In my last article, we looked at the first seven steps to profitability.

We’ll continue where we left off: with the trading journal.

9. Check what happens after you close a trade to see if you’re leaving money on the table.

Trading is about:

- Losing less from your losers

- Winning more from your winners

- Increasing your potential trade ideas

Every single thing you do in trading will be geared towards these three concepts.

The first two (losing less and winning more) have to do with your profitability and your ability to capture multiples of your risk.

The third option has to do with frequency.

For example, it’s no good relying on a strategy that is the best risk/reward on the planet if it only sets up properly twice a year. What if you miss it the first time, and the second time it’s a losing trade? Now you’re negative for the year.

The more frequent the pattern, the more opportunities you have.

This doesn’t mean that infrequent patterns are bad. It just means you shouldn’t be reliant on something rare.

This is why I trade breakouts. Breakouts are common, and if I miss one there’s always going to be another one around the corner.

Maybe they’re not so common in bear markets, but I simply flip the breakout strategy on its head and instead short breakdowns.

If you think about it, for any stock to make a new high, it has to break out. Therefore, I can trust this will be a repeatable pattern for me to trade.

A final point regarding your trading journal is to monitor what happens after you close a trade.

Most traders log their opens and closes and do some analysis around these two points.

Few traders log their opens and closes and then look at what happens once that trade was closed.

For example, you might find that more often than not the trade continues to rally and by closing the trade when you do you’re actually costing yourself P&L.

The question you need to ask yourself: If you’re closing too early then what will you do about it?

Let’s move onto number 10.

10. Work out how you can lose less from your losing trades.

I believe that all traders are money managers. You need to protect your capital (both physical and psychological) at all costs to stay in business.

Your trading journal will tell you if:

- You’re missing your alerts to sell

- You’re not honouring your stops and instead moving them

- You’re getting slipped by your broker

You can then go and fix these for immediate results. But only if you log and consult your trading journal.

Once you’ve done this, then…

11. Identify your most profitable patterns from your playbook so you can now trade these in larger size.

Most traders make the mistake of sizing up too quickly.

Try 20% increments on R (not position size).

Remember, R is calculated by taking risk per share/position size.

By scaling up R, you’re scaling up your risk and this means your risk stays constant.

Inconsistent risk gives inconsistent results.

And inconsistent results give us poor data that we can’t use.

Once you’ve scaled up it’s then time to decide where to allocate…

12. Trade your best patterns in larger size and continually monitor your P&L to improve.

This step is just repeating what you’re already doing with your journal.

It’s now a journey of:

- Idea generation

- Backtesting the idea

- Executing the idea (live testing

- Refining the idea (improving)

This journey will stay with you and the goal is to scale up your better ideas.

Once you’re more experienced and have the data to back it up you can allocate more of the account to your best trading patterns.

This finally means varying up risk and backing yourself harder where you’re strongest.

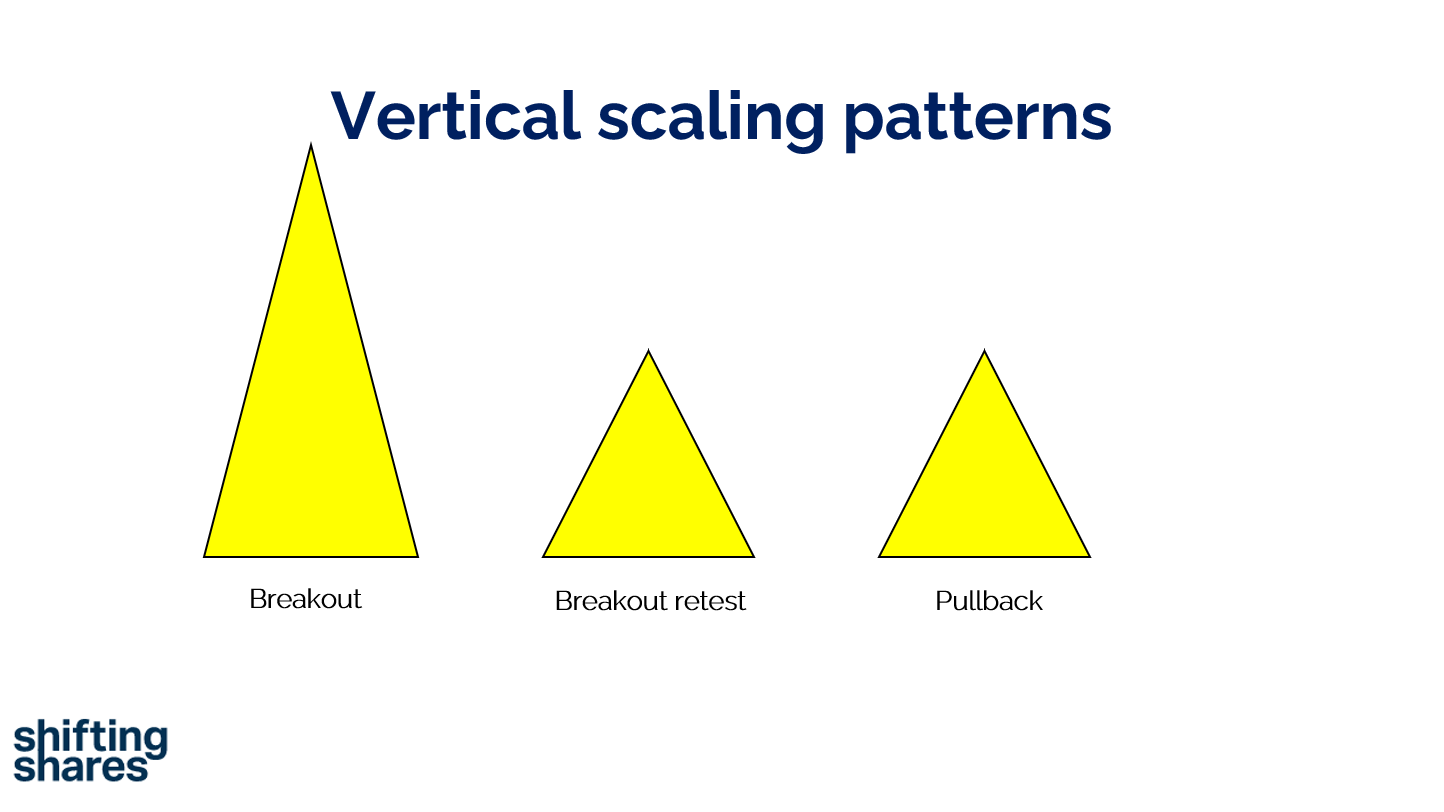

For example, you might find out that breakouts are your strongest trade.

Therefore, it makes sense to trade breakouts in bigger size.

Source: Spread Bet Accelerator

13. Look for more patterns to scale up horizontally as well as vertically.

Markets change, and strategies can become obsolete any day.

Once you have a few profitable patterns the focus should then be on finding new profitable patterns.

You want to build a playbook of trades.

14. Continue learning because the market changes and doesn’t always stay the same.

Those who adapt survive and prosper.

Those who don’t enter the annals of history.

Nobody remembers the former pit traders who didn’t adapt to electronic trading.

15. Show up daily because profitability is the result of small actions compounded.

Lots of people think that there is a magic secret or ingredient required that separates the successful from the failures.

The reality is that success comes down to discipline and consistency.

Trading is about playing the long game. You never know which trades will be big multi-R winners on your bell curve hence why you have to stay consistent.

Hopefully, this two-part series has been helpful!

If you want to read more of my writing for free, you can sign up to my newsletter below.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.