2022 has been a whirlwind year.

After 2020 and 2021, it was inevitable that we’d need to pay for the disruption Coronavirus caused. And John and I were saying it repeatedly on our podcast (which relaunches in the New Year!) – we just didn’t know when.

After all, you could’ve sold and gone to cash in July 2021 having believed that the market had rallied so much it was inevitable a pullback would occur.

And that pullback did occur, it just took another several months of sitting on the sidelines watching everyone else make money.

That’s an excruciating position to be in. Don’t underestimate it.

Here’s what Stanley Druckenmiller had to say on the matter (original source):

“In January of 2000, after riding that tech boom to a T and making billions of dollars in 1999, I sold everything.

I had a couple of internal portfolio managers at Soros who didn’t sell out. They had smaller portfolios but made 30% after I sold.

And I just couldn’t stand it anymore. And I’m watching them make all this money every day. For two days, I’m ready to pick up the phone and buy this stuff back.

I pick up the phone and I buy them.

I might have missed the top of the Dotcom Bubble by an hour.

I ended up losing $3B on that trade alone. I had made more of the year before, but you know $3B is a lot of money.

It was all because I got emotional and dropped every tool of discipline I’d ever had. And somebody says, what did you learn from [the trade]? And I just said, “I learned nothing. I learned that 25 years ago.”

Just to be clear: one of the best investors of all time:

- lost control of his emotions,

- almost printed the exact top of the Dotcom Bubble,

- went onto lose $3 billion on that trade alone,

All because he couldn’t stand watching other people make money whilst he wasn’t.

This is why calling tops and bottoms is a fool’s game.

And why this game is so emotional.

What do the indices look like now?

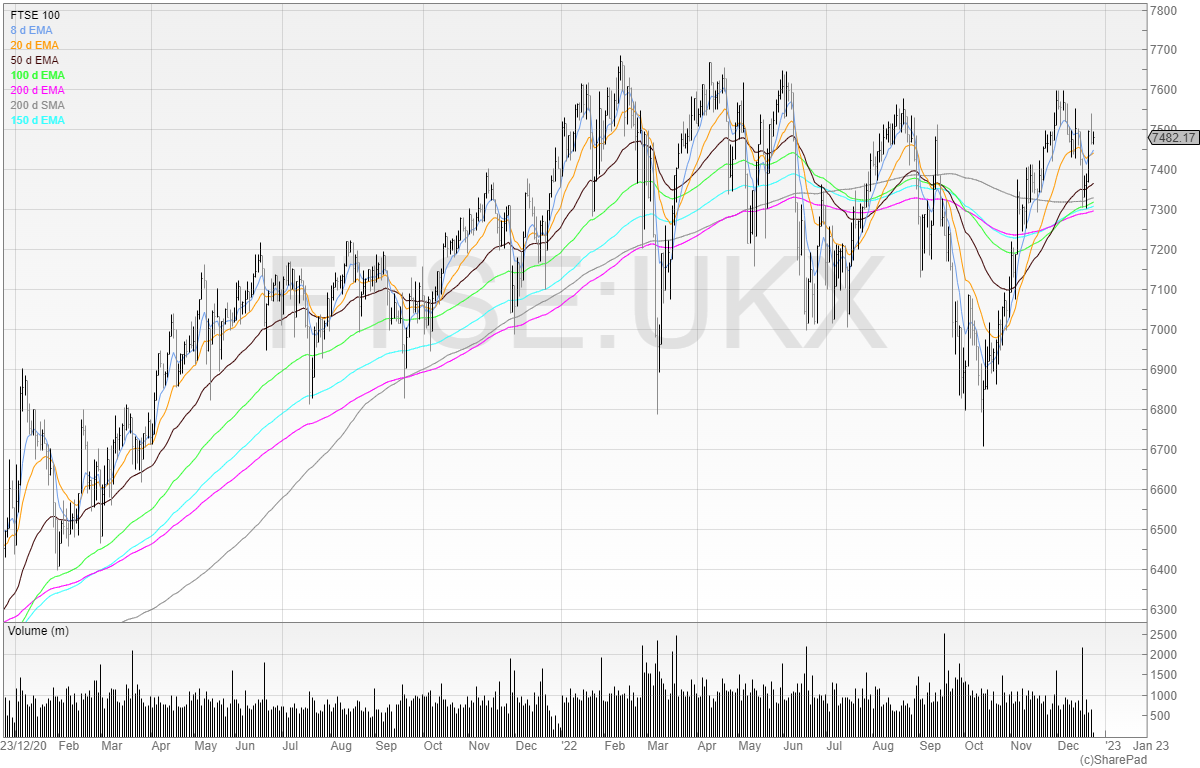

FTSE 100

The FTSE 100 has been remarkably resilient. Anyone with a portfolio of boring established companies has done brilliantly.

The same can’t be said for the more domestic FTSE 250.

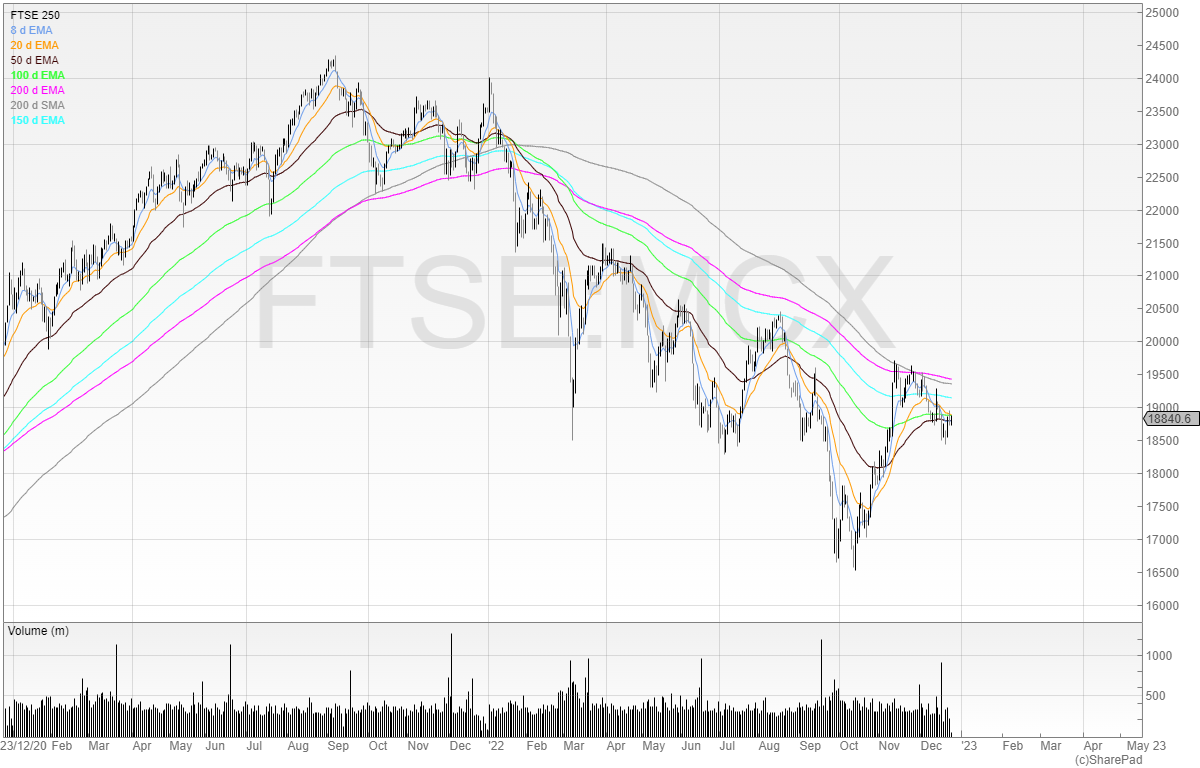

FTSE 250

The FTSE 250 tried to have a pop at the 200 moving averages but since then has failed.

However, the index has rallied from the lows which will no doubt be giving bulls some hope.

The issue is that the index has had big bear market rallies before. March and July both saw quick price rises, only for the downtrend to continue.

Until the index convincingly prints above both the 200 moving averages, I don’t see any reason to be overly bullish on the market in general (individual stocks, of course, are a different thing).

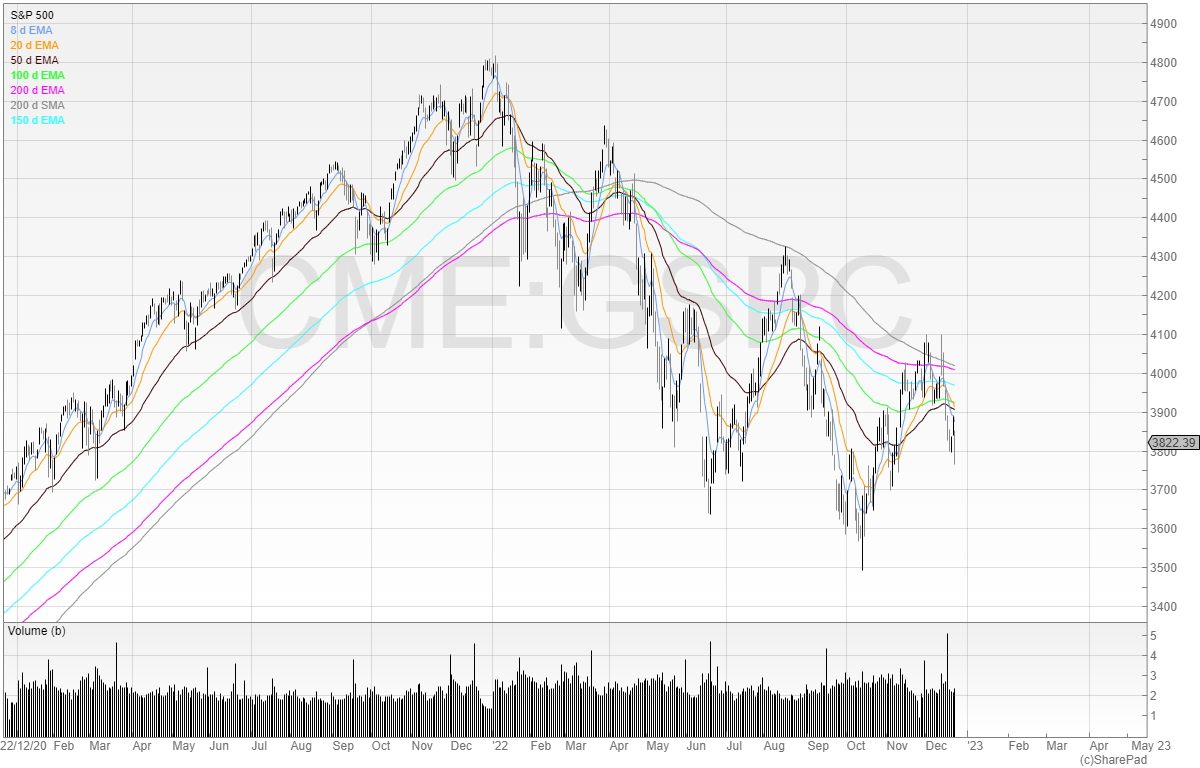

S&P 500

The S&P 500 has been savaged throughout the year. The chart does nothing to suggest that that could change at the moment.

Again, I’d want to see the two 200-moving averages be challenged and broken.

2023: the year ahead

There’s a lot to be worried about in 2023.

Higher interest rates mean every month more and more households are going from low rates to new rates. This can mean mortgage payments significantly increase, and cutbacks elsewhere.

It’s highly like that customer discretionary spending is going to continue to have a big headwind.

But companies will hold back on marketing and spending as they try to survive, which in turn means less revenue for other companies, which may, in turn, mean job losses and bankruptcies.

This is, unfortunately, the reality of capitalism. Survival of the fittest. Many zombie companies that should’ve gone bust during 2020 and 2021 were kept alive by cash injections. I’m not saying whether this is right or wrong but simply stating facts.

We’re now paying for the recession we should’ve had.

However, every bear market has been followed by a bull market. Cycles repeat, and we’ve spent much of 2022 trade in a bear market.

And with less competition, it gives some companies an advantage. An advantage that may show itself in the form of stock price appreciation.

There will always be good stocks in bad markets and bad stocks in good markets. There is always opportunity.

So with that said, have a great break and see you in 2023!

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.