Bruce looks at the government’s misguided attempt to defend the pound with capital controls in the 1970s. Companies covered are forex traders ALPH and EQLS, plus CAPD.

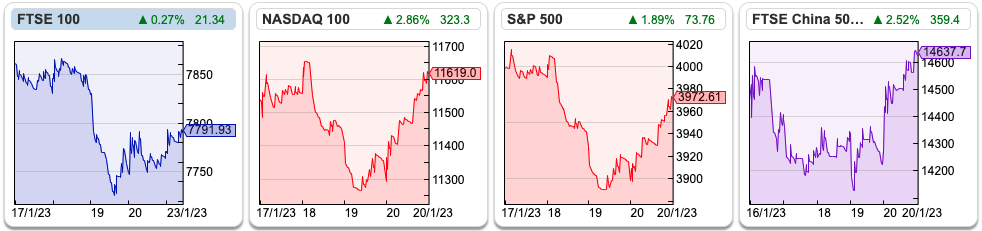

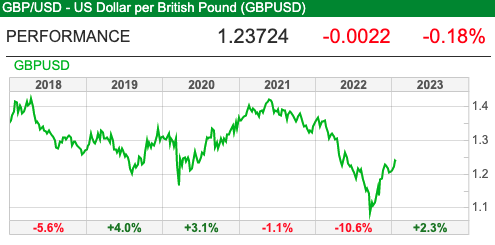

The FTSE 100 was down 0.9% in the last 5 days to 7,791. The S&P500 was down -0.3% while Nasdaq100 was up +1.39% over the same time period. The FTSE China 50 continued to benefit from China’s re-opening. Sterling/USD rose to 1.24, so is also enjoying a strong start to the year and the pound is now up +15% since its September low against the dollar.

I’ve come across a short form finance podcast, full of interesting historical episodes from the dark corners of financial markets. It’s done by journalists Neil Collins and Jonathan Ford, each episode is around 15 minutes. I enjoy podcasts, particularly while out walking, but I do find many of them are i) too long ii) too American.

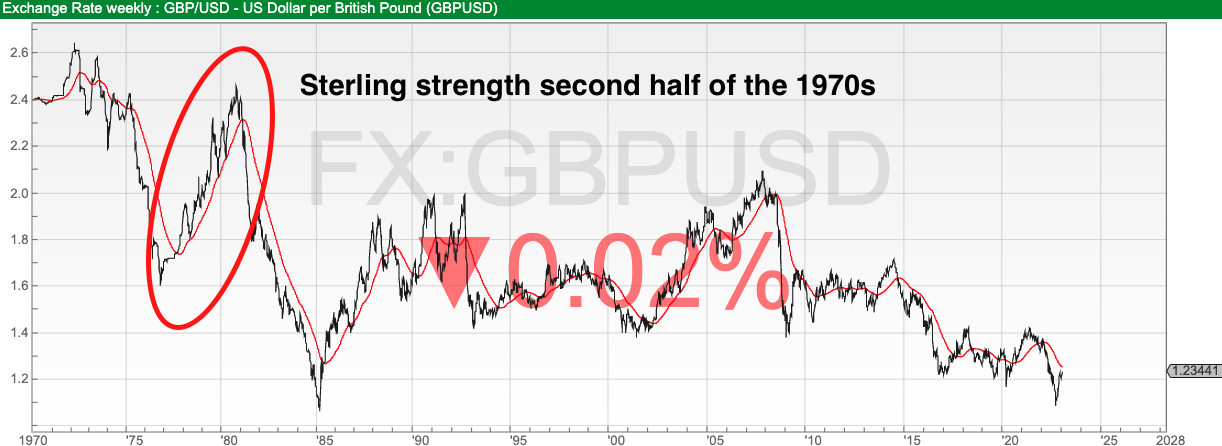

Instead, ALTiFin has bite-sized episodes on subjects like Black Wednesday in September 1992, when the UK fell out of the ERM, or tracing the non-dom financial legislation back to King George III and this one about foreign exchange controls in 1970’s Britain. Holidaymakers were limited to taking £50 per person out of the country. Ford and Collins point out capital controls were ineffective even before electronic transfers for individuals were commonplace; capital controls didn’t prevent a one-third devaluation of the pound in the early 70’s to 1.6 GBPUSD. But also that sterling was remarkably strong in the second half of the 1970’s following the secondary banking crisis and the IMF bailout. They attribute this not to capital controls, but the discovery of North Sea oil.

Financial history is a fascinating area, and it’s possible to listen to or read about episodes then use Sharepad’s long-term historical graphs to verify and investigate further. For instance, the graph below shows the strong rally in sterling in the second half of the 1970s, followed by >50% decline in the early 1980s. That puts the Black Wednesday devaluation in 1992 into context.

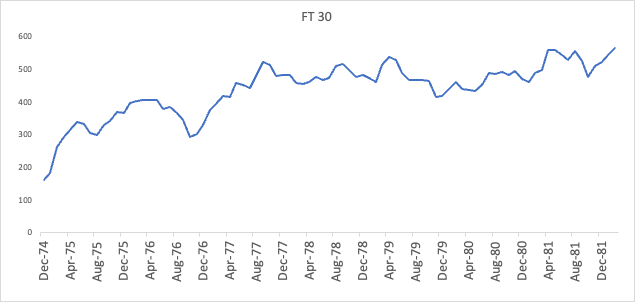

Interestingly Sharepad shows that the FT30 (UK.FT30), the precursor to the FTSE100, also trebled between 1975-1981 suggesting that London’s equity market can rally even as the pound strengthens.* We’ve seen that in the last 3 months too.

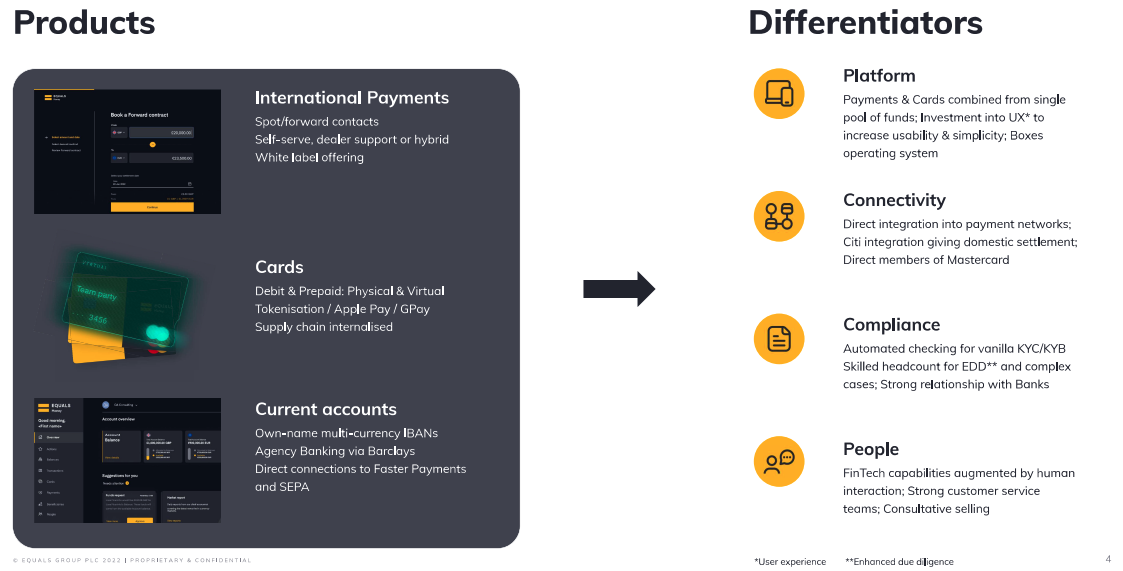

Below I look at Equals and Alpha Group updates, these forex and payments companies, have enjoyed a bumper 2022 at a time when most stocks on AIM have struggled. Management seem to be positive about the outlook for 2023 and investing for top-line growth. They have good margins, RoCE and are net cash, yet they are taking market share from banks which struggle to report RoE between 0-10%.

Given all that, I think that they are enjoying a structural advantage (not just better tech or client service) in currency markets versus the banks. I’ve tried to work out what the Risk Weighting on currency swaps is for banks. The answer is “it’s complicated”. Banks have internal models that create different numbers depending on the assumptions input by each bank. This is not just the Value at Risk (VaR) in the trade, but a Credit Valuation Adjustment (CVA) specific to the Counterparty Credit Risk (CCR) for the Exposure at Default (EaD). Banking regulators do love their Three Letter Abbreviations (TLAs)!

Overall, the story seems to be that regulators are trying to discourage systemically important clearing banks from doing too many risky trading activities. Strictly speaking, it’s not regulatory arbitrage, because this is the outcome that regulators are looking for. The new landscape has created an opportunity for the likes of Alpha, Equals and Argentex who don’t lend money but just execute currency swaps on behalf of clients. If that analysis is correct, then these could be much larger businesses in 5 years’ time. There are risks though, a couple of years ago ALPH had a Norwegian client with an unpaid margin totalling £30.2m, which was eventually repaid in weekly instalments to June last year. Izzy Kaminska (ex FT Alphaville, now The Blind Spot) has a theory that FinTechs like Wise, Monzo and Klarna are benefitting from higher interest rates because they are using their treasury departments as a profit centre. So perhaps some of that is also going on too, just because they don’t make loans, doesn’t mean that there aren’t other risks.

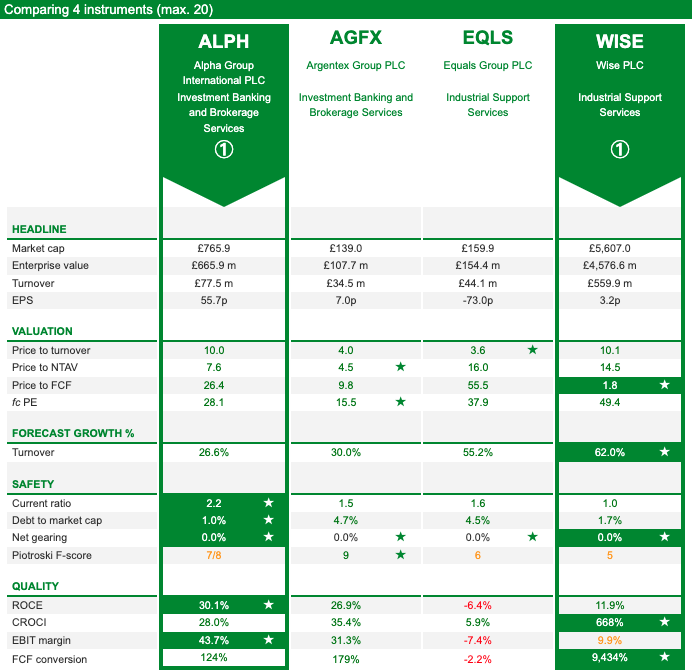

Below I’ve used Sharepad’s compare tool, to evaluate the sector. Interestingly the ranking algorithm prefers the larger companies, WISE and ALPH despite the fact that they are trading on more ambitious valuations.

Normally I would expect the smaller companies to trade at a premium, partly because they are more likely to be take-over candidates if we see consolidation. However, this could be an industry where there are increasing returns of scale, so the bigger companies report higher margins? It’s a fascinating sector and there’s more background here in an article I wrote for MoneyWeek in October last year.

Unrelated to forex capital controls, but with a related name, I finish up with a look at Capital Drilling, which hires out gold mining rigs in Africa.

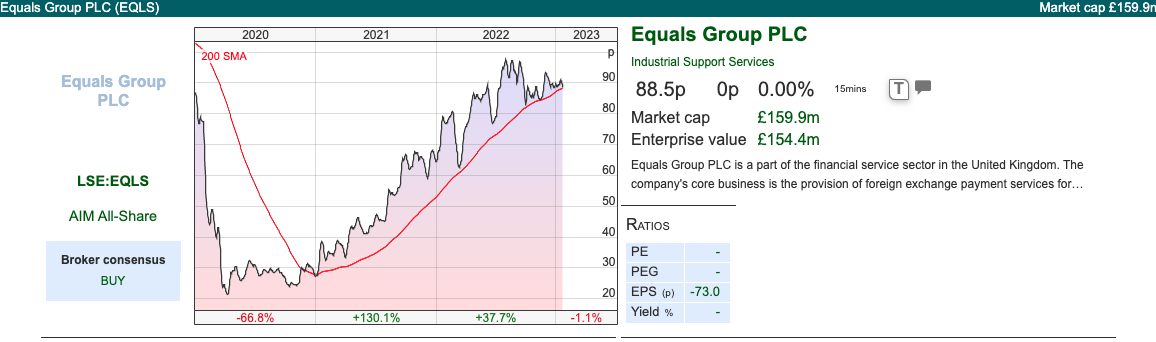

Equals FY Dec Trading Update

This SME forex and payments company last updated the market with a strong 11-month trading update in early December. Last week they announced revenue for the FY to Dec would be £69.7m +59%. Adj EBITDA is expected to be just above £12m (v £11m on Sharepad’s forecast tab, though it’s not clear if the adjustments are the same.) EQLS has approximately £15m of cash at the end of Dec, an increase of +15% versus Dec 2021.

These were very strong results, but it does look like a considerable slowdown to ‘just’ +35% in the final month of the year. Management say “H2-22 included a period of pronounced GBP volatility in September which moved some customers to transact in Q3-22 rather than Q4-22 but these effects smooth out over the six-month period.” That is some clients did a lot of business in Sept/Oct when the were was volatility from Truss/Kwarteng mini-budget, which pulled forward business from December. That seems a reasonable explanation. Sharepad has revenue growth slowing to +18% FY 2023F and +19% FY 2024F.

Wise: The £6bn market cap forex currency FinTech also released a trading update FY Mar 2023F on the same day. They raised FY23 total income growth guidance to a range of +68 to +72% (versus +55 to +60% previously). Wise predominantly targets retail customers, they had 5.8m customers transacting up +33% y-o-y, whereas Equals serves SMEs, there is some risk that Wise decides to gain market share with business customers, which would be a risk for EQLS, ALPH and AGFX.

Valuation: Sharepad shows EQLS trading on 19.5x 2023F with the 2024F yet to be updated at the time of writing. That’s not cheap in this environment, but the firm does seem to be able to deliver top-line growth and operational gearing uncorrelated with the general market. The historic RoCE and EBIT margin is unimpressive (-7% and -13% respectively, last 3 years’ average), but the business now seems to be on a sustainable footing so that should improve in future. For comparison ALPH and AGFX both report 3-year average RoCE between 25%-33% (AGFX has higher RoCE, but ALPH has higher EBIT margins of 40%).

Opinion: 2022 was a positive year for EQLS, but also competitors AGFX and ALPH who all seem to be taking market share from high street banks. 2023F revenue is forecast to slow to 15-30% for the sector. The banks don’t seem to be able to respond. That implies that mid-teens growth is sustainable into the medium term, so unless I’m missing something this seems to be an attractive investment case. I own AGFX, but I can see EQLS or ALPH (see below) might also make sense.

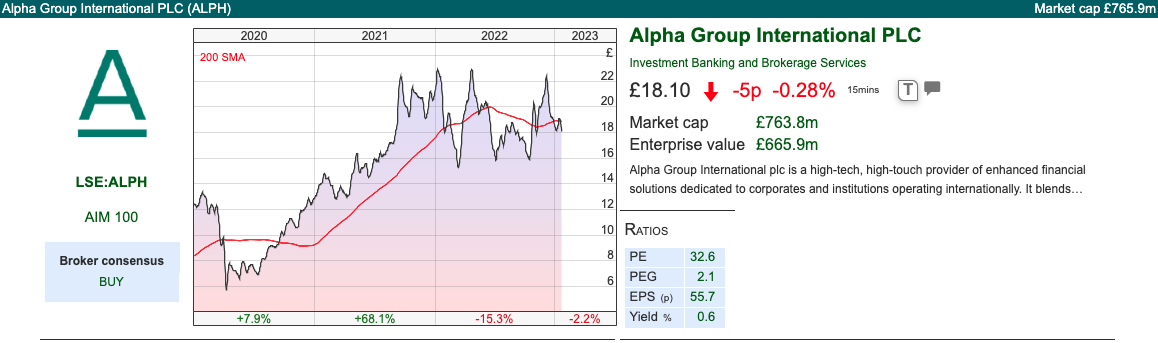

Alpha Group FY Dec Trading Update

Alpha Group, which is in the same sector as Equals but c. 5x larger, also reported a trading update for FY December. FY revenue is expected to be up +27%, to approximately £98m. Operating PBT is in line with expectations, but statutory PBT is ahead, because they are earning a higher rate of interest on the cash they hold. They say higher interest rates contributed £9m of PBT in the last 4 months of the year, or £27m annualised. That comes from client balances (a figure they don’t give) and their own cash balances of £98m in H1 June. I think management would be well-advised to explain what they are doing to generate such a high return on cash, otherwise, investors will fret about hidden risks.

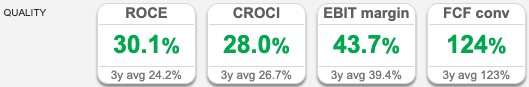

They say that if operating PBT (which excludes interest) exceeds expectations for 2023F, currently, £45m implying +16% growth according to Sharepad, then they will bring forward marketing spend. This is designed to accelerate growth, without becoming embedded in the cost base. However, it does sound like we won’t see raised guidance this year. That makes sense to me. I’d rather see the management of a high RoCE business investing in the future than ‘harvesting’ returns. ALPH has reported a 30% RoCE and an EBIT margin of 44% – this is the sort of business where management should be investing!

Alpha is split into two divisions. Risk Management, which comprises two-thirds of revenue, helps SMEs manage their currency volatility. This arm generates income from the spread in spot or futures-market transactions, and the average revenue per client is £66,000. Interestingly management say that revenue per client increases in the first three years that they take on new clients, as the grow ‘wallet share’ of existing clients. They are going to open an office in Madrid later this year, to enhance growth in Spanish-speaking markets.

The second division, Alternative Banking Solutions, a third of revenue, is for firms wanting to manage high-volume but smaller payments and to open local currency accounts. Alpha FX charges an annual fee, as well as margins on spot trades, and revenue per client, is about £9,000. It is an investment in ABS that management are going to prioritise. ABS saw a record month in December, for both new accounts and revenue.

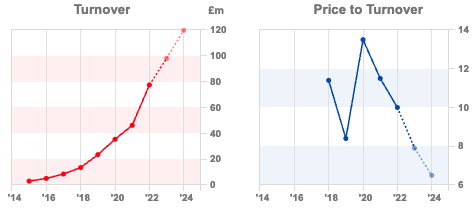

Valuation: The shares are trading on 25x PER 2023F (again no 2024F as of the time of writing). The shares are also on 6x 2023F turnover. It’s interesting that price/turnover has de-rated from above 10x, even as turnover has grown very strongly in the last couple of years.

Opinion: I like that management are investing in growing the business, even with the short-term hit to margins and PBT. However, I’m a little nervous about £27m of annualised interest income from client balances, that’s more than half of the PBT forecast in 2022F. Management do say that some of the benefits comes from macroeconomic conditions beyond their control, so presumably, investors should not put a high multiple on that earnings stream. There are a couple of interviews on YouTube, with the Founder/CEO, Morgan Tillbrook, who comes across well and still own 16% of the shares – but the most recent is H1 2021. I’d like to see this issue clarified in FY 2022 investor presentation.

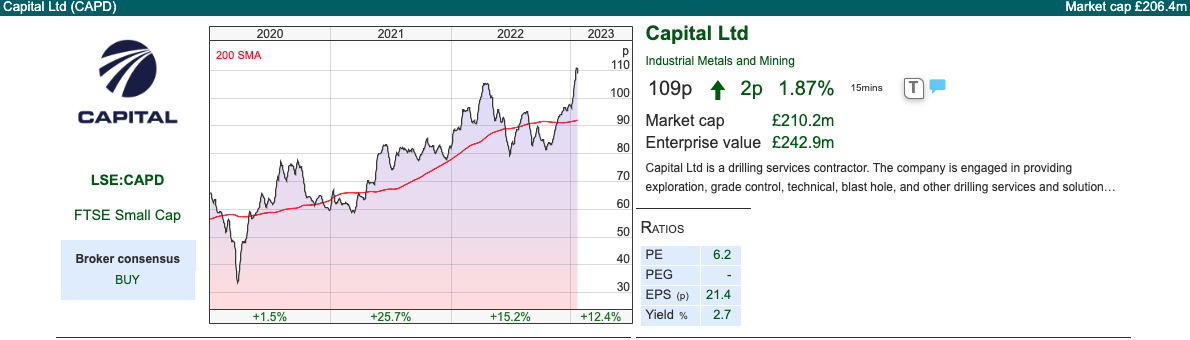

Capital Ltd FY Dec Trading Update

This African gold mining support services company, that was Mark Simpson’s pick for this year, announced a Q4/FY Dec Trading Update. I also own the shares. FY revenue was up +28% to $290m, which was the top end of the increased guidance range ($280-$290m v $270-$280m guided in H1). Pleasingly Q4 revenue v Q4 last year was up +19% to $79m. There’s no mention of PBT in the RNS, but there wasn’t in last year’s FY trading update either.

Outlook: The drilling business (72% of revenue) has a strong outlook for 2023 according to management. Their MSALABs (28% of revenue) also is seeing strong demand. This is an assay business, which tests for the quality and proportions of precious metals in ore. The price of gold has risen +16% to around $1,900 an ounce, so this bodes well for gold miners like Barrick and B2Gold, who are large customers of CAPD. Revenue and CAPEX guidance will be announced on 16th March when they report FY results.

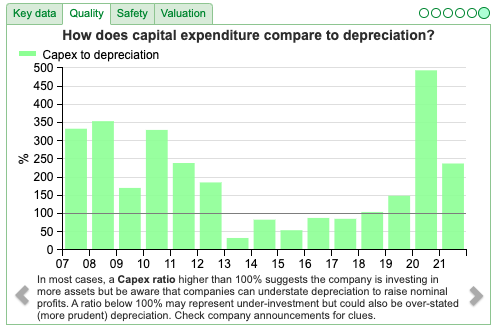

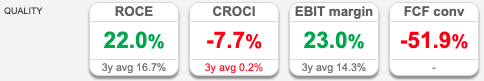

Valuation: The shares are trading on 7x 2023F and 2024F PER. Return on Capital Employed is an impressive 22%, for a company on a such low PER rating. One concern is that CAPEX of $42m FY Dec 2020 and $46m FY Dec 2021 has been higher from net cash generated from operations, hence net cash from investing has outpaced cash generated in the last two years. Below is a long-term chart showing CAPEX v depreciation.

Hence the disconnect between RoCE and CashRoCI -7.7% and rising net debt ($36m at H1). I think that this is a timing difference, however, it is worth keeping an eye on and probably explains the low valuation as investors (rightly) prefer to focus on cash versus accounting profits.

Investments: Also worth noting that CAPD management often take equity stakes in their gold mining customers, which gives an adjusted net cash (ie including investments marked to market of $11m at H1). As of the end of December, the value of their investments (listed and unlisted) has fallen to $39m v $60m at the end of Dec 2021), partly because they were a net seller and partly because gold mining shares have fallen in value.

Opinion: Mining rigs in Africa and the current poor cash generation may be beyond some readers’ risk appetite, so please do your own thinking. However, I like it and CAPD strikes me as an interesting way of having some exposure to the gold price, without buying a gold mining company. Sharepad has the price of gold in US dollars, but below is a log chart showing the price of gold in GBP per ounce is up almost 8x in the last 20 years. I’d imagine that was a similar level to the 1970s when capital controls were in place.

Notes

The author owns shares in Argentex and Capital Group.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 24/01/23 | ALPH, EQLS, CAPD | Currency markets and capital controls

Bruce looks at the government’s misguided attempt to defend the pound with capital controls in the 1970s. Companies covered are forex traders ALPH and EQLS, plus CAPD.

The FTSE 100 was down 0.9% in the last 5 days to 7,791. The S&P500 was down -0.3% while Nasdaq100 was up +1.39% over the same time period. The FTSE China 50 continued to benefit from China’s re-opening. Sterling/USD rose to 1.24, so is also enjoying a strong start to the year and the pound is now up +15% since its September low against the dollar.

I’ve come across a short form finance podcast, full of interesting historical episodes from the dark corners of financial markets. It’s done by journalists Neil Collins and Jonathan Ford, each episode is around 15 minutes. I enjoy podcasts, particularly while out walking, but I do find many of them are i) too long ii) too American.

Instead, ALTiFin has bite-sized episodes on subjects like Black Wednesday in September 1992, when the UK fell out of the ERM, or tracing the non-dom financial legislation back to King George III and this one about foreign exchange controls in 1970’s Britain. Holidaymakers were limited to taking £50 per person out of the country. Ford and Collins point out capital controls were ineffective even before electronic transfers for individuals were commonplace; capital controls didn’t prevent a one-third devaluation of the pound in the early 70’s to 1.6 GBPUSD. But also that sterling was remarkably strong in the second half of the 1970’s following the secondary banking crisis and the IMF bailout. They attribute this not to capital controls, but the discovery of North Sea oil.

Financial history is a fascinating area, and it’s possible to listen to or read about episodes then use Sharepad’s long-term historical graphs to verify and investigate further. For instance, the graph below shows the strong rally in sterling in the second half of the 1970s, followed by >50% decline in the early 1980s. That puts the Black Wednesday devaluation in 1992 into context.

Interestingly Sharepad shows that the FT30 (UK.FT30), the precursor to the FTSE100, also trebled between 1975-1981 suggesting that London’s equity market can rally even as the pound strengthens.* We’ve seen that in the last 3 months too.

Below I look at Equals and Alpha Group updates, these forex and payments companies, have enjoyed a bumper 2022 at a time when most stocks on AIM have struggled. Management seem to be positive about the outlook for 2023 and investing for top-line growth. They have good margins, RoCE and are net cash, yet they are taking market share from banks which struggle to report RoE between 0-10%.

Given all that, I think that they are enjoying a structural advantage (not just better tech or client service) in currency markets versus the banks. I’ve tried to work out what the Risk Weighting on currency swaps is for banks. The answer is “it’s complicated”. Banks have internal models that create different numbers depending on the assumptions input by each bank. This is not just the Value at Risk (VaR) in the trade, but a Credit Valuation Adjustment (CVA) specific to the Counterparty Credit Risk (CCR) for the Exposure at Default (EaD). Banking regulators do love their Three Letter Abbreviations (TLAs)!

Overall, the story seems to be that regulators are trying to discourage systemically important clearing banks from doing too many risky trading activities. Strictly speaking, it’s not regulatory arbitrage, because this is the outcome that regulators are looking for. The new landscape has created an opportunity for the likes of Alpha, Equals and Argentex who don’t lend money but just execute currency swaps on behalf of clients. If that analysis is correct, then these could be much larger businesses in 5 years’ time. There are risks though, a couple of years ago ALPH had a Norwegian client with an unpaid margin totalling £30.2m, which was eventually repaid in weekly instalments to June last year. Izzy Kaminska (ex FT Alphaville, now The Blind Spot) has a theory that FinTechs like Wise, Monzo and Klarna are benefitting from higher interest rates because they are using their treasury departments as a profit centre. So perhaps some of that is also going on too, just because they don’t make loans, doesn’t mean that there aren’t other risks.

Below I’ve used Sharepad’s compare tool, to evaluate the sector. Interestingly the ranking algorithm prefers the larger companies, WISE and ALPH despite the fact that they are trading on more ambitious valuations.

Normally I would expect the smaller companies to trade at a premium, partly because they are more likely to be take-over candidates if we see consolidation. However, this could be an industry where there are increasing returns of scale, so the bigger companies report higher margins? It’s a fascinating sector and there’s more background here in an article I wrote for MoneyWeek in October last year.

Unrelated to forex capital controls, but with a related name, I finish up with a look at Capital Drilling, which hires out gold mining rigs in Africa.

Equals FY Dec Trading Update

This SME forex and payments company last updated the market with a strong 11-month trading update in early December. Last week they announced revenue for the FY to Dec would be £69.7m +59%. Adj EBITDA is expected to be just above £12m (v £11m on Sharepad’s forecast tab, though it’s not clear if the adjustments are the same.) EQLS has approximately £15m of cash at the end of Dec, an increase of +15% versus Dec 2021.

These were very strong results, but it does look like a considerable slowdown to ‘just’ +35% in the final month of the year. Management say “H2-22 included a period of pronounced GBP volatility in September which moved some customers to transact in Q3-22 rather than Q4-22 but these effects smooth out over the six-month period.” That is some clients did a lot of business in Sept/Oct when the were was volatility from Truss/Kwarteng mini-budget, which pulled forward business from December. That seems a reasonable explanation. Sharepad has revenue growth slowing to +18% FY 2023F and +19% FY 2024F.

Wise: The £6bn market cap forex currency FinTech also released a trading update FY Mar 2023F on the same day. They raised FY23 total income growth guidance to a range of +68 to +72% (versus +55 to +60% previously). Wise predominantly targets retail customers, they had 5.8m customers transacting up +33% y-o-y, whereas Equals serves SMEs, there is some risk that Wise decides to gain market share with business customers, which would be a risk for EQLS, ALPH and AGFX.

Valuation: Sharepad shows EQLS trading on 19.5x 2023F with the 2024F yet to be updated at the time of writing. That’s not cheap in this environment, but the firm does seem to be able to deliver top-line growth and operational gearing uncorrelated with the general market. The historic RoCE and EBIT margin is unimpressive (-7% and -13% respectively, last 3 years’ average), but the business now seems to be on a sustainable footing so that should improve in future. For comparison ALPH and AGFX both report 3-year average RoCE between 25%-33% (AGFX has higher RoCE, but ALPH has higher EBIT margins of 40%).

Opinion: 2022 was a positive year for EQLS, but also competitors AGFX and ALPH who all seem to be taking market share from high street banks. 2023F revenue is forecast to slow to 15-30% for the sector. The banks don’t seem to be able to respond. That implies that mid-teens growth is sustainable into the medium term, so unless I’m missing something this seems to be an attractive investment case. I own AGFX, but I can see EQLS or ALPH (see below) might also make sense.

Alpha Group FY Dec Trading Update

Alpha Group, which is in the same sector as Equals but c. 5x larger, also reported a trading update for FY December. FY revenue is expected to be up +27%, to approximately £98m. Operating PBT is in line with expectations, but statutory PBT is ahead, because they are earning a higher rate of interest on the cash they hold. They say higher interest rates contributed £9m of PBT in the last 4 months of the year, or £27m annualised. That comes from client balances (a figure they don’t give) and their own cash balances of £98m in H1 June. I think management would be well-advised to explain what they are doing to generate such a high return on cash, otherwise, investors will fret about hidden risks.

They say that if operating PBT (which excludes interest) exceeds expectations for 2023F, currently, £45m implying +16% growth according to Sharepad, then they will bring forward marketing spend. This is designed to accelerate growth, without becoming embedded in the cost base. However, it does sound like we won’t see raised guidance this year. That makes sense to me. I’d rather see the management of a high RoCE business investing in the future than ‘harvesting’ returns. ALPH has reported a 30% RoCE and an EBIT margin of 44% – this is the sort of business where management should be investing!

Alpha is split into two divisions. Risk Management, which comprises two-thirds of revenue, helps SMEs manage their currency volatility. This arm generates income from the spread in spot or futures-market transactions, and the average revenue per client is £66,000. Interestingly management say that revenue per client increases in the first three years that they take on new clients, as the grow ‘wallet share’ of existing clients. They are going to open an office in Madrid later this year, to enhance growth in Spanish-speaking markets.

The second division, Alternative Banking Solutions, a third of revenue, is for firms wanting to manage high-volume but smaller payments and to open local currency accounts. Alpha FX charges an annual fee, as well as margins on spot trades, and revenue per client, is about £9,000. It is an investment in ABS that management are going to prioritise. ABS saw a record month in December, for both new accounts and revenue.

Valuation: The shares are trading on 25x PER 2023F (again no 2024F as of the time of writing). The shares are also on 6x 2023F turnover. It’s interesting that price/turnover has de-rated from above 10x, even as turnover has grown very strongly in the last couple of years.

Opinion: I like that management are investing in growing the business, even with the short-term hit to margins and PBT. However, I’m a little nervous about £27m of annualised interest income from client balances, that’s more than half of the PBT forecast in 2022F. Management do say that some of the benefits comes from macroeconomic conditions beyond their control, so presumably, investors should not put a high multiple on that earnings stream. There are a couple of interviews on YouTube, with the Founder/CEO, Morgan Tillbrook, who comes across well and still own 16% of the shares – but the most recent is H1 2021. I’d like to see this issue clarified in FY 2022 investor presentation.

Capital Ltd FY Dec Trading Update

This African gold mining support services company, that was Mark Simpson’s pick for this year, announced a Q4/FY Dec Trading Update. I also own the shares. FY revenue was up +28% to $290m, which was the top end of the increased guidance range ($280-$290m v $270-$280m guided in H1). Pleasingly Q4 revenue v Q4 last year was up +19% to $79m. There’s no mention of PBT in the RNS, but there wasn’t in last year’s FY trading update either.

Outlook: The drilling business (72% of revenue) has a strong outlook for 2023 according to management. Their MSALABs (28% of revenue) also is seeing strong demand. This is an assay business, which tests for the quality and proportions of precious metals in ore. The price of gold has risen +16% to around $1,900 an ounce, so this bodes well for gold miners like Barrick and B2Gold, who are large customers of CAPD. Revenue and CAPEX guidance will be announced on 16th March when they report FY results.

Valuation: The shares are trading on 7x 2023F and 2024F PER. Return on Capital Employed is an impressive 22%, for a company on a such low PER rating. One concern is that CAPEX of $42m FY Dec 2020 and $46m FY Dec 2021 has been higher from net cash generated from operations, hence net cash from investing has outpaced cash generated in the last two years. Below is a long-term chart showing CAPEX v depreciation.

Hence the disconnect between RoCE and CashRoCI -7.7% and rising net debt ($36m at H1). I think that this is a timing difference, however, it is worth keeping an eye on and probably explains the low valuation as investors (rightly) prefer to focus on cash versus accounting profits.

Investments: Also worth noting that CAPD management often take equity stakes in their gold mining customers, which gives an adjusted net cash (ie including investments marked to market of $11m at H1). As of the end of December, the value of their investments (listed and unlisted) has fallen to $39m v $60m at the end of Dec 2021), partly because they were a net seller and partly because gold mining shares have fallen in value.

Opinion: Mining rigs in Africa and the current poor cash generation may be beyond some readers’ risk appetite, so please do your own thinking. However, I like it and CAPD strikes me as an interesting way of having some exposure to the gold price, without buying a gold mining company. Sharepad has the price of gold in US dollars, but below is a log chart showing the price of gold in GBP per ounce is up almost 8x in the last 20 years. I’d imagine that was a similar level to the 1970s when capital controls were in place.

Notes

The author owns shares in Argentex and Capital Group.

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.