The Swiss Central Bank’s balance sheet in 2022 shows signs that Credit Suisse’s problems were well understood, but harder for the authorities to resolve. Companies covered KAPE, SDRY, ALPH and EQLS.

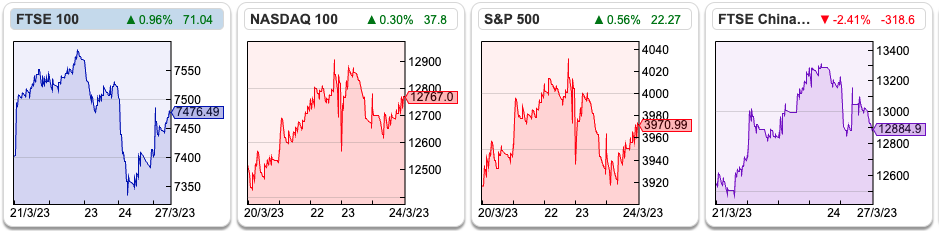

The FTSE rose +1% to 7476 in the last five days, most of which was on Monday morning. The Nasdaq100 was up +2% and the S&P500 was up +1.4%, as problems in the banking sector seemed not to have fed through to the broader indices in the US. The price of gold rose above $1971 per ounce, up +2.9% in the last five days. 1971 was of course the year Nixon took the USA off the gold standard. I’m by no means a gold bug, but I do occasionally visit the WTFhappenedin1971 site as a guilty pleasure.

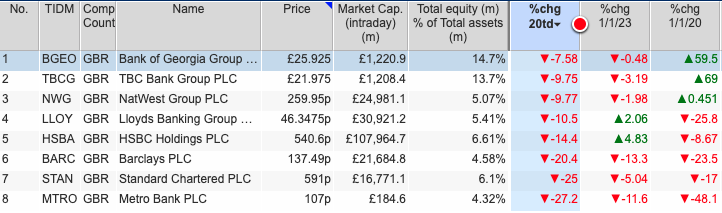

The Fed and the Bank of England both raised interest rates by 25bp, the Fed to a target range of 4.75% – 5.0% and the BoE to 4.25%. Below is a table of London-listed banks, with the Georgians performing better over the last 20 days, probably because equity is a greater proportion of total assets (ie they are less geared, thus better able to withstand shocks). Worth noting that the same trend is reflected in share price performance since 2020.

Izzy Kaminska at The Blind Spot has been digging through the Swiss National Bank (SNB) Annual Report and discovered indications that the Central Bank was quietly supporting Credit Suisse for around 6 months. In 2022 the Central Bank shrank its balance sheet by -17% to CHF881bn, which on the face of it would drain liquidity from the system. However, at the same time the SNB issued just under CHF253bn of debt, of which it then purchased CHF154bn leaving a balancing amount of CHF98bn as a liability. That is, the liquidity it mopped up with one hand, was poured back into the market with the other hand, likely to support CS. Secondly, the SNB expanded its criteria of eligible collateral that counterparties could park at the Central Bank in return for liquidity by 72x to CHF11.4 trillion.

If the SNB knew there was a problem with Credit Suisse in Q4 last year, then they had plenty of time to prepare. A vast amount of work has gone into ensuring systemically important banks can be wound up without costing the taxpayer. Yet worryingly Karin Keller-Sutter, the Swiss Finance Minister, said last weekend that the crisis resolution mechanisms for Too Big To Fail banks didn’t work. She said the plan could work legally, but in practice, resolving Credit Suisse according to the plan would have caused too much economic damage.

One good source for understanding what is going on and what will happen next is Mervyn King’s book: The End of Alchemy. Almost a decade ago he wrote:

“The transmutation of bank deposits – money – with a safe value into illiquid risky investments is the alchemy of money and banking. Despite innumerable banking crises, belief in the alchemy persists.”

Last week we saw finnCap and Cenkos announce an all-share merger. Both companies (FCAP, March year-end; Cenkos, Dec year-end) have seen a -40 to -45% drop in revenues. It’s very hard to manage a people business with that amount of cyclicality, like the UBS / CS merger I am not sure that consolidation really solves the underlying problem. We could still be 6-12 months away from the point when brokers look attractive, so I haven’t written up the merger in detail.

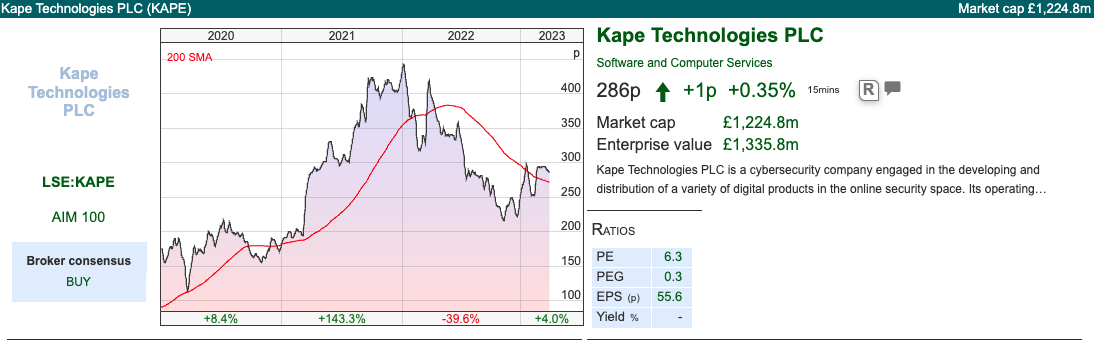

Instead, I look at Tedi Sagi’s bid for Kape, Superdry’s sale of their brand in Asia and forex currency traders Alpha Group and Equals. I think we can expect further volatility in the months ahead, caution is likely to be better rewarded than risk-taking in my view.

KAPE FY Dec Results

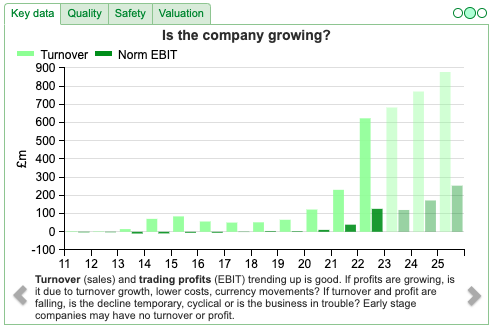

This digital company and Virtual Private Network (VPN) company that has received an offer of 285p per share from Tedi Sagi (55% majority shareholder) announced FY results. Revenues increased 2.7x to $623m, however, that was driven by the acquisition of ExpressVPN in December 2021 for $936m total consideration ($699m in cash, $237m in shares). On an organic basis revenues grew +19%. Statutory PBT was up almost 3x to $93m.

In October 2022 they raised £190m ($213m) at 265p per share, plus a month later refinanced their debt facilities which resulted in $425m of committed long-term debt. Net debt finished the year at $120m down from $458m at the end of 2021. The gross cash figure has increased from $27m at the beginning of the year to $251m at the end of December 2022.

I last wrote about the company when it announced the Unikmind offer in late February. Since then the independent directors have consulted shareholders and said that the offer materially undervalues the company and they will not recommend it. They published a 30-page response on the 20th of March, available on their website, but not on the RNS feed. The key points are:

- Unikmind currently owns 54% of KAPE, but needs 75% support to delist the shares.

- Until last week’s results, Unikmind had agreed not to buy more shares in the market. Following the publication of results last week, that restriction will no longer be in place. Raising their shareholding increases the likelihood of Unikmind passing the delisting resolution.

- Kape is incorporated in the Isle of Man, which has different rights for minority shareholders in takeover situations – specifically, there is no obligation for minority shareholders to receive the offer price once the bidder has obtained 90% of the shares.

Conclusion: If Unikmind buys enough shares in the market to delist the company, Kape shareholders should seriously consider accepting the offer, even if they believe it materially undervalues the company. The final date when the offer can be accepted is 5th of May. Presumably, if the offer is rejected after that, Unikmind will still seek to convene a general meeting to try to delist the shares.

Valuation: The shares are trading on a PER 7x Dec 2024F and a PER 5x 2025F. Kape is trading on 2.1x sales which looks very cheap on the face of it. Progressive Research publishes paid for research on the company, but hasn’t put out anything since the offer was announced. That’s a reminder that paid for research can be useful, but not in situations when the majority shareholder and the board disagree.

Opinion: This is a really difficult one. I think shareholders need to take a view based on their individual risk tolerance, unrelated to what they believe Kape is actually worth. I’m assuming that we will see Unikmind’s “rule 8” disclosures on the RNS feed, and be able to track how Tedi Sagi’s shareholding is increasing as the 5th of May approaches. I don’t own KAPE, but I think if I did, I would hold on to the shares and vote against both the deal and the delisting. However, that might backfire.

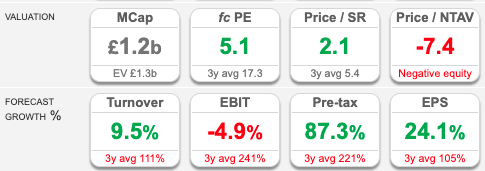

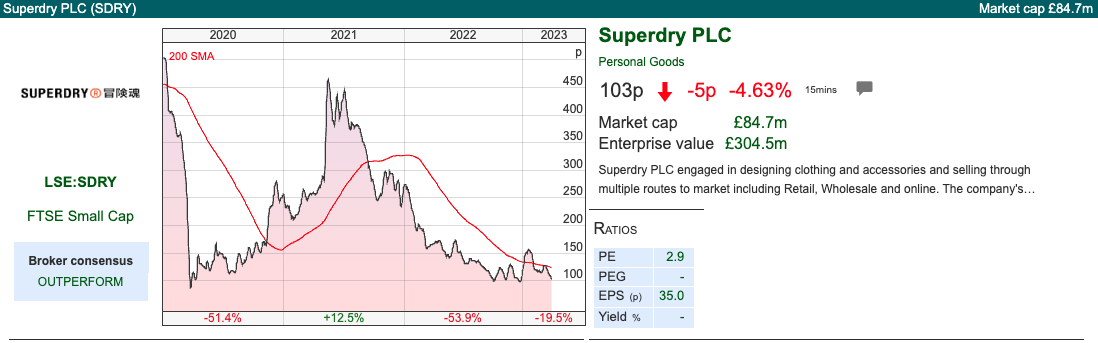

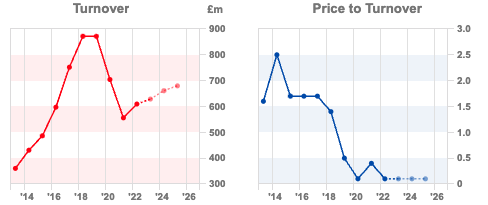

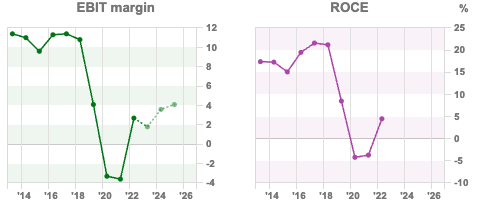

Superdry Asian IP disposal

This clothes retailer announced last week that it would sell its intellectual property (IP) in Asia Pacific (mainly Korea and China, but not India and Australasia) for $50m. Superdry will continue to use Asian suppliers to make clothes, but not make any profits on China or Korea. The business being sold contributed £7.4m of revenue (1.2% of group) and £2.5m PBT, so that seems a remarkable 6x revenue multiple, versus Superdry itself which trades on 0.1x revenue. Or put another way, if SDRY shares traded on the same multiple as the Asian business they are selling, the market cap would be £3.7bn, equating to £44 per share. I must be missing something!

As the brand was developed internally, there’s no value recorded on the balance sheet, so the proceeds should convert into a gain on disposal of c. $40m (or £34m) net of transaction costs and tax.

Management point out that they have previously lost material amounts of money trying to expand into China and closed down sales in 2020, with no plans to revisit this in the foreseeable future. They believe that growing the business in Asia will need significant further investment spend and a third-party partner is more likely to be successful.

The money from the sale will strengthen SDRY’s balance sheet. The RNS also says management are considering potential equity issue.

Valuation: SDRY shares are on a PER of 9x Apr 2024F dropping to 6x Apr 2025. However, there’s a worry that management have been too optimistic in the past, and last week’s announcement suggest we may see profitability measures revised down.

Opinion: At first glance £34m in cash is good news! However, talk of a capital raising, and probably a weak start to 2023 suggest that the May trading update (the company has an April year-end) could be disappointing, showing that the turnaround is taking longer than expected with sales and margins under pressure. I own the shares and would rather see them raise money and survive than try to bluster their way through and go bust.

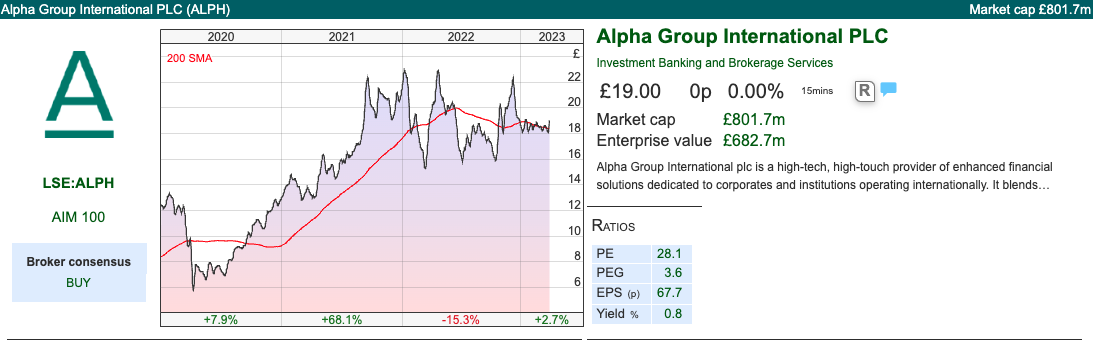

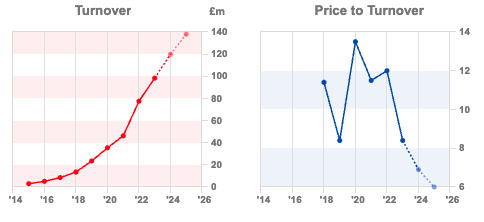

Alpha Group FY Dec Results

Both EQLS and AGFX sold off heavily in response to the problems at Credit Suisse, while ALPH held up much better. That may just be investors nervous about counterparty risk to large G-SIFIs (Global Systemically Important Financial Institutions). Or perhaps traders have other concerns?

Alpha announced strong FY results, with revenue +27% to £98m, and PBT +42% to £47.2m. Like Hargreaves Lansdown, Alpha has benefitted from earning higher rates of interest on client balances and not passing on the full benefit to customers. The effect is largely beyond their control, so they split this out in the Other Operating Income line, £9.4m in the last four months of 2022 (versus nil before then). YTD average balances were £1.6bn, 2.8% average interest rate implies £44m annualised. Those average balances are much larger than I was expecting, given that cash was just £137m at the end of last year (v £108m Dec 2021). They say that they have hedged some of this interest rate income with swaps.

I like the way the Chief Exec Morgan Tillbrook communicates in the text of the RNS. For instance, he says that he is “torn between the need to provide enough context for new investors, without creating too much repetition for existing ones.” His solution is to provide hyperlinks, to let investors opt-in to the additional detail. No one else does this, but it seems a good technological solution from someone who clearly has an entrepreneurial mindset and is not put off by the argument “but no one else does that”. In keeping with that, here’s a link to what I last published on ALPH.

He says that ALPH has not benefited from currency volatility last year, because Alpha clients hedge for commercial reasons: a client that needs to hedge $10m of future cashflow obligations, doesn’t suddenly need to hedge $15m because markets are more volatile. I think AGFX has more fund managers as clients, so that point may not apply equally across the sector.

Share scheme: There’s a share scheme for employees with new classes of shares being created based on revenue growth targets, and these then convert to shares in the group at an 8x the earnings multiple. This was announced in an RNS in early January, and the company has yet to publish its full Annual Report. 1.2m (3% of the group’s shares outstanding) vested last year, worth £22m at the current share price. I think I will investigate further when the Annual Report is available on their website.

Ownership: The Chief Executive/Founder owns 16.7%. Liontrust 12%, Jupiter 9.7%, M&G 7.5% and Soros 6%. In 2024 they intend to move from AIM to a premium listing on the Main Market. There are already quality institutions on the shareholder list, but that implies we could see more index trackers buying. I don’t know the specific numbers, but I would imagine there is significantly more passive money following the FTSE All Share than AIM.

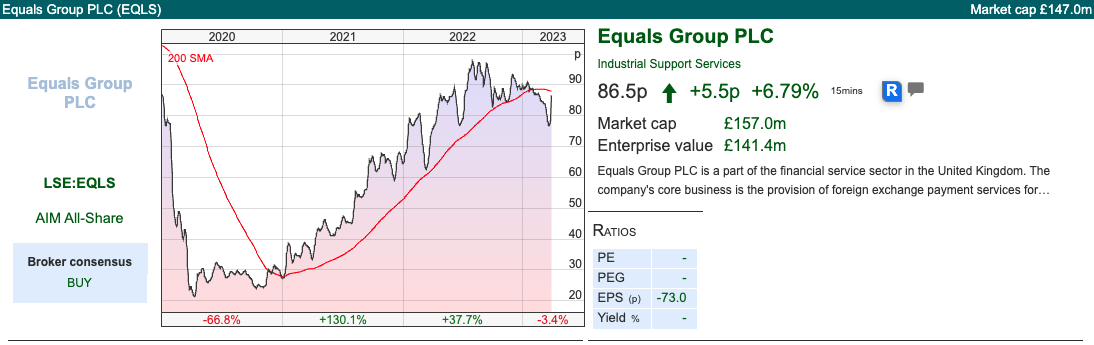

Equals FY Dec Results

Equals reported revenue +58% to £70m and PBT was £3.6m versus a £2.3m loss last year. Impressively Q1 2023 revenue to last Friday (24th Mar) was up +54% versus the same time period last year. The cash position was £15m at the end of December, a +15% increase. They expect FY Dec 2023F to be ahead of expectations. It’s good to see some financial organisations can do turn arounds!

They have some small acquisitions, Roqquett (open banking) and a couple more that are yet to complete, Hamer & Hamer (a UK FX broker) and Oonex (a Belgium payment processor).

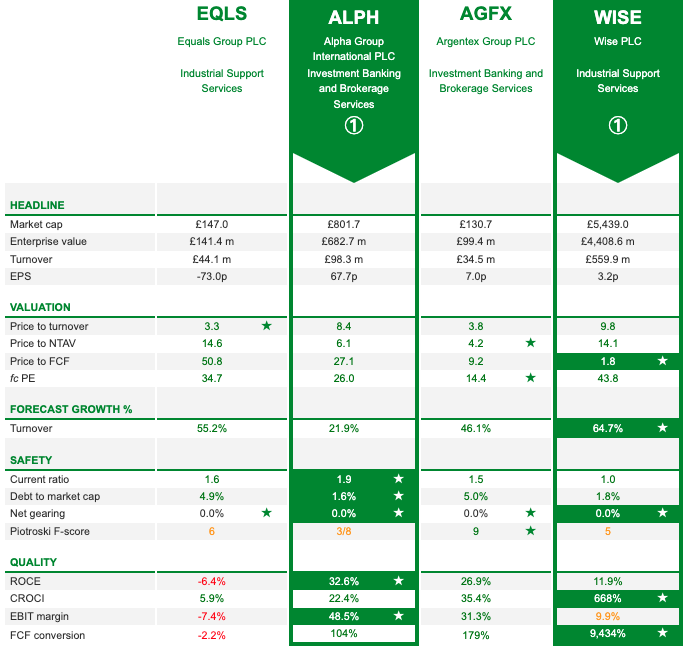

Valuation: Equals is trading on a PER 18x Dec 2023F, however, that PER may drop towards 15x when the EPS upgrade feeds through. That compares to ALPH PER 26x Dec 2023F and 23x Dec 2024F, so ALPH trades on a c. 70% premium. Below I’ve used Sharepad’s “compare” feature to weigh up all four of WISE, AGFX, EQLS and ALPH.

Opinion: I like this sector, though I’m not 100% clear I understand the downside. ALPH have clarified that average client balances are around 12x higher than the year-end cash figure of £137m that appears on the balance sheet. Otherwise, the interest that they were earning would have been so high there would have been hidden risk (for example Swiss bank AT1 debt). EQLS don’t give an average balance figure.

I’m sceptical of the “we are growing revenue at between +30% and +60% per year because we offer a superior, high touch, service that the high street banks can’t compete with” investment case. I think there’s also some regulatory arbitrage going on, with the banking regulator trying to encourage forex trading activity to move away from Too Big To Fail clearing banks, or at least giving banks a less generous capital treatment for forex swaps.

Notably, ALPH did report a £2.9m bad debt charge in 2021 relating to a Norwegian client, so there is some credit risk inherent in the model. There’s a notional principal derivative exposure of £21bn for ALPH. Don’t worry, notional derivative exposure is always a large number, the equivalent notional derivative figure for Deutsche Bank was $42 trillion at the year end…so that is reassuring, isn’t it?

Bruce Packard

Notes

The author owns shares in Superdry and AGFX

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 28/03/23 | KAPE, SDRY, ALPH, EQLS | The End of Alchemy

The Swiss Central Bank’s balance sheet in 2022 shows signs that Credit Suisse’s problems were well understood, but harder for the authorities to resolve. Companies covered KAPE, SDRY, ALPH and EQLS.

The FTSE rose +1% to 7476 in the last five days, most of which was on Monday morning. The Nasdaq100 was up +2% and the S&P500 was up +1.4%, as problems in the banking sector seemed not to have fed through to the broader indices in the US. The price of gold rose above $1971 per ounce, up +2.9% in the last five days. 1971 was of course the year Nixon took the USA off the gold standard. I’m by no means a gold bug, but I do occasionally visit the WTFhappenedin1971 site as a guilty pleasure.

The Fed and the Bank of England both raised interest rates by 25bp, the Fed to a target range of 4.75% – 5.0% and the BoE to 4.25%. Below is a table of London-listed banks, with the Georgians performing better over the last 20 days, probably because equity is a greater proportion of total assets (ie they are less geared, thus better able to withstand shocks). Worth noting that the same trend is reflected in share price performance since 2020.

Izzy Kaminska at The Blind Spot has been digging through the Swiss National Bank (SNB) Annual Report and discovered indications that the Central Bank was quietly supporting Credit Suisse for around 6 months. In 2022 the Central Bank shrank its balance sheet by -17% to CHF881bn, which on the face of it would drain liquidity from the system. However, at the same time the SNB issued just under CHF253bn of debt, of which it then purchased CHF154bn leaving a balancing amount of CHF98bn as a liability. That is, the liquidity it mopped up with one hand, was poured back into the market with the other hand, likely to support CS. Secondly, the SNB expanded its criteria of eligible collateral that counterparties could park at the Central Bank in return for liquidity by 72x to CHF11.4 trillion.

If the SNB knew there was a problem with Credit Suisse in Q4 last year, then they had plenty of time to prepare. A vast amount of work has gone into ensuring systemically important banks can be wound up without costing the taxpayer. Yet worryingly Karin Keller-Sutter, the Swiss Finance Minister, said last weekend that the crisis resolution mechanisms for Too Big To Fail banks didn’t work. She said the plan could work legally, but in practice, resolving Credit Suisse according to the plan would have caused too much economic damage.

One good source for understanding what is going on and what will happen next is Mervyn King’s book: The End of Alchemy. Almost a decade ago he wrote:

“The transmutation of bank deposits – money – with a safe value into illiquid risky investments is the alchemy of money and banking. Despite innumerable banking crises, belief in the alchemy persists.”

Last week we saw finnCap and Cenkos announce an all-share merger. Both companies (FCAP, March year-end; Cenkos, Dec year-end) have seen a -40 to -45% drop in revenues. It’s very hard to manage a people business with that amount of cyclicality, like the UBS / CS merger I am not sure that consolidation really solves the underlying problem. We could still be 6-12 months away from the point when brokers look attractive, so I haven’t written up the merger in detail.

Instead, I look at Tedi Sagi’s bid for Kape, Superdry’s sale of their brand in Asia and forex currency traders Alpha Group and Equals. I think we can expect further volatility in the months ahead, caution is likely to be better rewarded than risk-taking in my view.

KAPE FY Dec Results

This digital company and Virtual Private Network (VPN) company that has received an offer of 285p per share from Tedi Sagi (55% majority shareholder) announced FY results. Revenues increased 2.7x to $623m, however, that was driven by the acquisition of ExpressVPN in December 2021 for $936m total consideration ($699m in cash, $237m in shares). On an organic basis revenues grew +19%. Statutory PBT was up almost 3x to $93m.

In October 2022 they raised £190m ($213m) at 265p per share, plus a month later refinanced their debt facilities which resulted in $425m of committed long-term debt. Net debt finished the year at $120m down from $458m at the end of 2021. The gross cash figure has increased from $27m at the beginning of the year to $251m at the end of December 2022.

I last wrote about the company when it announced the Unikmind offer in late February. Since then the independent directors have consulted shareholders and said that the offer materially undervalues the company and they will not recommend it. They published a 30-page response on the 20th of March, available on their website, but not on the RNS feed. The key points are:

Conclusion: If Unikmind buys enough shares in the market to delist the company, Kape shareholders should seriously consider accepting the offer, even if they believe it materially undervalues the company. The final date when the offer can be accepted is 5th of May. Presumably, if the offer is rejected after that, Unikmind will still seek to convene a general meeting to try to delist the shares.

Valuation: The shares are trading on a PER 7x Dec 2024F and a PER 5x 2025F. Kape is trading on 2.1x sales which looks very cheap on the face of it. Progressive Research publishes paid for research on the company, but hasn’t put out anything since the offer was announced. That’s a reminder that paid for research can be useful, but not in situations when the majority shareholder and the board disagree.

Opinion: This is a really difficult one. I think shareholders need to take a view based on their individual risk tolerance, unrelated to what they believe Kape is actually worth. I’m assuming that we will see Unikmind’s “rule 8” disclosures on the RNS feed, and be able to track how Tedi Sagi’s shareholding is increasing as the 5th of May approaches. I don’t own KAPE, but I think if I did, I would hold on to the shares and vote against both the deal and the delisting. However, that might backfire.

Superdry Asian IP disposal

This clothes retailer announced last week that it would sell its intellectual property (IP) in Asia Pacific (mainly Korea and China, but not India and Australasia) for $50m. Superdry will continue to use Asian suppliers to make clothes, but not make any profits on China or Korea. The business being sold contributed £7.4m of revenue (1.2% of group) and £2.5m PBT, so that seems a remarkable 6x revenue multiple, versus Superdry itself which trades on 0.1x revenue. Or put another way, if SDRY shares traded on the same multiple as the Asian business they are selling, the market cap would be £3.7bn, equating to £44 per share. I must be missing something!

As the brand was developed internally, there’s no value recorded on the balance sheet, so the proceeds should convert into a gain on disposal of c. $40m (or £34m) net of transaction costs and tax.

Management point out that they have previously lost material amounts of money trying to expand into China and closed down sales in 2020, with no plans to revisit this in the foreseeable future. They believe that growing the business in Asia will need significant further investment spend and a third-party partner is more likely to be successful.

The money from the sale will strengthen SDRY’s balance sheet. The RNS also says management are considering potential equity issue.

Valuation: SDRY shares are on a PER of 9x Apr 2024F dropping to 6x Apr 2025. However, there’s a worry that management have been too optimistic in the past, and last week’s announcement suggest we may see profitability measures revised down.

Opinion: At first glance £34m in cash is good news! However, talk of a capital raising, and probably a weak start to 2023 suggest that the May trading update (the company has an April year-end) could be disappointing, showing that the turnaround is taking longer than expected with sales and margins under pressure. I own the shares and would rather see them raise money and survive than try to bluster their way through and go bust.

Alpha Group FY Dec Results

Both EQLS and AGFX sold off heavily in response to the problems at Credit Suisse, while ALPH held up much better. That may just be investors nervous about counterparty risk to large G-SIFIs (Global Systemically Important Financial Institutions). Or perhaps traders have other concerns?

Alpha announced strong FY results, with revenue +27% to £98m, and PBT +42% to £47.2m. Like Hargreaves Lansdown, Alpha has benefitted from earning higher rates of interest on client balances and not passing on the full benefit to customers. The effect is largely beyond their control, so they split this out in the Other Operating Income line, £9.4m in the last four months of 2022 (versus nil before then). YTD average balances were £1.6bn, 2.8% average interest rate implies £44m annualised. Those average balances are much larger than I was expecting, given that cash was just £137m at the end of last year (v £108m Dec 2021). They say that they have hedged some of this interest rate income with swaps.

I like the way the Chief Exec Morgan Tillbrook communicates in the text of the RNS. For instance, he says that he is “torn between the need to provide enough context for new investors, without creating too much repetition for existing ones.” His solution is to provide hyperlinks, to let investors opt-in to the additional detail. No one else does this, but it seems a good technological solution from someone who clearly has an entrepreneurial mindset and is not put off by the argument “but no one else does that”. In keeping with that, here’s a link to what I last published on ALPH.

He says that ALPH has not benefited from currency volatility last year, because Alpha clients hedge for commercial reasons: a client that needs to hedge $10m of future cashflow obligations, doesn’t suddenly need to hedge $15m because markets are more volatile. I think AGFX has more fund managers as clients, so that point may not apply equally across the sector.

Share scheme: There’s a share scheme for employees with new classes of shares being created based on revenue growth targets, and these then convert to shares in the group at an 8x the earnings multiple. This was announced in an RNS in early January, and the company has yet to publish its full Annual Report. 1.2m (3% of the group’s shares outstanding) vested last year, worth £22m at the current share price. I think I will investigate further when the Annual Report is available on their website.

Ownership: The Chief Executive/Founder owns 16.7%. Liontrust 12%, Jupiter 9.7%, M&G 7.5% and Soros 6%. In 2024 they intend to move from AIM to a premium listing on the Main Market. There are already quality institutions on the shareholder list, but that implies we could see more index trackers buying. I don’t know the specific numbers, but I would imagine there is significantly more passive money following the FTSE All Share than AIM.

Equals FY Dec Results

Equals reported revenue +58% to £70m and PBT was £3.6m versus a £2.3m loss last year. Impressively Q1 2023 revenue to last Friday (24th Mar) was up +54% versus the same time period last year. The cash position was £15m at the end of December, a +15% increase. They expect FY Dec 2023F to be ahead of expectations. It’s good to see some financial organisations can do turn arounds!

They have some small acquisitions, Roqquett (open banking) and a couple more that are yet to complete, Hamer & Hamer (a UK FX broker) and Oonex (a Belgium payment processor).

Valuation: Equals is trading on a PER 18x Dec 2023F, however, that PER may drop towards 15x when the EPS upgrade feeds through. That compares to ALPH PER 26x Dec 2023F and 23x Dec 2024F, so ALPH trades on a c. 70% premium. Below I’ve used Sharepad’s “compare” feature to weigh up all four of WISE, AGFX, EQLS and ALPH.

Opinion: I like this sector, though I’m not 100% clear I understand the downside. ALPH have clarified that average client balances are around 12x higher than the year-end cash figure of £137m that appears on the balance sheet. Otherwise, the interest that they were earning would have been so high there would have been hidden risk (for example Swiss bank AT1 debt). EQLS don’t give an average balance figure.

I’m sceptical of the “we are growing revenue at between +30% and +60% per year because we offer a superior, high touch, service that the high street banks can’t compete with” investment case. I think there’s also some regulatory arbitrage going on, with the banking regulator trying to encourage forex trading activity to move away from Too Big To Fail clearing banks, or at least giving banks a less generous capital treatment for forex swaps.

Notably, ALPH did report a £2.9m bad debt charge in 2021 relating to a Norwegian client, so there is some credit risk inherent in the model. There’s a notional principal derivative exposure of £21bn for ALPH. Don’t worry, notional derivative exposure is always a large number, the equivalent notional derivative figure for Deutsche Bank was $42 trillion at the year end…so that is reassuring, isn’t it?

Bruce Packard

Notes

The author owns shares in Superdry and AGFX

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.