Share prices on London’s Alternative Investment Market (AIM) have come under huge pressure over the past 18 months. But dividends from AIM stocks actually hit a record high in 2022. So what do these mixed signals really mean, and where can you find the best dividends on AIM?

I am going to start this article for SharePad with what might come as surprising news that it is going to be my last. You can breathe a sigh of relief. I’m pleased to say that we haven’t fallen out (far from it, the team here at Ionic is fantastic). Long story short, the demands of life and family mean that I’m changing course and embracing the full-time 9-5 again.

One of the interesting things about being this side of writing about shares and markets is you get to see the themes that capture reader attention. Having watched this over time, I’d say that two of the most popular are the Alternative Investment Market and Dividends.

Now, on paper, those two ‘themes’ seemingly represent two quite different styles of investing.

On one hand, you have got AIM, which has evolved quite impressively over the past 20 years. But it’s still the tax-friendly, slightly speculative and under-researched field of opportunities (and threats) that really engages individual investors. It’s the territory of multi-baggers and beating the City at its own game by rolling up your sleeves and getting your hands dirty.

On the other hand, dividends and income investing have a rather more safe and steady feel to them. This is the land of compounding and higher quality, more predictable (and perhaps more pedestrian) firms. They act like reliable old friends but probably won’t shoot the lights out.

For different reasons, both AIM and dividend investing have experienced wildly mixed fortunes over the past three years.

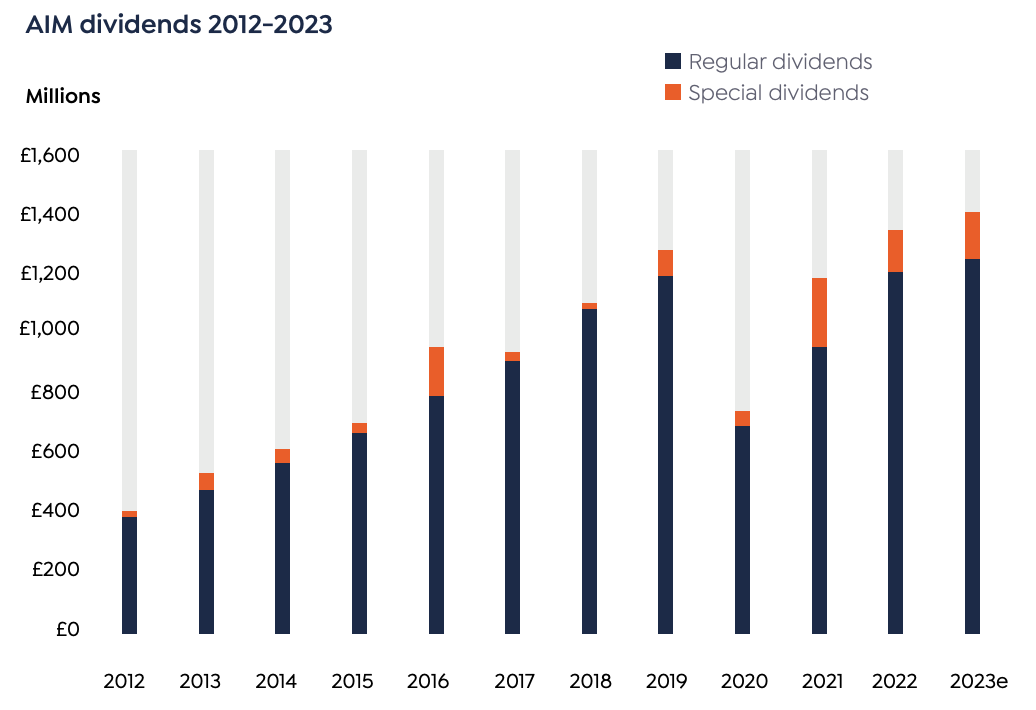

Dividends hit a new record in 2019 before wiping out in 2020 as businesses slashed payouts in the face of Covid-induced uncertainty. But last year, as investing styles spasmed and prices tumbled, dividend payouts proved once again how important they really are.

For the Alternative Investment Market, Covid was a short, sharp pullback before a spectacular tear. As the 5-year chart below shows, it was like pulling back a catapult and letting fly.

Chart: SharePad

But it wasn’t to last. AIM’s impressive post-Covid rebound came tumbling down in 2022. As higher-risk assets, equities were marked down everywhere. At the highest risk end of the spectrum, smaller, growth-oriented shares with unproven business models, weaker finances and unpredictable future cash flows, took the worst of the hit.

While the UK’s main indices are broadly flat so far in 2023, AIM has slipped another 5.6%. In total, the index has lost 35% of its value since the start of last year.

AIM prices tumble but dividends hit a new high

Despite the pressure on prices, new research shows that dividend payouts from AIM shares hit a new high in 2022 despite lower year-on-year special payouts.

Research by investment services firm Link Group shows that 30% of companies on AIM paid a dividend last year, up from 26%. In total, the payout from those firms grew by 13.7% to £1.34 billion.

In yield terms, the forward yield on the whole AIM market stands at 1.4%. But if you exclude stocks that don’t pay a dividend, the forward yield rises to 2.4%. That’s not too dissimilar from the average yield historically on offer from the FTSE 250.

According to Link’s research, every sector on AIM saw an improved dividend payout in 2022. Oil, industrials, mining and financials were particularly strong, and despite some weakness for miners this year, they are all continuing to perform well.

Source: Link Group

The market-wide improvement in AIM payouts is credited to the continuing post-pandemic recovery and generally improved profitability across the market. And it’s really here where the big questions for investors lie…

At first glance, there could be an argument to say that the AIM sell-off has been unfair on some solidly profitable firms – evidenced by their increasing dividend payouts. But on the flip side, the prospect of an economic slowdown, which may even be occurring now, could hurt the profits of smaller AIM companies, and that would hit dividends.

Smaller firms can be more susceptible to economic pressures, and if they are forced to cut their dividends it can spook investors. To try and tread this tightrope – which applies to dividend shares anywhere in the market – here are some all-weather dividend rules that you might use in the search for AIM income shares:

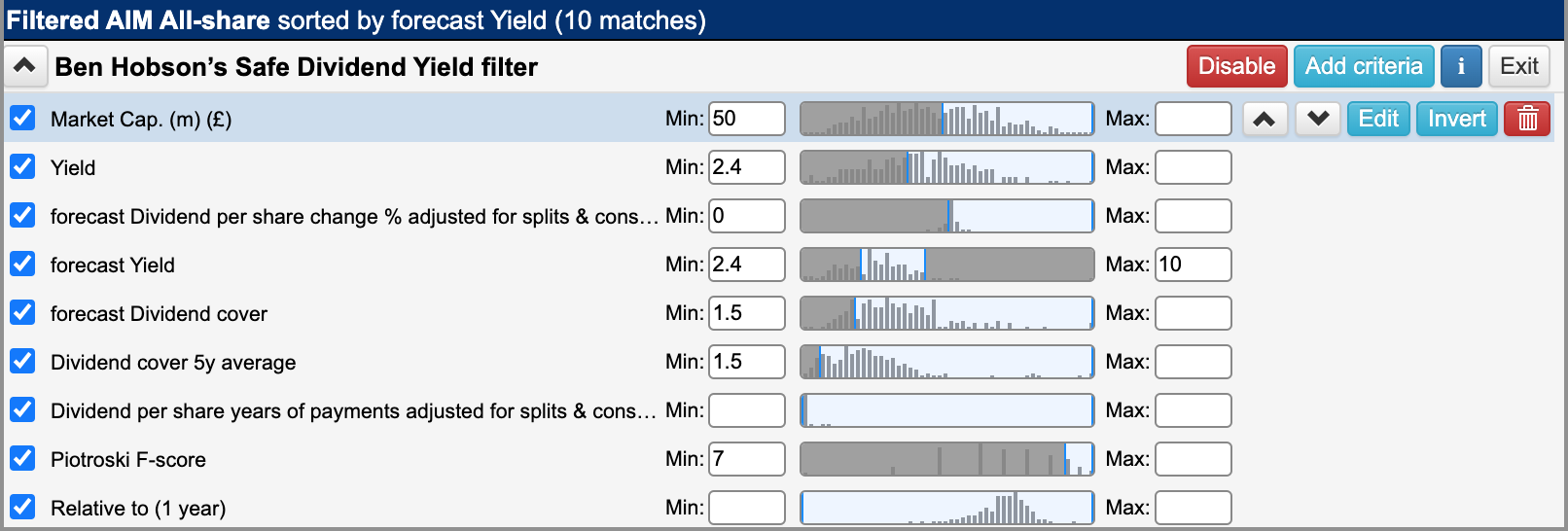

Dividend yield and growth:

- A forward dividend yield of more than 2.4% (the market average)

- Forecast dividend growth in the year ahead

Dividend safety:

- Minimum market capitalisation of £50 million

- Dividend cover (5-year average and 1-year forecast) of more than 1.5 times earnings

- A track record of paying dividends (at least two years)

- A Piotroski F-Score (of improving financial health) of at least 7 out of 9

Here is how that looks at a SharePad filter:

Introducing rules like a strong record of dividend payouts needs care. Many companies cut their payouts during Covid, so looking for strong sequences of payouts, and even payout growth can reduce the universe of shares to consider – so it can pay to be flexible.

Likewise, the Piotroski F-Score is a catch-all health check that scores companies based on improving trends in their financials – with 9 being the top score. It’s a tool that can be used in any strategy to detect early warning signs and prioritise firms where finances are in good health.

This is how the screen looks currently. The table includes each stock’s price performance relative to the wider AIM market over the past 12 months. Several have performed well, which suggests a focus on quality does pick up strong performers (as you would hope) – but others have undershot an already weak index.

Are AIM shares and dividends a good match?

While AIM occasionally experiences troubling behaviour from companies (which can be detrimental to shareholders) there is no doubt that standards have improved – along with the size and sophistication of both companies and investors – over the past 20 years.

In that time, dividends have become increasingly welcome, not only as a source of returns but also as a sign of company quality, careful management and consideration for shareholders.

As last year’s strong pullback in prices showed, the market is still prone to investor flight when economic clouds gather. With many still nursing heavy losses on shares that had been flying just months earlier, it shows that dividends are arguably just as important on AIM as they are anywhere else in the market.

As always, yield is one of the most desirable traits, but keeping an eye on dividend growth, consistency and safety are essential.

All the best.

Ben Hobson

Got some thoughts on this week’s article from Ben? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for ‘share chat’.