Following on from my last article on trading biases, this week I’ll be running through some of the biggest losing trader mistakes.

I’ve made several of these in the past and it’s good to be aware of these so you can check if you’re falling into the traps.

1. Not having an edge

Not having an edge is one of the biggest reasons traders lose money.

Punters sign up to spread bet brokers in their droves, often lured by low or free commission apps who gamify the trading process, and they start trading stocks by pressing buttons.

Some of these brokers rip their clients apart with commissions. For example, Shares take 0.79% per trade.

That means if you buy £1,000 of stock on the platform, then £7.90 is going on fees instantly. That is insane.

But punting stocks with no edge is even crazier.

If you can’t define your edge then you probably don’t have one.

That means you’re providing liquidity for those that do.

To find an edge, use SharePad’s charting features to backtest data. I have several filters on the library (search Michael). There are plenty of other filters available too.

Look at the data, spend time with charts, and you’ll notice certain patterns.

Trading is just a pattern recognition game with risk management thrown in.

2. Not following a strategy

Having a specific strategy is necessary when attempting to extract consistent profits from the market.

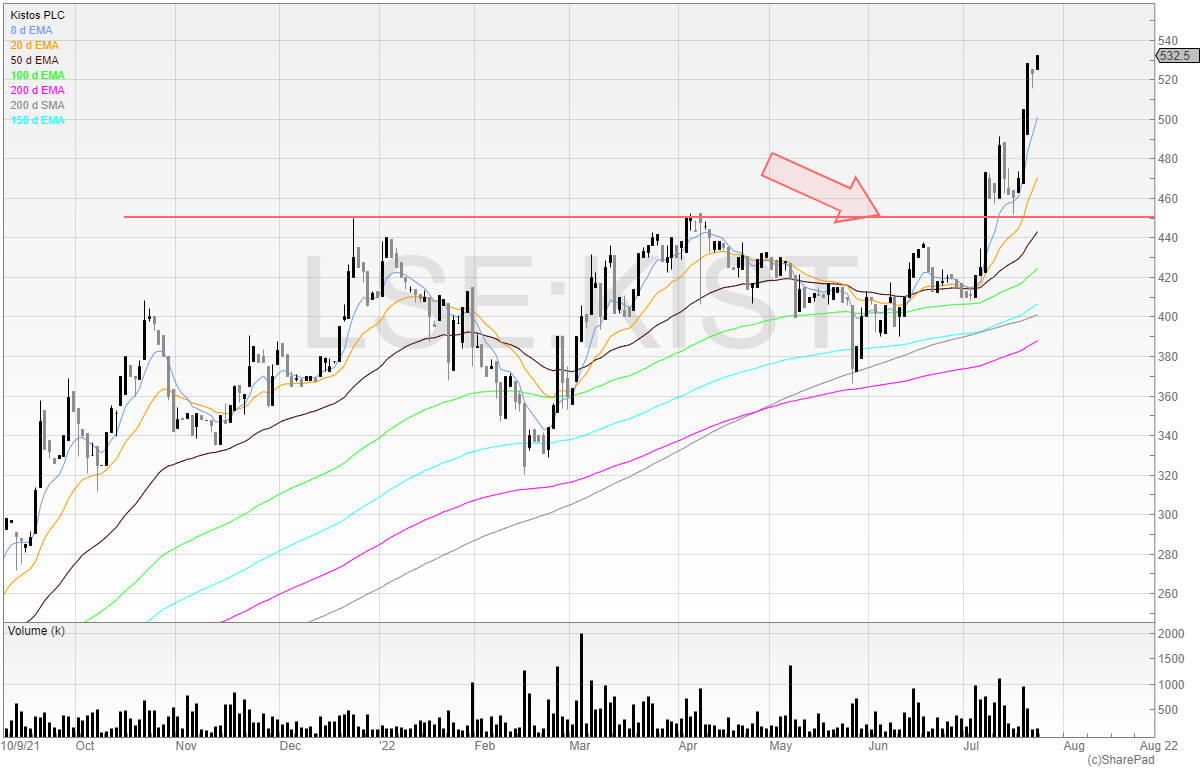

For example, one of my strategies is to buy uptrending stocks that have consolidated when they break out and have strengthening fundamentals.

Here’s a stock I highlighted that I was looking to buy in my newsletter.

Kistos has unhedged gas production and it’s clearly in a stage 2 trend.

This is the strategy. I know that over time if I repeat this process with sound risk management and proper position sizing to allow my edge to play out then I will be profitable.

Of course, buying breakouts in a collapsing market can be tricky. No strategy works all the time.

But this is why traders should be continuously looking to refine their strategy and find others that work too. Or you can just choose to sit the market out. Only a fool thinks they ought to trade every day just because the market is open.

3. Averaging down

This is one of the biggest mistakes a losing trader can make.

Averaging down can work for investors. For traders, it’s a losing game.

When you’re 25% down, you need to make 33% just to break even. At 50% down you now need a 100% return to get back to where you were.

These numbers are not sustainable.

I improved my trading instantly when I stopped averaging down and instead cut the loss.

4. Not using proper position sizing

Another problem new traders have is that they decide to take a position based on how they feel. They might steam in with a large amount of capital, only to get burned, then decide to half their position for their next trade.

They win that trade and now they’re feeling confident, so they up the position size. You get the idea.

Inconsistent position sizing will lead to inconsistent results. To get rich data for you to use to improve, you have to be taking the same quantum of risk on every trade.

That means adjusting your position size for risk.

By picking your entry price and your exit price, you can then take the entry and minus the exit.

This gives you risk per share.

You then take your intended risk on the trade and divide this by the risk per share. This gives you the total amount of shares for the trade so your risk remains consistent.

Adjusting your size for risk means you’re not having a blanket set stop loss. For example, if you had a 10% stop loss and support is at 12%, then it’s not unlikely you’d be stopped out.

Rather it would be better to bring down your position size and widen your stop. This would increase your chances of staying in the trade.

You can use my position size calculator to help.

5. Taking on too much risk

This is another big losing trader mistake. The goal of trading is first, to survive. Not to make big money quickly. Therefore, you have to accept that trading is a long-term process and investment of time.

Your risk management should reflect this.

There are some simple things you can do to minimise your downside:

- Avoid binary outcomes such as Phase III trials and drill results

- Avoid speculative penny shares with wide spreads

- Learn how to read a balance sheet so you don’t buy a company before it places

- Don’t ever trade where you can lose a significant amount of your capital in one trade

If you’re risking 5% on a trade, then you have 20 rolls before you’ve done your money.

Therefore, scaling and downsizing is a good idea.

For example, if you have four losing trades in a row, then you’re down 20%.

But if your position sizing remains the same then your risk per trade has actually increased.

You’d be taking on more risk despite having had a string of losers.

I would say that 5% is relatively high and should only be reserved for your top trades. It takes time to find out what these trades are.

However, if you start with a £5,000 account then 1% of this is £50. If your broker commissions are £10 for a round trip trade, then if you make 20% on the trade, you’ve now paid your broker commissions.

Clearly, you either need to trade with more risk or build up your account.

This is why I say nobody should start trading with anything less than £4,000.

But neither is more always better. Starting with a small account teaches you the value of it.

The likelihood is that you’ll lose money and so it’s better to lose a smaller account than a larger one.

We’ll look at five more losing trader mistakes and how to fix them in two weeks.

In the meantime, I write weekly in my newsletter below.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.