Bruce looks at the idea of tail risk hedging but thinks that the strategy might be too difficult for private investors to implement. Instead, companies significant cash could be an interesting theme for H2. Companies covered WISE, TBLD and DPP.

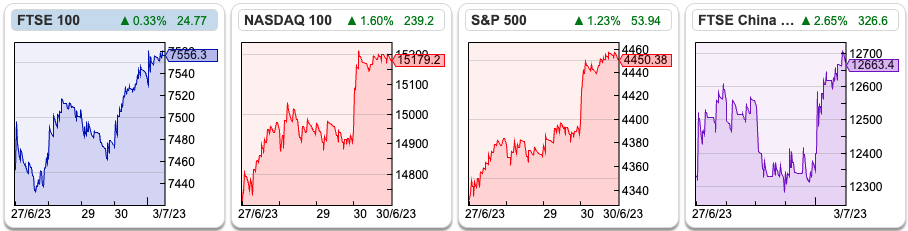

The FTSE 100 rose +1.4% last week to 7556, while the Nasdaq10 and S&P 500 were up +1.9% and +2.4% respectively. At 3.85% US 10Y bond yields are approaching their pre-Silicon Valley Bank peak of 3.95%. UK 10Y bond yields continue to rise well above their levels in early March 3.8% to above 4.4%.

Scott Patterson has published a new book on Nassim Taleb and Mark Spitznagel “tail risk” hedging fund, Universa. This sort of thing is anathema to financial orthodoxy, which dogmatically suggests the only way to achieve higher returns is by taking more risk. Spitznagel suggests that if you measure your returns with a geometric (not arithmetic) average, then looking for trades that pay off when everything else is losing money, can increase their returns.

Tail risk hedging is easier in theory than in practice – many assets look like safe havens and then turn out not to be. For instance, hedge funds bought gold ahead of the 07-09 banking crisis, only to see the yellow metal fall -28% in the second half of 2008. On the other hand, the Japanese Yen doubled in value over the financial crisis and Japanese banks (MUFG, SMFG and MFG) have performed better than the Nasdaq since October last year. Taleb and Spitznagel suggests not thinking of safe havens as static asset classes (gold, Japanese assets etc) but as pay-offs that are likely to do well as everything else breaks down. They believe the most cost-effective way to tail hedge is buying deep out-of-the-money options with explosive pay-offs. Most of the time these lose money, but occasionally (March 2020) they really pay off.

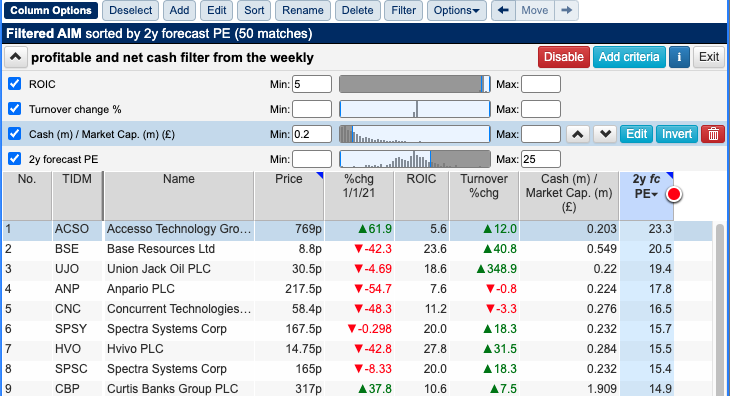

I think that strategy will be hard for most private investors to implement though. Instead, one idea I have is that companies with a high percentage of net cash could be an interesting theme for H2 of this year. The pay-offs look asymmetric, if interest rates rise higher than expected these stocks ought to be a safe haven. If interest rates are slashed as we are facing a recession, they also ought to prove relatively defensive. ARC, OMG, CML, FDEV, AGFX, and SLP are all shares with significant net cash that I already own. Other ideas that I don’t own could be ACSO, BPM, QIZ, SHOE, HVO, ANP, CTG, and SPSC – which are stocks I found with a Sharepad filter looking for cash as 20% of market cap and less than 25x PER ratio. That filter shows 50 matches out of 817 companies on AIM. I would then exclude the resources and oil stocks from the list because the cash they have raised is likely to go into digging holes in the ground with uncertain pay-offs.

These aren’t recommendations, just a suggestion for a filter for shares that might hold up well if the unexpected happens. This type of investing is not about making predictions, but instead protecting your downside when you know that there’s a wide range of outcomes. Schroders, the fund managers, are now suggesting UK interest rates could peak at 6.5% by the end of this year.

I haven’t read Patterson’s Chaos Kings book yet but can recommend Spitznagel’s Safe Haven – Investing for Financial Storms and anything by Taleb is worth reading (at least twice).

This week I look at Wise’s FY March results and another profit warning from tinyBuild, which is now down more than -95% from its IPO price and Domino’s Pizza Poland, which has performed even worse since its IPO in 2010.

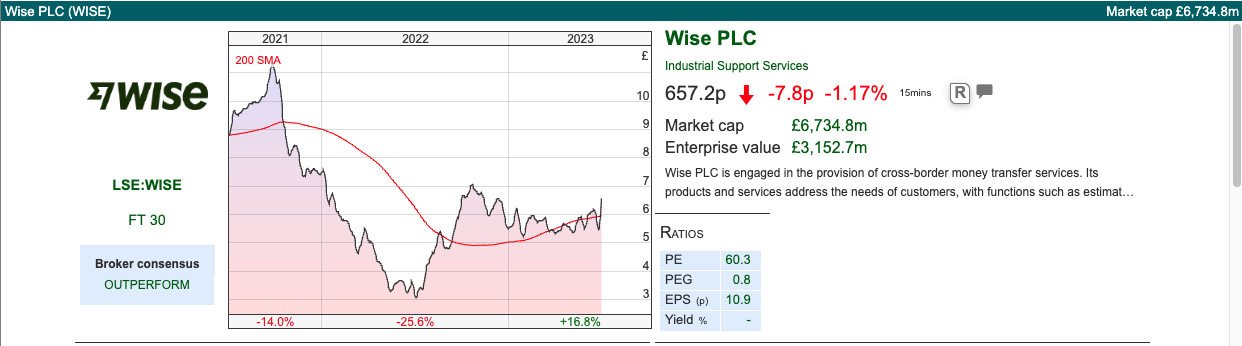

WISE FY March 2023

This foreign exchange platform sold off -15% in April, when they put out an RNS saying that they would start paying interest on client balances. Presumably, investors were hoping that WISE would keep the benefit of rising interest rates for shareholders, which is the banking business model. However, management are very clear, that they believe offering customers a fair return on their balances is the right thing to do because it builds trust and loyalty. I agree, I’m a big fan of this business model as much as I am a critic of traditional banks like LLOY.

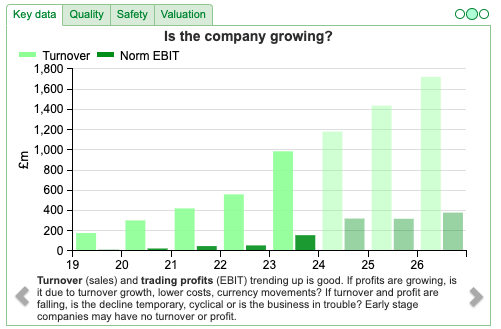

Last week the share price was up +16%, as they released FY March results showing income +73% to £964m, or +51% revenue excluding the benefits of rising interest rates. PBT was up 3.3x to £147m. They now have 10m active customers, which has trebled since 2019 and income per customer stands at £96m.

One thing to note for shareholders in Alpha FX, Equals and Argentex, is that though WISE started out as a consumer brand, they are investing in growing their market share of SME business customers. The group’s business income is currently 25% of the total, but growing at +96% y-o-y.

Outlook: They reiterated their target of > 20% CAGR income growth and an EBITDA margin at or above 20%. In the short term, they do warn that H1 to Sept will be a difficult comparative, because of exceptional volume growth in H1 last year. In H2 last year (ie Oct-Mar) they were receiving the benefit of higher interest rates, which they only decided to pass on to customers from April. They also say that the decline in house prices means large overseas balance transfers are likely to reduce. All of these points strike me as short-term noise, rather than anything that undermines the investment case.

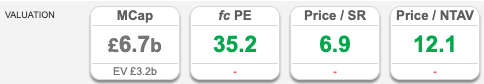

Valuation: The shares are trading on 35x PER FY Mar 2024F and Mar 2025F. Price to revenue drops from 6.9x Mar 2023 to below 5x in two years’ time. In the past, I’ve compared it to Alpha Group, which is also on a similarly high revenue multiple. However, ALPH has an EBIT margin in the high 30s, whereas WISE is around half that level. AGFX, which I own is trading on 7x Mar 2025F and below 2x revenues the same year.

Opinion: I like the business and the strategy, but just can’t get comfortable with the valuation. I struggle to pay more than 5x sales for any stock, however good the prospects. “Growth” investors Baillie Gifford owns 23%, IA Ventures 18% and Andreessen Horowitz 9%. I’m hoping that turmoil with Silicon Valley Bank means that the venture capital industry starts having to sell their liquid, listed holdings like WISE at a favourable valuation to new investors.

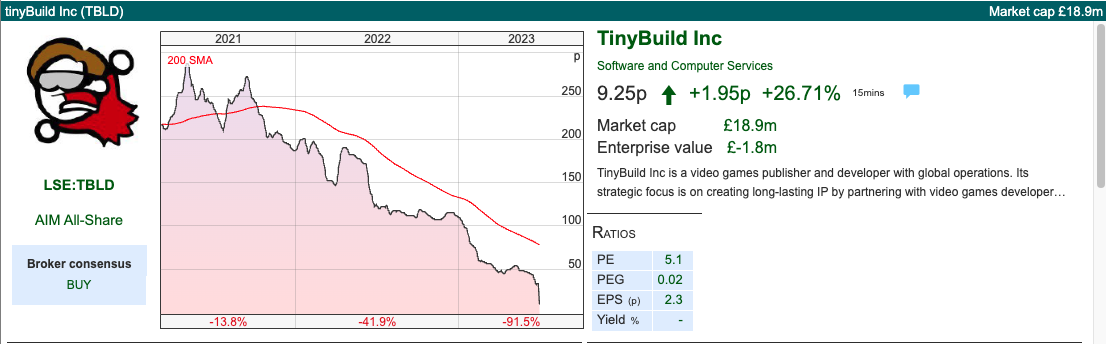

tinyBuild FY Dec profit warning

This is a very contrarian idea, but we’ve seen in the past some IPO’s that fall steeply can then go on to recover into multi-baggers (DX Group, Somero, CVS Group, ASOS) if you can pick your moment for the recovery. Last week TBLD shares had fallen over -95% from its 169p IPO price, following a couple of disasters, though the shares then bounced +27% at the start of this week. It’s obviously high risk, but the company is expecting to have net cash of $10m-20m (previously expected > $26m) at the end of Dec 2023. Cash at Dec 2022 was $26m, so they are expecting to lose $6m to $16m this year. With that caveat in mind, I look at their profit warning.

Management now believe revenue will be “materially behind” FY Dec 2023F and FY Dec 2024F (Zeus, their broker, cut this year’s forecast by -31% to $50m) and worse at the EBITDA level (Zeus slashed their Dec 2023F by -71% to $7m). Management expect this year to be the low point and believe they should be generating cash next year, based on the contribution of larger budget games in scheduled.

Similar to FDEV, which I covered a couple of weeks ago, they are finding the third-party publishing business tough. So they are re-focusing on their own IP games. They may also write off some assets in their back catalogue of games, as revenue has been disappointing. There was $80m of intangible assets on the balance sheet, versus shareholders equity of $112m, as of last Dec.

They will also cut costs, including looking at savings from recent acquisitions Versus Evil and Red Cerberus (both bought in Nov 2021). They spent $23m acquiring studios in 2021 and have already taken a goodwill write-down for those deals (goodwill at Dec 2022 was less than $4m).

Also worth noting that some of the sell-off is not their fault; they bought development studios in Ukraine (Hologryph LLC, October 2020) and in Russia (Moom Moose, Nov 2020 and Hungry Couch, Feb 2021). They have successfully relocated over a hundred people from those countries and set up a new studio in Belgrade in response to the war. That’s one-fifth of the entire company. If that wasn’t enough, they have also announced the CFO is leaving for personal reasons, to be replaced by Giasone (Jaz) Salone, who I used to work with at CSFB.

AGM vote: The founder Alex Nichiporchik still owns 38% of the shares, despite having sold 33m of shares at the IPO, worth £56m at the time. Under Takeover Panel rules he needs an exemption to hold more than 30% without making a bid for the entire company. At last week’s AGM, there was a resolution put forward to allow him to buy up to 45% of the shares without making a full offer. This resolution was voted down by institutions, with 41% of the shareholders voting against. It’s hard to know the different motivations, but one guess could be that having bought from him at the top, institutions are now nervous about selling to him at the bottom. Perhaps institutions have been influenced by Teddy Sagi’s lowball offers for KAPE and BOTB? That is just a guess, I haven’t talked to any of the professional fund managers, like Martin Currie, based in Edinburgh, who dumped their entire 5% position on the market last week. My view is that the share price reaction is indicating a breakdown in trust between the founder and professional fund managers who backed the IPO.

Equity Research analyst as CFO: There were some complaints on Twitter that the new CFO has a background in equity research, rather than auditing. I know Jaz Salati from our CSFB days. I would agree that an equity research analyst might not make a suitable Finance Director of a large complicated media company like WPP or a bank like BARC. This is not the challenge at TBLD though. In April this year Alex Nichiporchik, the founder, published a tweet explaining why TBLD is “probably the most undervalued game stock in the UK.” That didn’t age well. For TBLD the business needs a CFO to counterbalance an entrepreneurial founder, who can help communicate with disappointed investors. In short, rebuild trust.

Valuation: Zeus are forecasting $7m of adj EBITDA in Dec 2023F and 2024F, which translates into 0.24c EPS those years. That suggests around 5x earnings, with Dec 2023F net cash of between 41% to 83% of the market cap, based on the company’s guidance range in the RNS.

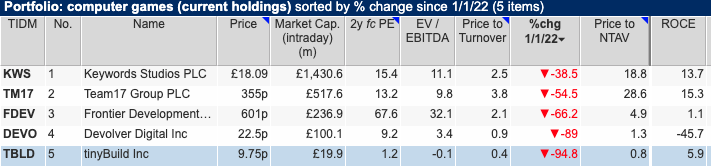

Opinion: Not for widows and orphans, but I think worth looking at if you have a contrarian style. I’ve already bought into FDEV, so I am not sure how much more exposure I want to this sector which has really been punished. Disappointments in the sector seem to have focused on the publishing side, as distribution platforms have invested less in the types of games that FDEV and TBLD’s third-party publishers create. So, emphasis on more of the internally developed IP makes sense.

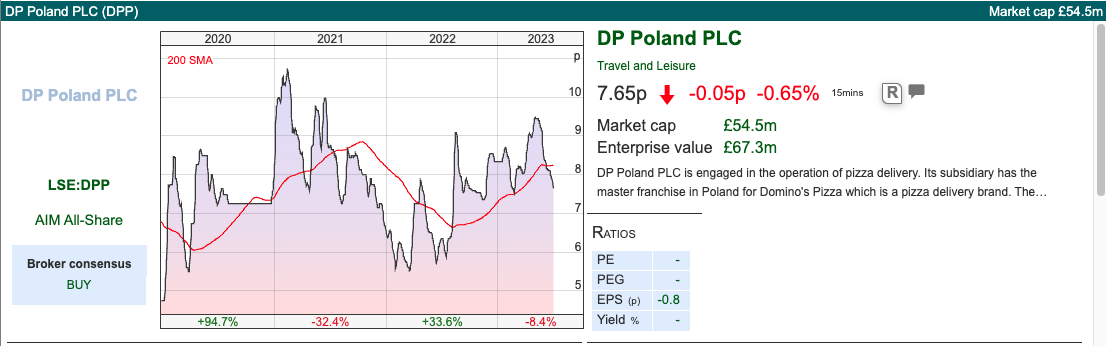

Domino’s Pizza Poland FY Dec Annual Report

On the subject of badly performing IPO’s: Domino’s Pizza Poland released FY Dec Annual Report on the last day of the month, just before the shares would have been suspended.

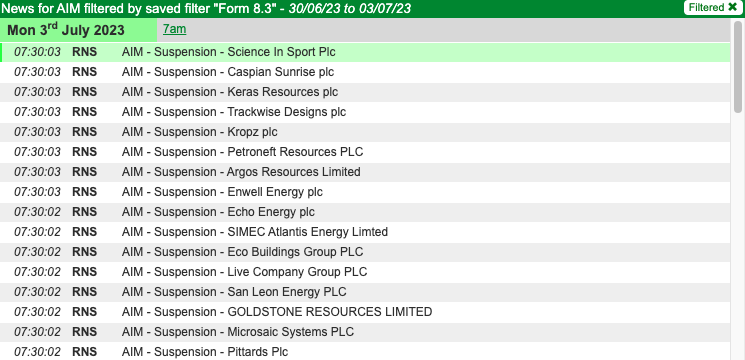

Science in Sport did similar, but issued a correction RNS saying their FY Dec results published on 30th June were preliminary (unaudited) rather than final (audited results). SIS shares were suspended with 15 other companies, for not publishing audited numbers within 6 months of their year-end.

Back to the Polish pizzas: revenue growth was up +19% to £36m. Following the reverse takeover of Dominium which operated 57 pizza restaurants across Poland, they now have 113 pizza restaurants in Poland, plus three more in Croatia. That represents c. £300K of revenue per Polish restaurant, however, the business is still loss-making, losing £4.3m both in 2022 and 2021. In fact, DPP has achieved the remarkable feat of being loss-making since Seymour Pierce IPO’ed the company at 50p per share in July 2010. 13 years of losses and counting. I think that (Sir) Fred Goodwin would look on with secret admiration as Royal Bank only achieved 6 years straight of losses, following the financial crisis. DPP have funded this by returning to shareholders and asking for more money, the number of shares has increased 350x from 2m at the IPO to over 700m today.

Most recently they raised £4.8m in August last year at c. 8p per share. They highlight £4.1m of “cash at bank” as a bullet point on the first page of the financial highlights. Regular readers should know that this phrase should set alarm bells ringing! Sure enough, tucked away in note 27, on page 32 of the RNS they disclose £6.8m of debt to Malaccan Holdings, the former owner of Dominium as part of the deal. So even without IFRS lease liabilities, the business is loss making and in net debt of £2.7m. Including lease liabilities net debt stood at £11m at Dec last year.

The Malaccan loan is repayable by December next year. Malaccan is a 39% shareholder in DPP (worth £21m at today’s share price). They were the owner of Dominium which reversed into DPP. Presumably, such a large shareholder would be keen for DPP to keep operating, however, there must be a reasonable chance of further dilution to come. Sharepad’s Altman Z score of -0.6 is indicating risk.

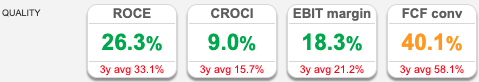

For comparison Domino’s Pizza in the UK (DOM), which is listed on the main LSE has revenue of £600m, PBT of £80m and 1,271 stores across the UK and Ireland. DOM shares are up 70x from their Dec 2000 low. The US business, Domino’s Pizza Inc (DPZ) has revenues of $4.5bn and PBT of $527m and has been a 100 bagger from its H2 2008 lows. For a long time I have been curious about why Domino’s Pizza does well in some countries, but badly in others. If readers have a theory, please do share on the chat. I’ve shown DOM (the UK plc) quality measures below:

2023 Trading: DPP had already said that Like-For-Like System Sales were up +18% in YTD to April. Inflation in Poland has been running ahead of the UK, but they say energy and food costs are now beginning to abate. They warn labour inflation remains a problem though. I think wage inflation is currently acute in bars and restaurants, my own experience from Berlin is many of the staff in my craft beer bar re-appraised their life during the pandemic. This is anecdotal, but one of them is now working for an NGO in Ukraine, another friend who was a chef for over 20 years is now selling advertising to SMEs for Facebook. Below are DPP’s quality measures, which are quite a contrast to the UK business.

Valuation: Sharepad shows losses are expected to continue for Dec 2023F and with the company then close to break even achieved Dec 2024F. Even if those forecasts do not disappoint, the Malaccan loan comes due at the end of next year and it’s not clear that they will have generated enough cash to pay it off. DPP shares are trading on 1.5x historic revenues. For comparison DOM trades on 2.0x and DPZ trades on 2.7x historic revenues.

Opinion: The bull case is that now the business has scale, DPP can compound away as the UK and US franchises have done. The bear case is that this has been the story for well over a decade, and reality has been consistently disappointing. My view is investors have to be careful not to be too early! Like tinyBuild, certainly not a high-conviction idea, but one for contrarians to ponder. There’s a presentation on InvestorMeetCompany. I am going to avoid, because I don’t like the voluntary disclosure.

Notes

The author owns FDEV, AGFX and other shares mentioned in this report

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 4/07/23 | WISE, TBLD, DPP | Safe haven investing

Bruce looks at the idea of tail risk hedging but thinks that the strategy might be too difficult for private investors to implement. Instead, companies significant cash could be an interesting theme for H2. Companies covered WISE, TBLD and DPP.

The FTSE 100 rose +1.4% last week to 7556, while the Nasdaq10 and S&P 500 were up +1.9% and +2.4% respectively. At 3.85% US 10Y bond yields are approaching their pre-Silicon Valley Bank peak of 3.95%. UK 10Y bond yields continue to rise well above their levels in early March 3.8% to above 4.4%.

Scott Patterson has published a new book on Nassim Taleb and Mark Spitznagel “tail risk” hedging fund, Universa. This sort of thing is anathema to financial orthodoxy, which dogmatically suggests the only way to achieve higher returns is by taking more risk. Spitznagel suggests that if you measure your returns with a geometric (not arithmetic) average, then looking for trades that pay off when everything else is losing money, can increase their returns.

Tail risk hedging is easier in theory than in practice – many assets look like safe havens and then turn out not to be. For instance, hedge funds bought gold ahead of the 07-09 banking crisis, only to see the yellow metal fall -28% in the second half of 2008. On the other hand, the Japanese Yen doubled in value over the financial crisis and Japanese banks (MUFG, SMFG and MFG) have performed better than the Nasdaq since October last year. Taleb and Spitznagel suggests not thinking of safe havens as static asset classes (gold, Japanese assets etc) but as pay-offs that are likely to do well as everything else breaks down. They believe the most cost-effective way to tail hedge is buying deep out-of-the-money options with explosive pay-offs. Most of the time these lose money, but occasionally (March 2020) they really pay off.

I think that strategy will be hard for most private investors to implement though. Instead, one idea I have is that companies with a high percentage of net cash could be an interesting theme for H2 of this year. The pay-offs look asymmetric, if interest rates rise higher than expected these stocks ought to be a safe haven. If interest rates are slashed as we are facing a recession, they also ought to prove relatively defensive. ARC, OMG, CML, FDEV, AGFX, and SLP are all shares with significant net cash that I already own. Other ideas that I don’t own could be ACSO, BPM, QIZ, SHOE, HVO, ANP, CTG, and SPSC – which are stocks I found with a Sharepad filter looking for cash as 20% of market cap and less than 25x PER ratio. That filter shows 50 matches out of 817 companies on AIM. I would then exclude the resources and oil stocks from the list because the cash they have raised is likely to go into digging holes in the ground with uncertain pay-offs.

These aren’t recommendations, just a suggestion for a filter for shares that might hold up well if the unexpected happens. This type of investing is not about making predictions, but instead protecting your downside when you know that there’s a wide range of outcomes. Schroders, the fund managers, are now suggesting UK interest rates could peak at 6.5% by the end of this year.

I haven’t read Patterson’s Chaos Kings book yet but can recommend Spitznagel’s Safe Haven – Investing for Financial Storms and anything by Taleb is worth reading (at least twice).

This week I look at Wise’s FY March results and another profit warning from tinyBuild, which is now down more than -95% from its IPO price and Domino’s Pizza Poland, which has performed even worse since its IPO in 2010.

WISE FY March 2023

This foreign exchange platform sold off -15% in April, when they put out an RNS saying that they would start paying interest on client balances. Presumably, investors were hoping that WISE would keep the benefit of rising interest rates for shareholders, which is the banking business model. However, management are very clear, that they believe offering customers a fair return on their balances is the right thing to do because it builds trust and loyalty. I agree, I’m a big fan of this business model as much as I am a critic of traditional banks like LLOY.

Last week the share price was up +16%, as they released FY March results showing income +73% to £964m, or +51% revenue excluding the benefits of rising interest rates. PBT was up 3.3x to £147m. They now have 10m active customers, which has trebled since 2019 and income per customer stands at £96m.

One thing to note for shareholders in Alpha FX, Equals and Argentex, is that though WISE started out as a consumer brand, they are investing in growing their market share of SME business customers. The group’s business income is currently 25% of the total, but growing at +96% y-o-y.

Outlook: They reiterated their target of > 20% CAGR income growth and an EBITDA margin at or above 20%. In the short term, they do warn that H1 to Sept will be a difficult comparative, because of exceptional volume growth in H1 last year. In H2 last year (ie Oct-Mar) they were receiving the benefit of higher interest rates, which they only decided to pass on to customers from April. They also say that the decline in house prices means large overseas balance transfers are likely to reduce. All of these points strike me as short-term noise, rather than anything that undermines the investment case.

Valuation: The shares are trading on 35x PER FY Mar 2024F and Mar 2025F. Price to revenue drops from 6.9x Mar 2023 to below 5x in two years’ time. In the past, I’ve compared it to Alpha Group, which is also on a similarly high revenue multiple. However, ALPH has an EBIT margin in the high 30s, whereas WISE is around half that level. AGFX, which I own is trading on 7x Mar 2025F and below 2x revenues the same year.

Opinion: I like the business and the strategy, but just can’t get comfortable with the valuation. I struggle to pay more than 5x sales for any stock, however good the prospects. “Growth” investors Baillie Gifford owns 23%, IA Ventures 18% and Andreessen Horowitz 9%. I’m hoping that turmoil with Silicon Valley Bank means that the venture capital industry starts having to sell their liquid, listed holdings like WISE at a favourable valuation to new investors.

tinyBuild FY Dec profit warning

This is a very contrarian idea, but we’ve seen in the past some IPO’s that fall steeply can then go on to recover into multi-baggers (DX Group, Somero, CVS Group, ASOS) if you can pick your moment for the recovery. Last week TBLD shares had fallen over -95% from its 169p IPO price, following a couple of disasters, though the shares then bounced +27% at the start of this week. It’s obviously high risk, but the company is expecting to have net cash of $10m-20m (previously expected > $26m) at the end of Dec 2023. Cash at Dec 2022 was $26m, so they are expecting to lose $6m to $16m this year. With that caveat in mind, I look at their profit warning.

Management now believe revenue will be “materially behind” FY Dec 2023F and FY Dec 2024F (Zeus, their broker, cut this year’s forecast by -31% to $50m) and worse at the EBITDA level (Zeus slashed their Dec 2023F by -71% to $7m). Management expect this year to be the low point and believe they should be generating cash next year, based on the contribution of larger budget games in scheduled.

Similar to FDEV, which I covered a couple of weeks ago, they are finding the third-party publishing business tough. So they are re-focusing on their own IP games. They may also write off some assets in their back catalogue of games, as revenue has been disappointing. There was $80m of intangible assets on the balance sheet, versus shareholders equity of $112m, as of last Dec.

They will also cut costs, including looking at savings from recent acquisitions Versus Evil and Red Cerberus (both bought in Nov 2021). They spent $23m acquiring studios in 2021 and have already taken a goodwill write-down for those deals (goodwill at Dec 2022 was less than $4m).

Also worth noting that some of the sell-off is not their fault; they bought development studios in Ukraine (Hologryph LLC, October 2020) and in Russia (Moom Moose, Nov 2020 and Hungry Couch, Feb 2021). They have successfully relocated over a hundred people from those countries and set up a new studio in Belgrade in response to the war. That’s one-fifth of the entire company. If that wasn’t enough, they have also announced the CFO is leaving for personal reasons, to be replaced by Giasone (Jaz) Salone, who I used to work with at CSFB.

AGM vote: The founder Alex Nichiporchik still owns 38% of the shares, despite having sold 33m of shares at the IPO, worth £56m at the time. Under Takeover Panel rules he needs an exemption to hold more than 30% without making a bid for the entire company. At last week’s AGM, there was a resolution put forward to allow him to buy up to 45% of the shares without making a full offer. This resolution was voted down by institutions, with 41% of the shareholders voting against. It’s hard to know the different motivations, but one guess could be that having bought from him at the top, institutions are now nervous about selling to him at the bottom. Perhaps institutions have been influenced by Teddy Sagi’s lowball offers for KAPE and BOTB? That is just a guess, I haven’t talked to any of the professional fund managers, like Martin Currie, based in Edinburgh, who dumped their entire 5% position on the market last week. My view is that the share price reaction is indicating a breakdown in trust between the founder and professional fund managers who backed the IPO.

Equity Research analyst as CFO: There were some complaints on Twitter that the new CFO has a background in equity research, rather than auditing. I know Jaz Salati from our CSFB days. I would agree that an equity research analyst might not make a suitable Finance Director of a large complicated media company like WPP or a bank like BARC. This is not the challenge at TBLD though. In April this year Alex Nichiporchik, the founder, published a tweet explaining why TBLD is “probably the most undervalued game stock in the UK.” That didn’t age well. For TBLD the business needs a CFO to counterbalance an entrepreneurial founder, who can help communicate with disappointed investors. In short, rebuild trust.

Valuation: Zeus are forecasting $7m of adj EBITDA in Dec 2023F and 2024F, which translates into 0.24c EPS those years. That suggests around 5x earnings, with Dec 2023F net cash of between 41% to 83% of the market cap, based on the company’s guidance range in the RNS.

Opinion: Not for widows and orphans, but I think worth looking at if you have a contrarian style. I’ve already bought into FDEV, so I am not sure how much more exposure I want to this sector which has really been punished. Disappointments in the sector seem to have focused on the publishing side, as distribution platforms have invested less in the types of games that FDEV and TBLD’s third-party publishers create. So, emphasis on more of the internally developed IP makes sense.

Domino’s Pizza Poland FY Dec Annual Report

On the subject of badly performing IPO’s: Domino’s Pizza Poland released FY Dec Annual Report on the last day of the month, just before the shares would have been suspended.

Science in Sport did similar, but issued a correction RNS saying their FY Dec results published on 30th June were preliminary (unaudited) rather than final (audited results). SIS shares were suspended with 15 other companies, for not publishing audited numbers within 6 months of their year-end.

Back to the Polish pizzas: revenue growth was up +19% to £36m. Following the reverse takeover of Dominium which operated 57 pizza restaurants across Poland, they now have 113 pizza restaurants in Poland, plus three more in Croatia. That represents c. £300K of revenue per Polish restaurant, however, the business is still loss-making, losing £4.3m both in 2022 and 2021. In fact, DPP has achieved the remarkable feat of being loss-making since Seymour Pierce IPO’ed the company at 50p per share in July 2010. 13 years of losses and counting. I think that (Sir) Fred Goodwin would look on with secret admiration as Royal Bank only achieved 6 years straight of losses, following the financial crisis. DPP have funded this by returning to shareholders and asking for more money, the number of shares has increased 350x from 2m at the IPO to over 700m today.

Most recently they raised £4.8m in August last year at c. 8p per share. They highlight £4.1m of “cash at bank” as a bullet point on the first page of the financial highlights. Regular readers should know that this phrase should set alarm bells ringing! Sure enough, tucked away in note 27, on page 32 of the RNS they disclose £6.8m of debt to Malaccan Holdings, the former owner of Dominium as part of the deal. So even without IFRS lease liabilities, the business is loss making and in net debt of £2.7m. Including lease liabilities net debt stood at £11m at Dec last year.

The Malaccan loan is repayable by December next year. Malaccan is a 39% shareholder in DPP (worth £21m at today’s share price). They were the owner of Dominium which reversed into DPP. Presumably, such a large shareholder would be keen for DPP to keep operating, however, there must be a reasonable chance of further dilution to come. Sharepad’s Altman Z score of -0.6 is indicating risk.

For comparison Domino’s Pizza in the UK (DOM), which is listed on the main LSE has revenue of £600m, PBT of £80m and 1,271 stores across the UK and Ireland. DOM shares are up 70x from their Dec 2000 low. The US business, Domino’s Pizza Inc (DPZ) has revenues of $4.5bn and PBT of $527m and has been a 100 bagger from its H2 2008 lows. For a long time I have been curious about why Domino’s Pizza does well in some countries, but badly in others. If readers have a theory, please do share on the chat. I’ve shown DOM (the UK plc) quality measures below:

2023 Trading: DPP had already said that Like-For-Like System Sales were up +18% in YTD to April. Inflation in Poland has been running ahead of the UK, but they say energy and food costs are now beginning to abate. They warn labour inflation remains a problem though. I think wage inflation is currently acute in bars and restaurants, my own experience from Berlin is many of the staff in my craft beer bar re-appraised their life during the pandemic. This is anecdotal, but one of them is now working for an NGO in Ukraine, another friend who was a chef for over 20 years is now selling advertising to SMEs for Facebook. Below are DPP’s quality measures, which are quite a contrast to the UK business.

Valuation: Sharepad shows losses are expected to continue for Dec 2023F and with the company then close to break even achieved Dec 2024F. Even if those forecasts do not disappoint, the Malaccan loan comes due at the end of next year and it’s not clear that they will have generated enough cash to pay it off. DPP shares are trading on 1.5x historic revenues. For comparison DOM trades on 2.0x and DPZ trades on 2.7x historic revenues.

Opinion: The bull case is that now the business has scale, DPP can compound away as the UK and US franchises have done. The bear case is that this has been the story for well over a decade, and reality has been consistently disappointing. My view is investors have to be careful not to be too early! Like tinyBuild, certainly not a high-conviction idea, but one for contrarians to ponder. There’s a presentation on InvestorMeetCompany. I am going to avoid, because I don’t like the voluntary disclosure.

Notes

The author owns FDEV, AGFX and other shares mentioned in this report

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.