Michael looks at the first two hours of the trading day and how to view potential mispricing.

The hour between 8am and 9am is just as important to the intraday trader as 7am to 8am.

Whilst 7am to 8am is the time to meticulously work through RNSs and come up with a shortlist to dig deeper, 8am to 9am is often the critical execution phase.

This is because sometimes there can be an overload of information at 7am, meaning the person who knows certain stocks better than others will have an informational edge.

For example, a company that announces a new piece of information will be completely new to the person who has no idea about the company. The person who has tracked that company will be able to contextualise that information better and have a more thorough understanding of what the RNS can mean for the price.

Let’s say a retailer last talked in the results about business headwinds such as footfall declining. If the next set of results are in line, yet the business talks about footfall increasing as customers accept price increases, the share price may move up because the market believes the worst may be over. But if you look at the RNS and assume it’s in line only – and haven’t followed the business – you might miss out on a potential trade. The details often matter.

A good example of this was Gulf Keystone Petroleum (GKP) this week.

This company operates in a place you probably wouldn’t want to go on holiday to (the Kurdistan region of Iraq – and apologies if you happen to live there) and has continuously struggled to collect money from the KRG.

The closure of the Iraq-Turkey Pipeline in March has impacted the company and stalled further payments.

Therefore, the company has “shifted rapidly from a focus on driving profitable production growth to preserving liquidity, suspending all expansion activity and aggressively reducing expenditures across the business”.

However, many people believed this RNS to be good news. Apparently, being able to cover the cost of the monthly capital and operating expenditures by local sales was a positive (that’s the only positive that I could pick out).

Indeed, the RNS coverage by the brokers also didn’t mention anything bad.

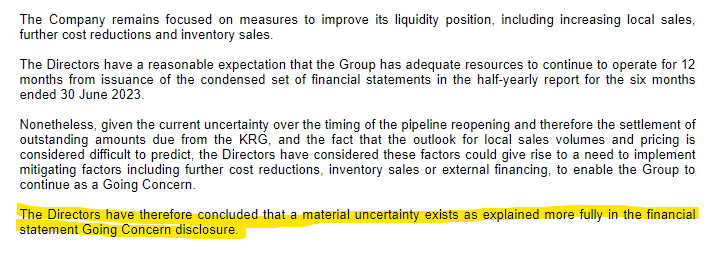

Yet scroll further and we get a “material uncertainty”.

This is never good news, because the directors are saying there is a material uncertainty as to whether the company is financially stable enough to meet its obligations and continue doing business for the next 12 months.

My belief was that the stock would open down, especially as management were talking about external financing (likely equity given the high-risk jurisdiction of the business).

It opened down a few pence, then sharply rallied for the next few minutes to 107p.

Was this because:

- Shorters were closing positions?

- Bulls were disregarding the material uncertainty?

- Nobody had read the material uncertainty?

In options 1 & 2, the material uncertainty had come into play but it was deemed not material to the price.

And in option 3, there was a time lag between the information being released into the market and the market processing the information.

This can sometimes happen when bad news is buried within the RNS and not so prominent at the top.

It also means that if the stock reverses against you, and you think the market has yet to acknowledge and price in the bad news, there can be a high-risk but high-reward trade by adding to the position.

However, this is not a trade for amateurs, and it should already be a part of your trade plan before you enter the trade.

Setting aside some of the position to get a better entry price if it goes against you is completely different to “the market has yet to price this in therefore I’m adding to a losing position”.

One is calculated. The other is emotional.

We can see that since yesterday’s high of 107p the stock has traded below 93p against the pre-new close of 102.5p.

Why does this matter?

For intraday traders, it can take time for the market to digest new information.

If you think you’ve spotted something significantly good or bad and the price doesn’t move – don’t assume that you’re wrong and close the trade.

Sometimes it can pay to hold and place a tight stop, knowing that if you’re wrong you took a small loss, but if you’re right you’re at the start of a potential move.

I’ve often seen prices not move until after 8.30am. Perhaps it takes time for broker notes to circulate and we are told what to think by the ‘smart money’. Or perhaps the market just didn’t read it properly.

This is one of the reasons why intraday trading is hard, because you never know what is truly happening, and there is a lot of variance. Sometimes stocks sell off because a new fund manager has taken the helm and is wiping the slate clean. Or maybe because a private investor needs capital for a new bathroom.

However, log your trades and eventually you’ll notice commonalities between your winners and losers.

Michael Taylor

Buy the Bull Market premium trading newsletter available at: newsletter.buythebullmarket.com

Twitter: @shiftingshares

Got some thoughts on this week’s article from Michael? Share these in the SharePad chat. Login to SharePad – click on the chat icon in the top right – select or search for a specific share or the “Traders chat”.