Everyone likes a turnaround. This is because people like the idea of buying at the bottom and reaping the rewards.

However, trading turnarounds can take a lot of time. Businesses are often slow to change and it is not a quick process.

This article will show you how to trade some potential turnaround stocks and give you some pointers to look at next time you are considering trading a turnaround.

With SETS traded stocks trades are matched onto the electronic order book. This facilitates liquidity and market participants can deal with each other without the middle party, or the market maker.

The advantage of this is that liquidity is less of an issue.

When trading SETSqx stocks the market makers call the shots. They decide at which price and what size they want to do business at as the market maker, and we the market takers decide if we will accept this.

Trading SETSqx stocks is a different ball game compared to SETS. It is worth being mindful of the differences and how they can affect you (there is a good walkthrough here).

Let’s look at a selection of potential turnarounds.

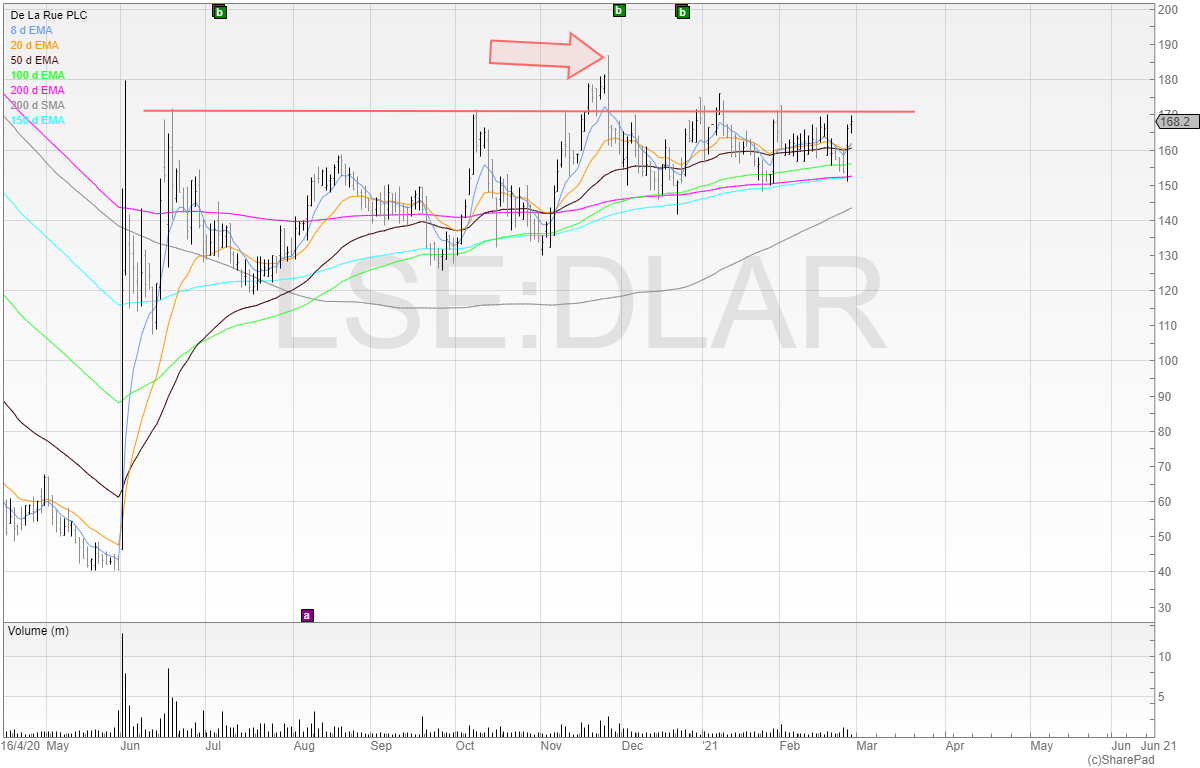

De La Rue (DLAR)

De La Rue is a global business offering specialist services in currency, passports, and authentication.

It had a staggering 2020 as we saw a huge short squeeze play out in early June.

We can see the spike in volume and the price spike in the middle of the chart. From then on, the stock has been tipped as a turnaround story. Yet nearly nine months later the price has gone sideways.

The issue here is that after a large price move the stock then needs to consolidate that ground it has gained. No stock goes up forever, and prices tend to revert to the mean.

When there is a big price rise, money is made very quickly. It is only natural that profit takers wish to exit and new shareholders to the register pick up the stock.

This process can take weeks or months and in some cases years.

Here is an example of International Greetings, or IG Design as it is now known, making a stage 1 base between autumn 2009 and the spring of 2015.

Any shareholder who was holding through this period must’ve been demoralised and it wouldn’t surprise me if many of them simply tapped out and went to seek their fortunes in stocks elsewhere.

After all, a dead stock is dead money. Stocks that are not moving is an opportunity cost for traders.

We want to be in the stocks in play, or stocks that are on the move.

Buying into stage 1 bases in the hope they will eventually lead to a stage 2 – even if the fundamental story is increasing in strength – can lead to long wait times.

But here is the price action chart from after this period.

Which five years would you rather have been holding IG Design? The former chart or the latter? The latter delivered multibagger returns in the stage 2 uptrend.

Therefore, when trading turnarounds, it is better to be late to the party than too early.

Too early and you might sell for a loss or be waiting around for years. Being fashionable late when the party has started ensures two things:

- You are buying into an uptrend

- You are not wasting your time and hard-earned cash

Coming back to De La Rue, I would like to trade the stock if it can convincingly break out of the range.

The stock is making all the right noises. We can see that:

- Volume and volatility are contracting

- The price is putting in higher lows

- The moving averages are now uptrending

Many private investors are holding De La Rue and are losing patience. Instead of sitting on the sidelines waiting and hoping, it is best to enter when the stock breaks out.

SIG plc (SHI)

SIG plc is a UK based building materials business in specialist distribution and roofing.

In the chart we can see the big fall and volume begin to increase in March and April.

Since then we have had a long period of consolidation with lots of false downs and frustration.

Again, we can see volume and volatility coming down. This is a sign that the noise is leaving the market and what we are left with is a truer reflection of the price.

However, my alarm has been set on SHI at 38p for months now. Until the price prints there I see no reason to enter the stock.

Next time you are looking at a turnaround stock, zoom out of the chart and look at the big picture.

No doubt everyone was getting overly excited when the stock had gone from a low of 18p to near 40p, but ever since then the price has yet to come close.

In my next article we will look at some more stocks with turnaround potential and entry points.

If you found this article useful – my monthly newsletter covers more trading ideas and market knowledge.

You can sign up at my website below.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.