You often hear of people who are staunchly for either technical or fundamental analysis. Chartists will sneer at those who read the financial statements because they have no predictor on price and fundamentalists will claim that chart-reading is kooky and for those who need to give their head a shake.

I’ve never understood why these people aren’t open to learning new things because if you can get an advantage using both types of analysis then why wouldn’t you? Fundamentals have never got me into a trade since I started looking at charts first, but they have been used to select and identify better candidates or find a catalyst for the price to move. If you can identify what drives a share price, that matters more than being right. As Mark Minervini said, being right is an expensive hobby. Choose your battles carefully!

A good example is Argo Blockchain.

With Bitcoin rallying (and Argo has historically followed) many traders could’ve assumed that the base breakout would’ve been a good trade.

And in hindsight – it was!

However, Argo Blockchain’s (ARB) balance sheet at the time was worse than when someone insists on showing you a “hilarious video” that just isn’t funny and having to listen to them repeat “it gets good in a second” but it never does.

Having sold its Bitcoin reserves to stay afloat, all that was left was a few Bitcoins and a truckload of debt. It was abundantly clear that without an external injection of capital, the company would be closing the curtains.

Eventually, there was a placing, hence the steep fall. But this wasn’t enough, and I highlighted this saying that the company will need more financing.

Bitcoin is going up, but Argo is not.

The deteriorating fundamentals are the reason, I’m sure.

Using basic fundamental analysis helps to pick breakouts and decide which stocks to trade. When a stock is just a quick technical trade, the fundamentals don’t much matter besides basic red flag checkup.

That includes checking SharePad for any potential upcoming earnings. For example, taking a breakout trade in late March when historically there has been a trading update in the first week of April is taking unnecessary risk. As traders. we want to minimise our downside risk and avoid this as much as possible.

Here’s an example of a stock that has come across my filters: Moonpig (MOON).

It’s clear that the stock looks like a potential breakout at 180p – it has hit resistance there four times and once broken out and failed.

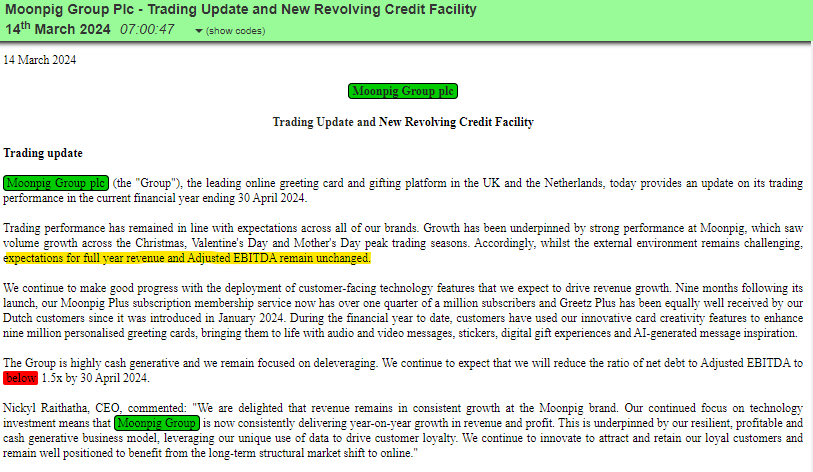

The company had a trading update earlier this week.

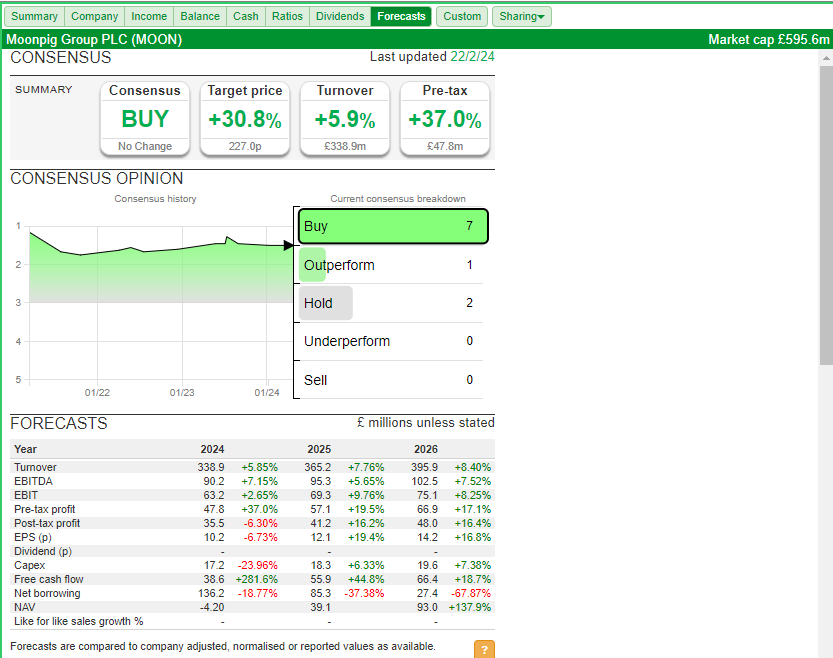

Now, we go to Financials > Forecasts to see the expectations. Note that the company did not say anything about profit.

If we look at forecast EBITDA of £90.2 million, that means with the market cap at £595 million we’d be paying over 6x EBITDA.

Or if we take post-tax profit – nearly 17x earnings.

That seems relatively expensive until we consider that the company is expected to grow its profit to £41.2 million next year. So perhaps a fair PEG.

But if the stock is either expensive or fairly priced, there is no clear catalyst for a move. So this means that this would only ever be a quick trade if it was a trade at all.

Stocks that have uptrending charts and strengthening fundamentals can see a lower PE as a driver in the price, as the market ascribes a higher valuation to the stock. Plus, you get the expected earnings growth too.

Historically, my best swing trades have come from three things:

- Extended sideways consolidation

- Strengthening fundamentals

- Reviled by other traders/investors

Usually, the valuation will be low here as people write the business off. The alpha comes from being early into the trade and my filters will often alert me to these.

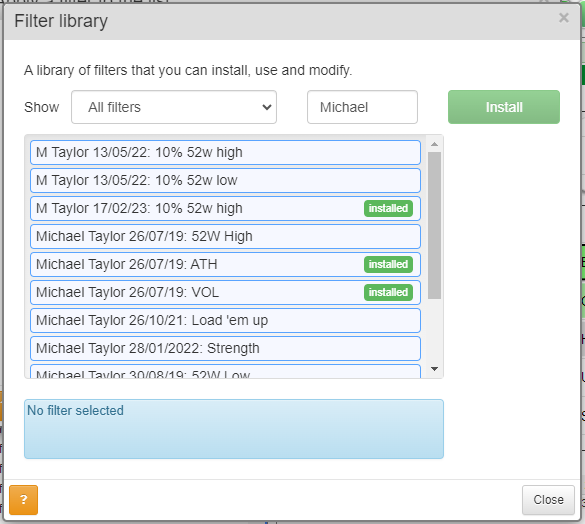

Remember, you can type “Michael” into the SharePad filter library and get the filters I’m using.

The latest version of the 10% within 52-week highs filter is the 17/02/2023 version. Whenever there is an update, it will appear in an article!

To recap, fundamentals can be useful for traders in the following ways:

- Balance sheet risk – avoid companies that are sorely in need of external financing (unless you are shorting, in which case it’s a positive!)

- Valuation – stretched valuations may leave little room for growth

As a caveat on point 2 – Fevertree and Boohoo in the late 2010s had stratospheric PEs. Yet the growth was huge and the companies kept beating their expectations, and so in hindsight, the stocks were more fairly priced than it seemed.

It’s also worth noting that the top stocks will consistently seem expensive. If you have a lot of breakout candidates, then finding the ones with the best charts and then looking at valuations can be a second deciding factor.

~

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.