Michael explains his new filter and goes through some of the stocks it has provided.

My 10% within 52-week highs filter is starting to pick up plenty of names. Does this mean the bull market is back? Well, not exactly.

But it does mean that stocks are approaching their 1-year highs and threatening to either break out (or have already broken out if they are showing as 100% on the filter)

I was asked a question if, because of the high amount, would I focus on a shorter timeframe.

My gut feeling was that if I reduce the timeframe, I’d get even more stocks on the filter. And after building it, I found out that was the case.

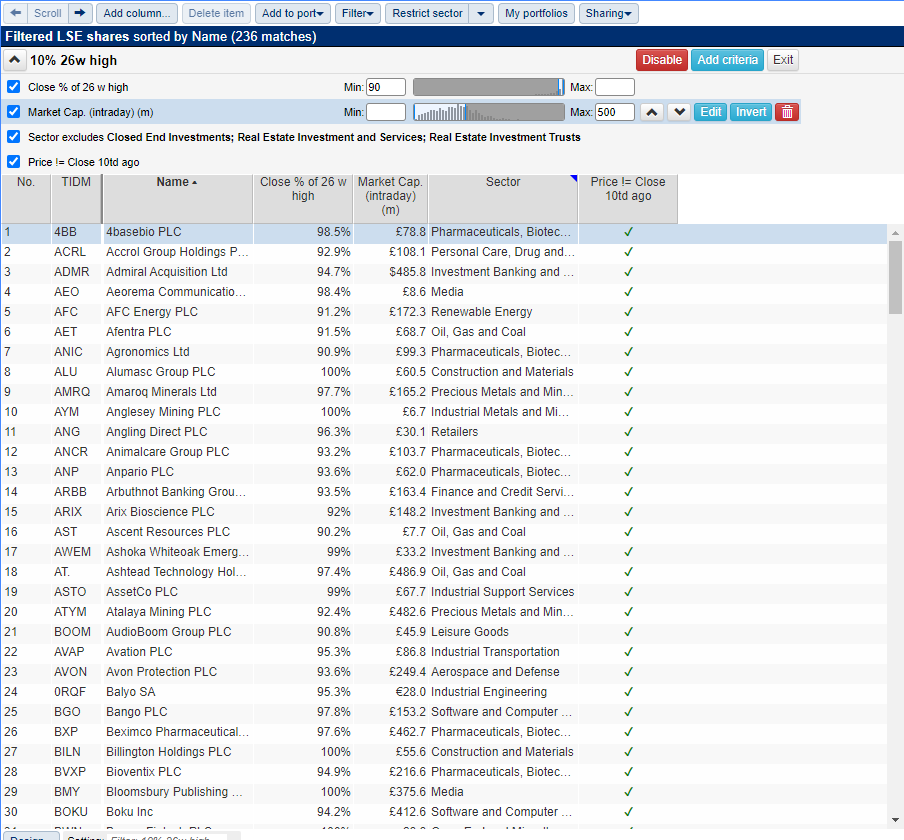

Here you can see there are 236 matches on the new 10% within the 26-week high filter.

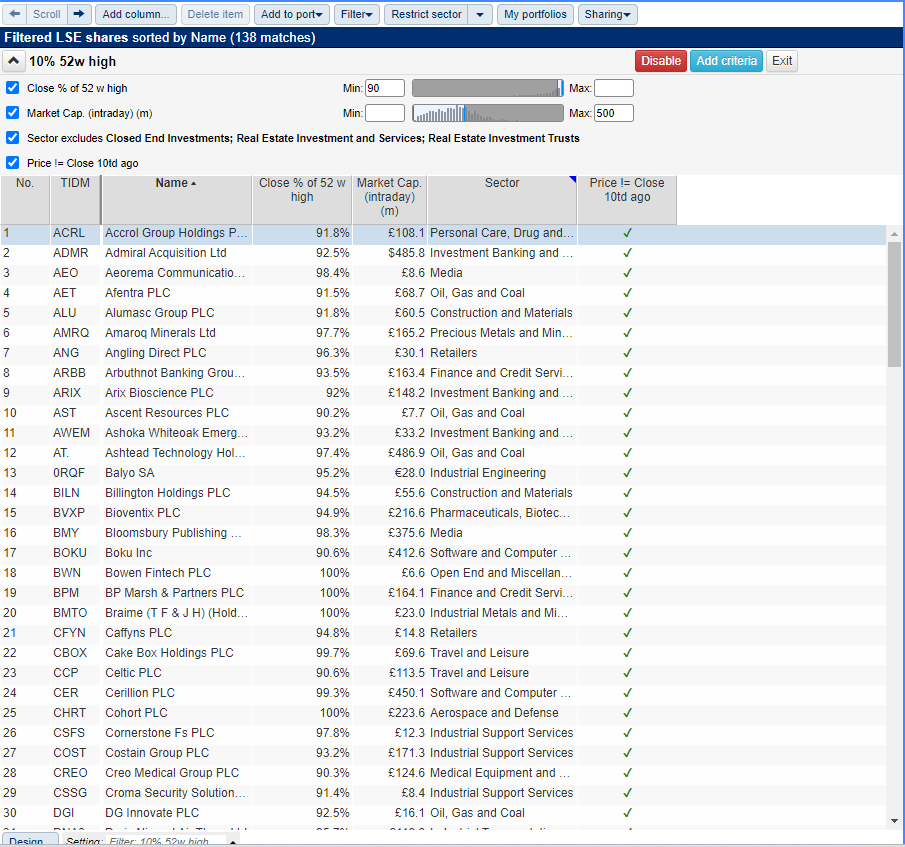

And on the 10% within the 52-week high filter, there are 138 matches, significantly more on the 26-week high filter.

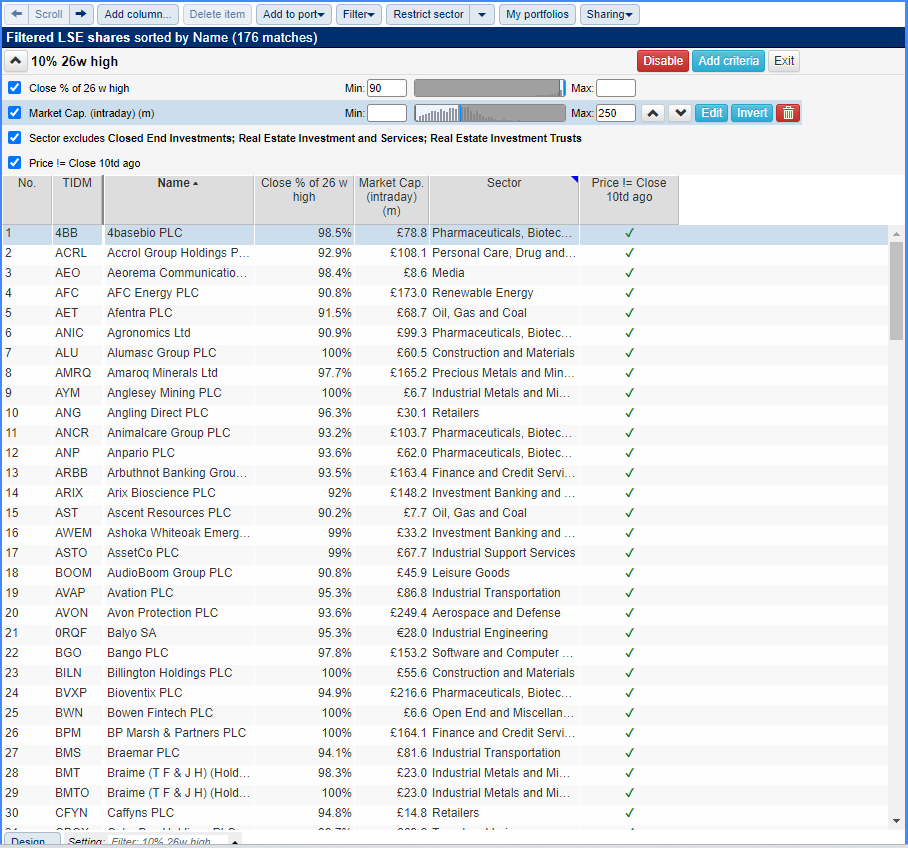

Back to the 26-week high filter, I’m going to cut down the market size in half and see what happens.

Not much! I’ve shaved it down to 176 from 236, which is still too many.

Changing the market cap to £150 million gives us 139 results.

The market cap criterion can be adjusted up and down in size when the market is producing fewer and more results. This is discretionary. Obviously, if you’re trawling through 500+ results a day then I suspect this probably isn’t the best use of your time.

I see this filter as a way to spot potential smaller stocks making moves early as they’re breaking into new six-month highs.

However, I’d run this filter once a month because the 52-week high filter is far better and more selective. Here, by dropping the market cap down to £100 million, I’m cutting off a lot of the small-cap universe that I may want to see. It can’t be relied upon.

But let’s see what this filter has thrown up..

Audioboom (BOOM)

This stock has done the Grand Old Duke of York.

For years, shareholders saw the stock stagnate around similar levels.

Then in 2021, the stock went up more than 1,000%.

And then gave back the whole lot.

Maybe times are changing?

This chart is looking better. It’s ahead of the gap down in June. And the moving averages are now starting to turn upwards (aside from the 200 which is levelling off).

The stock has doubled in the last two months. If there were distressed sellers then the bulls have overwhelmed them powering the stock higher. This is important when looking at new uptrends.

It’s difficult to bottom-pick a trend if the stock is trundling along its lows. But if it’s rallied significantly? It’s an early warning of a potential change in trend. Of course, not every stock that rallies significantly will continue to trend upwards. But by going in favour of the trend, you ensure you’re in stocks that are more likely going to continue their trajectory upwards rather than reverse course and plummet.

That said, I don’t want to chase a rally here.

Rather, I’d like to see some consolidation and allow those in nice paper profits to exit, and new shareholders to come in and pick up the stop. A consolidation gives a nice base to trade from and look for a potential long.

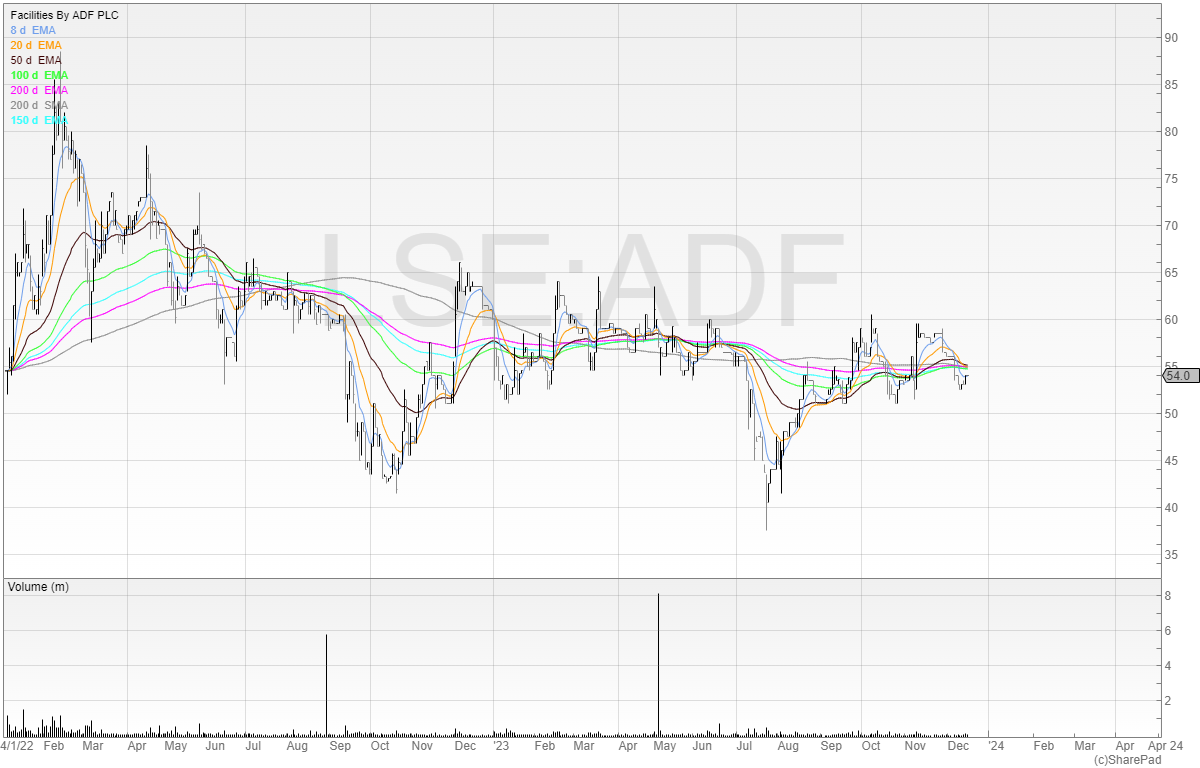

Facilities By ADF

I see this company a lot as they’re often filming near Regent’s Park. But as busy as it might appear to be on the surface, the stock price leaves a lot to be desired.

The filter has pulled this stock up and aside from a fall in the summer, it has traded sideways for most of the year.

I’ve not looked at the fundamentals of this company but perhaps it’s worth setting an alert close to the 52-week highs of 65p to keep track of it.

Hostmore (MORE)

Hostmore was a spinout from Electra Private Equity on 1 November 2021.

It runs TGI Friday’s, which, after the thoroughly disgusting Frankie & Benny’s, is in second place of my most hated brands.

However, Richard Staveley of Rockwood Strategic says it’s the fourth most recognised casual dining brand in the UK (the top three are all pizza brands).

It has just over 80 units, and though “we all know it”, the brand is fatigued and worn out.

Historically, it’s always been profitable. The question is whether the brand can return to profitability in the new environment of higher rates.

I’m not going to pretend I have an edge on the financials here.

New openings have been paused, which, given each unit costs at least £1-2 million is a good thing, and there are talks to refinance the debt which are expected to conclude by Q1 2024.

The stock is now trading above its moving averages and looking to test the recent highs at 24.5p.

Also, the 200 EMA is now pointing upwards for the first time in the stock’s history.

I think it’s worth going on the watchlist here as any solid positive news and a technical breakout could see this stock move significantly.

It’s not without risk though, and certainly would only ever be a trade for me.

Get detailed analytics on all of your trades with Michael’s trading journal available free here: www.tradesmash.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”