It’s beginning to feel like we’re well into this bear market.

Stocks are no longer looking like easy shorts. Many stocks have already bottomed and are trending upwards.

As I said in my last article – I don’t know if this is the beginning of the new bull market.

And I still don’t need to time it perfectly. Stocks will set up and stocks will rally. That’s all I need to be concerned about.

One stock that I’m watching closely (and hold a small long position in) is Oxford BioDynamics (OBD).

Oxford BioDynamics

This is a biotechnology company that focuses on the discovery and development of biomarkers for us within the pharmaceutical and biotech industries.

It has a platform called EpiSwitch, which is a “proprietary industrial platform for detecting CCSs uses well-accepted principles of CC detection, proprietary molecular biology techniques and operates under ISO compliant standards”. How’s that for a word salad?

I’ll probably never truly understand what this company does, but what matters is the chart and background story.

The company raised £9.1m plus an open offer in October at a 33% premium to the prevailing share price of 15p.

The goal of this placing is to continue the commercialisation of EpiSwitch and focus on sales and marketing activities.

Here’s the chart.

We can see the stock price has been hammered down in a stage 4 downtrend. All of the moving averages are trending lower and so it’s been a classic avoid.

However, the trend appears to be changing.

Here’s the last six months.

Notice that in October the price started rallying before the placing and since then the stock has held up well, trading around the 20p areas both above and below it.

We’ve seen the price tag 22p three times now and fail to break out, two of which put in higher lows. This is also around the 200-exponential moving average (pink line).

I think this is a potential breakout here as the company is now funded and the price is not far from 100% from its lows. That signals to me a potential change of trend.

There may be loose hands from 20p looking to book their 10% profit at 22p in the last few weeks volume has picked up showing accumulation from buyers.

Technically, this is a nice setup, and so I’ll continue to watch this.

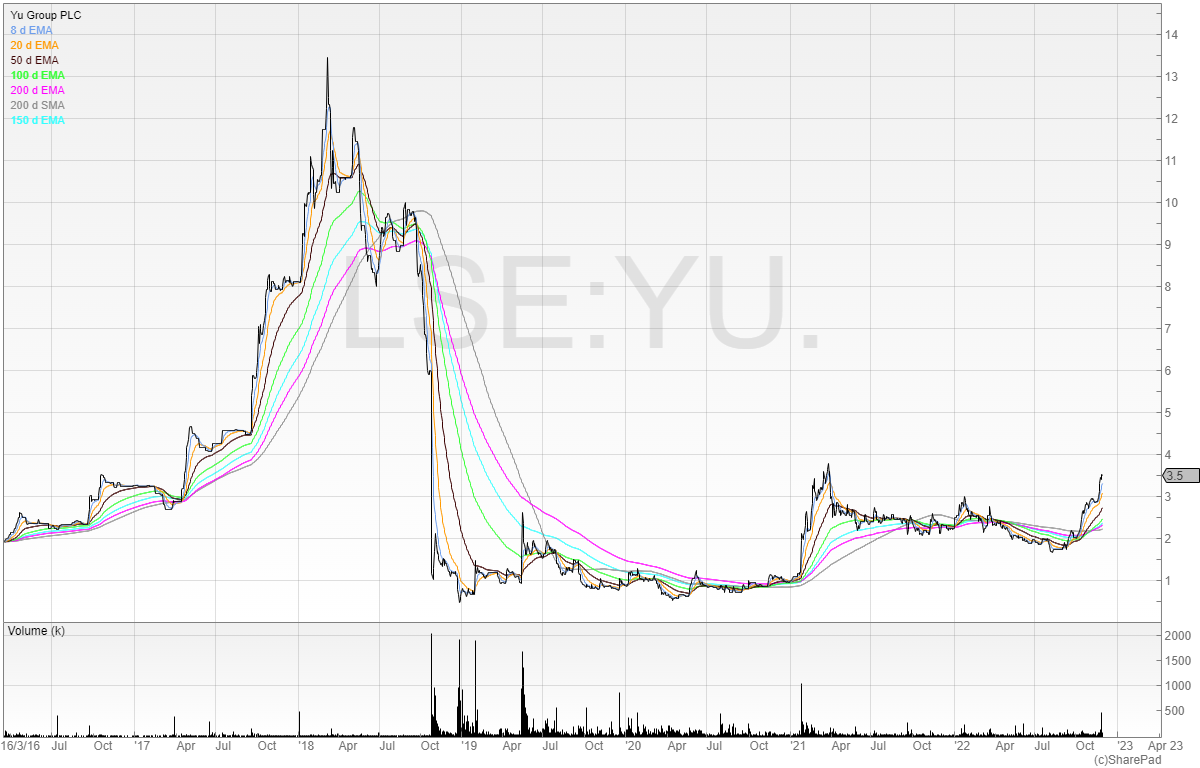

Yü group (YU.)

This stock is probably one of the most unpronounceable stocks on the entire exchange.

It’s been listed since 2016 and had a period of boom and bust.

However, the business appeared to turn a corner in early 2021. The price rallied from 120p to 380p in a few months and since then has drifted sideways.

This stock has been on my radar since early 2021 after I sold my position into strength.

Sometimes stocks can take a long time to consolidate and break out. This is the reality as profit takers need to be churned out and new shareholders to pick up the stock.

Here’s the immediate chart.

I missed my entry in the small base as the stock started moving. I entered on the gap up on good news with a small position and closed this down quickly for a loss as supply came into the market.

This is understandable given how quickly the stock price has moved.

It was already extended, and with a gap up the price had rallied more than 33% in the space of six sessions. Naturally, had I avoided the stock, it would’ve rallied to 500p without me in it.

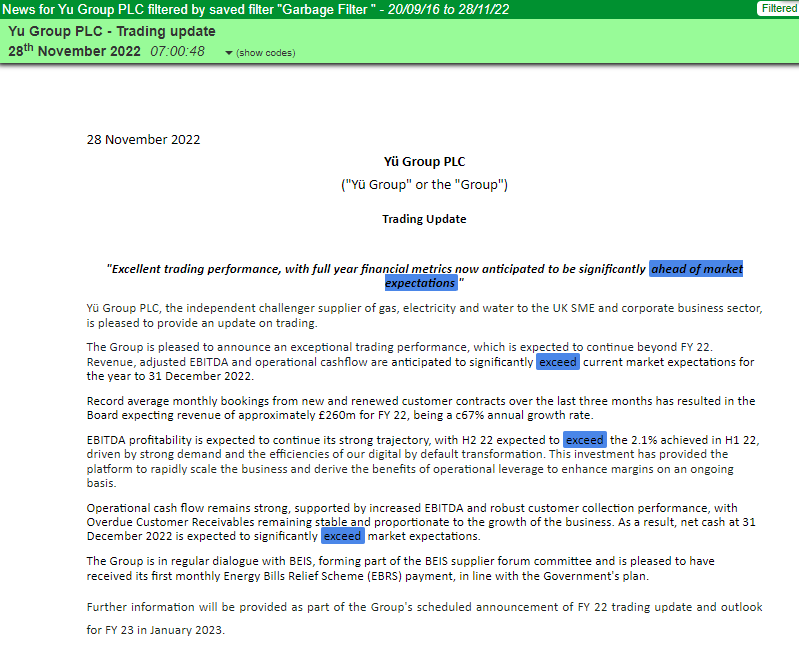

This is the update.

We can see that the business is firing on all cylinders and all the metrics are tracking the right way.

Forecasts for post-tax profit in FY23 are £6.88 million, which, at the share price of 350p it puts the PE ratio at 8.5.

This looks like a cheap growth stock to me with the chart going the right way too.

I’m watching for a tightening of the price and the stock to build a base before trying another breakout trade.

Remember, with breakouts, we want to see a base build and a tightening of the price. I currently have no position in YU. but will continue to watch it closely.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.