Keystone Law is top of Richard’s research list because it is unlike any other listed law firm. Not only has it performed better than the others, it has a different way of doing business. But how special is it?

One of the many things that hinder my understanding of companies is a direct result of spending so much time looking at listed businesses.

I forget about all the unlisted ones.

SMIATI

Let us call this weakness SMIATI (pronounced smartie), the Stock Market Is All There Is. If you are of a similar disposition, let me awaken you with an example.

Ten years ago, there were no law firms listed in London. Then a flurry of listings meant there were more than you could have counted on the fingers of one hand. Now, due to delistings, there are four.

Where do you think those four listings stand in the list of the UK’s largest law firms by revenue, according to The Lawyer?

I took a quiz to find out.

The highest-ranked listed law firm is number 37, Gately, followed by Knights at 41, Keystone Law at 60, and RBG Legal Services at 92.

The biggest law firm of all was DLA Piper. It earned revenue of £2.8 billion.

Next were Allen & Overy and Clifford Chance, both with just over £2 billion in annual revenue.

In comparison, Gately, the biggest of the listed law firms, earned revenue of £163 million.

Tot up the four listed firms’ revenues and you get to about £350m, less than 1% of the mighty £40 billion UK legal services market.

What you see, definitely isn’t all there is.

You may be wondering why I am still interested in listed law firms given the potential for competition, and the conclusion of my sector review a few weeks ago. I thought the act of listing had broken the partnership model and turned most of the listed law firms into bad acquirers.

Those observations were confirmed in a subsequent conversation with a tame lawyer, a friend who is a partner at a conventional law firm. That is to say, a law firm owned by its senior lawyers.

My friend confirmed that firms like his receive many enquiries from lawyers at listed firms keen to join an old-school partnership.

They also said DWF, the firm taken out by private equity earlier this year after a period of poor performance, had a nickname: “Dodgy Will Fail”.

But they also confirmed Keystone Law is different. Hence, I have read the annual report…

The customer is the lawyer

At Keystone, the customer is the lawyer:

“Our model offers lawyers freedom, flexibility and autonomy whilst delivering long-term and consistent growth.”

Source: Keystone Law annual report, 2023

Founded in 2002, Keystone says it was the first, and is the biggest, of a new kind of distributed law firm in the UK.

The vast majority of its lawyers are self-employed. This frees them from the managerialism and office politics of the partnership system, and from targets stipulating the fees they must bring in.

In tune with the times, self-employment appeals to lawyers who want a better work-life balance. To be able to work from home, for example, or part-time.

Keystone handles the insurance, contracting, and billing. It provides a network connecting the lawyers so they can refer work to each other, form ad-hoc teams, and use a small pool of junior in-house lawyers.

Keystone has a different take on profit share, which it says, often earns lawyers more money than their previous partnerships. Keystone lawyers keep 60% of the fees they earn plus 15% if they introduced the client. The head office gets the rest.

This distributed model aims to achieve the best of both worlds. It enables lawyers to focus on their needs and those of their clients’, while centralising easily automated and co-ordinating head office functions. It dispenses with costly premises and management hierarchies.

The promise is lower costs, happier staff, better service, bigger profit, and a more easily scaled business than a typical law firm.

The lawyer recruits the clients

When Keystone recruits lawyers, they bring many of their clients with them. To grow it needs to recruit more lawyers.

Keystone has managed to do this every year since it floated in 2017, although growth has slowed in recent years.

This may be because pay at traditional law firms has increased after a surge in legal work after the pandemic. Keystone reckons demand will normalise, and disgruntled lawyers unable to meet higher targets required to justify their pay will turn to self-employment again.

Critically, clients contract with Keystone. It bills the client and only pays the lawyer once it has been paid.

This means free cash conversion is very strong and with little office space and much of the business done over an IT platform, Keystone does not need to invest heavily to grow.

The cost of paying the lawyers is variable. Keystone earns less if its lawyers do when times are tough, in proportion to the decline in billings. At traditional law firms, there is a large fixed component to remuneration, which eats into profit more.

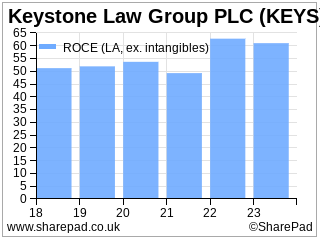

Consequently, Return on Capital has been very impressive since Keystone listed, despite a small wobble in the first year of the pandemic.

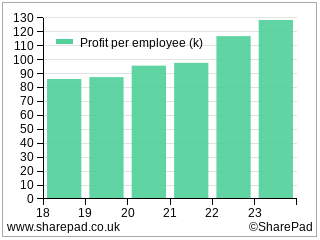

And the company has increased profit per employee significantly:

Perhaps there is a hint in the data that the company is capable of becoming even more profitable as it grows.

SMIATI again

The other listed law firms must be envious. While they have been wasting capital paying too much to acquire rivals, companies like Keystone just take a bite out of them and other law firms every now and then.

It is a very interesting setup, but shiny new business models can also have limitations.

While there may not be anything law firms can do to stop lawyers from telling their clients they are leaving and then soliciting business, there could come a point when there are not enough traditional law firms left to supply the distributed law firms.

To put your mind at rest about limits to growth, about 2,500 lawyers work for distributed law firms according to Keystone. There are nearly 40,000 lawyers working in the mid-market that Keystone draws from.

Then there are the other distributed firms. They are in my blind spot because they are not listed.

My friendly lawyer pointed me in the direction of Setfords, perhaps Keystone’s closest competitor. It is a private company which has quite an aggressive pitch.

Setfords’ last published results show it earned less revenue than Keystone.

Its lawyer count grew at an astonishing rate of more than 100 a year in 2021 and 2022, though, lifting the total to 439. Setfords’ website says it now has more than 450. That puts it just ahead or just behind Keystone, depending on how you count Keystone’s fee earners, not all of whom are necessarily lawyers.

No doubt the business models differ in detail. My first impression is that Keystone targets more experienced lawyers, and its profit share is more equitable.

But Keystone appears to have a faster-growing rival, which is what you can find when you appreciate The Stockmarket Is Not All There Is.

Happy Christmas!

If there was ever a time of year to recognise that the Stock Market Is Not All There Is, it is the week before Christmas! Have a great one 🎄

~

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Got some thoughts on this week’s article from Richard? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.