I’ve written extensively about breakouts. Breakouts are a popular strategy used by traders in the financial markets. It involves identifying a price level at which the market is expected to break out from its current range, and then entering a trade when that level is breached. Why does this work? Because the price breakout from the range tells us that the stock may be ready to move higher.

This can especially be the case when the resistance has been significant.

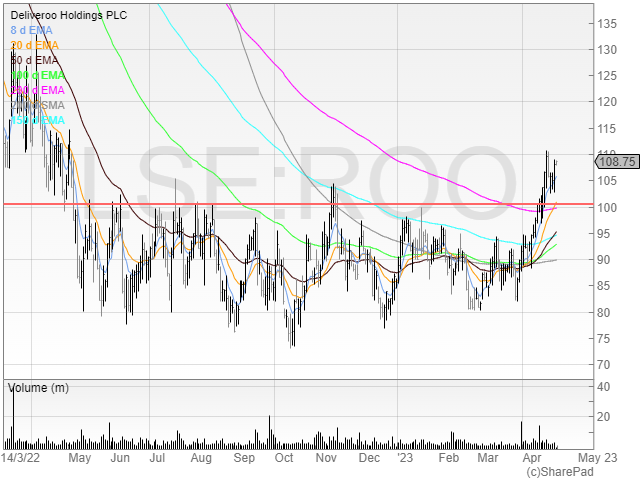

Here’s the Deliveroo chart to show you what I mean.

Notice how the 100p level was tested at least 7 times before it finally broke out on the 8th?

The stock also broke through the 200 EMA at the same time, removing another point of resistance and showing signs of the trend changing.

Breakouts can offer significant opportunities for traders, but they also come with certain risks that need to be considered.

Firstly, let’s discuss why breakouts can be good for traders. One of the key advantages of using breakouts is that they can provide clear entry and exit points for trades. By identifying a price level at which the market is likely to break out, traders can set their entry orders as the stock is breaking out, and use a stop that is below the stop loss liquidity of the recent high. It can help traders to manage their risk more effectively and avoid large losses.

Another advantage of breakouts is that they can offer traders the potential for significant profits. When a market breaks out of its range, it is often a sign of a strong trend developing, and traders who are able to enter the market early can potentially profit from that trend. Additionally, breakouts can also provide traders with the opportunity to ride a trend for an extended period of time, as long as they are able to manage their risk effectively.

However, it is important to note that breakouts also come with certain risks that traders need to be aware of. One of the main risks of using breakouts is that they can result in false signals. Sometimes, the market may break out of its range only to quickly reverse and move back into its previous range. This is frustrating, and I was stopped out of Deliveroo in a prior false breakout from 100p. It can also deter traders from entering again as they’re scared to only to have the market move against them and trigger their stop-loss orders. My view is that a false breakout just means the stock may not be ready to move yet. If the trade thesis hasn’t changed – stick with it.

Here are three potential breakout plays I’m watching.

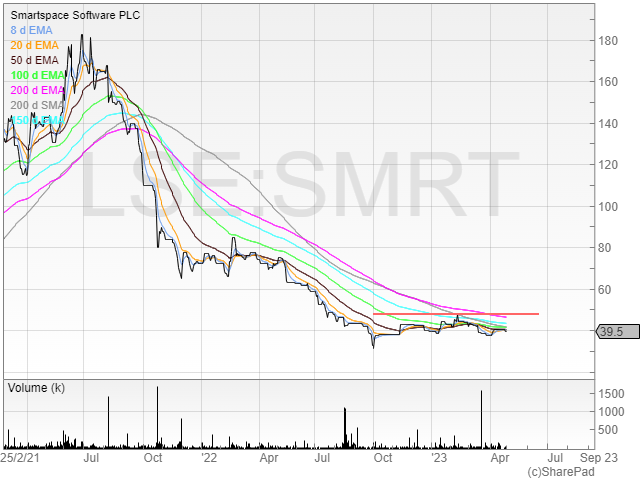

Smartspace Software (SMRT)

This stock has been hammered as growth wasn’t as expected and the stock derated. It’s fallen from highs of 190p back down to 40 – a more than 75% slide in price fall.

However, it could be building a stage 1 base. I note that if the stock was to break out of the recent high then the price would likely be above the 200 EMA and so this would be a bullish sign of a potential change in trend.

The company is growing its revenues and ARR, and cash looks to be managed well too. So I don’t expect there to be a high of a significantly discounted placing (although you never know).

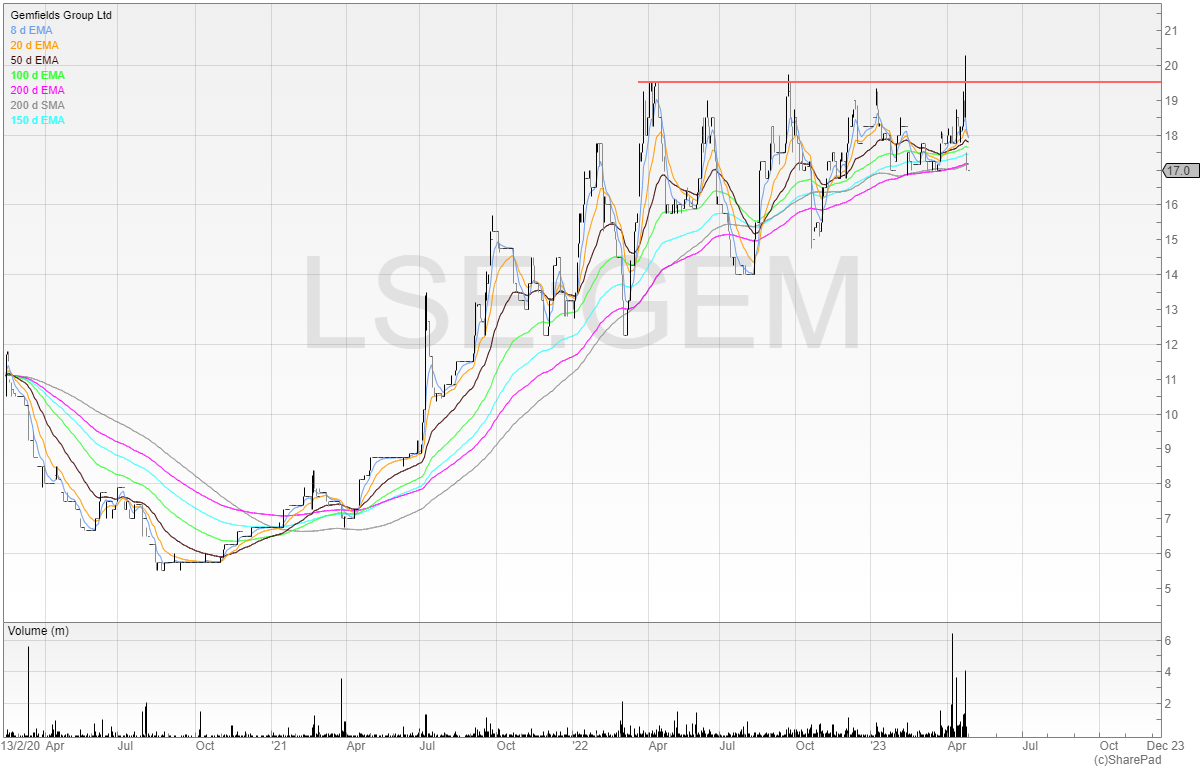

Gemfields (GEM)

Gemfields is a relatively new addition to the market having listed in February 2020 – a few weeks before the carnage of Covid.

Gemfields Group is engaged in the mining and marketing of coloured gemstones. It has mining operations in Zambia for emeralds and amethysts, and in Mozambique for ruby and pink sapphire. These are not exactly risk-free jurisdictions and so I’d highlight this as a potential risk. Although for a trade it’s one I’m comfortable with.

I’d be looking to buy the breakout if the stock goes through the 19.5p closing high. The stock has traded below the 200 EMA three times in 2022 and recovered each time. It’s a nice stage 2 uptrend and I think worthy of the watchlist.

Iofina (IOF)

The final stock on my list is Iofina (I hold a long position in this company as disclosed on Twitter).

The stock is breaking into 8-year highs and the iodine price market is tight. It’s not unlikely there will be further price rises from the current price of $70 (although a price above $50 means handsome profits for the company).

I’ve been critical of this company in the past due to the lack of explanation given for why IO9 was repeatedly delayed but progress has started on negotiations for IO10.

Increased production with a strong iodine price has the potential to see this stock having further upgrades. Net debt will be cleared by the end of the year.

Here’s a closer look at the chart:

It’s more than 100% up from the lows and clearly in a stage 2 uptrend.

For more trade ideas, see my new newsletter below.

Michael Taylor

Buy the Bull Market premium trading newsletter available at: buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.