery technology moved at a snail’s pace, but that appears to be a thing of the past because there is a greater urgency; therefore, buckets of money to be made through government incentives and, of course, a wider acceptance from the public to switch from ICE to EV modes, and this trend is likely to continue, subject to critical factors, such as the price of a charge, and battery costs.

Many governments worldwide, including the UK Government, are committed to a transition away from ICE, with a ban on the sale of new petrol and diesel vehicles in 2030, with hybrids to follow in 2035. However, the new PM, Liz Truss, has pledged to revise the Government’s position on the madness of Net-Zero; as such, it is too early to see what the Government plans for the future transition from ICE to EV. One thing is for sure, the current rate of EV sales is likely to create a “Hunger Games” type situation as drivers attempt to find a charging point for their vehicle unless there is a substantial increase in the installation of public charging points.

Market Trend

The best place to start is EV market trends because it is the crucial premise to deciding if we want investment exposure to this market trend, which is still in its infancy in terms of gaining market traction. For now, ICE vehicle production massively outproduced that of EVs, but this is narrowing yearly, not least because most western governments have implemented strict transition goals from ICE to EV production – 2030 is a pivotal year for many developed economies. Some world’s largest motor manufacturers have pledged to be 100% EV by 2030. However, each major motor manufacturer has plans for progressing to EV, and some high-end sports car manufacturers have no plans or desire to adopt EV technology. The Times has provided a fascinating guide to manufacturer plans beyond 2022.

The electric car market is snowballing, with over 520,000 pure-electric cars on UK roads at the end of July 2022 and more than 930,000 plug-in models, including plug-in hybrids. As a result, the global Electric Vehicle Market size is projected to grow from 8,151 thousand units in 2022 to 39,208 thousand units by 2030, at a CAGR of 21.7% (2022-2030).

The data published below offers an excellent guide to the global EV trend. However, the data related to the USA seems a tad low. Why? The state of California, the world’s 5th largest economy, has put in strict legislation, including banning ICE vehicles. By phasing out the sale of new diesel- or gas-powered cars in the state by 2035. The rule requires 35% of new cars, SUVs and small trucks sold to be zero-emissions starting in 2026, increasing to 68% in 2030 and 100% in 2035. In 2022, zero-emissions vehicles have made up about 16% of new cars sold in California. But that is not all; no fewer than seventeen states with vehicle emission standards tied to rules established in California face weighty decisions on whether to follow that state’s strictest US new rules that require all new cars, pickups and SUVs to be electric or hydrogen-powered by 2035.

One factor to keep in mind with the above is that democratic-run states usually lead these policies. So, if Trump regains control of the White House again, it is unclear how the market dynamics will change.

Supply and Demand Issues

As we now know, the race is on to transition from ICE to EV across the whole vehicle models. I have cautioned in previous articles about the time it can take to bring a Lithium mine on stream, and of course, the pace in which it can be mined in sufficient quantities, hence why I argue there should not be a mad dash by investors to pile into Lithium related Companies.

The salient thing about all of this is that the spot price of all these critical components inside batteries such as lithium and nickel have just spiked. China the price of lithium hit $70,000 per tonne recently and Nickle another critical component was $100,000 per tonne and this is just supply and demand.

For some context, and supply-side warning it is important to provide an “insider” overview from the conference, which offers cautious observations we as investors should and cannot ignore.

Andrew Miller who is the chief operating officer of benchmark mineral intelligence which hosted the conference says. “I think people have to treat these as a warning sign (he means the elevated prices of these minerals) what’s still to come for the market and for the various aspects of the supply chain over the years to come.”

“We are expecting this year alone (2022) the global demand for lithium-ion batteries to grow by about 14% and if you contrast the market where it was last year at around 450 Giga Watt hours we expect that by the early 2030s that number will top 3000 Giga Watt hours.

Sinead Kaufman CEO of Rio Tinto says: “battery materials in Rio have really been dedicated to trying to build at scale a portfolio of mining assets across lithium but also other critical minerals and battery materials and we see as others do an enormous demand for lithium as a building stock for lithium-ion batteries.”

She continues; “forecast show that light electric vehicles will make up 50% of light vehicles on the road by 2030 which means that lithium consumption needs to surge way above anything that’s currently being planned to be mined so these things aren’t even in the planning stages.”

Yet and the forecast of elevated demand is in the pipeline and let’s face it were only eight years away and in the context of setting up a full-on mining operation extracting thousands of tonnes of the target minerals.

Sinead continues; “as with every project in the world is projected to come on, we’ll still be short by 50% of the amount of lithium that’s required to build the electric vehicles.”

I’m going to give that to you one more time right she would not with every project in the world that is projected to come on we will still be short by 50% of the amount of lithium that’s required to build the electric vehicles so let’s just think about it.

There are four fully funded Lithium miners I believe will be on stream within the next 12-24 months if not sooner; Atlantic Lithium, Core Lithium, Lake Resources and Ioneer.

As more Lithium resources come on stream, it is likely the part of the supply and demand issues, particularly pricing pressures discussed earlier, should reduce the costs to the end consumer, therefore, EVs should become a cheaper proposition, therefore more popular. Subject to supply demands, raw materials prices should become more stable.

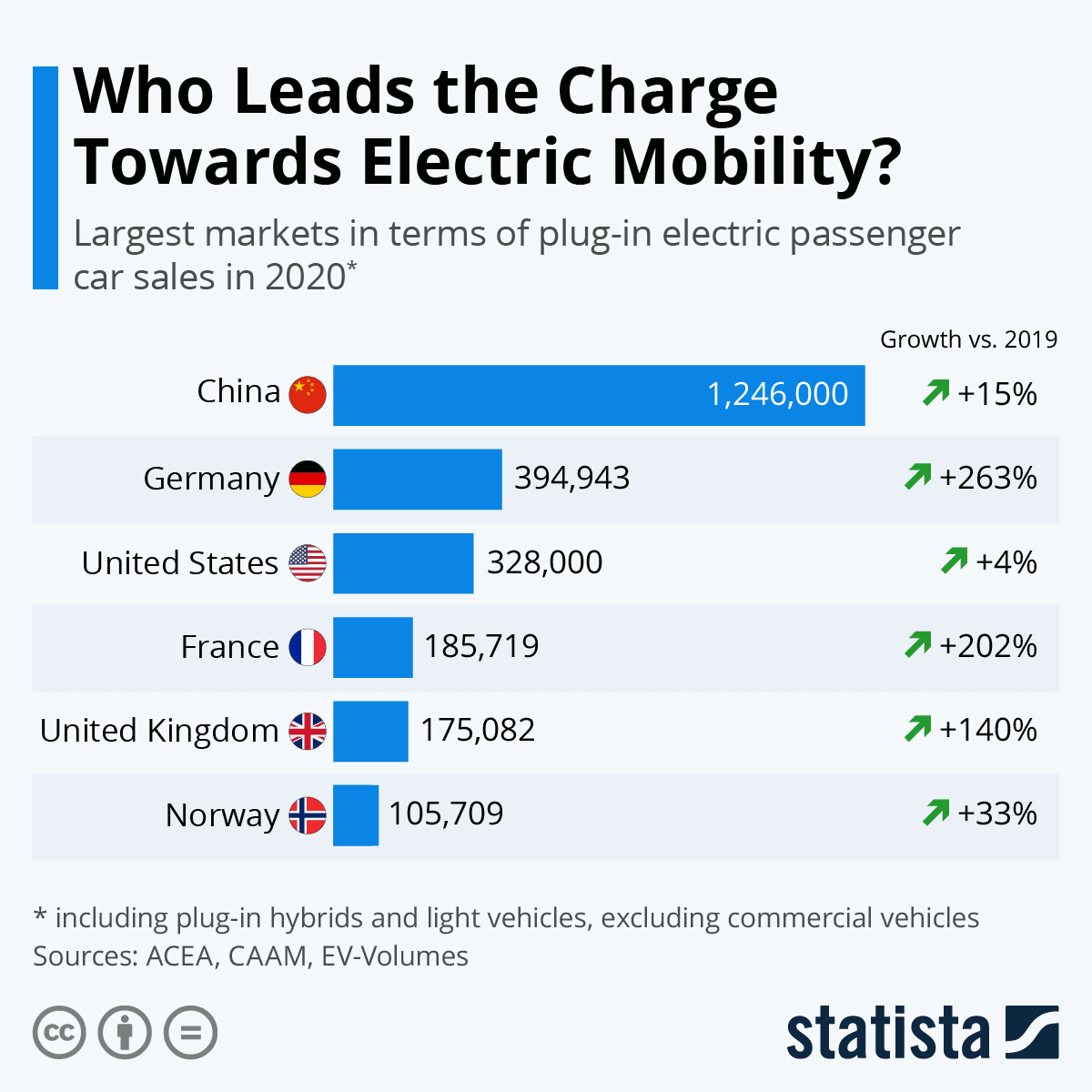

The graph below provides a clear indication of the scope of transition from ICE to EVs, China is leading the charge in terms of EVs currently on the road. In terms of percentage swing from ICE to EVs, European countries are well ahead.

China leads the electric vehicle market, with a growth of 15% from 2019-2020. Image: Statista

Lithium or Sodium Batteries?

EV battery options are not limited to Lithium or sodium; there are a few options, but I will concentrate on these two options for now.

Lithium-ion has been around for over a decade. However, there are a few issues, including short life spans and range. Lithium is the least dense material known to man; therefore, lightweight coupled with higher energy density makes Lithium more suitable for EVs because it extends the range of the vehicle.

Lithium energy density makes them the defacto preferred battery option for motor manufacturers. Unfortunately, this has created supply chain concerns because it can take several years to bring a lithium mine online and produce the goods. This issue will only worsen over the next 2-3 years until capacity increases. I highlight several mining Companies that look set to benefit in this regard.

For a more in-depth analysis of Ioneer, Lake Resources. More on Lithium, and electric vehicle-related stocks this year, as can be read here, here, here and here.

Sodium is an ALKALI METAL and is thought to be a viable option by swapping the lithium element to sodium, which sits on a level down in the periodic table. This means it has similar characteristics to Lithium; therefore, it can be a charge carrier in battery cells. However, the sodium alternative is bulkier. A particularly problematic area has been the design of the anode. Engineers have struggled to reduce the anode size to an acceptable level that allows for excellent energy density to travel, so perhaps sodium batteries are not ready to challenge Lithium.

Contemporary Amperex Technology Co., Limited (CATL) in China is a global leader in the manufacturing and development of lithium-ion and sodium batteries manufacturing. CATL products include power battery systems, energy storage systems, and lithium battery materials. The company products are applied to electric passenger vehicles, buses, trucks, diversified special vehicles, grid frequency modulation, communication base stations, commercial & industrial buildings and household energy storage. It also supplies integrated product solutions and comprehensive, complete life cycle services to global clients.

CATL has been developing Life-based lithium cells for several years. The Company has focused on studying and developing sodium ion battery electrode materials in cathode materials. CATL uses approved white material with a higher specific density. Moreover, CATL has changed the bulk structure of the material by reordering the electrons. CATL has developed a high-carbon material with a unique porous structure that allows sodium ions to be stored and transported quickly while providing exceptional cycle performance based on a series of innovations. As a result, CATL’s first generation of sodium-ion batteries has the advantages of high energy density, fast charging capability, excellent thermal stability, outstanding low-temperature performance and high integration efficiency. CATL battery can achieve an energy density of up to 160 Watt-hours per kilogramme in can be charged to 80% state of charge in only 15 minutes when kept at room temperature and even in a low-temperature environment of negative degrees.

Lithium-ion batteries are way ahead when it comes to high energy density. Lithium-ion batteries’ energy density ranges between 260-270 Watt-hours per kilogramme, while lead-acid batteries range from 50-100 Watt-hours per kilogramme.

After a significant number of charge cycles, lithium batteries’ maximum charge capacity will decrease. For these batteries, this degradation process typically begins at around 1500 – 2000 cycles. Most electric vehicle batteries have an estimated 1500 to 2000 charge cycles.

Most manufacturers have a five to eight-year warranty on their batteries. However, the current prediction is that an electric car battery will last from 10 – 20 years before they need to be replaced. I am more than a tad sceptical of this claim at this stage in the development cycle.

The cost of EV batteries has been decreasing during the past decade due to technological advancements and the production of EV batteries on a mass scale in large volumes. This has reduced the cost of electric vehicles as EV batteries are one of the vehicle’s most expensive components. Nevertheless, the price of a typical family EV is several £1000s more costly than the same ICE version. However, one of the primary commodities, Lithium, has increased by over 400% in the past year.

Companies of Interest (Battery Supply-Chain)

Li-Cycle Holdings (LICY) Li-Cycle recycles lithium-ion batteries. North America’s largest lithium-ion battery recycler went public through a SPAC merger in August 2021. Li-Cycle recycles lithium-ion batteries safely and resells the battery metals. The green metals they collect include lithium carbonate, nickel, manganese and Cobalt.

According to Li-Cycle, a battery recycling company, 460,000 tons of lithium-ion batteries are reaching their end of life each year. Furthermore, Li-Cycle estimates that 1.7 million tons of batteries will reach their end of life by 2020, with some estimates at 15 million tons by 2030. These figures are only going one way with the push for EVs from ICE vehicles.

Livent Corporation (NYSE: LTHM) has one of the broadest product portfolios in the industry, powering demand for green energy, modern mobility, and the mobile economy. It produces battery-grade lithium compounds, including butyllithium and purity lithium metal used in various performance applications. The Company’s low-cost lithium carbonate production comes from brine resources in Argentina, which produces high concentrations of Lithium with low levels of other contaminants, the result of a proprietary purification process that was first pioneered and commercialised by FMC. This process extracts lithium chloride from brine with greater than 95% purity.

Livent also operates downstream lithium hydroxide conversion plants in the USA and China and has a 25% stake in a fully integrated Canadian lithium project.

Livent has been extracting Lithium Brine at Salar del Hombre Muerto for more than 20 years. As a result, the Company claims it is one of the lowest-cost resources globally for Lithium Carbonate.

Microvast, Inc. (NASDAQ: MVST) is a battery manufacturer founded in 2006 and headquartered in Houston, Texas, but do not allow this to fool you, and it is a Chinese company that operates manufacturing bases in the United States, China, and Germany.

Microvast makes lithium-ion batteries for electric vehicles and energy storage systems. Microvast has developed a broad range of products covering many market applications, including electric cars, energy y storage and battery components, by integrating the process from raw material to system assembly.

iM3NY is a New York-based independent lithium-ion cell manufacturer specialising in commercialising cell chemistry developed in the USA. It is currently constructing a Gigafactory for its EV batteries. Production from the first manufacturing lines will begin by June this year, with further expansion targeting production exceeding 30 GWh/year within the next few years! Although not listed on any exchange, you can still see exposure via Australian listed Company Magnis Energy Technologies Limited (ASX: MNS) (HAM: U1P) (OTCMKTS: MNSEF), which owns 60% of the issued shares capital.

Lithium Miners

Atlantic Lithium Limited (AIM: ALL, OTCQX: ALLIF) is a fully funded Australia-based lithium exploration company – Formerly known as Iron Ridge Resources. The Company owns an extensive portfolio of exploration and development assets providing exploration. Atlantic is unique in the lithium industry because its flagship Ewoyaa Project in Ghana is fully funded for production, so there should not be any dilution concerns for the project.

AVZ Minerals Ltd (ASX: AVZ) is an Australia-based mineral exploration company that explores and develops iron ore, base metals, and rare earth metals blocks in Namibia. The Company is interested in the Manono Extension lithium, tin, and tantalum project in the southern Democratic Republic of Congo (DRC), where it recently updated its core Manono Project.

Core Lithium Ltd (ASX: CXO) is a lithium exploration company with copper deposits in Northern Territory and South Australia. The Finniss Lithium Project was awarded Major Project Status for its copper, zinc, and lead project located just 25 kilometres from Darwin Port. Core leads Australian peers with the lowest lithium transport emissions in the Finniss greenhouse gas assessment.

Ioneer (ASX: INR) is expected to be one of the first significant lithium suppliers in the USA. The big caveat here is the Company is not yet in production – this is expected around Q2 2023 when its first shipment to clients is anticipated. The Company spent December 2021 preparing its wholly owned Rhyolite Ridge Project in the United States, its lead asset located in Nevada, closer to development. The Rhyolite Ridge is a large shallow, lithium-boron deposit located close to existing infrastructure, which itself reduces significant investment costs.

Lake Resources NL (ASX: LKE) (FRA: LK1) (OTCMKTS: LLKKF) is an Australia-based company which is engaged in exploring and developing lithium brine projects in Argentina. The Company’s projects include Kachi Project, Cauchari Project, Olaroz Project, Paso Project and Catamarca Pegmatite project.

Elric Langton of Small Company Champion

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do research before buying or selling any investment or seek professional financial advice.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.