Michael introduces two new filters to get ahead in difficult times through advance notices of potential breakouts and breakdowns.

It pays to be bullish.

History has shown us that over a long enough period of time being bullish on stocks has been a winning strategy.

Economies grow, new technologies are invented, and value is created.

This is why stocks (mostly) go up.

However, people are learning now that stocks don’t always go up.

This will come to a shock as traders of my generation have never been through a proper bear market.

Covid doesn’t count – it lasted six weeks. We then have helicopter money printed and the value of all assets rocketing.

Some will call this recent selloff a rout. But if you look at a 10-year chart then this selloff is merely a blip.

My belief is that (and this is something John Hughman and I have covered heavily in our podcasts) we are in for some pain. Real pain.

Inflation is at the highest level since I’ve been alive, which means the cost of capital increases, discount rates go up, and stocks lose some of their attraction.

Not to mention prices rising faster than wages, and heating bills. We’re six weeks into the first heating bill rise, yet energy bills are (currently) set to rise to an average of £2,700 in October from £2,000 now. That’s a big rise.

Does that mean that you shouldn’t go long? Definitely not. Trade the setups where they appear, but be prepared for more false breakouts.

Trading has been a one-way street since the Covid crash, with a bull market ready to bail people out.

Easy money is no longer lying around waiting for people to pick it up.

One of the filters I use to trade downtrending stocks has previously been my 52w lows filter (this is already on the library).

However, I found that my filters on the library are a bit outdated and so two more have been added:

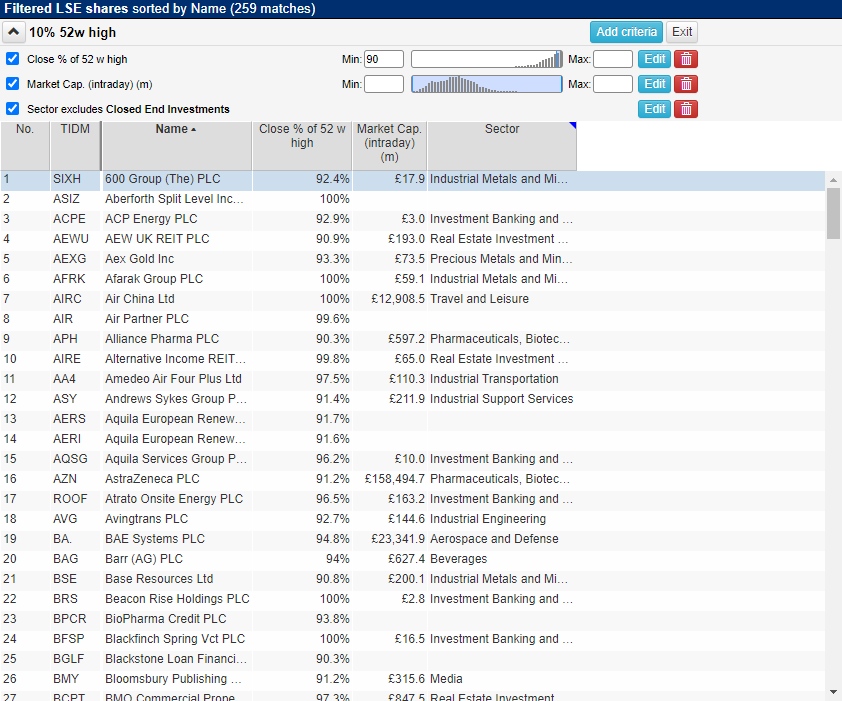

- 10% 52w high

- 10% 52w low

These filters identify stocks trading within 10% of their respective 52-week closing highs, and stocks trading within 10% of their 52 closing lows.

Using these filters will give alert you when stocks are potentially getting ready to break out or break down, rather than filtering stocks under the old filters that would tell us when stocks are already printing 52-week highs and lows.

In a falling market, I flip the breakout strategy on its head and sell breakdowns.

Finding stocks that have bounced several times off support are attractive candidates.

This is because the more often a stock trades around a particular level, the more significant this level becomes.

When the price breaks out or down from a significant level, then the price is telling us that the stock may be ready to make a new significant move.

Here’s an example from the new short filter.

You’ll see I’ve created a closing price percentage of the 52-week low. To do this, you combine items when you create a new filter, but as I’ve already done it for you here it’s not necessary.

I’ve set a max of 110%, as I want to find stocks within 10% of their 52-week lows. You can change this if you want to use

(You can run this screen for yourself by selecting the “Michael Taylor 13/05/22: 10% 52w low” filter within SharePad’s Filter Library.)

I’ve added a market cap filter in so that we can remove the horribly illiquid stocks.

The problem with shorting small cap stocks is that they can be incredibly volatile to the upside. All it takes is one rampy RNS to puff it up, or a well-executed pump and dump to clean a shorter out.

Shorting hyped up stocks and fading the crowd can be profitable, but it’s speculative. Trading selective breakdowns is a proven strategy over the long term.

I’ve also removed Closed End Investments – trusts can be illiquid and move rarely, so I’m not interested in those.

I’ve also excluded SETSqx stocks from my filter as I prefer to trade liquid order book stocks. But you can remove this and it’ll show both SETS and SETSqx stocks.

Here’s one stock I’ve picked from the list: Aston Martin.

It’s trading 101% within the 52-week low, but once you extend the chart out you can see the all-time low is not far off.

I’ve marked a line alarm here because I want to short the breakdown of the all-time low.

This is the same filter I used to find Deliveroo (ROO) that I wrote up in my weekly email.

It was also a big round number of 100p. Significant numbers often provide significant levels to trade from. This was the case with Deliveroo, as it quickly broke down once it fell through the all-time low.

You can use the 10% 52w high filter to look for stocks almost breaking out.

You’ll notice that there are less stocks in this filter despite me including SETSqx stocks here.

This means that more stocks are trading towards their lows than they are their highs.

It’s can be a useful barometer of how the market is performing.

(You can run this screen for yourself by selecting the “Michael Taylor 13/05/22: 10% 52w high” filter within SharePad’s Filter Library.)

These filters essentially allow you to trade both directions in the market with advance warnings.

Make sure you’re protecting your capital and not running losers. My view (and I can always be wrong) is that we have not seen the worst of it.

That said, it’s not an opinion I’m willing to lose capital over.

Ultimately, the price will tell you if you’re right or wrong. That’s all that matters.

It’s fine having strong opinions – but don’t be willing to dig in and fight the market. It’s cleaned out many a trader before and no doubt will do so again!

Look out for these two filters in the SharePad library!

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

WG Gann wrote over a hundred years ago that “The 4th attempt on a specific level usually always goes through” – the dynamics of markets have changed since then but not the underlying factors or formations

This isn’t always true though as you can see in the AML chart above it went through on the 6th attempt – If you look at GOLD in the months after the 2011 high, it fell on the fourth attempt – that was the period of time when 99% of all commentators were hyping up gold to $10,000 oz!!!!!!!!!

Sharp eyed traders will have seen that very recently the FTSE100 bounced off the 4th attempt level and rallied, if it comes back down for a fifth attempt will it go through or bounce? – no-one knows for certain, but its a key area to watch should price get back down to that level [6800]

Trade what you SEE, not what you think – Is always a good mantra

Hi Michael, good article, unfortunately neither filter seem to be showing in share pad?

Hi Huw, the new filters should be in your library. Filter > Apply or manage filter > Library. The two new filters from Michael should be at the top with a red “new” next to them.

Thanks, Michael for your usual helpful comments. Much appreciated!!