I don’t trade indices as I much prefer equities – however one thing I learned from the pandemic is that instead of shorting 30-40 stocks, I could’ve easily boosted my returns by putting on an index short.

Once you go above 20 shares, you start to significantly correlate the very index you’re trying to beat. Shorting an index often has a tight spread with no payable commission, unlike dealing in stocks where you pay two sets of commission for a buy and sell. This of course doesn’t include split sells and split buys.

When it comes to indices, I keep an eye the FTSE 100, FTSE 250, S&P 500, and Dow Jones Industrial average.

The FTSE 100 is the main index with the largest companies on the London Stock Exchange included. It is filled with old economy stocks.

Below is a list of the top 33 stocks. We can see:

- AstraZeneca, a pharmaceutical

- Royal Dutch Shell, an oil & gas company

- Unilever, a consumer products business

- BHP Group, a miner

- Diageo, a drinks business

When you compare this to the FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google), our main index seems relatively unexciting.

This could be why the UK often seems undervalued, as the FTSE 100 is mainly made up of industry stalwarts rather than exciting growth companies.

The fact that the FTSE 100 holds a lot of commodity stocks that are heavily weighted could also explain the relative strength compared to other indices too.

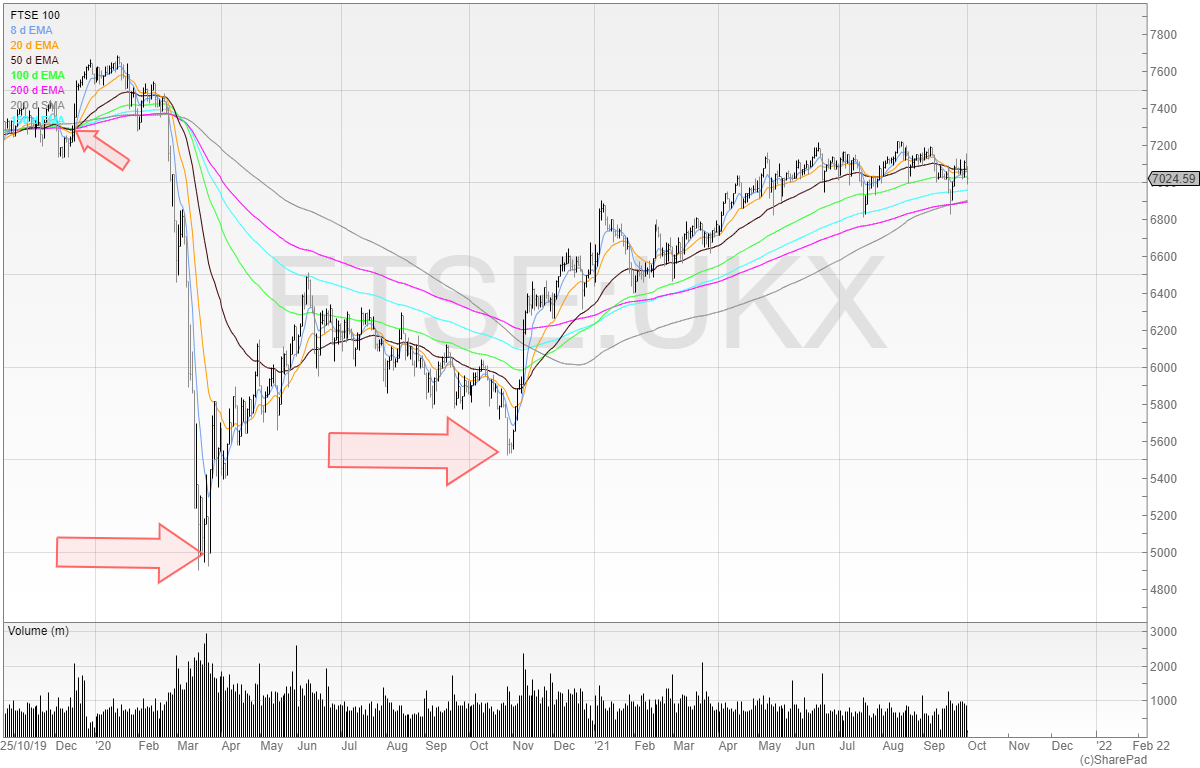

Here’s the FTSE 100 chart.

The two arrows mark the bottoms, when the two lockdowns were announced.

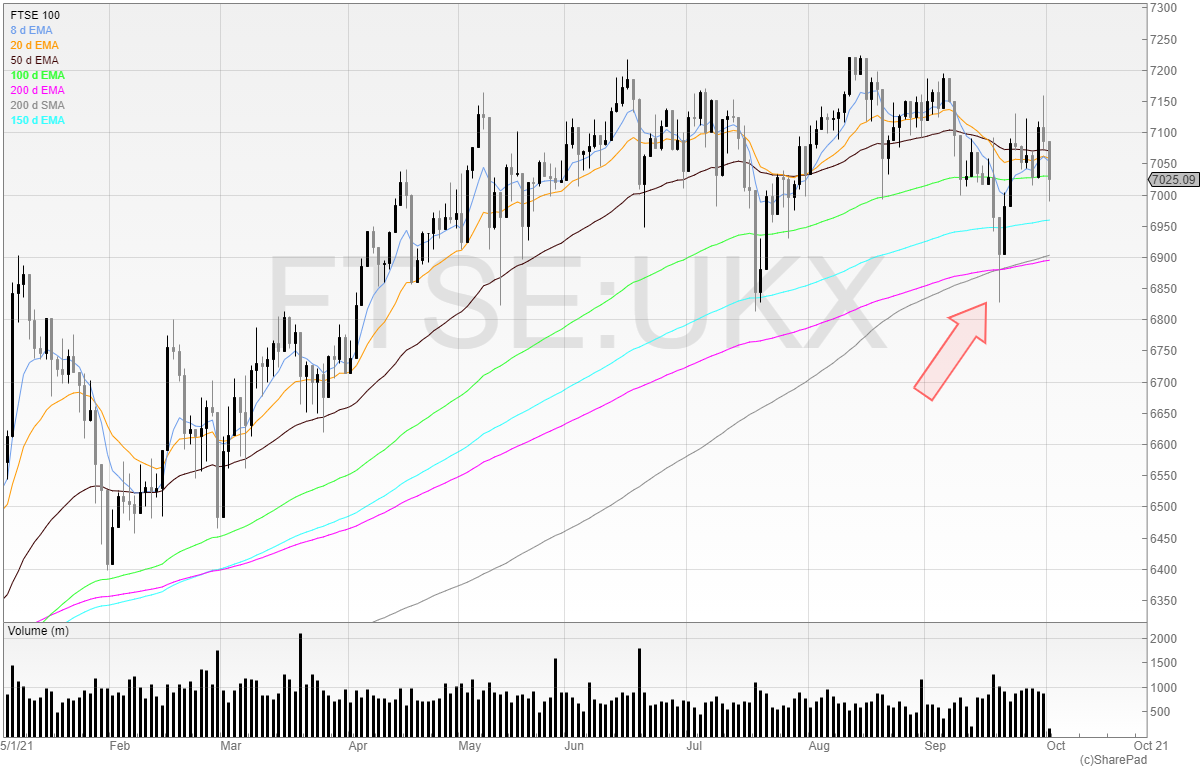

Let’s look closer at the recent price action.

I’ve marked an arrow where we can see the price tested the 200 exponential moving averages. We can mark this as support.

I don’t trade the FTSE 100, but if the stock were to trade below those moving averages I would consider this a potential change of trend to the downside.

There’s a lot to worry about in the market but there’s always a lot to worry about. However, the difference is that we have had a stonking rally since the lows of 2020.

Let’s look at the FTSE 250.

The FTSE 250 is made up of the next 250 largest companies after the FTSE 100.

We can see it has tested the 50 EMA (black line) several times.

This time, it has broken through and traded further down.

I’m short the FTSE 250. I hold no macro view here, and I am simply playing the chart.

People love to make macro calls. People want reasons for why things are happening.

Experts will predict crashes, and give complex reasons for why the economy is going to collapse, stocks will trade lower, and longs will lose their money.

But in an economy, there are so many moving parts that affect each other and in various ways. To me, it seems like a futile exercise making predictions. I’d rather let price action guide me.

The other two indices I look at are the Dow Jones Industrial Average and the S&P 500.

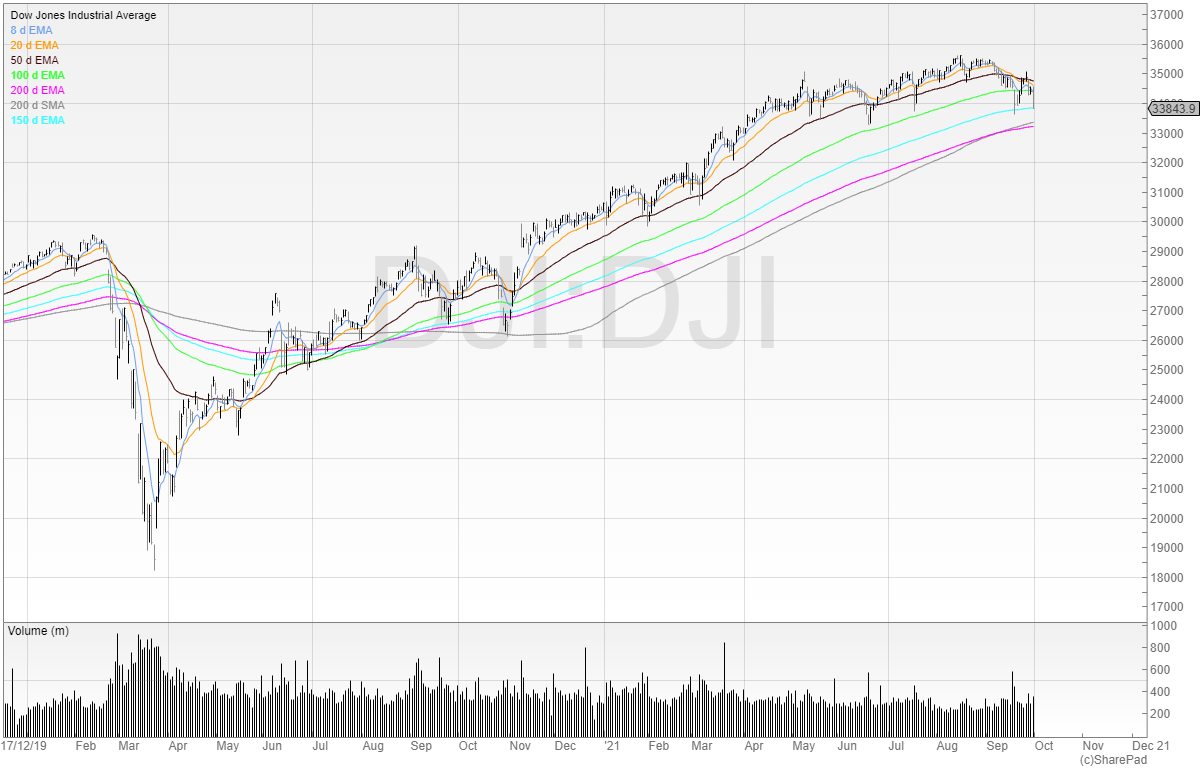

Here is a chart for the Dow Jones.

We can see it had almost doubled from the lows. That’s some recovery!

We can also see that the 50 EMA has been a big support zone too.

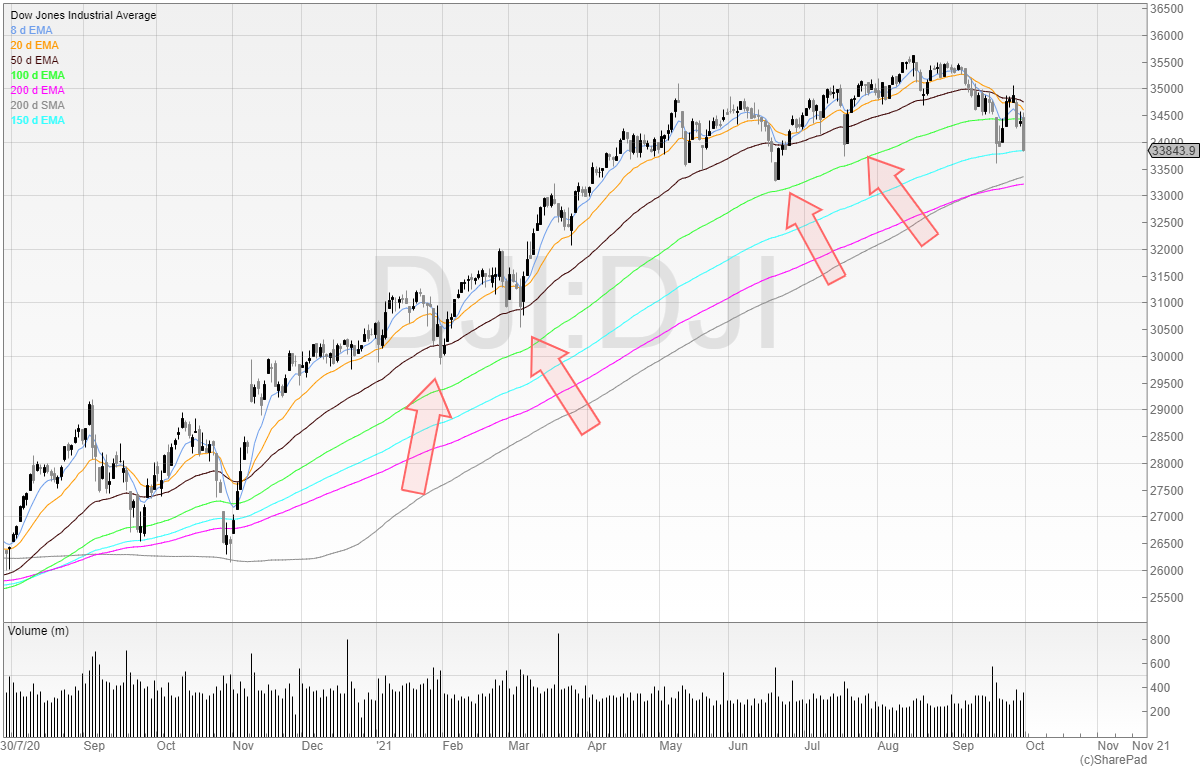

Let’s look closer.

Since Vaccine Day, the stock has yet to trade under the 200 moving averages.

I see those levels as being key for the next market trend. If that zone holds then market participants who are heavily long will be relieved. But if the stock prints through it, we could be in a sign for a fall.

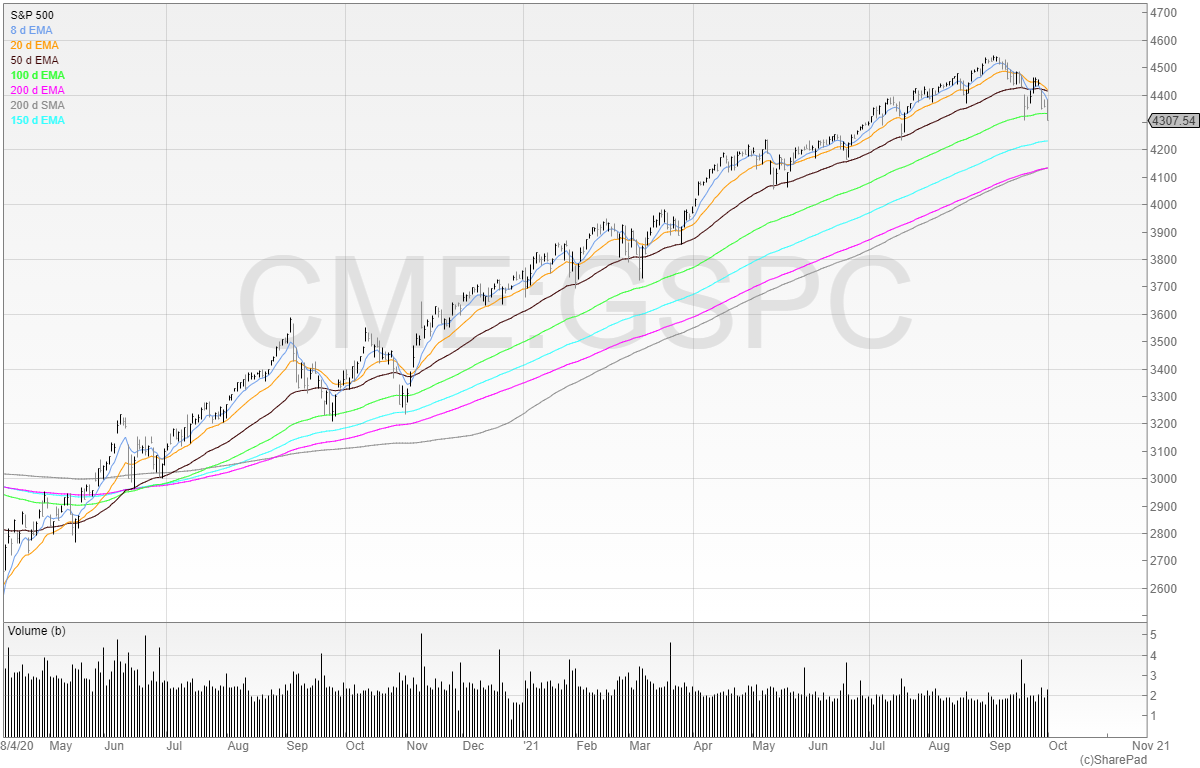

The S&P 500 chart is similar

The stock has been in a firm uptrend since Vaccine Day and has tested the 50 EMA several times but stayed afloat. There are warning signs now that that trend may be coming to an end.

The old saying goes: Ride that trend right to the end!

Again, I see the 200 EMA and 200 MA as key points to watch.

Everyone appears to be bearish at the moment. And usually, when everyone is on consensus, the opposite happens. Whether that is the case this time – who knows!

In any case, you don’t need to worry about market collapses. As I said in my YouTube video, know your exits.

Know where you’re getting out of a stock, and watch out for liquidity. This can be problematic in small caps as when there is a rush to exit it becomes crowded, and you may not be able to sell at the price given on screen.

Once you know your exits on all your positions you don’t need to worry about a stock market crash.

You simply execute and follow your plan. The hard work is done by preparing before the event.

I hold a short position in the FTSE 250.

Michael Taylor

Buy the Breakout trading newsletter available at: www.shiftingshares.com/newsletter

Twitter: @shiftingshares