In this article, Michael looks at the importance of checking RNSs when management thinks you’re not looking.

Last Friday was a nice summer evening (at least it was for me, I can’t assume that it was for you), and a company decided to slip out an RNS at 17:56.

The market has been shut for nearly an hour and a half, and few people (if any) are sat staring at the RNS feed.

When a company puts out an RNS after hours, it makes you question if it’s a good one. We can assume that if it was good news, the company would do its best to put it on in the normal 7:00 slots and get eyes on it.

The company in question was Harland & Wolff (HARL). And the RNS was not good news. The CFO wrote that the business was “under-capitalised would need to address our [the company’s] capital stack in due course”. The company’s £70.35 million loss on revenues of £27.96 million and £62.6 million in loans and borrowings doesn’t paint the best picture of the business.

When the CFO is saying the business is under-capitalised, then you can assume that the business will do one of three things in order to get access to capital:

- Debt funding

- Equity placing

- Rights issue

Two of these are dilutive and the first, in this market, often comes with steep interest rates. And in regards to this company, it already has plenty of debt. Can it take on more?

Thinking back to my last article, ‘Pouring fuel on the fires of shorters’, short-term trading is about what may be perceived, not necessarily what it is.

And the comment from the CFO doesn’t sound too clever.

Therefore, my theory was that the price would fall on Monday and that there would be an opportunity to short the stock because of the CFO’s comment and the state of the financials.

I’ve closed the trade already, but as of Friday morning, it’s printing new lows at 8.65p.

It’s always worth checking the RNSs after hours. It’s when management hope you’re not looking.

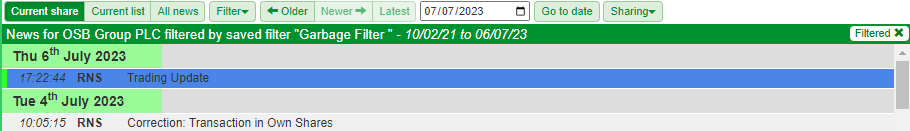

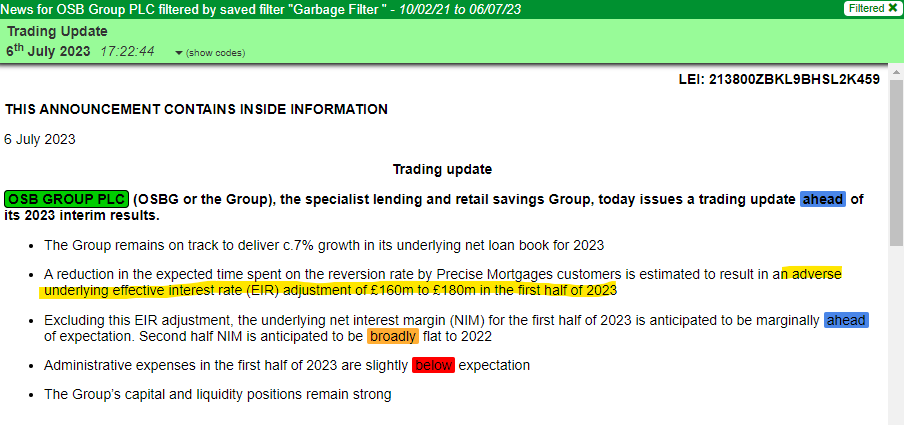

Unfortunately, I forgot to follow my own advice and missed One Savings Bank. And RNS at 17:22 is suspicious indeed!

As expected, it wasn’t good news.

The company mentions that, excluding the aforementioned EIR adjustment, the underlying net interest (NIM) margin rate for the first half of 2023 is marginally ahead of expectation.

So basically, excluding all the negative news, the company is doing fine. But unfortunately for the company, the market doesn’t exclude it in the price, and the stock price moved.

Here’s how the stock reacted.

Notice that the meat of the move came after the uncrossing trade and that from the uncrossing trade, the price started falling.

To take advantage of shorting in the uncrossing trade, you need a CFD account. I use IG.

However, one disadvantage of CFDs is that they are subject to Capital Gains Tax.

Depending on how often you trade, and how big your profits are, it may be worth creating a limited company and using a corporate account to trade CFDs. This means that instead of Capital Gains Tax you’d pay Corporation Tax, and can pay yourself a small salary plus dividends after you’ve put all the costs of the business through to reduce your taxable profits.

Please note though, whilst I do this myself, it is in no way financial advice, but something for you to consider for your own situation.

Conclusion

- Make it a habit to check the previous evening’s news or check it once the RNS service has finished at 18:30

- Always check any trading updates that are published late as there’s a high chance it is not great news

By following the above two rules you can add to your potential trading opportunities.

Michael Taylor

Buy the Bull Market premium trading newsletter available at: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.