Michael talks shorting and specifically – using this weeks news story on Ocado as an example – when the shorters get squeezed.

Let’s be honest. Everyone loves a short squeeze. Unless, of course, you’re the shorter being squeezed. Then it’s like being nailed to a chair that’s set on fire.

But shorting is an active part of the market – and a much needed one at that.

Remember, it’s never the regulator that spots the fraud. It’s always those that are motivated to profit from it.

Do shorters use dramatic exposures and reveals to maximise the effect? Yes. But where’s the difference to longs actively promoting their own book on podcasts, in their newsletters, on social media? To me it’s no different and shorters take on significantly more risk too. If they’re wrong then their losses (assuming they’re trading from a professional account) are unlimited.

So, whilst I’m thoroughly in favour of shorting, and have written a guide on it, that doesn’t mean it isn’t fun being part of or at least watching a squeeze from the sidelines.

Such a squeeze happened in Ocado earlier this week.

Squeezes often have a spark

In this case, it was The Times’ article published Thursday June 22 2023 at 12:00am titled: ‘Ocado rises as rumours of bid interest circulate’.

Here’s an excerpt from the source.

“[Y]esterday Ocado spent most of the session at the top of the FTSE 100 leaderboard as speculation of bid interest from more than one American suitor took hold. The talk was that technology heavyweights such as Amazon were pondering the merits of an £8-a-share move, with Goldman Sachs and JP Morgan, as it happens, said to be acting for bidders.”

At first glance it doesn’t seem material.

Here’s the chart.

A bit of a non-event, to say the least. The stock didn’t trade anything out of the ordinary in terms of volatility or volume. In fact, without the article, nobody would’ve suspected anything.

However, the next day..

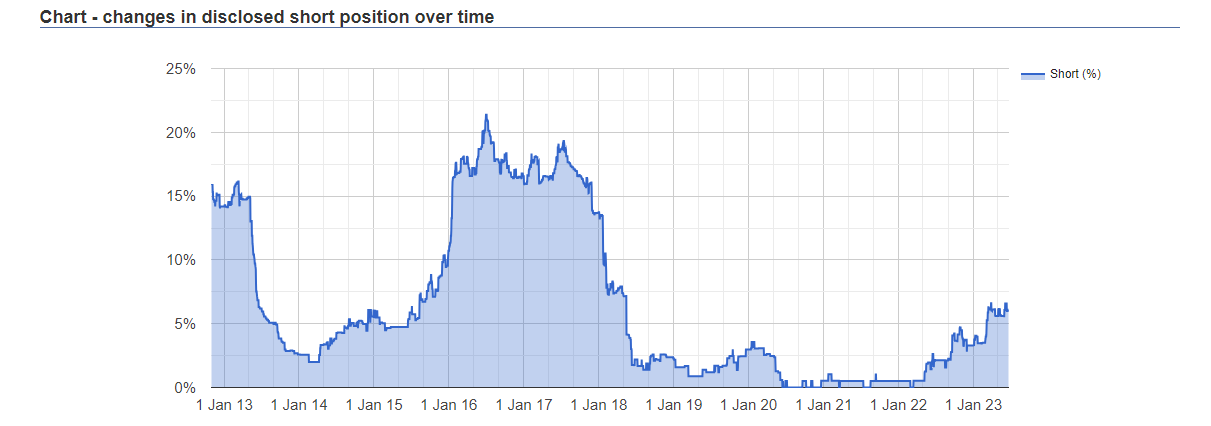

There was a small gap up, and a mad scramble for stock. Ocado is a heavily shorted stock, with Short Tracker claiming 6.09% out on loan as of 19 June 2023 (see chart below).

Whenever you get:

- A heavily shorted stock, and

- A not uncredible bid rumour

Then there is the powder keg of potential waiting to be blown off.

In these instances, if the gap is small on the intraday, then it can be worth paying up to get involved in the uncrossing trade.

There are then three potential outcomes.

- Nobody believes the story, and nobody buys the stock

- Nobody believes the story, but people buy the stock anyway

- People believe the story, and buy the stock

Two of these three outcomes will result in a price rally.

Remember, short-term trading is not about what is true. It’s about what is perceived.

It’s also about other market participants and where they’re at.

In this instance, some who are short the equity will’ve been nervously watching the stock price on the open, hoping for a non-reaction.

Others may’ve just wanted cover before any spike started, but that buying to close is obviously buying pressure that shows up on the book. Then there are other traders either longing the stock hoping for a rally, or those ready to jump on any rally.

This is why short squeezes happen because there are two sets of buyers. Buyers who want to close before the price rallies too much, and those who want to put the hurt on shorters by trying to drive the price up and force some to close, which in turn adds more buying pressure and pain on those who have yet to close.

Here’s an intraday chart of the action.

We can see the stock starting printing daily highs continuously from the open and rallied into auction.

The auction gave the market five minutes (and a random 30-second uncrossing period) to collect itself but not long after continued to rally into another auction.

Stocks auction when they hit their Millennium threshold limit, which is based on the last uncrossing price. These auctions are designed to quell any excessive volatility, although in reality that’s not always the case.

The stock was +45% on the day at one point, and so shorters took a pasting on their intraday P&Ls.

To trade these events in the future, it’s worth keeping an eye on the most heavily shorted stocks, and if there is a bid rumour out of market trading hours, watch it the next day.

If there’s no gap up at all, you can go long with excellent risk/reward. Because if there’s no reaction, then you can close with a minimal loss.

But if there is a reaction, you can get an outsized risk/reward on the trade.

Michael Taylor

Buy the Bull Market premium trading newsletter available at: https://newsletter.buythebullmarket.com/

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.