In the third part of this series about avoiding investment mistakes, Ben looks at some of the reasons why companies disappoint investors – and the red flags that can help you avoid them.

When it comes to navigating your way through the stock market, there are plenty of factors that can lead you astray. Psychology plays a huge part, and so do a range of outside influences that can overwhelm your ability to think and act rationally.

In this series, I have explored some of the personal instincts and emotions that can influence decisions (Part 1 – Human psychology). I have also looked at how outside influences – like forecasts, too much information, and our love of stories – can send us off course (Part 2 – Outside influences).

While the source of some mistakes comes down to human nature, the causes of many more investment disasters lie squarely with the companies themselves. While good investing often focuses on the positive traits you want to see in quoted firms, it doesn’t always consider the traits that you definitely don’t want.

At best, ignoring the warning signs could leave you with a share that perpetually underperforms, promising good things but rarely delivering. At worst, it could land you in a stock that delists, becomes insolvent or at the extreme, turns out to be fraudulent.

If you are examining a share for the first time, knowing a few red flags to watch for could save you from disappointment.

#1. Beware of expensive story stocks

Lottery-like payouts from big re-ratings in individual shares are rare and unpredictable. But that doesn’t stop investors from seeking them out. Unfortunately, it means looking in parts of the market for firms with strong stories but often weak finances. They are generally (but not always) small businesses with unproven models in speculative sectors like technology and biotech.

The watchwords with this red flag are ‘pre-profit’. While it is common for companies to experience one-off years of losses, those that consistently fail to achieve a profit can be problematic. It means that conventional valuation methods, like the price-to-earnings ratio, can’t be used. Nonetheless, these stocks can enjoy strong price momentum as their stories permeate the market. This makes them volatile and susceptible to wild swings on news, tips and rumours.

These 10-year charts from SharePad (below) show two examples of pre-profit companies where strong price momentum collapsed quickly. The first is the FTSE 100 grocery distribution tech group Ocado, and the other is the micro-cap AIM-quoted engineering materials firm Versarien. Both stocks have seen strong momentum in their prices on promising news, but this strength has ultimately collapsed:

#2. Watch out for shares that regularly raise new equity

Story stocks often have common characteristics, but one important measure to be aware of is share dilution.

Companies that regularly raise equity funding by issuing new shares are effectively diluting the holdings of their existing investors. This can be damaging to confidence but also a warning that the firm is struggling to fund itself and there may be deeper problems with its model.

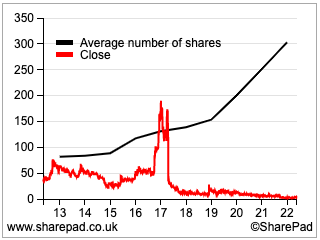

This chart from SharePad (below) shows how persistent equity raises can work against shareholders. While there is nothing to say there is anything wrong with this particular company – the micro-cap biotech firm ImmuPharma – you can see how its shares in issue and share price have diverged over time.

#3. Don’t be lulled into a value trap

Buying good shares at cheap prices is a widely used strategy. But when you find companies that are being priced for the bargain bucket, it’s worth being cautious.

This is the territory of the hardened value investor, but the risks with apparently very cheap stocks are obvious. At best the market takes a long time to re-rate them, and at worst they just keep getting cheaper.

Value traps tend to be found in firms with broken businesses, cast out by the market as toxic, out of favour, beaten up and ready for the scrap heap. For those paying a dividend, an exceptionally high yield will be an early warning sign that the market doesn’t like it.

While it’s not uncommon to find firms with low single-figure price-to-earnings ratios, there is usually a reason that you should know about.

It could be that they are highly cyclical (like some mining and house-building shares) or prone to regulatory clampdowns (which was a factor with some financial trading stocks). It could be that the firm has legal proceedings hanging over it, or a substantial pension deficit. Whatever it is, you need to find out.

#4. Look at what directors and City investors are doing

Contrary to what some think, academic studies of directors dealing in their own company shares show that ‘buying’ is a stronger signal than ‘selling’. Buying shows more intent, especially when individuals buy in substantial size or they buy as a group.

When it comes to selling, the reasons can be harder to define. Some sell for tax reasons, divorces, school fees or genuine diversification – or it could be that they know there are problems ahead.

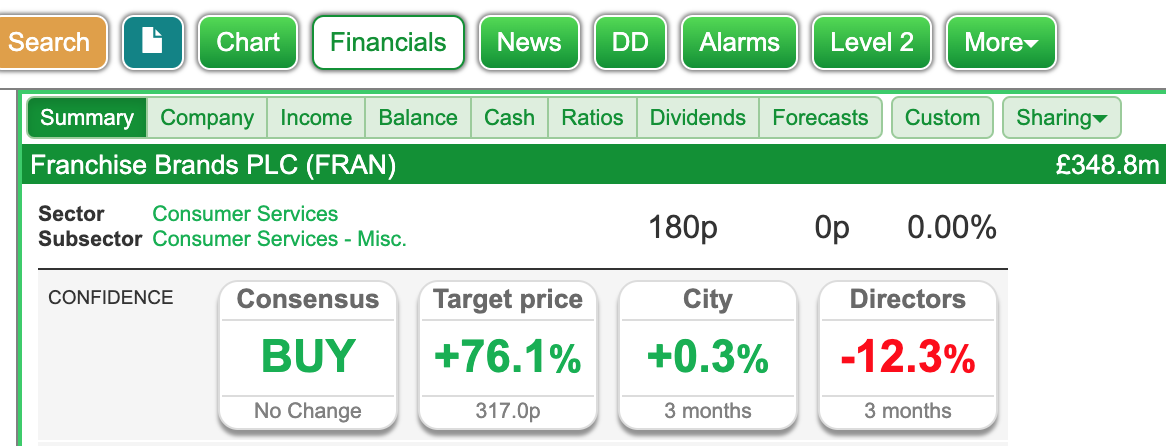

Either way, keeping an eye on dealings by directors (especially top executives) and City institutions can be a useful check. In SharePad, go to the main company page and select Financials and then the Summary tab for a quick view of changes in holdings over the past three months.

#5. Check for red flags in the finances

Comparatively recent examples of companies with accounting problems – either fraudulent or otherwise – show how hard it is for most people to detect. When senior management, accountants and bankers don’t notice, there can be little hope for those at more of a distance. And while some investors definitely have a nose for these kinds of issues, most don’t go looking for problems.

In recent memory, accounting scandals have hit firms like Carillion, Globo, Patisserie Valerie, WANdisco (and even Tesco had a fraud issue in part of its business in 2014). The details are rarely shared, but generally, they add up to some kind of aggressive or downright fictitious overstatement of revenues and profits.

The upshot for shareholders, at best, is usually a confidence-killing restatement of accounts and a huge loss on the shares. At worst, companies never get back on their feet, and simply get shut down, broken up and sold off.

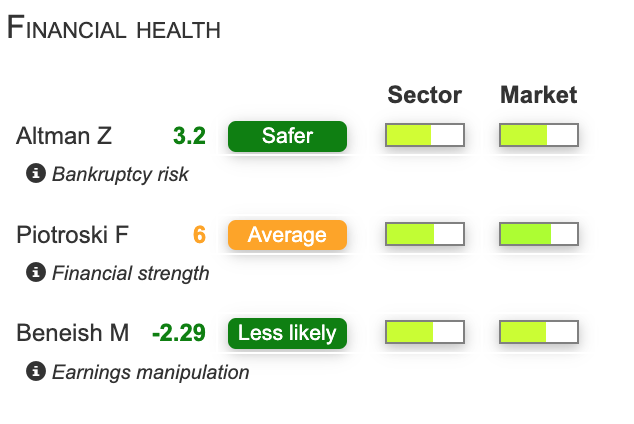

Accounting checklists are not bombproof, but it’s worth taking note of obvious red flags in financial trend scores like the Altman Z, Piotroski F and Beneish M, which are shown on SharePad’s company pages:

The Altman and Beneish scores are designed to examine how closely the finances of a company resemble those of firms that have entered bankruptcy or manipulated earnings in the past. The Piotroski F Score looks back at trends in certain accounting measures over time to detect improving or deteriorating trends.

#6. Avoid shares on a negative trend

For investors who build their strategies around the strengths of companies and their finances, the idea of using technical techniques can seem alien. But just as traders use fundamentals in their checklists, investors have a lot to gain by looking at price momentum.

Academic studies of momentum show that strong price trends (often driven by investor behaviour) tend to persist for anything up to a year – both up and down. The key here is to avoid stocks on a persistent downtrend.

Advocates for price momentum like to see prices performing well relative to the market, accelerating and, even better, hitting new highs. Most momentum strategies combine price strength with other factors such as cheap value or high quality. Regardless of preference, medium-term price trends are an important consideration because buying into a negative trend is unlikely to work out well.

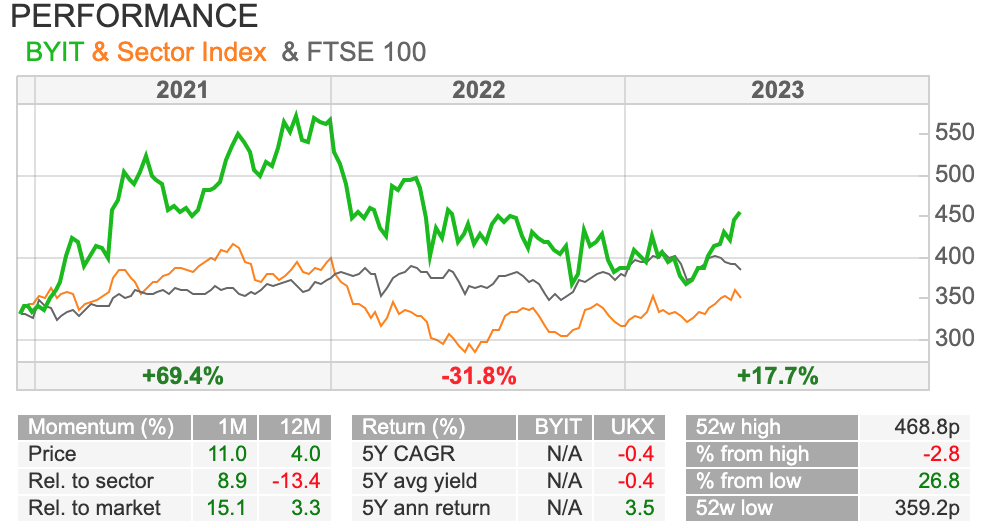

In SharePad you can get an excellent view of a share’s current and medium-term trend versus itself, its sector and the market. You can find this in the Performance section of the Summary tab when you click on Financials.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.