There’s been plenty of action this week.

And perhaps sentiment for the UK market is on the mend?

The news is full of articles sounding the alarm for the UK stock market. Peel Hunt’s chief Steven Fine said that there was “no sign of a revival in London’s moribund market for initial public offerings”, and warned that if the trajectory continues then the London market will be dead.

The Telegraph reported that it was “starting to look terminal” but

So far, no dead and buried.

But a big blow would come if Shell decided to list in the US, as current chief executive Wael Sawan mentioned that he would explore “all options” to close the perceived valuation gap between its US peers.

Biotechnology company e-Therapeutics also made the decision to delist as detailed in this thread.

Some of it is summarised below.

Part of the reason for the unwillingness to invest is that it is both heavily loss-making and highly adept at burning through cash. And whilst it’s true that risk appetite in the US is higher, I’m not sure that delisting the company will make it any more valuable (though I could be wrong). What does make sense though is if the company can’t utilise the primary reason for its listing (raising capital) then there is not much point in paying listing fees for something it can’t use.

Other loss-making pharmaceutical companies have left the market in recent weeks such as Redx Pharma and C4XD.

But in all honesty… who cares? OK, if you were a shareholder holding onto a lottery ticket stock, then you might care. But companies that don’t make any money and are a long way from doing so, if they ever do so at all, are not a big loss to the London Stock Exchange.

Shell would be a big loss to the London Stock Exchange. Quality companies that are getting taken over as a result of low public market valuations are a loss to the London Stock Exchange. But loss-making garbage is not.

The solution to this is to simply list better-quality companies.

It’s not a quick fix. Nothing is. But listing better quality companies will attract more investment – although it doesn’t fix the issue that the public markets are undervaluing plenty of stocks that are being taken over.

That said, there are stocks that are moving higher and there are companies that are having no problems raising money.

The London Stock Exchange may be having issues but it’s not dead and buried.. at least, not just yet.

Cake Box (CBOX)

One company that is doing better than expected is Cake Box (CBOX).

Profits were “slightly ahead of market expectations” and the chart is looking like a firm uptrend.

However, on a forward PE of 15, I think there may not be any low-hanging fruit left.

The board did reject outright an indicative approach in July last year of 160p per share saying that it was “materially undervaluing the Company” and there has been no other news of an offer since.

Gulf Keystone Petroleum (GKP)

Gulf Keystone Petroleum also moved on news of the Iraq-Turkey Pipeline reopening, but this was speculation in the Baghdad Daily and nothing came of it.

When the Iraq-Turkey Pipeline does reopen though, I expect there to be a significant move.

Warpaint London (W7L)

Warpaint announced that it was trading ahead of expectations.

Whenever a stock falls into good news, that tells me that the news was unexpected as if it was, then the price would’ve rallied into the announcement.

This is often a good trade entry as you’re buying into a stock where the market hasn’t priced in the expectations. Does it work all the time? No, but then nothing does. But it’s worth keeping an eye on when a stock falls into good news.

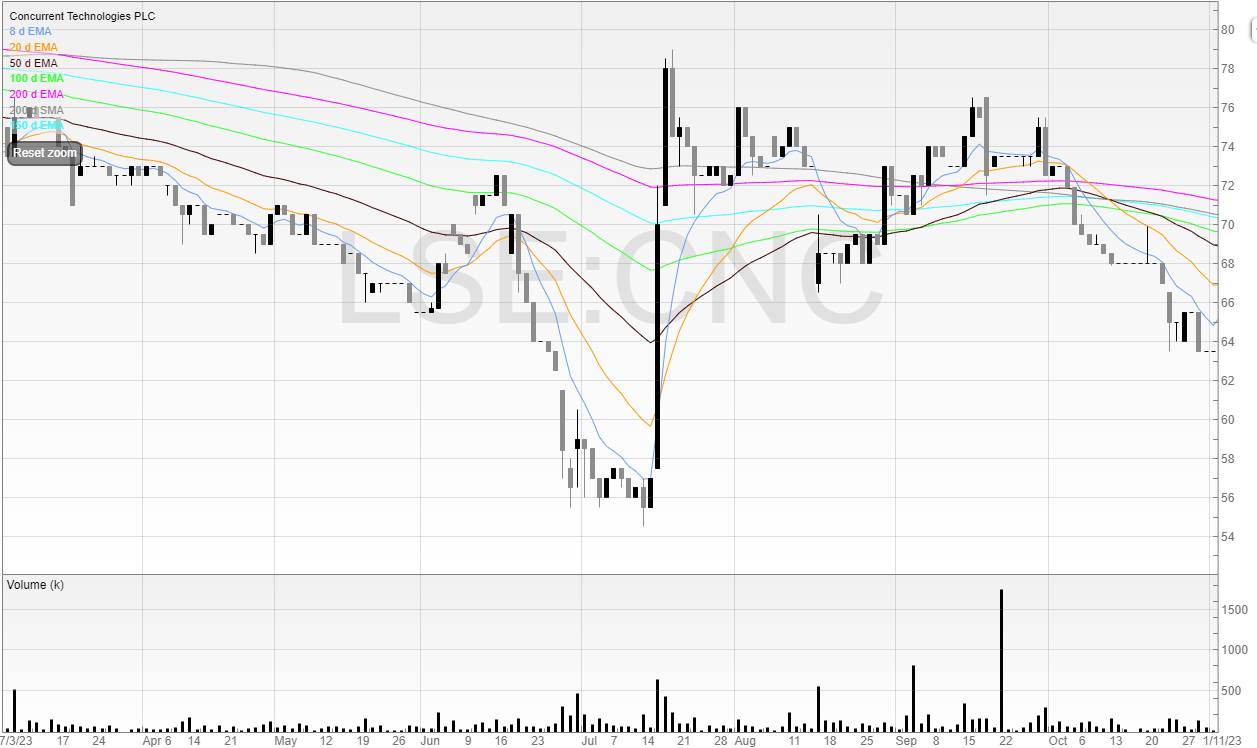

A good example is Concurrent Technologies, which fell sharply into a ‘materially ahead statement’.

The price then rallied significantly on the news.

IQE (IQE)

IQE was one of the movers of the week on a better-sounding outlook.

I see potential resistance at the point where the stock would begin to close the gap.

Petrofac (PFC)

The biggest news of the week (to me, at least) is Petrofac’s business update.

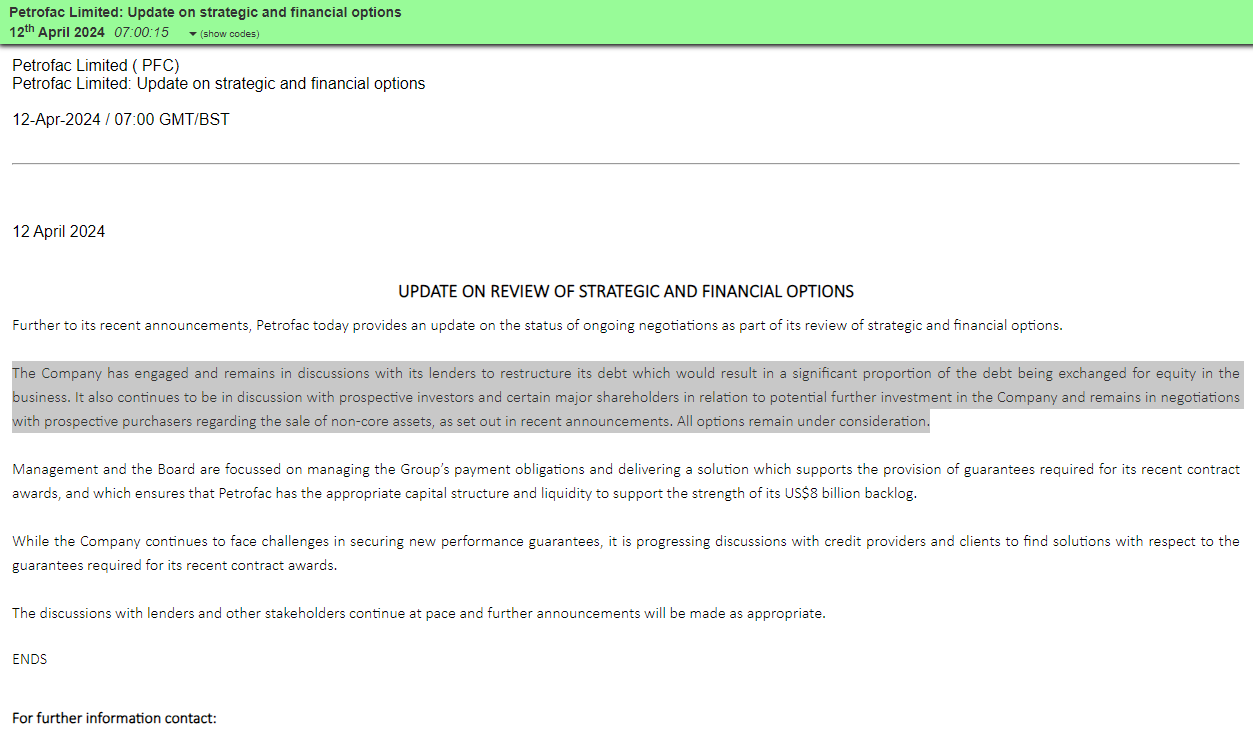

Here’s the update (emphasis mine).

The company is talking about restructuring its debt with a debt-for-equity swap and also discussing with prospective investors and certain major shareholders in relation to potential further investment – so a placing.

We can see the stock rallied into the news.

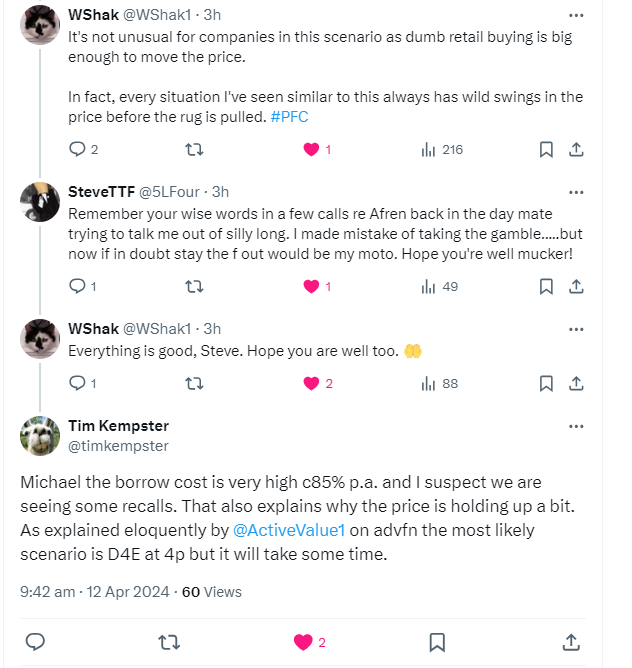

I have no idea why this is, but my question was answered by @WShak1 and @timkempster on Twitter (X) in response to my tweet.

I hold a short position in Petrofac, but won’t be sticking around due to its volatility.

As I wrote in my tweet, it’s also heavily shorted with 11.23% loaned out already.

It’s not a trade for widows and orphans, that’s for sure.

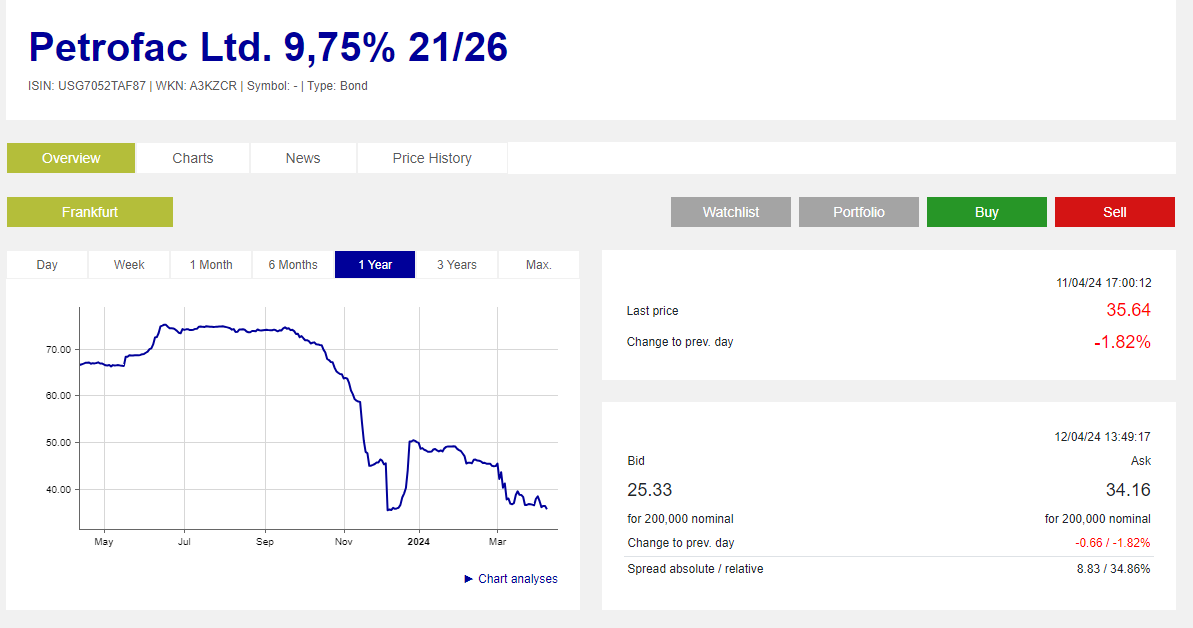

The bond price for Petrofac is showing that bond investors do not believe in the ability of the company to repay its debts. Hence the big discount!

This was also the case with Thomas Cook when I warned investors to avoid it before it collapsed.

I don’t know the end case with Petrofac but I believe the target price should be a lot lower.

And if I don’t get stopped out, we’ll see if I’m right.

Michael holds a short position in Petrofac (PFC).

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.