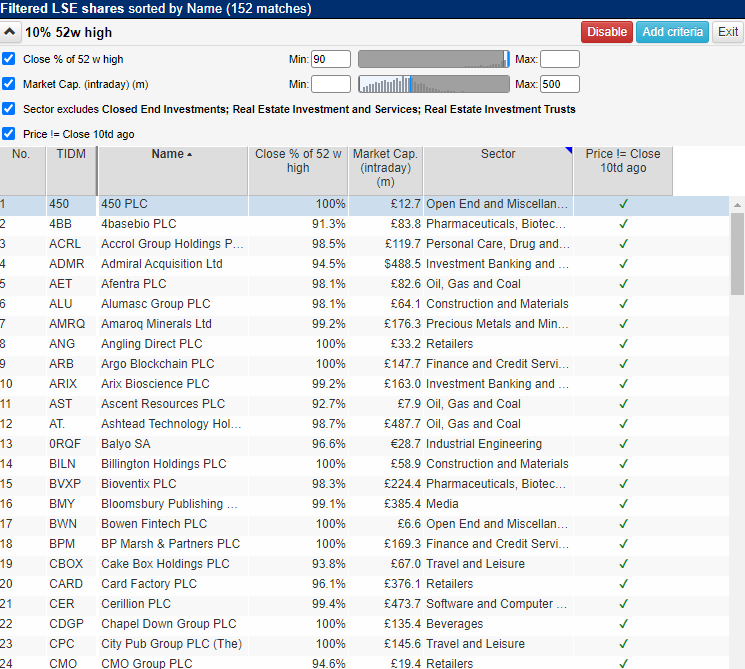

After a big market rally in November and December, there are going to be plenty of new stocks to take a look at.

The filter has pulled up 152 results.

I use £500 million because stocks that are bigger tend to move less quickly.

That means you need to use more capital because volatility is lower, hence the position size needs to be bigger.

And because the position size needs to be bigger, the account risk is bigger.

Therefore, I feel you get more capital efficiency by trading in smaller stocks that have higher volatility and don’t require as large position sizes.

The filter has pulled up 152 results.

Let’s take a look at some of these.

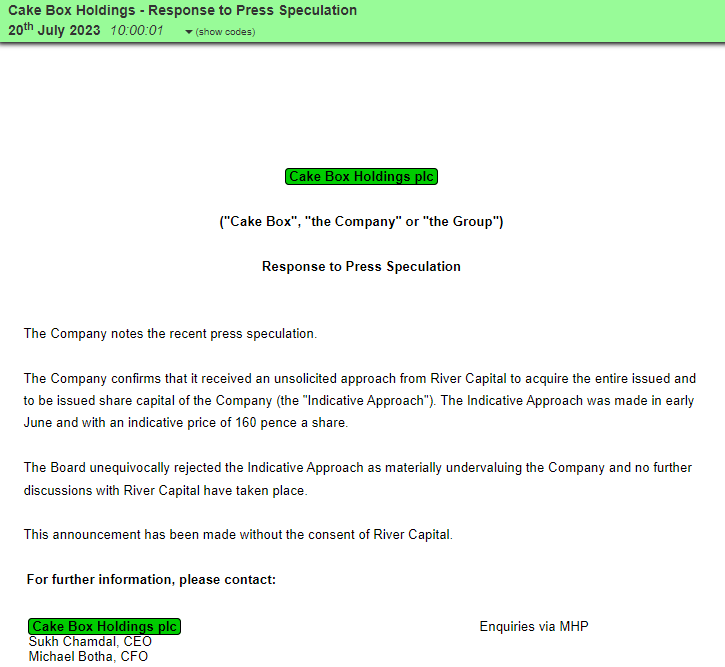

Cake Box (CBOX)

Cake Box has been down in the doldrums ever since fellow ShareScope writer Maynard Paton found some issues with the accounts.

But since then, there have been some board changes, a cost-of-living crisis, and some stabilisation in the stock price.

Is this pullback a potential cup and handle forming?

If so, then the stock looks like it could set up a nice potential breakout trade with a tight stop.

Cake Box hasn’t issued any new equity and whilst we can’t compare historic PEs like-for-like due to interest rate changes, the company did turn down an offer of 160p per share.

The chief executive and founder has a large holding here (25.41%) and so, he will be motivated to ensure the stock bounces back and he can achieve a nice exit at some point.

That said, I’ll stick to playing the chart.

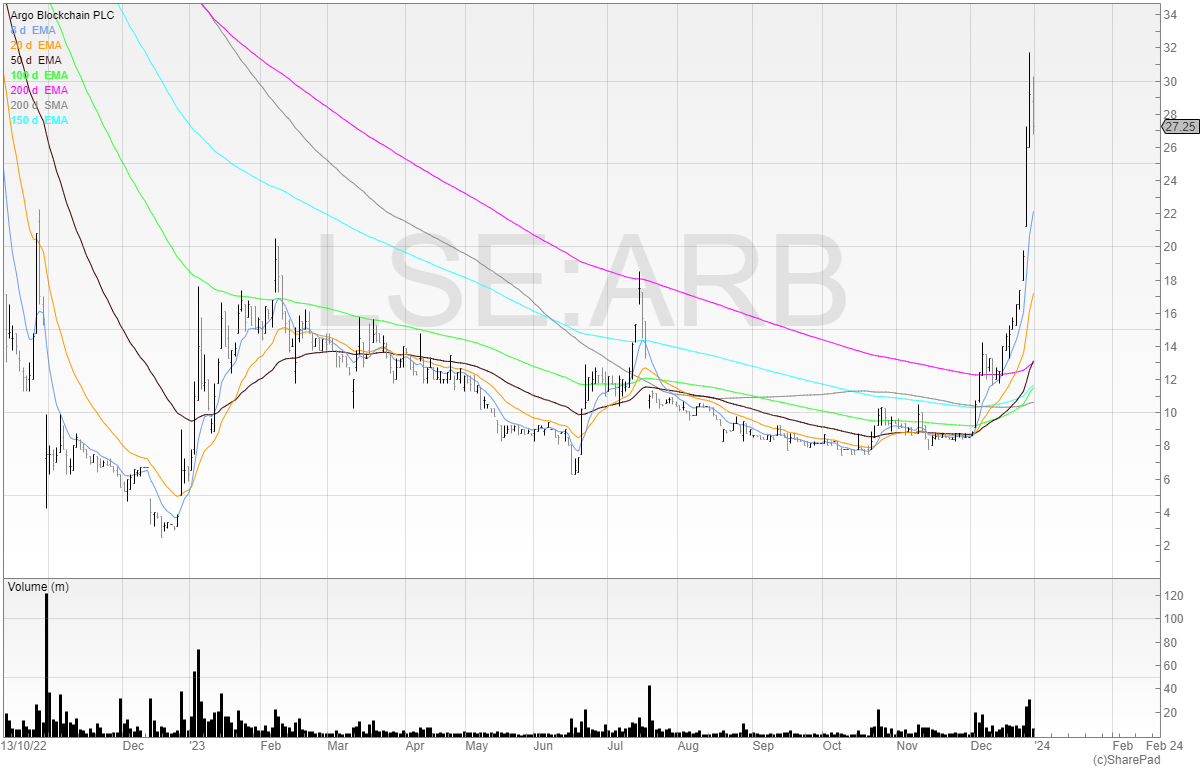

Argo Blockchain (ARB)

This is the stock of dreams for many a punter.

It rallied from 4.5p in October 2020 to highs of 332p in February 2021.

A few months ago, I warned it would need a placing imminently in my newsletter, then a week later the company announced a fundraise at 10p (price had traded up to 18p).

Bizarrely, the stock has now rallied sharply.

It appears to be driven by the NASDAQ ADR.

But why the Americans are buying it I have no idea.

The company needs the price of Bitcoin to at least double to have a chance of surviving.

In April, the halving will happen where it becomes twice as difficult to mine Bitcoin. So even if the price does double – it’s back to square one.

But that’s assuming it can get its daily BTC production up, which, so far it is struggling to do so, having increased it 5%. This is despite the 9% increase in difficulty.

It takes a brave and/or foolish person to enter a front side short onto a stock that could rally for a long time yet.

But if the price of Bitcoin does appreciate significantly, and the company does get its production rate up significantly, then this stock could even be long.

For now, I’m avoiding it completely.

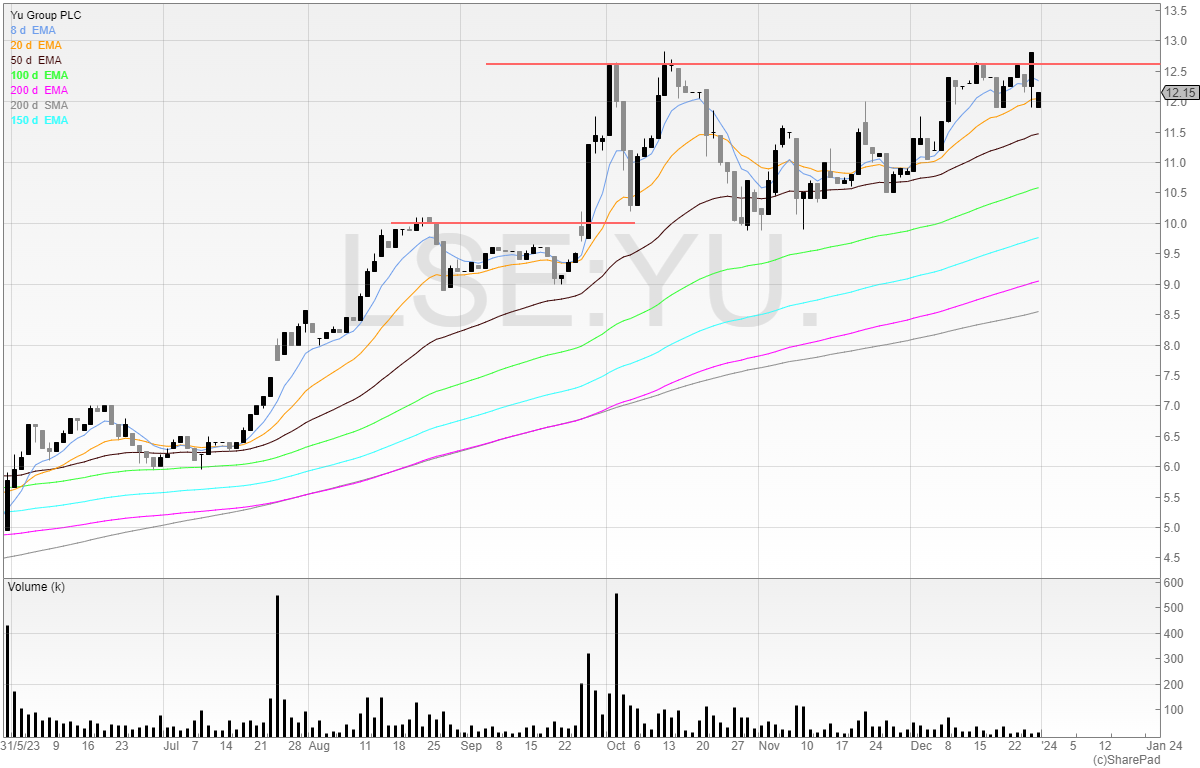

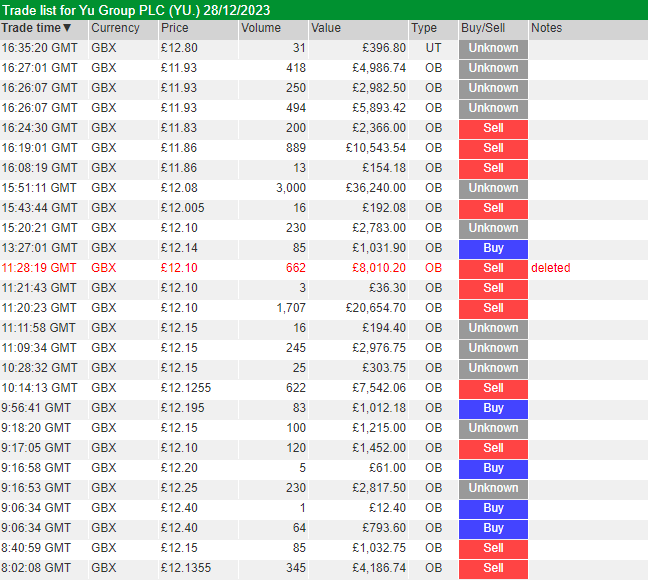

Yu Group (YU.)

Yu Group must be one of the top performers of 2023. A broker got me onto a call with management as there was a seller at the time in 2022.

I decided to wait it out, then missed my initial breakout entry, and never managed to get on board with the amount I would’ve liked.

It spent the first half of 2023 getting sold into on good news.

However, the stock is now closing in on its all-time highs and looking to break out of its 52-week high.

A quick look at the chart would tell you the stock broke out the session prior. However, this is when checking the trades is important.

We can see from the trades that the stock was trading well away from the £12.80 level and the stock only printed at that level in the uncrossing trade and with 31 shares for a value of £396.80.

To me, I think it’s worth ignoring this and accepting that whilst the chart shows the closing price of £12.80, this is not the real price the stock was trading at.

Therefore, I’d consider this to not have broken out.

Shoe Zone (SHOE)

Shoe Zone has been building a base since the start of 2023.

Zeus has FY24 EPS (fully diluted adjusted) at 24.7p, putting the stock on a current PE of 10 at 245p.

A low rating, but we have to remember this is a retailer.

In any case, if this stock continues growing, and breaks out, it could be worth a long.

Get detailed analytics on all of your trades with Michael’s trading journal available free here: www.tradesmash.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.