Michael looks at The 90% Club from 2021 and how to avoid getting caught by overpriced IPOs.

Warren Buffett doesn’t like IPOs.

In fact, this is what he said about them:

“An IPO is like a negotiated transaction – the seller chooses when to come public – and it’s unlikely to be a time that’s favourable to you.”

Yet many people had either not heard this or disregarded him completely in 2021.

There were lots of IPOs where money changed hands. Some of these raised no additional money meaning the sellers were cashing out and new people were buying the sellers’ shares.

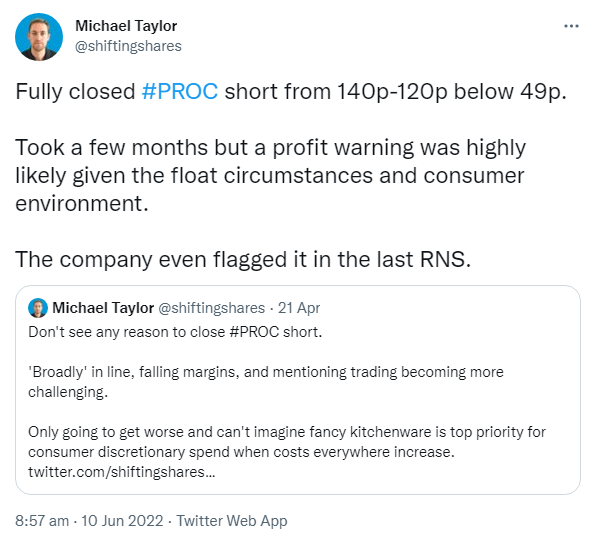

Pro Cook

One example of this was Pro Cook. When the market started to turn sour, I started to short the stock.

After the trading update, this became an even better short. The company was telling us that trading was already becoming challenging, and that it was ‘broadly’ in line. Yet the price barely moved. It was a slam dunk!

The profit warning came, and I managed to close my short capturing a 65% move.

Here’s the chart from Pro Cook.

The arrows mark my first short sell and my covering of the whole position.

Made.Com

A similar thing happened with Made.Com. The company’s Chair spoke at a conference and told attendees that shoppers have held back their spending. This wasn’t announced via the RNS.

But it told me everything I needed to know. A profit warning was coming!

Here’s the chart of MADE. From 200p to 2p.

I think my MADE sofa is soon going to be worth more than the entire company. It looks like it’s going to go bust.

What have we learned so far?

So far, we’ve learned that the market is not efficient.

If it was, people wouldn’t have been biting sellers’ hands off for stock back in 2021.

And yes, the macroeconomic environment has changed with Russia’s invasion of Ukraine.

But all this did was exacerbate existing symptoms – supply chains were already tightening and people were already watching their spending.

This recession isn’t a surprise to anyone. So why people load up on fancy kitchenware and expensive furniture, both of which had extraordinarily good years because of lockdown and increasing spending, is beyond me. But they did.

We’ve also learned that there are great trading opportunities out there when it comes to shorting IPOs.

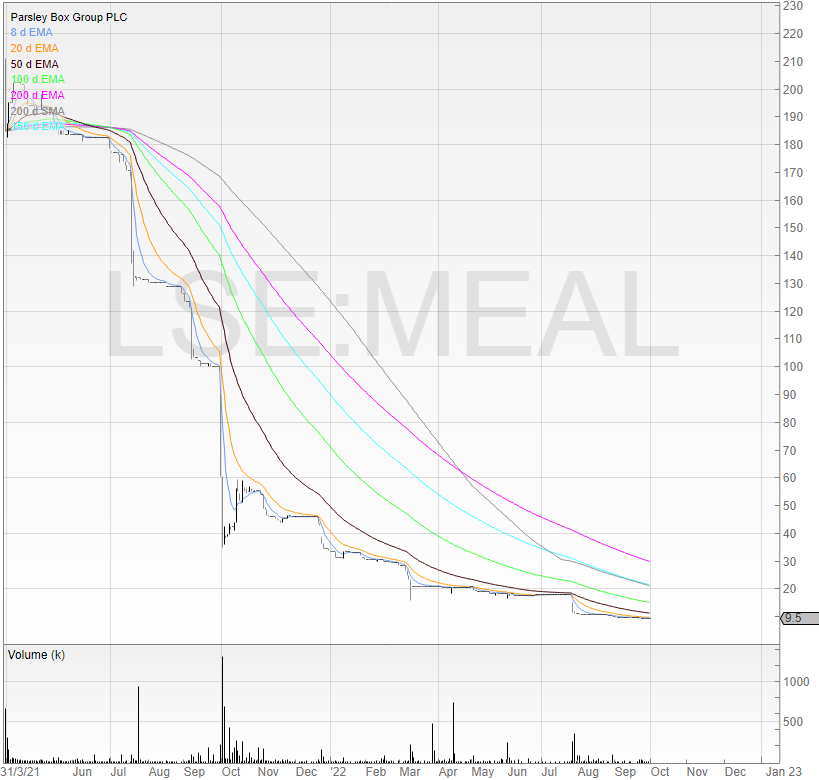

Here’s another one, Parsley Box, that has been an IPO dud.

And another one, Victorian Plumbing, which is likely to join the 90% club shortly.

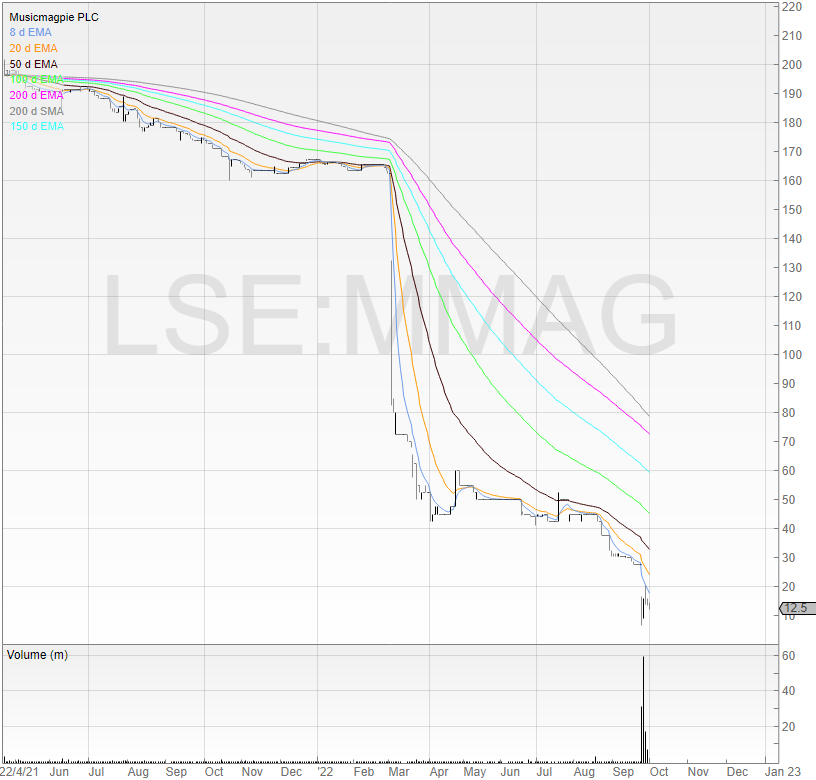

And finally, Music Magpie, which is looking like it’s about to join it too.

How to avoid the 90% club

There were lots of warning signs and red flags in order to avoid overpriced IPOs.

- First of all, look at the reason the stock is listing.

In the case of Pro Cook, the company was talking about expanding to Europe and telling a growth story.

But it wasn’t raising any new funds at all. The raise was solely for the existing holders to convert shares into cash.

Lots of people didn’t bother to ask if the business was so good – why were the existing holders selling (and selling so much!) if they had plans to expand and grow the business?

And if they did ask the question, they appeared to be satisfied.

But remember: management will always tell you what they want you to hear.

They’re paid to sell the business.

- You also need to look at the last few years of trading.

Has the business had any tailwinds that have significantly benefitted the business (and thus making it a good time to sell)?

It’s likely that the insiders and management understand the business better than you, and probably better than anyone else in the world.

If they’re selling, it’s probably because they think they’re getting a more than fair price for the wares they’re offering.

Ask yourself if you want to be the schmuck who takes that side of the trade.

- Check the capital structure

You also want to look at the capital structure. What price did the current shareholders pay for their shares?

When Argo Blockchain listed in 2018, some shareholders paid 0.1p for their shares.

Guess what happened when the stock listed at 18p and the shareholders were 180x up?

It dumped. Big style. 18p to 3p.

Many investors are calmed by the management being “locked in”.

This is supposed to mean that management can’t sell any shares until a certain date.

However, there aren’t any consequences for breaking these lock-ins, so a lock-in is relying on a gentleman’s agreement. And not everyone in the market is a gentleman.

In short: you should disregard a lock-in and view it cynically.

- Wait before getting involved

Even if you don’t do any of the above, you only need to do this final one.

Wait before taking a position.

With the benefit of waiting, you can see how the stock reacts and what happens.

Plus, if the stock breaks down and trends downwards, you can simply avoid a stage 4 stock.

All of the 90% club had this in common at one point. They broke down and didn’t stop falling.

There are lots of ways to make money in the market but the best way to avoid losing it is to never buy a downtrending stock.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.