As a seasoned observer and participant in the lithium market, I’ve navigated through its ebbs and flows with a blend of caution and opportunism. My investment strategy, focused on a basket of pre-commercial lithium juniors, was crafted with a long-term vision, fully aware of the turbulent waters of this sector, warned readers, for which I received much critique from some bulls. In this editorial, I aim to delve deep into the intricacies of the lithium market, its impact on EV adoption, and the broader implications for investors and industry stakeholders. I adopted a pound-cost-averaging strategy for several reasons. One of them is the long-term nature of my project. I also wanted to smooth out the highs and lows as I treat each investment like a pension fund. However, despite my careful approach to avoid buying near a company’s peak, I still ended up buying at new lows every time I added to my investment. As it happens, it seems I am still a good twelve months or more too early with my strategy.

Despite a surge in lithium demand, the recent collapse in lithium prices stands as a stark paradox. The assumption of consistent growth in the EV market underpinned my diversified investment in lithium companies. However, the reality has been somewhat jarring. While EV sales have grown, they haven’t met the lofty expectations set by industry pundits. This mismatch has led to an oversupply of lithium, pressuring the prices downwards and adversely affecting the share prices of lithium mining companies.

The lithium market’s complexities are further compounded by heightened competition. The entry of numerous players has turned the market into a battleground where only the fittest survive, often at the cost of dwindling profit margins. This has inevitably dented investor confidence.

Geopolitical factors, too, play a critical role. Trade tensions and instability in lithium-rich regions add layers of unpredictability, influencing stock prices. A case in point is Albemarle’s retreat from the deal with Liontown Resources for the Kathleen Valley mine – an agreement more about the mining industry’s foibles than the project itself.

The UK-listed lithium options paint a dismal picture. None have reached production, with Atlantic Lithium now at the forefront. Yet, even if these projects come online, their output pales compared to international projects like Rio Tinto’s Jadar. Though significant for local supply chains, the UK’s lithium production is a drop in the global ocean.

While necessary, the transition from ICE vehicles to EVs is fraught with challenges. The infrastructure for EV adoption, particularly charging stations, remains inadequate. This deficiency is a significant deterrent for potential EV buyers, who fear being stranded without a charging point. The pricing structure of EVs, particularly in the second-hand market, has not helped either. Prices have plummeted, further dampening sales.

This leads us to the crux of the problem – the EV market’s expansion is not just about manufacturing more vehicles. It’s about creating an ecosystem that supports these vehicles – from charging infrastructure to stable and affordable pricing models. Without this, the adoption of EVs will remain stunted.

The lithium market is also a reflection of broader economic trends. The slowdown in China’s economic growth post-pandemic has ripple effect, impacting global commodity markets, including lithium and cobalt. This is reflected in the dramatic price drops of these metals since their peaks in 2022. Despite this, the futures market for lithium and cobalt has seen burgeoning interest, a sign that investors still see potential in these markets.

As an investor, I see a landscape riddled with volatility but not opportunityless. The global push for EVs is irreversible, and lithium remains a cornerstone of this revolution. The projected deficits in lithium supply towards the end of the decade suggest that a price rebound is on the horizon. However, this optimism must be tempered with the reality of the current market conditions and the pace of EV adoption.

As we close 2023, reflecting on the tumultuous journey of the lithium market, a recent development offers a glimmer of hope for 2024. The sudden surge in share prices of Chinese lithium producers, notably Tianqi Lithium Corp. and Ganfeng Lithium Group Co., has ignited optimism among investors. This surge, marked by a 6.5% and 7% rise in Hong Kong, signals a potential market trajectory shift.

The backdrop of this optimism is set against a steep fall in lithium prices. Lithium carbonate futures, which traded at a staggering 200,000 yuan at their debut in July, plummeted to 92,450 yuan by year’s end. Analyst Zhang Weixin of China Futures Co. suggests that this downward trend is nearing its end, with an expected bottoming out between 80,000 and 90,000 yuan a ton. This perspective offers a semblance of stability after a period of intense volatility.

However, a word of caution is warranted. While a drastic drop in lithium prices may be unlikely, a sharp turnaround seems equally improbable. The market’s slump is attributed to a massive expansion in supply, coupled with slowing EV sales growth rates. Benchmark Mineral Intelligence predicts that a global market deficit is unlikely to occur before 2028. This view is echoed by Rio Tinto Group CEO Jakob Stausholm, who highlights the inherent volatility in lithium prices, primarily driven by fluctuating sentiment in the EV market.

The stark reality is that spot prices of lithium carbonate have nosedived over 80% from their peak last November. This scenario is exacerbated by continued overcapacity in the market, fueled by a surge in investments banking on the growing demand from the energy transition movement. Tianqui Lithium’s Chief Integration Officer, Yasmin Liu, underscores the importance of strategic planning to navigate this price volatility.

Looking ahead, the lithium market faces a critical juncture. The current cycle of lower prices raises the question: will this lead to the cancellation or delay of new mining or refinery projects? This concern is not unfounded, as evidenced by Albemarle Corp., the world’s largest lithium producer, which reported a trend of project deferrals last month.

The critical turning point is whether high-cost mines will exit the market. This insight, offered by Wei Xiong of Traxys at a conference in Shanghai, points to a possible reshaping of the industry landscape. Such exits could alleviate oversupply, paving the way for a more balanced market.

As we venture into 2024, the lithium market remains a complex and challenging environment. Investors and industry players must navigate this landscape with a keen understanding of market dynamics, geopolitical factors, and the broader shifts in the EV sector. While uncertain, the possibility of a market rebound is not entirely out of reach. However, it requires a strategic approach, factoring in the intricate interplay of supply and demand, policy support, and the evolving needs of the EV market.

The transition from internal combustion engine (ICE) vehicles to electric vehicles (EVs) presents a rather thorny issue for the more informed sections of the public. While the proponents of EVs wax lyrical about environmental benefits and long-term cost savings, they conveniently sidestep the elephant in the room: the significantly higher insurance and repair costs associated with these shiny new electric chariots.

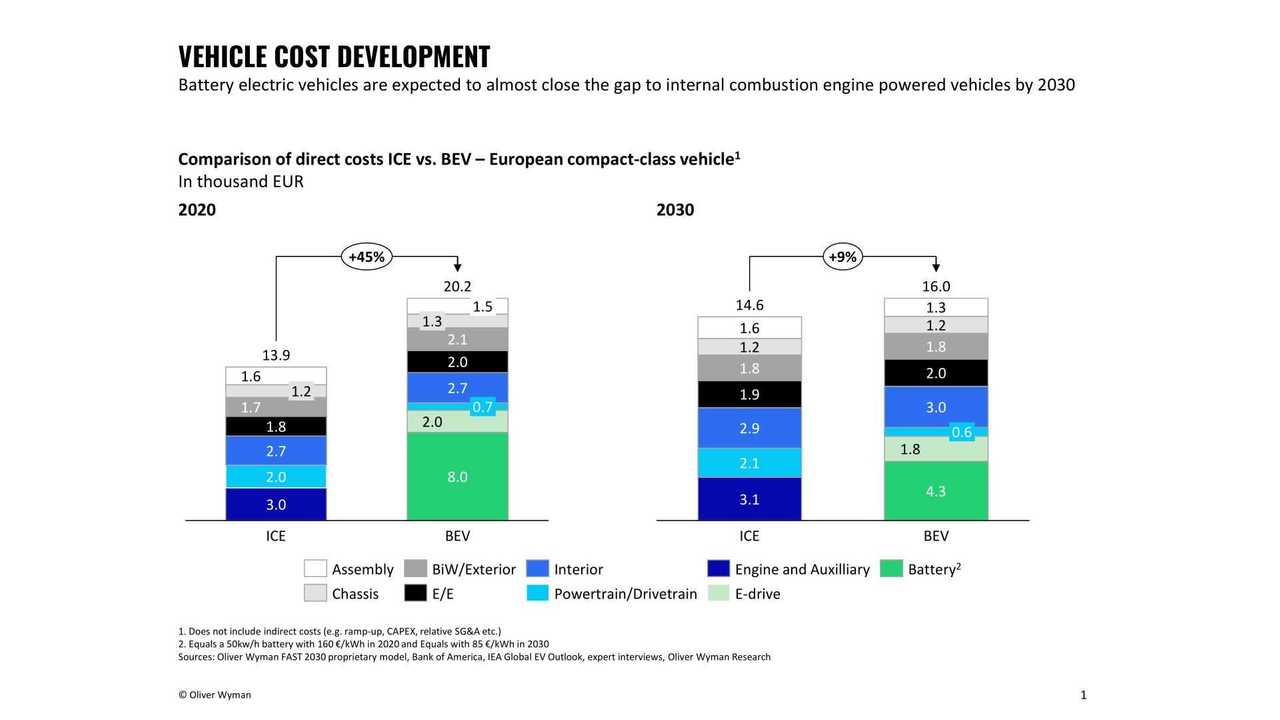

Let’s crunch some numbers to illuminate this point. The manufacturing cost of a standard ICE vehicle, say a compact C-segment car, is around €13,900, a figure that includes various components like the engine, powertrain, and so forth. Now, enter the world of EVs, where the production cost balloons to a hefty €20,200, primarily due to the expensive battery packs that come in at a whopping €8,000.

This stark difference in manufacturing costs isn’t just a matter of academic interest; it directly impacts the wallets of end-users. Higher production costs inevitably translate to heftier price tags for the vehicles, which in turn leads to increased insurance premiums. After all, it costs more to replace or repair a pricier car, particularly one laden with complex, cutting-edge technology.

Moreover, the repair bills for EVs can be eye-wateringly high. The technological wizardry that makes these vehicles run is not only expensive but also requires specialised, often more costly, maintenance and repair services. This could very well lead to a public pushback, as potential EV adopters weigh the environmental benefits against the hard-hitting financial realities.

In summary, while EVs represent a leap forward in automotive technology and environmental stewardship, they also bring with them a heavier financial burden for consumers in terms of insurance and repair costs. This aspect often glossed over in the glossy brochures and enthusiastic sales pitches, might just be the spanner in the works for widespread EV adoption. The informed public is starting to take note, and their response might not be as electric as the vehicles themselves.

Elric Langton of Small Company Champion & Lemming Investor Research Newsletter

Twitter: @LEMMINGINVESTOR

Do you have some thoughts on this week’s article from Elric? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.