Many people like the idea of day trading: being able to open and close a trade within a few minutes, banking a nice profit, and doing nothing for the rest of the day.

Unfortunately, that’s all it is. An idea. The reality is somewhat different.

Yes, you can close a trade in minutes (and even seconds), but that doesn’t factor in the account of looking for the trade, checking out the dynamics of it, and the risk/reward before you even put the trade on.

I gave a talk last week to a group of non-execs and shared some statistics on trading.

The reality is not only somewhat different, but sobering.

Of all traders that start? 40% will quit within the first month. This is because they come in with unrealistic expectations or have burned through enough of their account in the first 31 days to realise that trading (or at least trading with no idea what they’re doing) is not for them.

Within two years another 40% (taking the total to 80% will have quit) will have quit. Account fees, commissions, and a general lack of profitability will kill them here.

Studies estimate that only 7% will actually remain after five years. If we think about Furlough Freddy and Fiona – a few of those faces are still in the game. Bull markets are great for convincing people that they’re actually good because they were long in a bull market.

And sometimes that’s all you need to do well, but people struggle to hit collect and take their profits whilst the going is good. Once the market turns, they grimly hold until they can’t take the pain anymore, and then attempt to salvage what they can.

Finally, we come to the end, where it’s estimated that 1% of all intraday traders can profit net of fees.

When you’re churning through lots of trades, fees add up and become a drag. The amount of spreads you’ll need to cross and the fact that your strike rate will dramatically fall compared to swing trading will make intraday trading much tougher mentally.

There are also a lot more variables to consider in intraday trading. Broker notes, recent price action, are they (the market) long or short, hidden meanings in RNSs… Here are a few from last week.

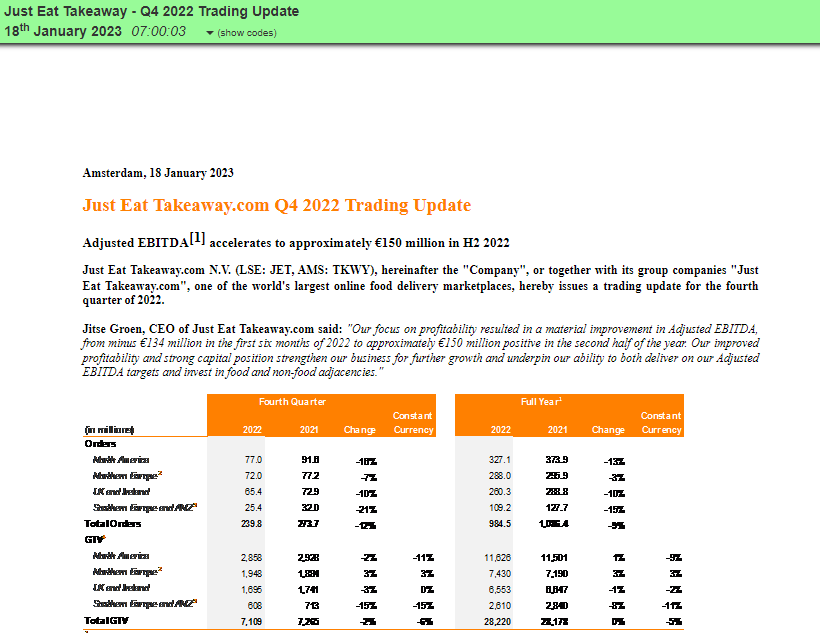

Just Eat Takeaway (JET)

I highlighted JET as a breakout trade in my premium newsletter I launched last week (this is a more detailed version of the ‘3 stocks I’m watching’ monthly emails I send out to 12,000+ people every month).

We can see a cup and handle was forming and the stock had built a base. It was also near 100% off the lows too.

Let’s look closer at the chart.

The stock did break out and had a shake with the big hammer candle. A few days later it then announced a trading update.

I had no idea whether this was good news or not in terms of forecasts but the market reacted well.

There was a gap up, followed by a pullback, a double top, and then a strong downward drift back to where the price was before the trading update.

It’s easy to say in hindsight the company had materially grown its adjusted EBITDA and therefore it was obvious to go long. But was it?

What if the market was expecting much more? Companies can announce positive news and the stock sells off because it didn’t live up to expectations.

And it’s easy to say that there was a double top on the 1-minute therefore it was obvious to go short. But was it?

The trend was up, the stock had gapped up, and the market had reacted well to the news.

Here’s another stock in the same sector: Deliveroo.

Deliveroo (ROO)

Sometimes there can be a read-across trade when one stock in a sector puts up good numbers and the others follow. Not the case here. There was thin liquidity in the stock and nobody cared.

But then the stock also had better than expected numbers. GTV (Gross Transaction Volume) was better than expected and the directorspeak was good (though when is it not?).

Despite the huge selloff in 2022 in equities, Deliveroo actually held up well.

It’s been trading in a range of 80p-100p since May. And now we’re seeing good news in a market where stocks are rising.

Seems like it could be a nice opening drive trade.

Nope! The market discounts the news within an hour.

Onto the next.

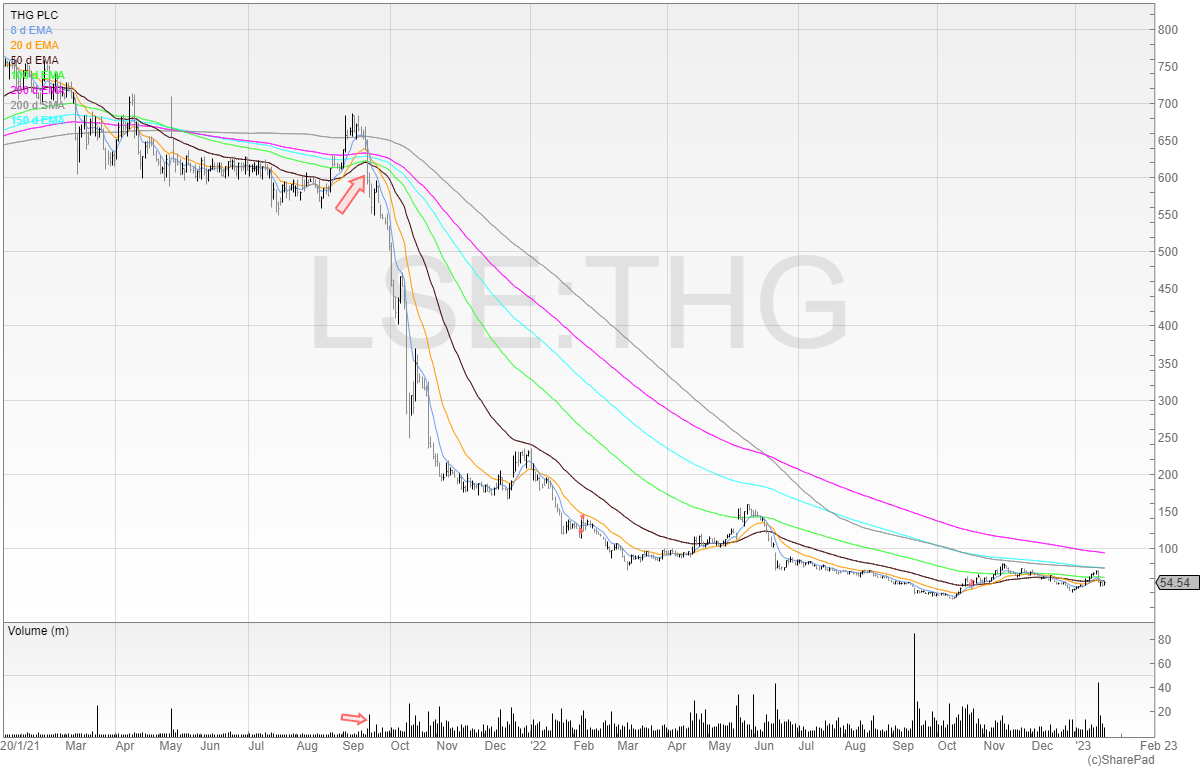

THG (THG)

It’s well known that THG has had problems since listing.

Here’s the chart since IPO. I’ve marked the arrows where short volume came in and started hammering the price.

Last week it announced a profit warning. This is typically a high beta stock and so it went on the watchlist for stocks in play that day.

Here’s the chart for the last few months (I’ve marked an arrow for the day of the warning).

We have a downtrending stock that has rallied in 11 of the last 12 sessions. Shorters have been able to cover and maybe the market is even long.

Makes sense to try a short out in the uncrossing trade? Right.

Stock gapping down? Makes sense – people want to get out because of the warning.

Except the stock gapped down and then rallied!

It did reverse after the auction – and again it’s easy to say that you could’ve shorted at 70p. But this is hindsight.

A better trade would’ve been to short the day’s lows and run the trade but I forgot to set an alert.

The reason why intraday trading is so hard is because what works one time doesn’t work another time, and there is no consistent way to stack the variables to give you an edge.

Most intraday trades are often around 50% on their strike rate. Clearly, they don’t have an edge when it comes to picking trades in the short term. But if they’re profitable, it’s the risk management and position sizing that keeps them going.

Let’s look at another.

4imprint (FOUR)

FOUR had better-than-expected news last week.

But despite being worth more than £1.2 billion in market cap, the spread at the open was more than 300p – more than 5%!

You really need to have conviction to trade that because the cost of transacting is so high.

In the end, not much happened.

Spirent Communications (SPT)

Here’s one I completely missed: Spirent Communications.

Sounds good, right? Revenue up and adjusted operating profit slightly ahead of market consensus.

Look again.

It’s a warning of a potential warning.

And this is what happened to the stock price.

It’s hard to catch when you’re skimming due to the sheer amount of news RNSs there are in January.

But this is why the stock didn’t gap down much and instead sold off straight from the open.

To conclude, be aware of broker upgrades and downgrades (you can get these from Alliance News which is AN on the RNS page), be aware of recent price action and what is actually expected in the market, and always check the outlook.

Look for what management did and didn’t say.

And whatever you do: keep the losses small. Live to play another day.

Intraday trading isn’t about making solid trades every day.

It’s about manoeuvring your position into a position where you can stack on some size and drive your P&L. Typically, a good size of my monthly P&L from my intraday trading account comes from a handful of trades.

Around 50% of them are cut at a small loss. There are some small wins, and every now and again you get lucky with a screamer. It’s hard. But doable.

My best trades though are always in the swings.

And for anyone interested in my premium newsletter where I write about potential trades and how to get better – please see the details below.

Michael Taylor

Buy the Bull Market premium trading newsletter available at: https://www.buythebullmarket.com/

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.