In my previous article on trading turnarounds, we looked at why trading turnarounds can take time and investors can lose patience.

We looked at how traders should look to play these and the importance of a well-timed buy.

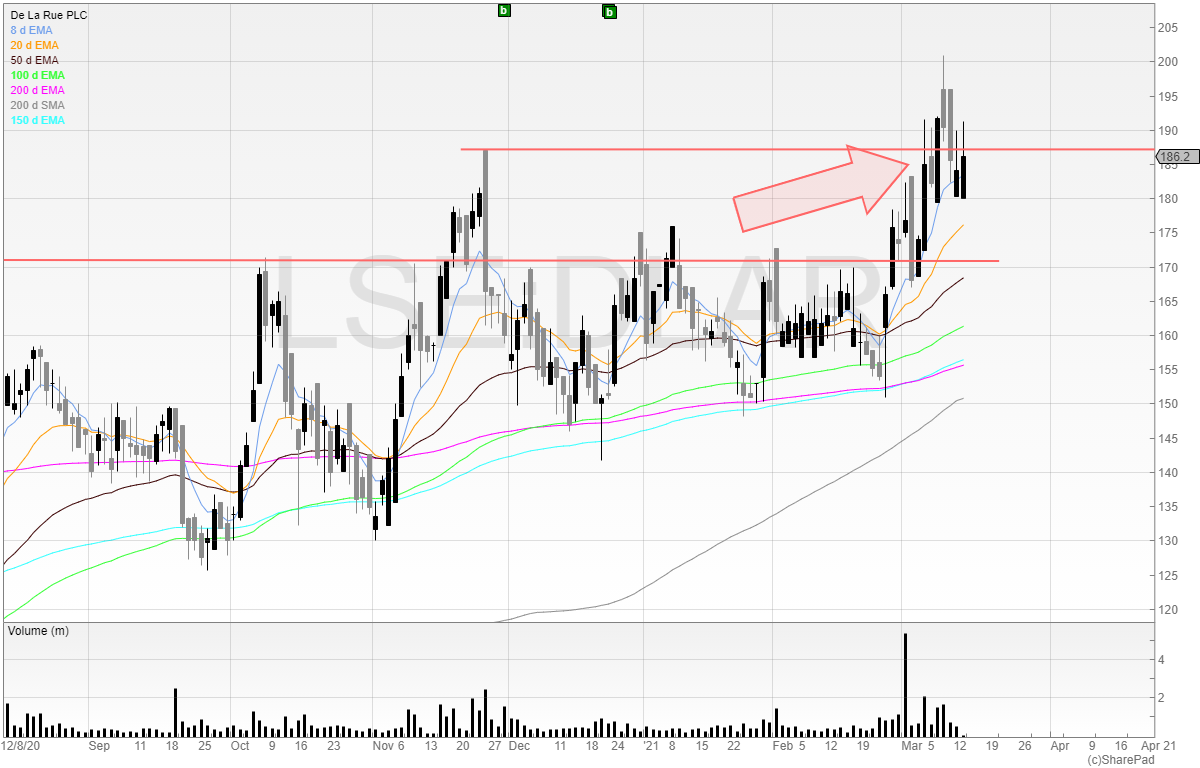

De La Rue was one stock featured.

Since the article, it has broken through the high and looks to be in the process of retesting the breakout. I’m now a holder.

The breakout retest is a great way of trading a breakout if you missed the initial rally.

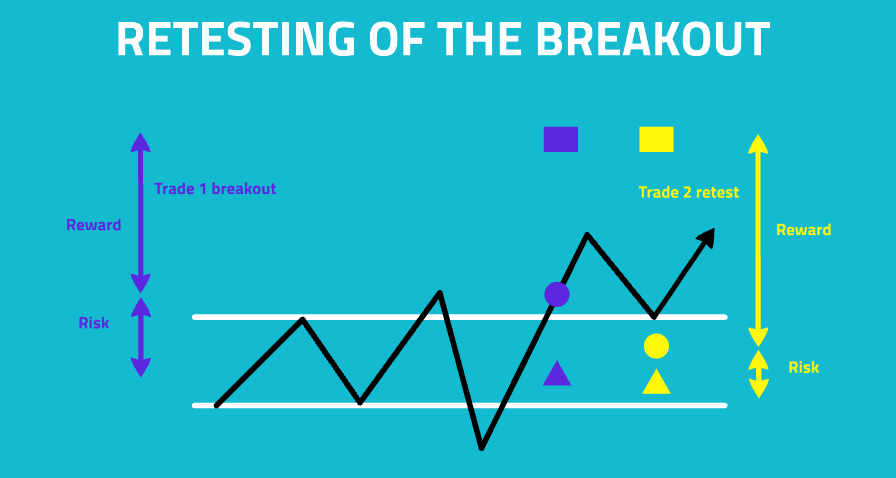

Here’s a snippet from my trading course:

We have the first trade in purple, which is the initial breakout. Our entry is the circle, and our stop is the triangle.

This gives us a risk/reward ratio on the left as defined by the purple arrows.

However, if the stock does pullback, we have the option to trade the breakout retest.

With our stop much closer to our entry price, the risk/reward ratio greatly expands.

By placing our entry into the stop loss liquidity just underneath the breakout we are getting in much closer to the danger zone.

This means we find out if we’re wrong much faster and can get out quicker.

Therefore, our risk/reward is much better on this trade.

However, there is no guarantee that the stock will pull back after it breaks out.

It’s worth keeping an eye on for the retest trade as they can offer excellent opportunities.

You can enter half a position into the breakout and the other half if the stock retests to work a better entry. This does mean your upside is halved if the stock doesn’t retest, but the goal of trading is to protect downside and keep the risk to the upside.

SIG plc (SHI)

We also looked at SIG plc in my last article with a view to taking a position at 38p if the stock broke out.

Here is the chart now – a decisive breakout over the base price.

I would be willing to bet many investors who had grown impatient of SHI sold their stock in recent sessions in relief.

But the breakout was the optimum time to buy. The stock is posting gains above 38p, and we may see a retrace (even a test of 38p), but it is clear from the above chart that the stock has now broken out.

Mark Minervini talks about ‘sit out power’ plenty. This is the idea of waiting for the right trade.

You don’t need to swing for every ball – rather you wait for the right pitch and then strike.

If you’re a poker fan, you might find the analogy of not having to play every hand better. With trading we just play the hands in our favour.

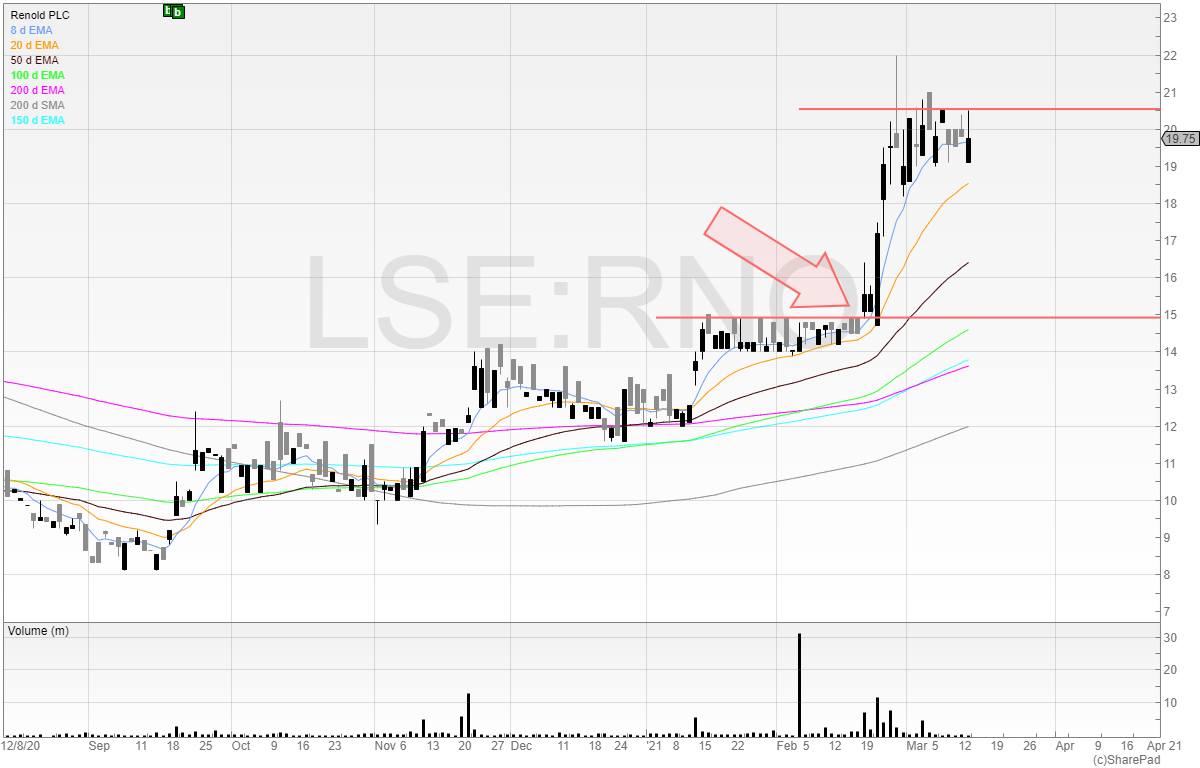

Renold (RNI)

Here’s a stock that is looking like it is acquiring a habit of building bases and breaking out.

I highlighted the trade on my Twitter and the stock quickly roared to 20p within a few sessions.

The stock is now looking like it is making a new base and consolidating.

It also now meets the criteria of my IC filter on SharePad where the stock must be over 100% from its previous low.

This gives me confirmation that the stock is now uptrending.

Many people don’t like buying stocks that they could’ve bought lower. I am happy to buy stocks that are going up because I’m moving in the direction of travel. I wouldn’t drive the wrong way down the motorway!

This is likely to cause some controversy with some readers. There is a debate as old as time itself whether averaging down or averaging up is the better strategy.

I am not going to say that either is better than the other. My view is simply: do what works for you.

Averaging up works for me, and so I’ll continue to do it. Managing my risk is the most important priority for me.

If you have an analytical edge and feel the market is mispricing the asset – that’s your decision. But just remember, the market can tell you you’re wrong for extended periods of time.

Plus, if you’re wrong on your valuation, you can lose a lot of money. But it’s your choice!

Here’s another stock that I’ve got on my watchlist.

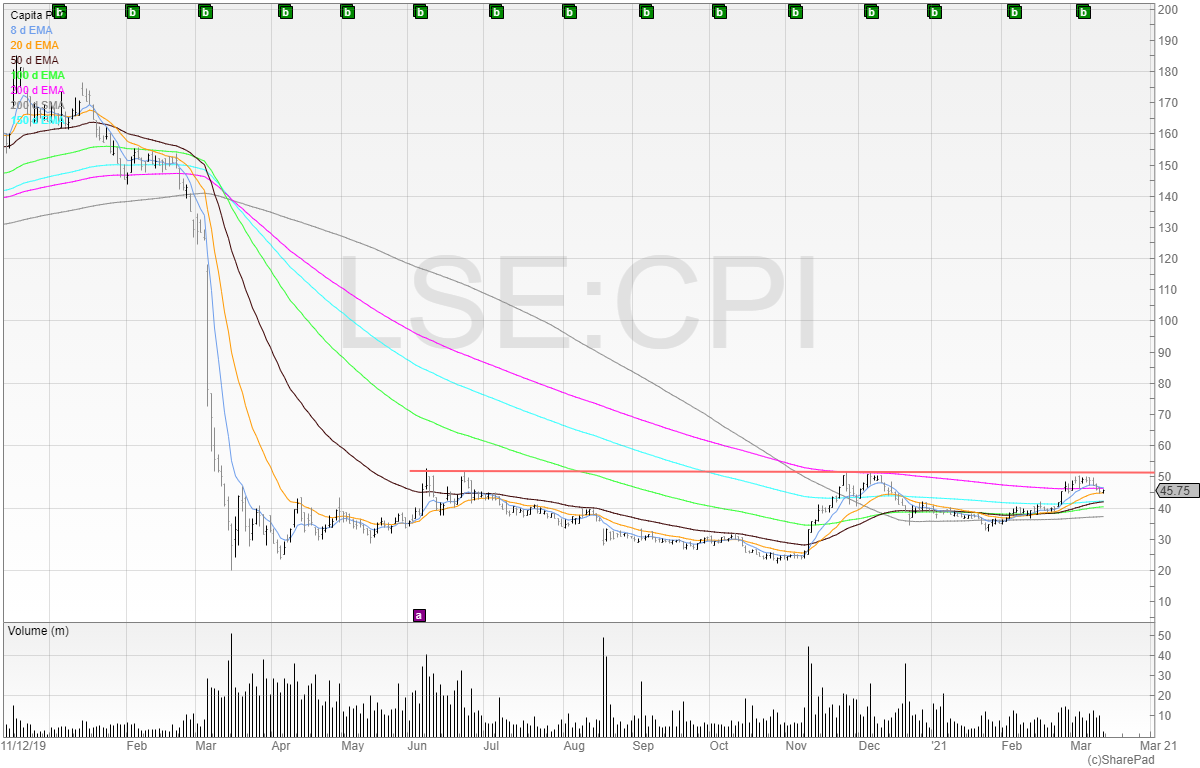

Capita (CPI)

I don’t know the fundamental story of Capita. Therefore, I don’t know if the business is billed as a potential turnaround or not.

But I do know that the chart is looking like a stage 1 stock.

I’ve drawn a line on the stock to show a trendline. The stock has hit this trendline four times and failed to tag it a third time recently.

However, we can see that in November 2020 the volume ramped up along with an increase in the share price. But the stock failed to break out and again a few trading sessions later.

I think this is a stock worth keeping on the watchlist for a trade only. Does it matter if the stock is garbage if it goes up? In my opinion – no.

If the stock can break out of that 50p level I intend to take a long position.

If you found this article useful – my monthly newsletter covers more trading ideas and market knowledge.

You can sign up at my website below.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

Disclosure: I hold positions long positions in DLAR and SHI

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.