The pharmaceuticals sector is another popular sector with private investors and retail traders. This is because the volatility is high and traders are often attracted to the blue-sky lottery ticket type stocks.

The road for a junior pharmaceutical company is long and hard. First of all, drugs need to go through three phases of testing (Phase I, Phase II, and Phase III) before they can be approved for use globally.

The most significant and important of these are the Phase III trials. These trials compare the new drug to the current standard drug for that treatment. The goal of this trial is to see if the new drug is significant superior to the current standard.

This trial uses two or more control groups and is randomised, with one control group getting the standard drug and the other getting the new drug.

Often, a Phase III trial will be repeated in another location if the first trial is successful.

However, there is no guarantee that just because a drug successfully completes the Phase III trial it will be approved by the FDA.

Motif Bio (MTDB) found this out the hard way after its drug Iclaprim successfully passed both REVIVE-1 and REVIVE-2.

The FDA decided that it “cannot approve the NDA in its present form and indicates that additional data are needed to further evaluate the risk for liver toxicity before the NDA may be approved”.

This meant that more testing and more money would be required, and the stock eventually was suspending from trading.

On the other hand, pharmaceutical companies can see soaring runs as speculation and one good RNS powers momentum.

One such example of this has been Synairgen.

Synairgen (SNG)

We can see that the stock has run from 6p to nearly 260p. But those who were buying in May above 80p saw a huge drawdown as the stock traded in the 30s a few months later. It then gapped up and had a 100%+ day.

Not for the faint of heart. Or anyone with realistic risk management.

This is the problem of such statistics: “Stock X is up 10,000% this year”.

Stock X may well be up 10,000 this year, but what brutal drawdowns did anyone have to endure by grimly holding on?

I can’t see any reason to be long Synairgen here. It’s a falling stock, with a lot of trapped buyers. It has also fallen past the previous high open and now could be in danger of closing the gap or falling further.

If I’d said that a few months ago, I would’ve been hounded as angry bulletin board punters are quick to tell me I’m wrong and that I’m a “deramper” or “bitter because I missed the rise”.

Personally, I like to see people do well, and I like to see stocks going up. That doesn’t mean I don’t enjoy rapid falls in stock prices (I do) but bull markets are where the money is made.

I doubt anyone is going to be around to berate me now, because the hot money has moved on. In my opinion, trading what’s hot is a good strategy so long as you don’t overstay your welcome.

There will be many who want to average down here. The problem with averaging down is that you compound your losses if the stock falls further. It’s a risky strategy, and not one I use myself. But if you do I wish you the best of luck.

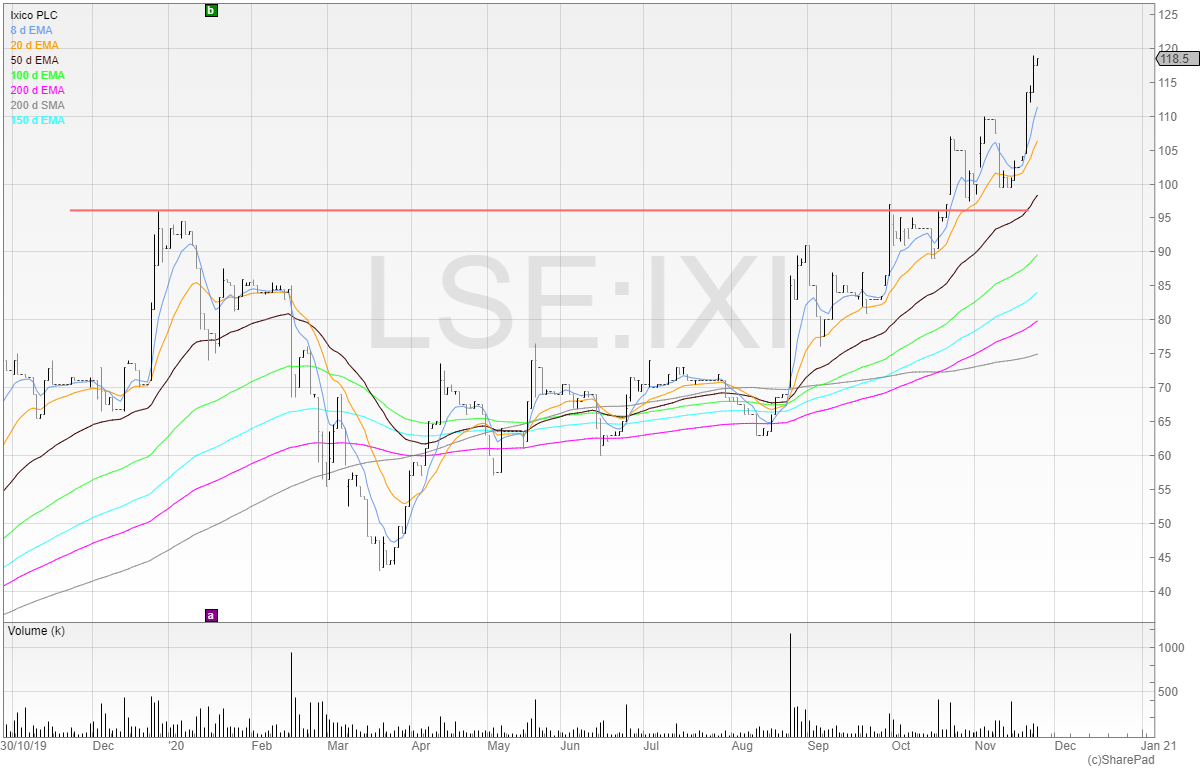

Ixico (IXI)

I hold a long position in this stock

This is an example of a chart that I like. It’s gently uptrending. It’s one that I have averaged up in and hope to keep unless my stop losses take me out of the market.

I was stopped out of my positions in the Covid-19 collapse. But I don’t mind buying back higher. Why would I? Do I want to massage my ego and avoid buying – or do I want to make money?

If you can’t get over buying stocks higher than when you sold them, you will find it difficult to trade your own money. Remember, with every news update, the fair value of a stock changes.

So you might be selling a stock that is overvalued, then buy it at a higher price when the market has undervalued its future prospects. Judging a stock on its share price is foolish, because it means very little. And if a stock is showing a breakout and you trade breakouts – not trading it because you sold it lower is foolish indeed.

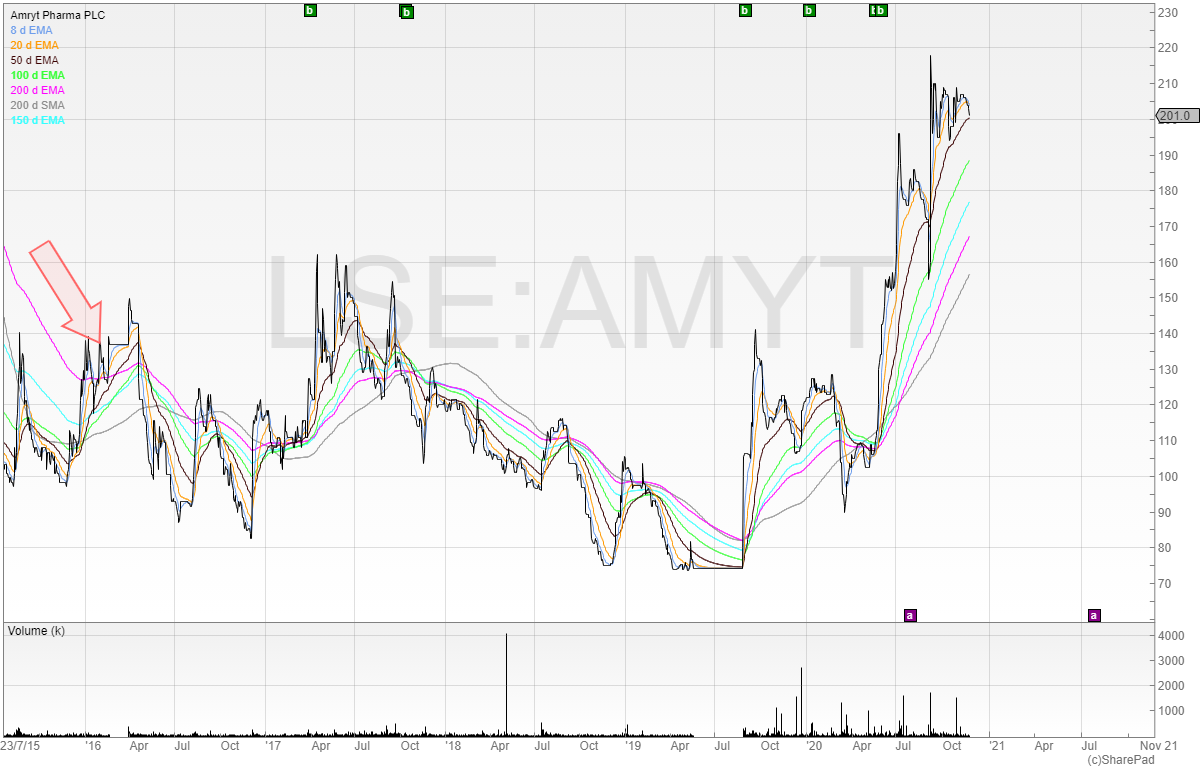

Amryt Pharma

Amryt Pharma is a stock that has taken its time since it was an RTO of Fastnet Oil & Gas in 2016.

The chart below shows the listed history of the stock from the arrow so far. Anyone who held stock from day 1 is still only around 33% up at these levels, despite the market cap sizably increasing. This is the effect of dilution.

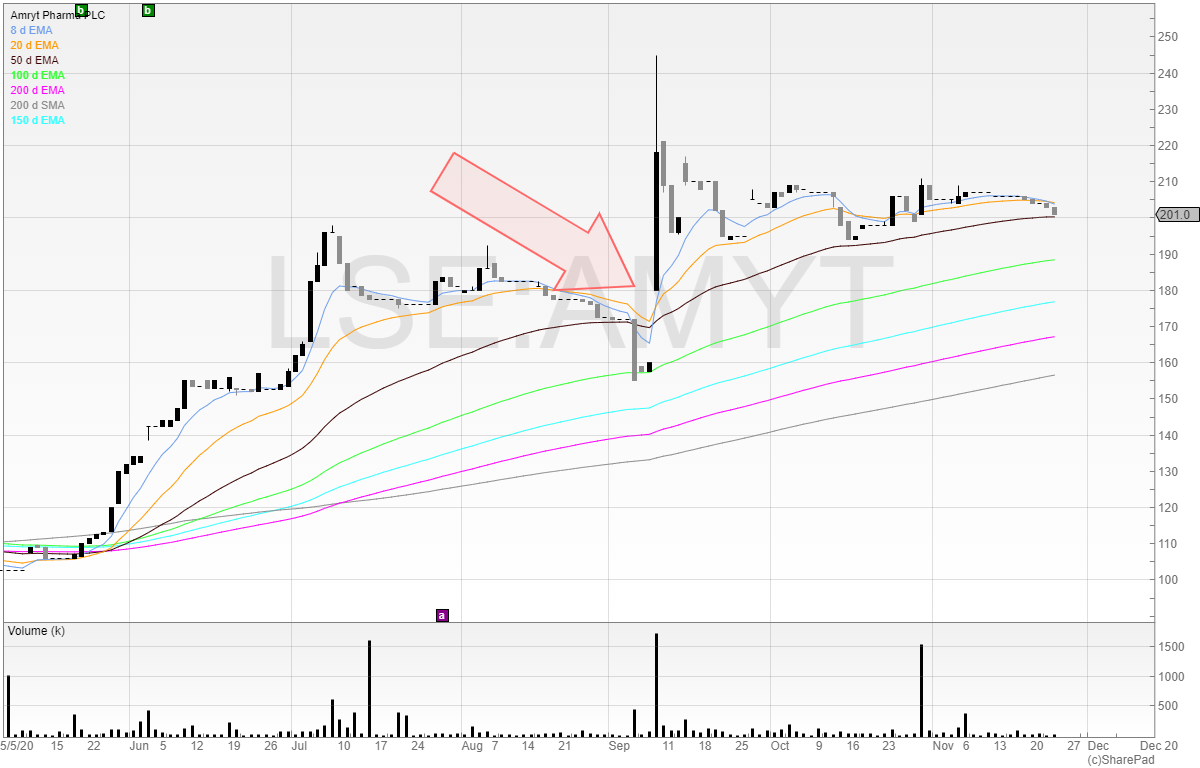

Below, we can see how the stock reacted to the Phase III readout of the EASE trial. These are always positive reactions, and so it’s worth looking out for the results of Phase III trials.

You can trade them long from the bell if they’re a success and meet the primary endpoint with statistical significance. Or you can trade the bounce as these stocks will often sell off heavily – the same with oil exploration companies that don’t find oil.

Conclusion

Pharmaceutical stocks are volatile and can move quickly both to the upside and to the downside.

Traders should be aware of this when position sizing and keep a sharp eye on potential news updates. One good RNS can send a stock soaring, and one bad RNS can wipe off more than half of the market cap!

Michael Taylor

Michael has released his UK Online Stock Trading Course sharing his knowledge and how he trades the stock market. This is a full walkthrough that can be accessed in your own time: www.shiftingshares.com/online-stock-trading-course

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.