In the second part of this series about avoiding investment mistakes, Ben looks at how influences from the outside world can ruin the best investing plans, and what you can do about it.

When it comes to sensible stock selection, careful portfolio management and navigating the ups and downs of markets with aplomb, we really are our own worst enemies.

Encumbered by emotional and cognitive shortcomings – from anchoring and over-confidence to the disposition effect and confirmation bias – human nature is in many ways a hindrance in the pursuit of investment profits.

But as I explored last week (Part 1 – Human psychology), many of these psychological trapdoors can be kept bolted shut with the help of simple rules and checklists to guide your decision-making.

Whether it’s choosing what and when to buy or sell positions, what to do in a market dip or how to deal with losing and winning holdings, a set of personal rules can avoid the temptation to act on instinct.

But while learning to manage your own impulses and aversions can make investing a more enjoyable and profitable endeavour, there are other forces to be aware of too.

In the next article, I’ll be exploring the traits of stocks that tend to lose money. But before that, it’s worth examining some of the outside influences that make us interested in them in the first place.

#1. Relying too heavily on forecasts

Research consistently shows that forecasts tend to be inaccurate and that humans are routinely over-confident in their ability to predict even the near future.

The problem for investors is that trading decisions hang on expectations of what lies ahead. It is widely agreed that markets are constantly pricing in expectations one or two quarters into the future. That implies that forecasts are a necessary evil.

Back in 2005, James Montier, the economist and investment strategist, wrote a note called The Folly of Forecasting (it is part of the Seven Sins of fund management group of papers). He described the fund management industry as being obsessed with forecasts – putting them at the centre of investment decisions – helped along by investors’ propensity to be over-optimistic and anchor their assumptions on “any irrelevant number”.

More recent research by the fund firm Verdad, examined US data between 1997 and 2021 and found that analyst forecasts still “systematically overshoot the actual outcomes”, particularly when it comes to predicting earnings.

The lesson here is to be wary of forecasts, especially the further into the future they look. Past trends can be a more reliable way of forming a view about a stock’s valuation, momentum and quality, which are all powerful factors that drive returns.

This article from Richard gives some useful pointers on using a custom table in SharePad to assess important historical trends in company performance (without relying on forecasts): One custom table to rule them all

#2. Too much information

With the evolution of the internet has come an era of non-stop news and opinion. It has transformed financial market information and made it easy for anybody to find and explore investment ideas.

However, behavioural scientists warn that all this information actually increases the chances of making mistakes. Rather than being useful, it dilutes the focus on a handful of important measures and criteria that you might have in a checklist. Again, it’s a factor that can lead to over-confidence, provoke unnecessary trading and instinctive decision-making.

At worst, too much information can exacerbate the chance of suffering from confirmation bias, by tempting you to search (and probably find) someone or something that agrees with your views. The increasing availability of broker research and online investor communities are a particularly potent source of confirmation, so should be treated carefully.

Ultimately, it’s preferable to select information for a collection of trusted sources and make decisions after consulting a range of them.

Suggestions in this article by Martin on how to build and manage a portfolio are a useful starting point in staying sane in the face of so much information: How I build and manage my share portfolio

#3. Be wary of stock market stories

Psychologists universally agree that stories play a vital role in human development from the moment we’re born. They impart senses of comfort, imagination, inspiration and enjoyment. Telling stories is baked into cultures and societies dating back to the start. It is no wonder that they hold such an appeal.

In the stock market, stories capture attention like statistics rarely can. But this is no place for fairytales. High hopes, expectations, possibilities and predictions of a happy outcome often end in bitter disappointment.

Story stocks are dangerous territory for investors, in part because when they do pay off they can deliver the kind of lottery-like returns many dream of. While these success stories are exceptionally rare, it can actually turn them from stories into folklore and even legends.

Some of the best story-tellers are company management themselves. After all, they are perfectly placed to know where the excitement is and raise the interest of investors.

In addition, share tips, press stories and supposed experts on Twitter or internet forums are often capable of spinning a speculative and serial loss-making story stock into the most exciting sounding prospect you’ve ever heard. If it’s in a hot sector or associated with emerging trends, innovative technologies or exciting breakthroughs, all the better.

While it might be too much to say you should always avoid them, the risks with story stocks are a strong reminder of why a solid process and investment rules are important. Being able to check the fundamentals of a company against a checklist of important criteria can at least give you an idea of what you are dealing with. Only then should you decide whether the story is worth pursuing.

Phil wrote a useful article here on the ideas that could be used in A checklist for busy investors.

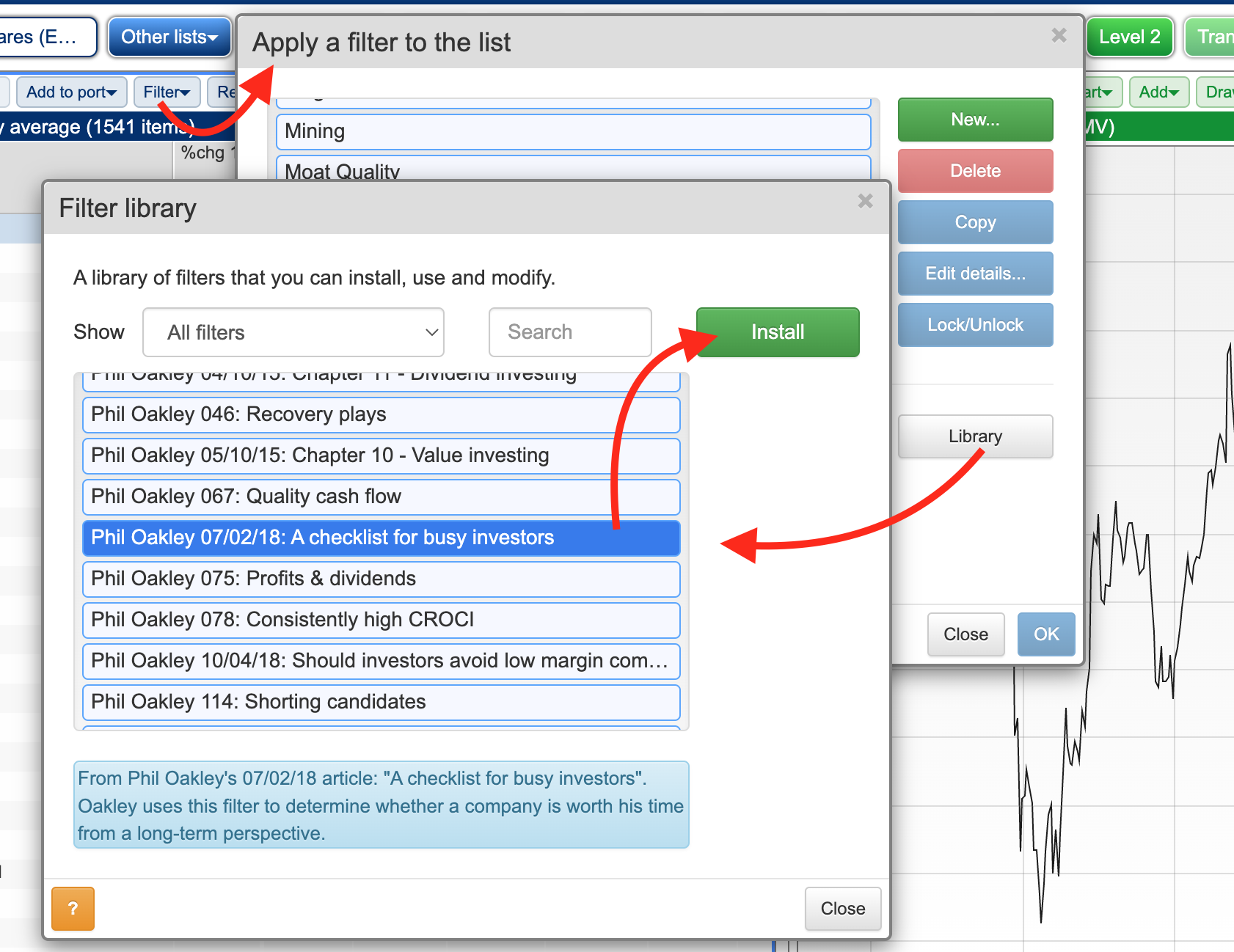

To quickly apply a checklist like that with SharePad, select a list of shares that you would like to explore. Click Filter at the top of the page, to launch your Filter options and then click Library to explore pre-set Filters to choose from. Choose any Filter checklist you like, including Phil’s checklist for busy investors:

Don’t be your own worst enemy

Human behaviour plays an important role in investing. Personal flaws can be managed with good processes (and the help of checklists) but it is important to be wary of outside influences too.

Parts of the investment industry – research and forecasts, news and opinion, the smaller, more speculative parts of markets – can all play on some of the classic emotional instincts of investors. It’s not that these areas are bad (far from it) but more that they should be treated carefully and not allowed to have excessive influence. Strong investment processes can help.

From here, the next step is to begin exploring the market itself and some of the factors investors should be cautious of when it comes to avoiding trouble. Many investment strategies, articles and commentary focus on the strengths you should be looking for in companies. Far fewer consider the weaknesses you should actively avoid. That’s where we’ll look next.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.