Lithium-ion Batteries, Recycling for Demand

Between our obsession with mobile electronics and the growing popularity of electric vehicles, lithium-ion battery demand is growing at an astonishing rate. You may have noticed I have featured several articles these past months specifically on the evolution, of the ongoing transition from ICE vehicles to electric vehicles (EVs). Most of the world’s electric devices contain 60% of lithium-ion batteries even though they only account for about 1% of automotive sales, but this latter figure is increasing at pace. Therefore, it’s not hard to imagine how far that’s going to go in time which raises the big question what happens to all those batteries when they die? This will be our focus for the purposes of this article, as will some of the Companies I view as likely investment potential.

There has been a lot of talk about transitioning from fossil energy to wind and solar, some pressure groups want an end to fossil fuels right now, even though there’s no real-world means to store what little electricity is generated by wind and solar farms. Adding storage scale seems a waste at this time when renewal energy accounts for a mere 20% of the global power grid and seems to me to be a waste of good hard cash for a hysterical response to a mere 3% of Co2 level attributed to mankind’s activity. Surely, better use of the $trillions spent over the next decade, and for what…no measurable benefit in the reduction of Co2! That said, there is no logical reason not to invest in the developing technology that will improve energy supplies as fossil resources deplete over time. We cannot ignore the political pressure COP27 will add to the argument for the reduction of ICE vehicles, therefore, regarding my view on the transition being too quick for existing technology, which is my gripe, not climate change.

Capacity & Demand

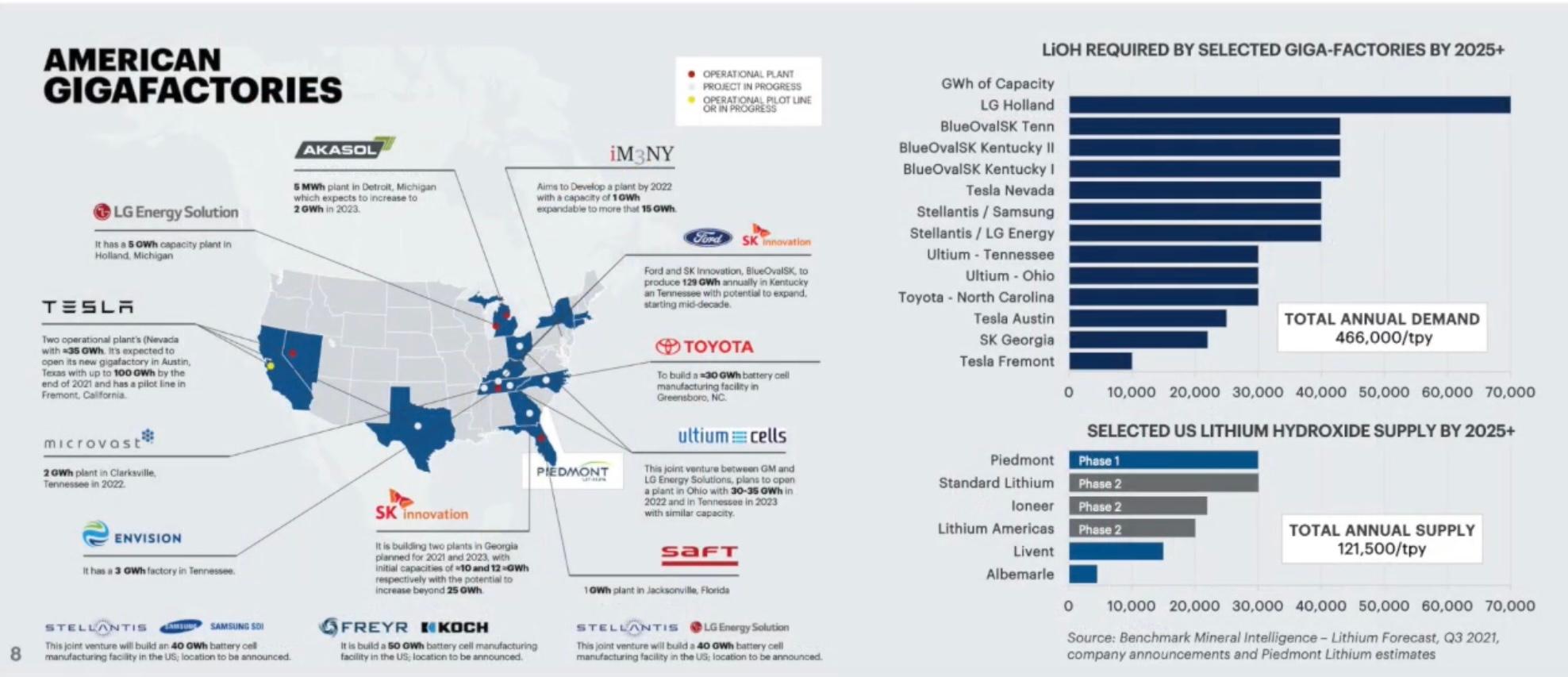

Adding the required scale of electric to the grid for the increase in EVs will require more lithium for storage projects such as home batteries like Tesla Powerwall or grid-scale energy storage systems as the scope of the problem gets dramatically bigger. In 2015 lithium-ion battery demand was about 60 GW hours, but just five years later, demand has ballooned to 300-Watt hours. According to some projections, electricity demand is expected to hit over 2 terawatt hours by 2030 which includes everything from consumer electronics to transportation. If you’re talking about just transportation the expectation is 1.8-terawatt hours demand. This raises another question; do we have enough materials to support that amount of battery production?

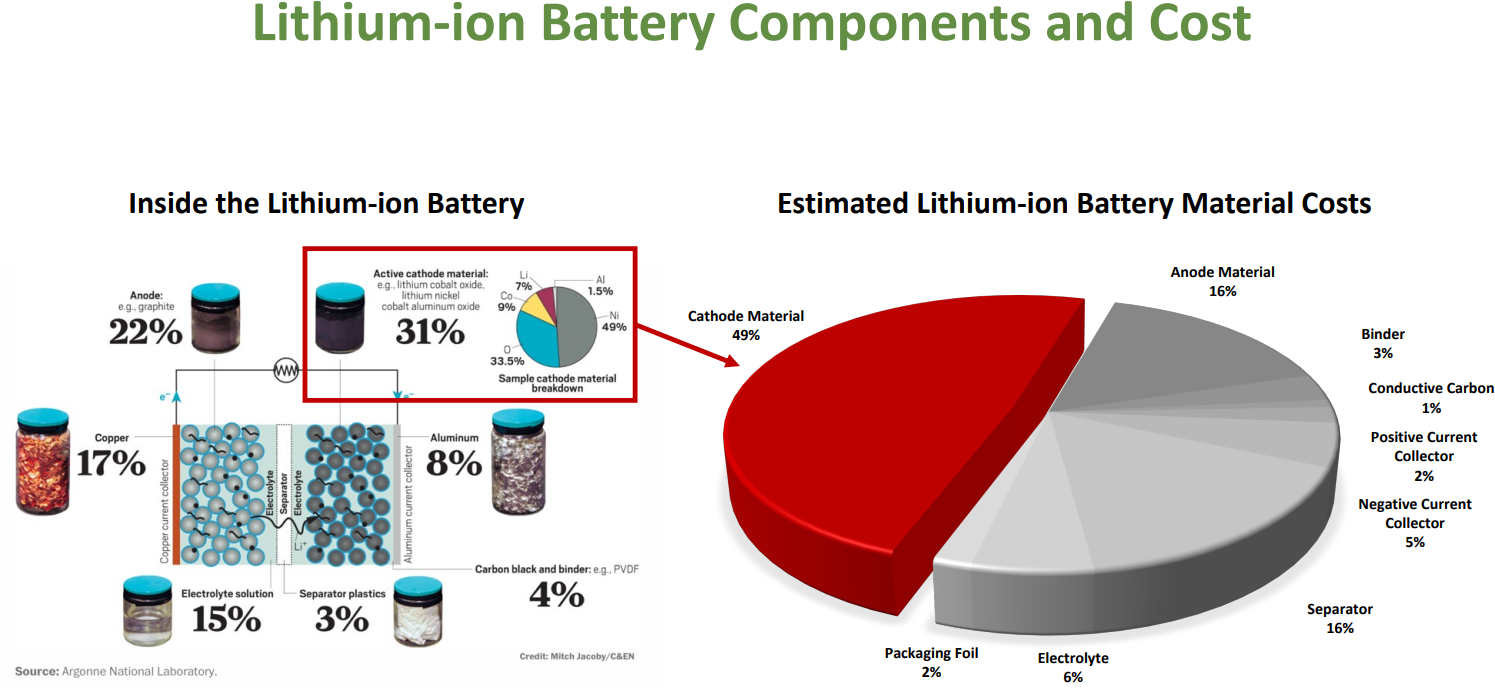

The most common materials needed for electric power and storage are lithium-ion batteries or nickel cobalt lithium graphite and copper – just the demand from lithium alone is expected to grow from c300,000 metric tonnes in 2020 to over 1.7 million metric tonnes by 2030. There are technical issues, such as the complex nature and time it takes to bring a lithium mine on stream, therefore, there are concerns there are not enough resources to support the demand; therefore, the next logical step to support the demand and supply chain is to recycle existing battery components. A lot of people I spoke to about the topic of recycling lithium batteries were very sceptical, mostly citing impractical due to the technical nature and the depleted life of the lithium; both are mythical!

USA Scale & Demand

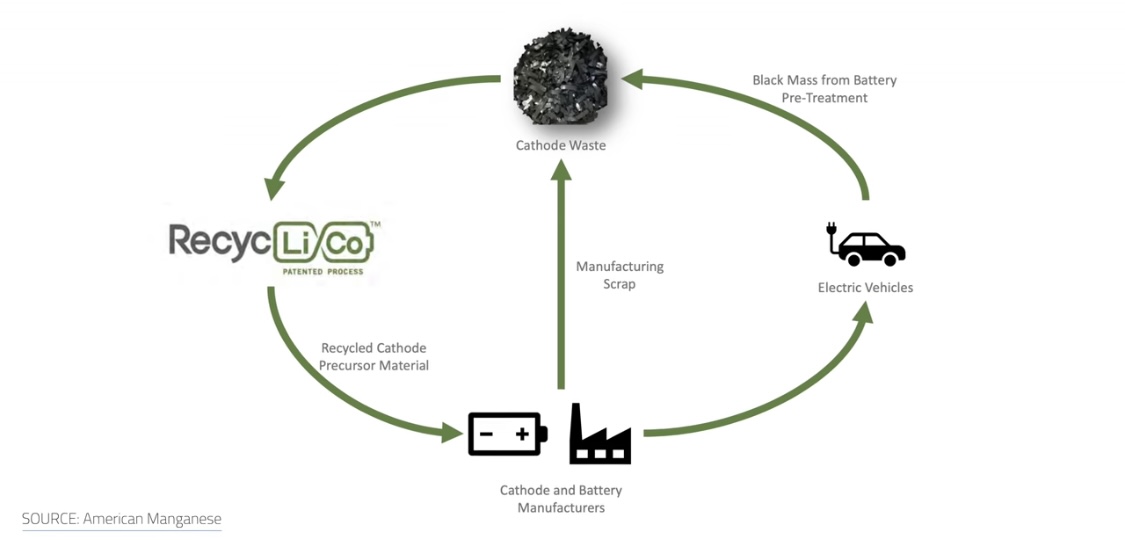

What makes me right, and the sceptics wrong? Market forces! There is a mad dash of companies all racing to market for lithium-ion battery recycling. There are around 100 companies worldwide and dozens in the US and Europe alone; indeed, I have already mentioned several of them in past editorials here, and via my own sites at Small Company Champion, and Lemming Investor Research Newsletter. These innovating Companies tackling the problem with unique techniques and technologies companies like Glencore Li-cycle and Redwood Materials. The common approach to recycling batteries is to have a spoke and hub model. This is when a company has multiple locations that are set up for processing spent batteries and remove casing materials, like plastic covers, and aluminium, while the remaining mixture is made up of things like lithium, manganese and cobalt. It looks just like it sounds, black massive battery parts just help us LD that then processes the black mass to convert it back into its component parts there are a lot of nuances to how this is done through methods of hydrometallurgy which uses chemicals or pyrometallurgy which is the high heat.

American Manganese Inc (TSX-V: AMY | OTCQB: AMYZF | FSE: 2AM) which has a novel approach to lithium-ion battery recycling in this case of American manganese recycle process its hydrometallurgy. Use this hydrometallurgy high-temperature process.

But then again you have a hydrometallurgical process but there are different techniques in the hydrometallurgy like what chemical reagents you use them general terms but how it’s done you know that’s within our practice as well chemicals concerns come up around worker safety and how environmentally safe it is, in this case, it’s very safe in the process itself is kind of recyclable.

The process is a closed or locked cycle process where the solution from the end of the process is cycled back within the process which means you don’t have any harmful environmental discharge containing working areas well you are dealing with these chemical reagents.

American Manganese initial focus is an example when typical cylindrical style cells manufactured their coding cathode and anode layers under foil sheets and then rolling them up. I have oversimplified the process, but that’s it in a nutshell that’s what’s happening.

There are parts during the manufacturing process that don’t pass quality assurance testing, defects occur which creates a lot of wasted material. A good example is to look at how much cell production Tesla and Panasonic were having to scrap during the initial stages of model three. Oh, OK – Half a million batteries a day are said to be scrapped at Gigafactory 1, the lithium-ion battery plant and electric vehicle subassembly factory shared by Tesla and Panasonic. Production ramps up an average of 39% quarterly cell loss, or three to four cells for every ten that they made recovering that crap and processing it so that they can go back into the manufacturing cycle.

Process for separating a solid from a solution when everything is complete, you’ll have clean aluminium and foil scrap from the trimmings. Separating active materials, such as lithium, nickel cobalt from plastics and others.

The process is to vertically integrate into existing battery manufacturing facilities. Battery recyclers are working closely with battery manufacturers to custom-tailor the recycling process to end up with a usable cathode mix for producing new cells based on those manufacturers’ needs for each company.

By working directly with battery manufacturers producing cathodes such as nickel, manganese and cobalt, you can ensure: your feedstock is homogenous and material can be directly integrated, thus there’s less reliance on independent recyclers who make profit by streamlining materials into the lithium-ion battery market, which will therefore require further processing and refinement.

Dealing with scrap loss can have a big impact on driving down costs, especially when you consider how much of the materials they can recover by end of our pilot plant tests, I mean within our path and we’ve achieved up to 100% of lithium, nickel, manganese, cobalt, and aluminium meaning we scaled up the pilot plant tests that you have some very extraction results in the pre legion leach was 99.7% and then that’s what high purity.

Transportation of materials and finish batteries to consider too. China dominates with over 80% of global production, and the USA is by 8% which is primarily from Tesla but the materials like lithium come mostly from Australia and Chile recycling batteries closer to locations where they are manufactured will save significantly there as well. Currently, there is a huge carbon footprint in the whole EV battery manufacturing process to materials crossing continents.

Reducing transportation in higher grade materials that are ready for new manufacturing will take time, but there are signs new lithium mines in Argentina (Lake Resources), USA (ioneer), will go a long way to reducing some of the carbon footprint.

American Manganese is developing a pilot plant in their demonstrator plant. It plans to upgrade or scale up the pilot plants to 500KG per day capacity, but now each of those stages will just fall the integrated in one and ran continuously over a few weeks and from there will be able to pull engineering data to see if it is economically viable.

Engineering data and economic data to put forward into a design or commercialisation so each step of the way is derisking the process.

Li-cycle already operates a demonstrator plant in Kingston Canada and another facility in Rochester NY and they just recently announced another facility in Arizona.

Also, Tesla Co-founder Jamie struggles, Redwood Materials could prove very promising if it lists on the stock exchange for obvious reasons. The Company claims its lithium-ion batteries facility can recover 80% of batteries, lithium in up to 95% of other materials already profitable at the unit level.

According to one report, the battery recycling market is expected to grow from 1.5 billion in 2019 to 12.2 billion in 2025 and 18.1 billion in 2030. We need to match the battery demand growth rate iceberg here people, recycling will be essential for sustainability and meeting demand is not likely going to replace the mining sector.

Hopefully, I have provided you with something to ponder and perhaps research the companies I have mentioned in passing. If you do, be aware there is a lot of volatility in lithium miners, especially ASX listed.

There’s a but…

Allow me to finish with an environmental concern which is not widely known, which I believe will grow in momentum. Lithium extraction, just like any resource extraction, has environmental consequences, such as air, water and soil contamination, as well as increasing the carbon footprint through transportation routes for processing. Lithium also requires an estimated 2.2 million litres of water per tonne of lithium. ESG-compliant miners such as Lake Resources may have an advantage over some, but, lithium mining could be the next religious cause taken up by those that believe wind and solar are the only viable option to save the planet from mankind.

For transparency, I have a modest, but growing interest in Lake Resources, and ioneer for reasons I have previously stated.

Elric Langton of Small Company Champion & Lemming Investor Research Newsletter

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.