There are a rapidly growing number of certified B Corps organisations that combine purpose and profit. As yet, only a handful are listed, but Richard thinks we’re at the beginning of a trend. It may be a profitable one for investors.

This year’s crop of Christmas gifts has rekindled my interest in investing in a particular kind of company: B Corps.

These are businesses that have avowed to look after the interests of all stakeholders including customers, suppliers, employees, society and the environment.

My family spent a lot of money on gifts supplied by B Corps this year. In my newsletter, I wrote about the pyjamas I gave my wife, and the rucksack she gave me, but I forgot to mention the body lotion we bought for two friends from a B Corp called Aesop.

One of my shares, soap, fake tan, and baby food maker PZ Cussons, is making the changes required to qualify for B Corp status.

I thought PZ Cussons might be the first listed B Corp, but then I discovered that Kin and Carta, the annual report printer turned digital transformation consultancy, qualified in 2021.

Last Tuesday I got a press release saying another digital transformation consultancy, TPX Impact, had just become a B Corp.

There are over 1,500 B Corps in the UK, up from 178 at the end of 2018.

Not all of these organisations are profit-seeking and even fewer are listed, but I think achieving B Corp status is a trend and it could become a profitable one for stock market investors.

A promising trend

The idea excites me for the obvious reason, B Corps are trying to do good, and also for a less obvious reason. They might help solve an investing conundrum that has bedevilled me for as long as I can remember.

It has long been recognised that people-focused businesses, those that delight their customers by cultivating their employees are among the most profitable.

The best of these are the so-called recruitment machines described in Intelligent Fanatics Project, a book that made a big impression on me. These companies recruit, train, motivate and retain staff, accumulating expertise and capabilities to serve customers better.

No doubt it was thoughts like these that led management consultant Peter Drucker to say “culture eats strategy for breakfast”.

A pool of motivated and experienced employees are capable of inventing new strategies and adapting to new circumstances indefinitely.

Recruitment machines are not just good businesses, but good businesses getting better.

Employees and customers are of course two of the stakeholder groups, B Corps focus on.

Long-term business strategy is not beggar-my-neighbour, it is win-win, which also extends to the other B Corp stakeholder groups: suppliers, society and the environment.

If you are in doubt that purpose and profit can go together, take a look at this “through the keyhole” profile of Aesop. It was published in that tabernacle of showy wealth, the FT’s How To Spend It Magazine, weeks after my wife became a customer.

The sales process included having her hands washed by the shopkeeper, an event my daughter described as “a bit weird”.

Aesop, Cambridge. I thought it was a small local business! The illusion is deliberate. Each shop is different.

L’Oreal, Aesop’s current owner, paid $2.5 billion for the business and the brand has 400 stores and counters around the world. I had no idea, but maybe I should have guessed when I heard my wife had handed over £72 for two bottles of body lotion.

All of my favourite investments espouse wholesome values. Not at all exclusive or expensive kitchen-maker Howden Joinery’s objective is, word for word, to be “worthwhile for all concerned”.

Howdens is actually a bad example for my purposes though, as it is very good at explaining how it is worthwhile for all. Most businesses are not. Measuring “culture” is difficult, and describing it quickly descends into platitudes.

Verifying a company has a good culture is difficult, and B Corp status may make things easier for us.

B Scores

If you have read my articles before, you will know that I am a big fan of scoring.

I score companies’ financial performance using my 5 Strikes system in SharePad, and if I think a company is likely to be a good long-term investment I score its business model and strategy in my Decision Engine.

Scoring boils complexity down to a single number, which can be compared to the numbers achieved by other companies and tell us whether a business meets the standards we set.

To qualify as a B Corp, a company has to achieve a B Score of at least 80 out of 200 in a B Impact Assessment. Not every listed business that achieves this mark will make a good investment, they have to be good at making a profit too. However, I would be very interested in any financially sound business that qualifies as a B Corp and earns decent profits.

So I have gone in search of other listed B Corps.

B Corp tracker

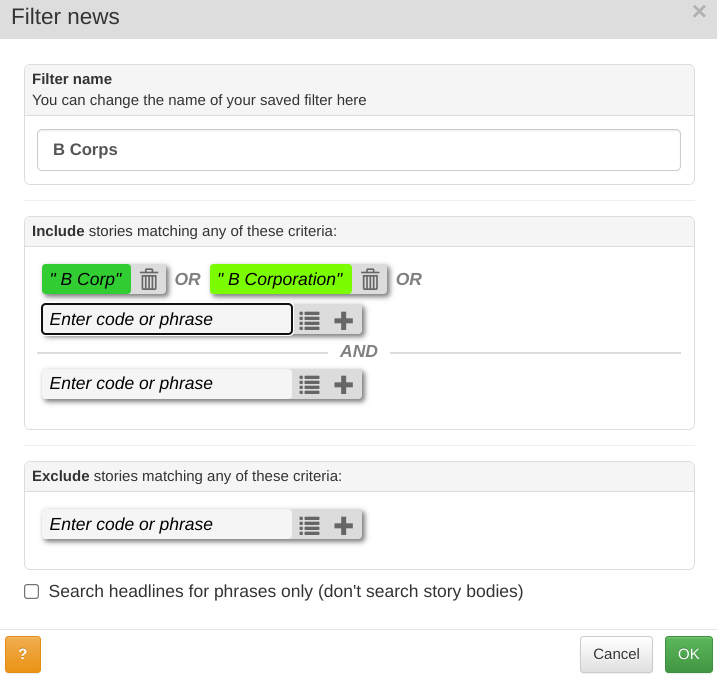

SharePad allows us to filter news items for certain phrases, so we can create a “B Corp” filter, which finds news items mentioning the words “B Corp” or “B Corporation”.

This is the setup (I included a space before each phrase to stop the search returning phrases like “Pub Corporation”!):

There are more listed B Corps. ProCook, a direct retailer of kitchenware, and concierge service Ten Lifestyle, are B Corps.

Other companies, Good Energy, Next 15, Science in Sport and PZ Cussons are B Corps aspirants. They are making changes to achieve B Corp status. Actually, I am not sure about Next 15, it last mentioned its quest for B Corp status in 2022.

To track them, I have added a B Corp status column using SharePad’s Notes facility to my 5 Strikes list view and created a portfolio of B Corps. If the company is a B Corp already, I put its B-Score in this column. If it is an aspirant, I put “A”.

The scores come from B Labs, the organisation that certifies B Corps. It lists all B Corps, their scores, and the composition of those scores.

By combining the B Score status with 5 Strikes, at a glance we should be able to find businesses that are good in terms of making money, and good in terms of purpose, aka The Holy Grail:

For an explanation of each strike, see our guide to 5 Strikes. A strike is simply a confounding factor, something in the numbers that makes the investment less palatable to me. Too many strikes and the company’s financial track record, which I rely on heavily, is too problematic for me to analyse.

As you can see my first trawl is not a massive endorsement for a B Corp investing strategy, but that may change as more companies become B Corps, and if these companies flourish.

ProCook, Science in Sport, and Ten Lifestyle do not qualify for 5 Strikes scores.

ProCook and Ten Lifestyle fail my basic criteria. ProCook fails because it has not yet been listed for three years, and Ten Lifestyle fails because it has not earned a positive Cash Return on Capital Invested averaged over the last three years.

Science in Sport is out for a few more months on a technicality. I only started scoring using the 5 Strikes system in March 2023 and score each company when it publishes its annual report. Science in Sport’s time has yet to come.

Of the others, only PZ Cussons (2 strikes) and Next 15 (1 strike), neither of them verified B Corps yet, are likely candidates for investment now. That is because they score less than three strikes.

Kin and Carta, a company with a dubious financial track record, is likely to disappear from the list. Braver investors than me are bidding to take it private.

~

Contact Richard Beddard by email: richard@beddard.net, Twitter: @RichardBeddard, web: beddard.net

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share