Michael looks at the price action of the indices over the last few weeks and includes two potential breakout trades.

US stocks had their second-best day in history this week.

The indices have continued to rally since I last wrote two weeks ago. Many UK stocks have seen uplifts in their valuations too.

The market has the feeling that easy money has been made on the shorts. We’re now 13 months since the FTSE 250 made new highs and so anyone looking to find trash too short is increasingly looking like they’re late to the party.

Does that mean short opportunities don’t exist? Absolutely not. Some stocks may rally way above their value and present new opportunities. Some stocks will have been overlooked.

But it’s getting harder to find stocks to short, and as stocks fall further, the risks become higher. Bear market rallies are sharp, and a stock that is heavily shorted can see big rallies quickly.

Look at Aston Martin Lagonda (AML).

In seven sessions the stock is up over 60%. That’s a rally!

In fairness, there were signs that the trend could’ve been changing. Aston Martin Lagonda started the year above 500p. It was more than 80% down from the high since 1 January 2022.

And if you look closely in September, volumes started consistently ramping up. There was the rights issue announcement which will have boosted activity in the stock, but in the first few sessions of November, the stock had huge volumes going through it.

Volume kills trends. Whenever you see a huge volume in a stock that’s fallen a lot, it’s time to take notice. Big volume means the stock is swapping hands meaning selling shareholders are finding willing buyers. And if the stock has had a huge rally and volumes ramp it – that’s clearly a sign of distribution.

However, anyone who was short AML at the start of the month is now feeling some pain.

Let’s look at the indices.

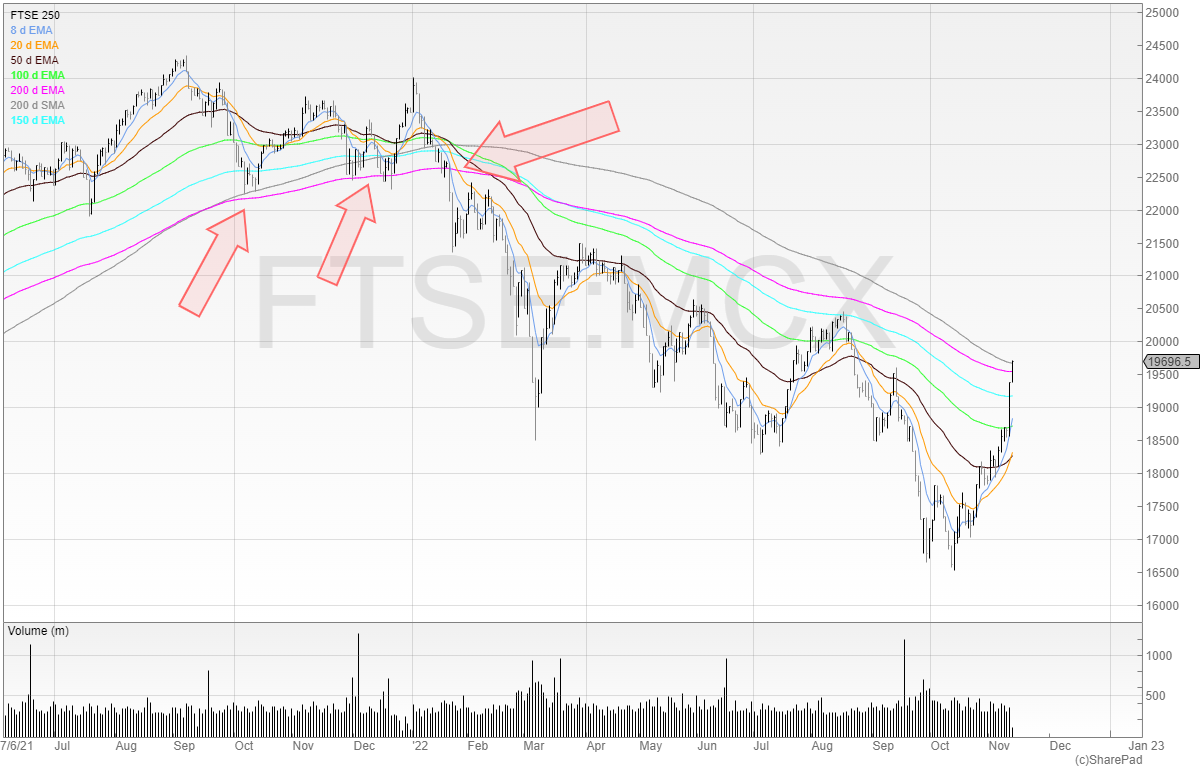

The FTSE 250 is now trading above all of the moving averages for the first time since January 2022.

This is significant. The 200 EMA (pink line) has clearly been support for the index as I’ve marked with the arrows. It then broke down and has been trending downwards ever since.

What the FTSE 250 does here will be interesting. Will it be resistance and stop the rally? Will it carry on and encourage new buyers to get on board?

It would be easy to say that days like yesterday don’t happen in bear markets.

But actually, they do.

The NASDAQ finished 7.35% up on 10 Thursday, November.

But during 2000-2002, the Nasdaq rallied at least 6% in a day no less than 14 times.

And if you thought the bottom was in each time? Then you would’ve been wrong all 14 times.

Here’s the NASDAQ.

We can see that twice it tried to rally above the 200 EMA and failed to hold both times. The index still needs to rally plenty to get there and retest it.

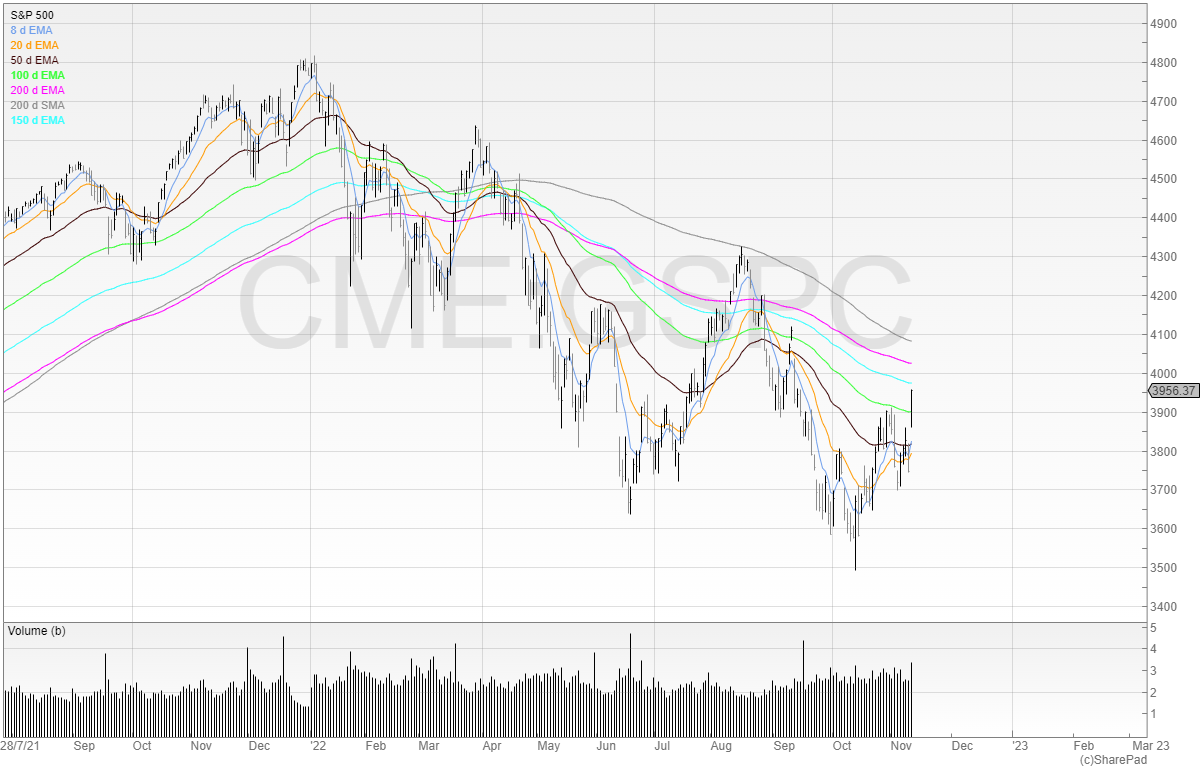

The S&P 500 still has some work to do too.

The grey line (200 moving average) stopped the previous rally in its tracks. After a recent huge day it looks like those levels could be tested again.

As I wrote two weeks ago, my strategy remains the same (even after these big moves).

Trade breakouts, short breakdowns.

Here are a few stocks I’m watching.

Dr Martens (DOCS)

Dr. Martens (DOCS) is a private equity cash-out from early 2021. Like most IPOs of that year, it hasn’t done well at all. That’s despite the fact that if you go to Soho wearing anything other than Doc Martens you feel out of place.

But the chart has tried to break out of 280p several times. For the first time this year, it’s looking like it could stay above the 200 EMA (should it break out of the resistance).

DOCS is SETS listed and so relatively easy to get in and out. That means you can keep the stop loss tight and not worry too much about the spread (though this of course does depend on your trade size).

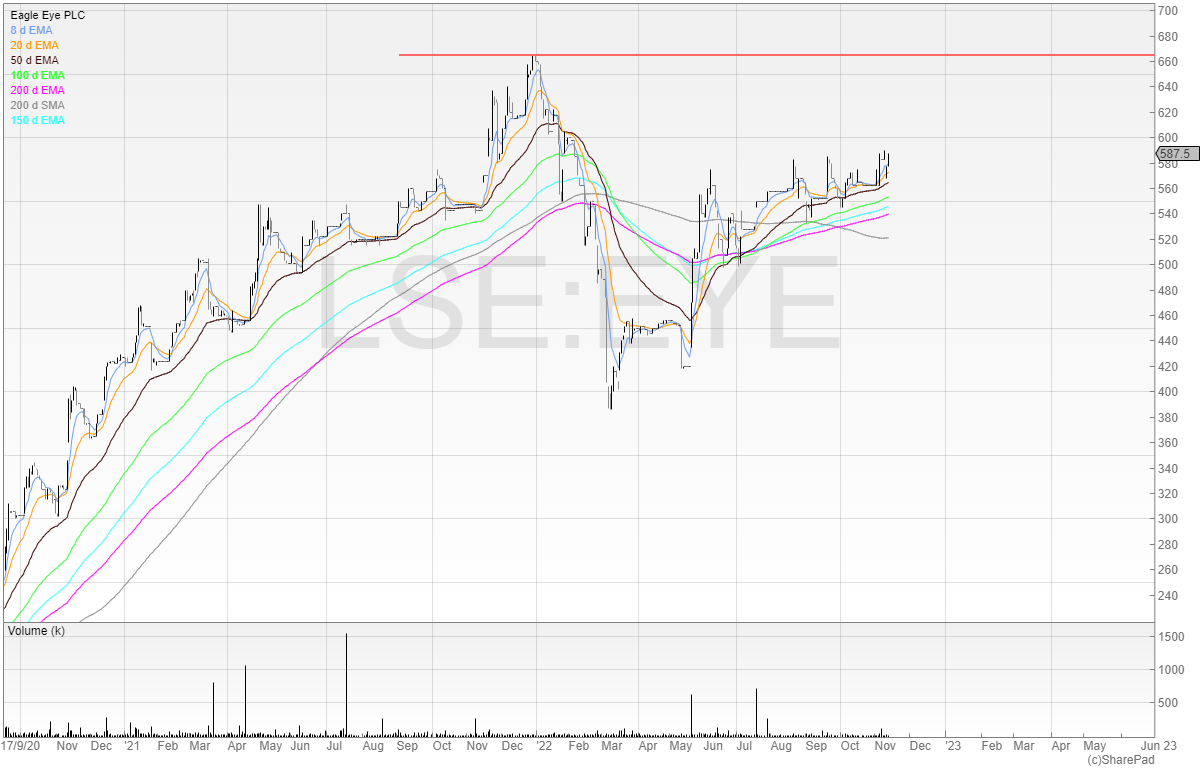

Eagle Eye (EYE)

This is a stock that got hammered in early 2022 but has recovered sharply, mainly due to the business being entirely unaffected by the war.

If you’re not familiar with the company, it offers discounting programmes and loyalty schemes to its clients. If you’ve seen the Pret A Manger £20 per month coffee subscription – that’s Eagle Eye.

It’s taken some time for this business to mature (nearly eight years) but it’s now cash flow positive and profitable. And has the benefit of being able to scale.

For that reason, I’m interested if the stock breaks through 660p.

There are going to be many breakouts if this is the bottom, and we’ll be spoiled for choice.

But as always, make sure you’re not getting too long in what could easily be a bear market rally.

Execute well and stay alive.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.