In this article, Michael looks at five different stocks and casts an eye over the charts.

I recently wrote a Twitter thread where I gave my thoughts on several charts.

Many said it was useful, so I thought an article where I do the same in a bit more detail may be of use in explaining what I’m looking for and why.

Charts are neither infallible nor are they a crystal ball. But they do homogenise the collective sentiment of investors and put it into one easy-to-read graphic.

For example, if everyone is bearish, then you’ll be able to see that in the trend. And if the bulls are fighting back, you’ll be able to see that too.

Let’s move onto the first chart.

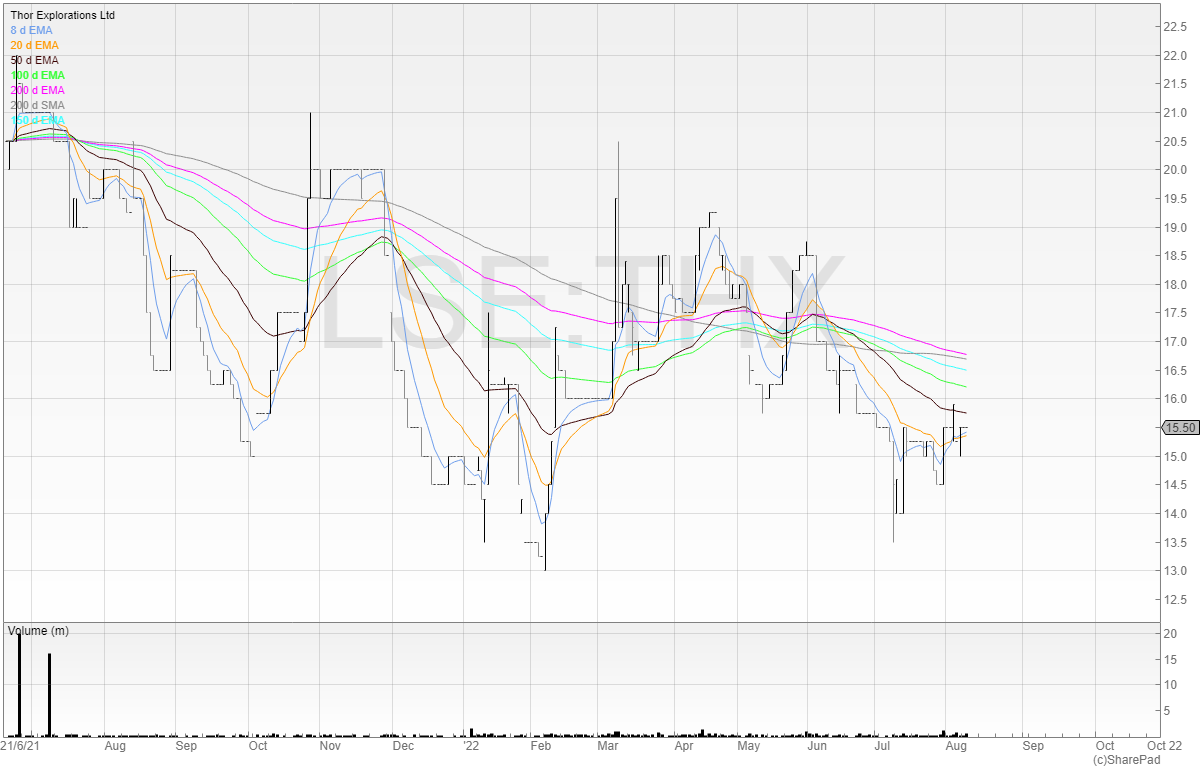

1. Thor Explorations Ltd (THX)

This company is a gold production company in Nigeria. Its projects include the Segilola Gold project, Douta Project, and Central Hounde Project.

The company is rapidly paying down debt and its fundamentals are strengthening. Forecast net profit for FY23 is $78.3 million in a note from Hannam Partmers. Long-term debt is expected to be wiped out completely in that year.

However, the company earned a little distrust from the market with some delays and so this is reflected in the price.

I believe this company has a great future. But even though that may be the case, I have no interest in buying the stock until it turns around and starts to trend upwards.

A breakout of all-time highs would convince me that this stock is potentially about to start trending.

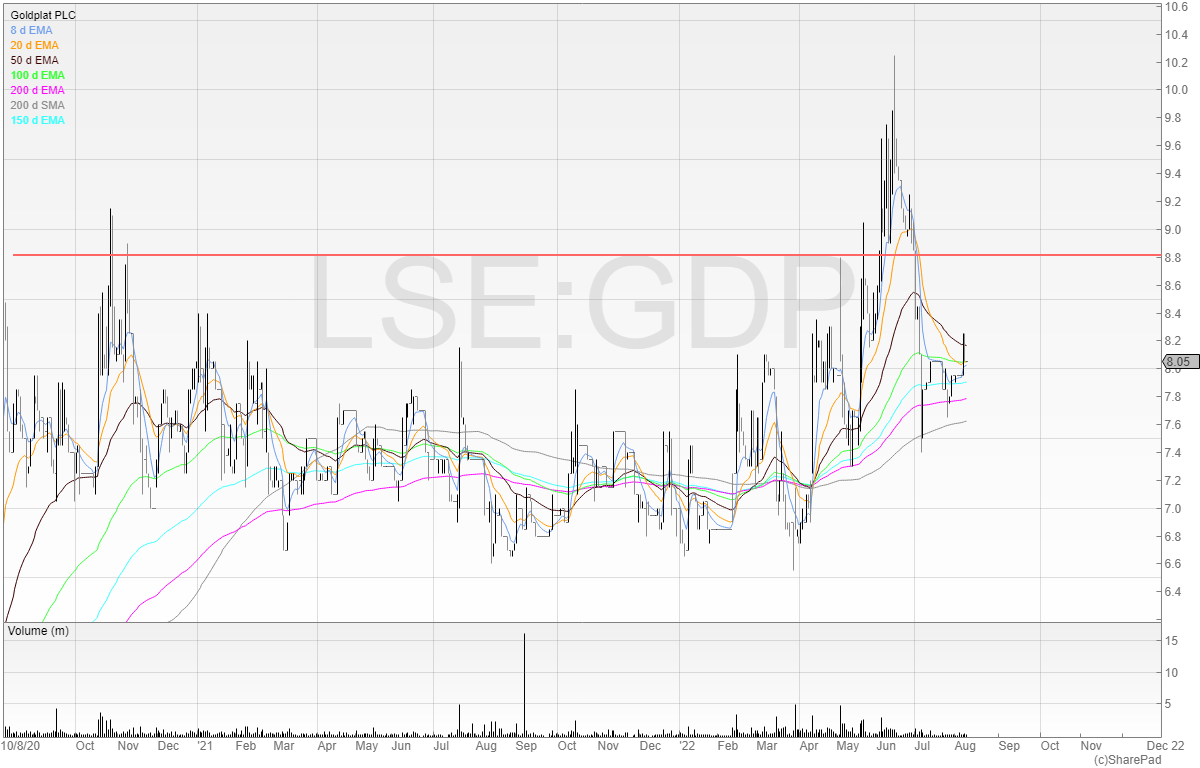

2. Goldplat (GDP)

Goldplat is another African gold company. However, it’s horrifically illiquid and has a wide spread.

I traded this stock on the breakout only to be stopped out. Since then we’ve seen the stock retest the 200 exponential moving averages (grey and pink lines) and so far bounced from this area twice.

However, I may be interested to trade this stock again if it breaks out because it has trended sideways for an extended period of time. The stock is lowly rated and is profitable, so I’m keen to get on board an early trend here.

Pre-tax profit for FY23 is forecast to be £6.5 million against the current market cap of £13.5 million, but the stock does come with execution and jurisdiction risks. Plus, the illiquidity is enough to put off any risk-averse investors and short-term traders.

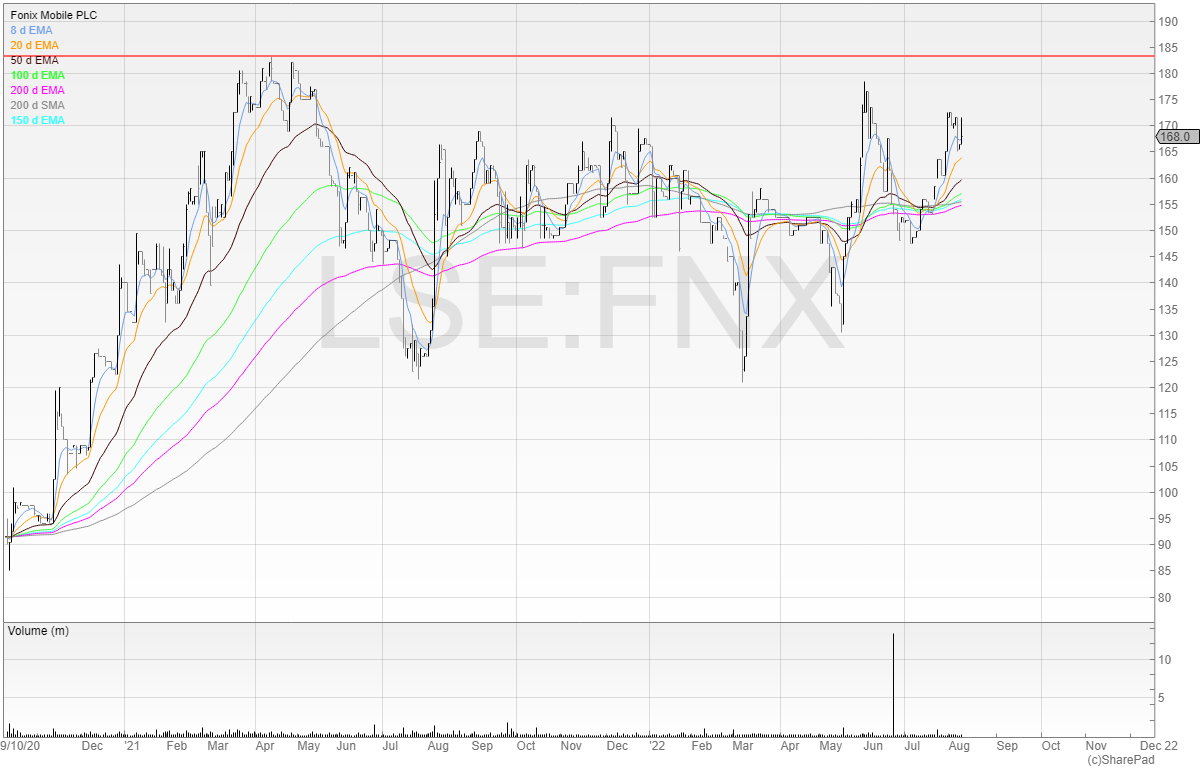

3. Fonix (FNX)

Fonix is a stock I have followed since its listing. It’s a steady stock that is growing with sticky clients.

However, the stock has been volatile and in the last 12 months has traded in a range of around 125p to 185p.

Looking at the chart there is some clear sideways trading which makes this stock a potential breakout candidate.

I’d want to see the stock make a clean break of 185p on larger than average volume. I’d also want the price to rally gently towards resistance rather than surge towards it.

The stock isn’t cheap with a forecast net profit of £8.8 million against its market cap of £167.5 million though the share price is more important. But should the stock issue a profit warning, that punch valuation will take a beating.

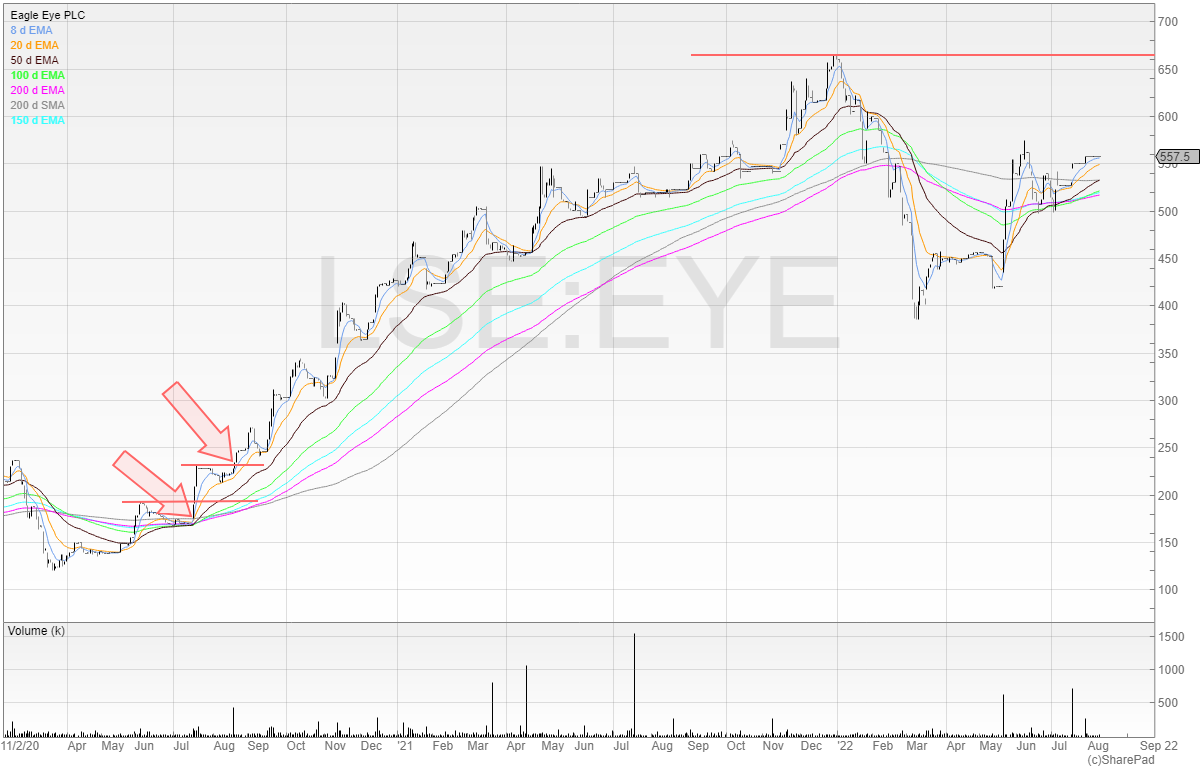

4. Eagle Eye (EYE)

Eagle Eye is a stock that has had a rough history on the stock market. But 2020 was the year that the company finally came of age and started to look like an actual business model.

The company gave clear breakout opportunities in early 2020 and since then has broken the trend before regaining momentum.

The above chart shows how the stock sold off sharply, but since then has recovered some ground.

I’ve set an alert around the breakout level as this company is still growing and has a huge target addressable market. It’s now cash flow positive which means no keep the lights on placings are required.

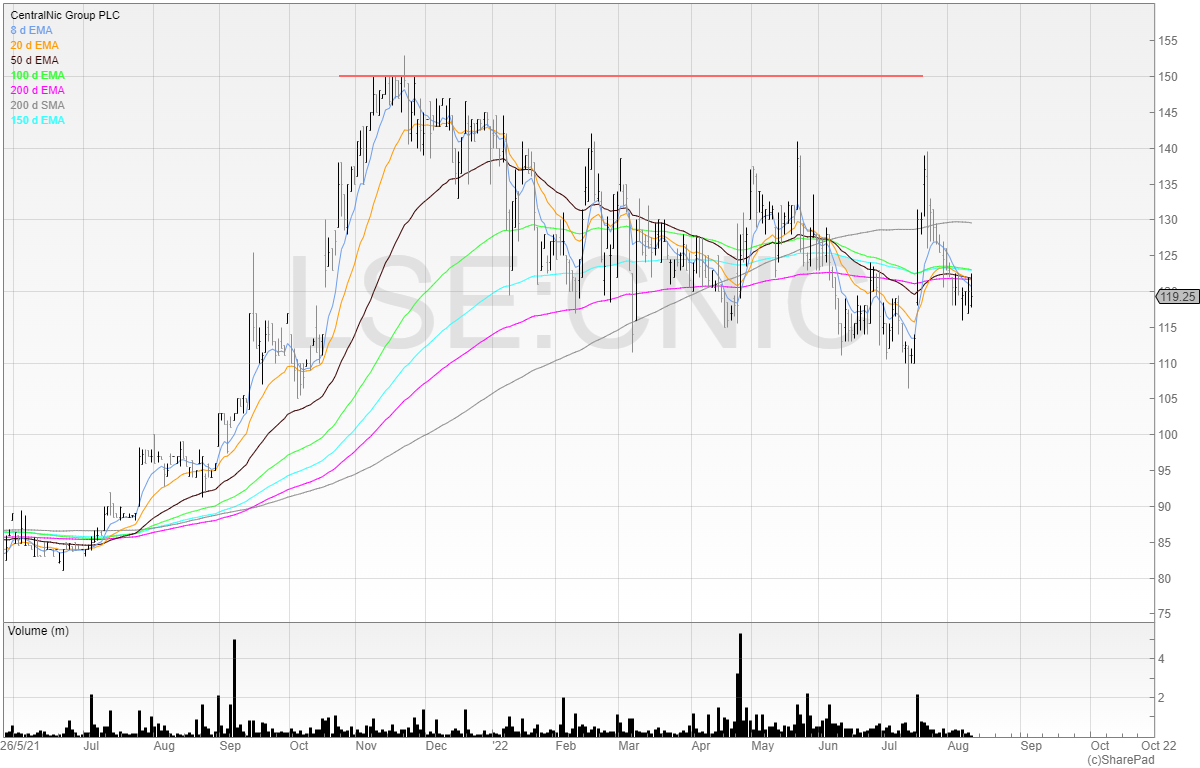

5. CentralNic

CentralNic is involved in the provision of global domain services. It also offers strategic consultancy and provides the essential tools for businesses to go online.

It’s a nice uptrending stock and growing quickly, hence why it’s firmly on my watchlist for a trade.

At the moment, it’s struggling to stay above the 200 EMA which to me is a warning sign.

Stocks that trend upwards should be like tennis balls – they bounce off support. This is opposed to stocks that act like eggs, which go splat.

It remains to be seen if I’ll trade this – for me to be interested the price needs to rise to around 150p.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.