The hospitality sector has been smashed in recent months. This is for several reasons. Lower footfall in high streets, offices closed and the work from home trend, and finally because many were already being hit in the casual dining crisis that is far from over.

In the aftermaths of the Great Financial Crisis restaurants boomed. Entrepreneurs had ready access to cheap debt-fuelled spending power, and they deployed it voraciously.

As with any successful industry there are always copycats. And so the “me-too” brigade jumped onboard the trend, providing a plethora of sustenance for the masses.

But what goes up must come down. The sector became too populated and too competitive. Margins were slashed as there is very little moat in hospitality. Restaurants crumbled and many went bust. Many are still to go bust.

But despite this gloomy outlook for the sector, it doesn’t mean that there isn’t money to be made.

In this article, we’ll look at a few charts and try to find some opportunities.

Greggs (GRG)

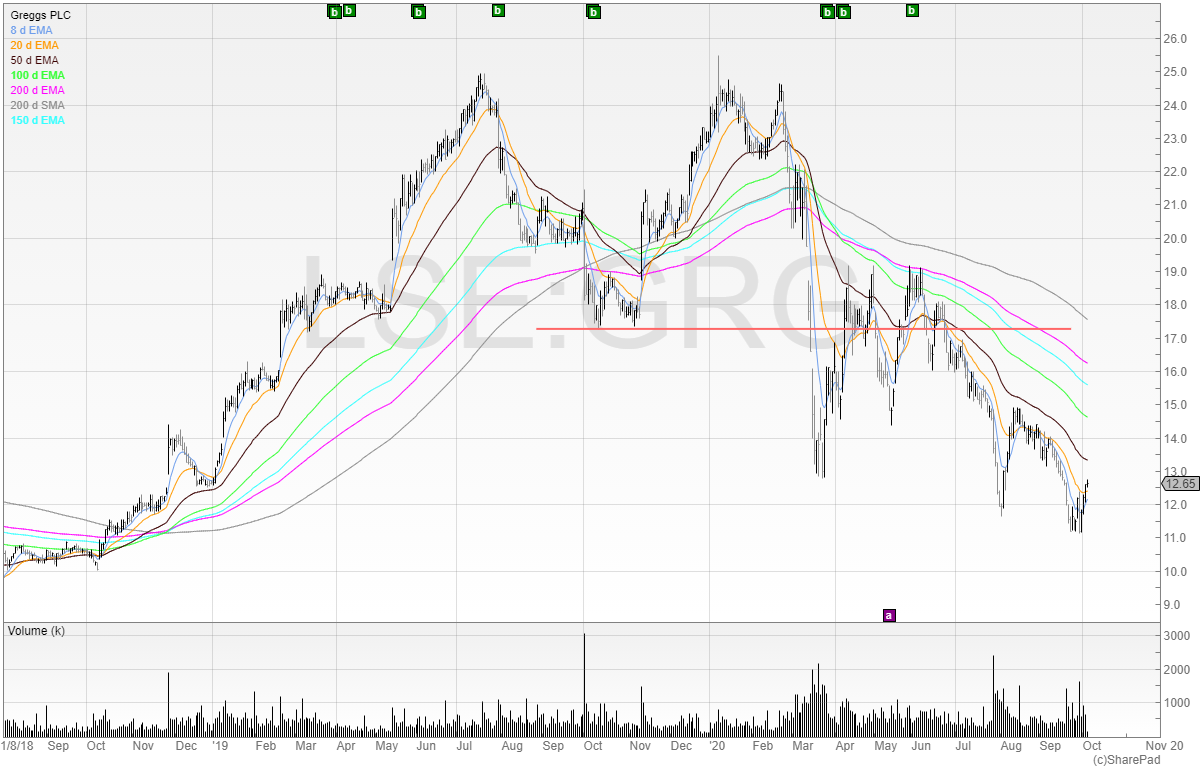

Greggs has not fared well in 2020. It’s off by around 50 percent this year. There are some claiming that there are signs of value (and they may well be right) but looking at this chart I can’t see anything that entices me like a piping hot steak bake would.

The stock trades below all moving averages. That is a sign of a downtrend. We should not be buying downtrending stocks as that is going against the trend.

Let’s look at the chart a bit closer.

Notice how the stock tagged the pink line (the 200 exponential moving average) twice.

This confirms this line as resistance therefore it tells me that there is either significant supply or short selling going on at this level.

For me to even be interested in trading Greggs, it would have to be a short term news-based trade, or the stock would need to be printing above the pink line.

For now, I think I will just eat the product.

Restaurant Group (RTN)

Restaurant Group is the owner of Chiquito’s (which closed down permanently in March), Frankie & Benny’s, Wagamama, and a few more. Here is a picture from their website.

It’s probably not unfair to say that many of these brands are fatigued and poor. For me, Frankie & Benny’s is very below average and Coast To Coast is below average (and I’m being kind). The only decent one is Wagamama but the amount of salt in it does leave me chugging water all night. Wagamama may be the saviour of Restaurant Group although many argue the company overpaid.

Nor do I have any more positive thoughts on the chart.

One could argue that this looks like a stage 1 base (we covered stage one bases in my first article for SharePad) but note that the stock price is trending well below the major moving averages.

Given that the sector is in a headwind, and the chart looks terrible, is this a stock anyone should be buying?

Not in my opinion. I’m not sure I’d be so quick to short either. The stock is illiquid and the time to short was when the company needed refinancing. The risk/reward on the short side is nowhere near as appealing as it once was.

Many units have been shut and the business is going to be leaner and more agile going forward. But I’d want to see an improvement in the price action first.

For now, I will continue to avoid most of its restaurants (especially Frankie & Benny’s).

Wetherspoon (JDW)

Whether or not you agree with Tim Martin’s political rants in RNSs it is hard to disagree with anyone saying that Wetherspoon is a great business. Or at least it was pre-Covid.

Years of growth and slow national domination has seen shareholders (of which Tim Martin is the largest one) well rewarded.

We can see Wetherspoon has been trading in a range of tramlines from around March. It broke out of the resistance in late May but struggled to break through the 200 exponential moving average. This puts the pink line as resistance (similar to Greggs).

One could try and trade the stock by buying just underneath the bottom tramline (where stop losses will be placed). But do we really want to be going long in this sector?

I feel it would be far better to wait for the stock to take out the 200 EMA and break out of the previous high at 1200p. If the stock can do that then it’s showing signs of strength.

Buying strength is usually a good idea. For a stock to make a new high, it needs to break out of prior resistance. Therefore, buying breakouts can offer many trading opportunities.

Cineworld (CINE)

Finally, a look at Cineworld. As James Bond has been cancelled Cineworld has decided to close all its UK and US cinemas.

Cineworld had already got itself into trouble with the acquisition of Cineplex. The company had too much debt, and then Covid struck. Since then, the company has managed to abort this but may face legal fees.

The chart for Cineworld is grim.

Cineworld failed to make a new high in 2017 and 2018. This was the sign that it was a stage 3 stock. Sure enough, the stock was already falling in a stage 4 downtrend before Covid struck.

Sometimes I’m asked if Cineworld is “cheap”. Even if it was cheap – would you bet against this chart?

In my opinion, it’s likely that Cineworld is going to 0p. It has a balance sheet that is worse than car crash, and the outlook is bleak.

However, as mentioned on Twitter, there will be short squeezes and volatility on the way. It is one to keep an eye on for the intraday traders.

Michael Taylor

Michael has released his UK Online Stock Trading Course sharing his knowledge and how he trades the stock market. SharePad readers can take advantage of an introductory offer by visiting www.shiftingshares.com/online-stock-trading-course

Twitter: @shiftingshares