In this article, Michael offers some thoughts on trading through a bear market and how to protect yourself.

Technically, the FTSE 250 is in a bear market. The FTSE 100 is not.

At the moment, neither are the Dow Jones and S&P 500 indices.

What if we bounce back and continue the epic bull run we’ve had?

Everyone will learn that stocks always go up, and they can afford to be lax with their risk management.

And if we don’t?

Then plenty of people are in for a world of pain.

The problem with bear markets is that hypothetically, everyone thinks they can handle it and they won’t be affected.

The reality is that reality is different from hypothetical situations. It was Mike Tyson who said, “everyone has a plan until they get punched in the face”.

Remember, how many people want to buy the dip until there is an actual dip?

It’s the same as being a contrarian.

Everyone likes the idea of being right when everyone is wrong, but nobody is willing to look wrong to start with.

The real test of a bear market is not the bear market, but how you react to the bear market.

The best plans are forged out of the heat of battle. If you’re starting a risk management plan now then it’s a little late – but it’s also better than not starting one at all.

The first thing to do is go over all of your positions.

You should already have exit plans in place for these stocks.

However, if you don’t, look at each one and ask yourself why you bought them and where you would’ve liked to get out.

It’s easy to do the buying in a bull market but you have to think about selling.

Don’t be tempted to hold on just in case it recovers. If you know you shouldn’t be holding the position – kill it.

Bear markets are opportunity markets

The bear market will provide you with an opportunity to see how you perform in a falling market. Bear markets are inevitable and part of the cycle.

However, bear markets also create new conditions for stocks to thrive. Just because the general market is going down doesn’t mean that stocks won’t break out.

The new market leaders show themselves in bear markets.

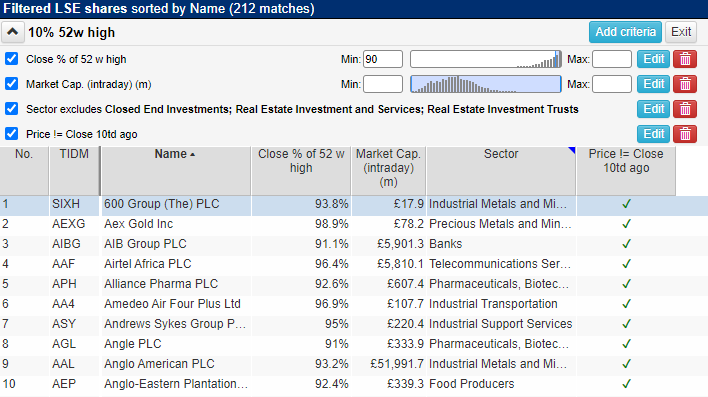

You can use the filter I introduced in my last article to find stocks trading within 10% of their 52-week highs.

Don’t try and call the bottom

You probably won’t call the bottom. Even if you do, it’s luck.

Amateurs call bottoms. Professionals wait for the setups.

Trading can be condensed into three things:

- Knowing what you want to see

- Knowing why you want to see it

- Knowing where you want to see it

For example, I love breakout patterns. Specifically, I like cup and handles.

Why do I want to see it? Because breakouts are high probability pattern entries and I like buying at the point of least resistance.

Where do I want to see these? In a stock that has traded sideways for an extended period of time and is above the 200 EMA.

Your strategy will be different to mine. But you should have your own answer to those three statements.

Stay consistent

Your emotions will be heightened during a bear market. Nothing gives you a more sickening feel in the stomach like seeing a big red number on the screen.

Even for the best-prepared trader, it’s inevitable that at some point a stock will issue a profit warning/placing/bad news and the trader will take a loss above 1R.

It happens.

During emotional phases, we tend to look for certainty or direction.

Don’t.

Every bear market is different, and the past is the past.

Could anyone have predicted with pinpoint accuracy that the market would rally after just six weeks of stocks falling? Maybe a few got lucky but the majority couldn’t. There will always be Harry and Henrietta Hindsight to tell us they did – but you’ll notice they probably didn’t say it at the time.

2020 was different to 2007 which was different to 2000. Which was different to all the other crises before it.

There are so many variables in the market that expecting a market to be predictable is at best naïve or at worst foolish.

Cash is a position

People assume that if they’re not invested then they’re not taking a position. Cash itself is a position.

It provides optionality on future trades and also is the perfect hedge to volatility.

Cash is defensive.

There is now the argument that cash is losing -11% in value a year due to inflation – but deploying cash on that basis would be a responsive act rather than a proactive act.

What if you put that capital into a sub-optimal stock because you’re worried about the value going down and end up losing? You’ve now damaged your physical capital and psychological capital needlessly.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

Got some thoughts on this latest article from Michael? Share these in the SharePad “Traders’ chat”. Login to SharePad – click on the chat icon in the top right – select or search for “Traders’ chat” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.