Bruce looks at recent trends in the IPO market and questions whether attracting new listings at any price really is good news for investors in London’s equity capital markets. Companies covered W7L, FDEV and VNET.

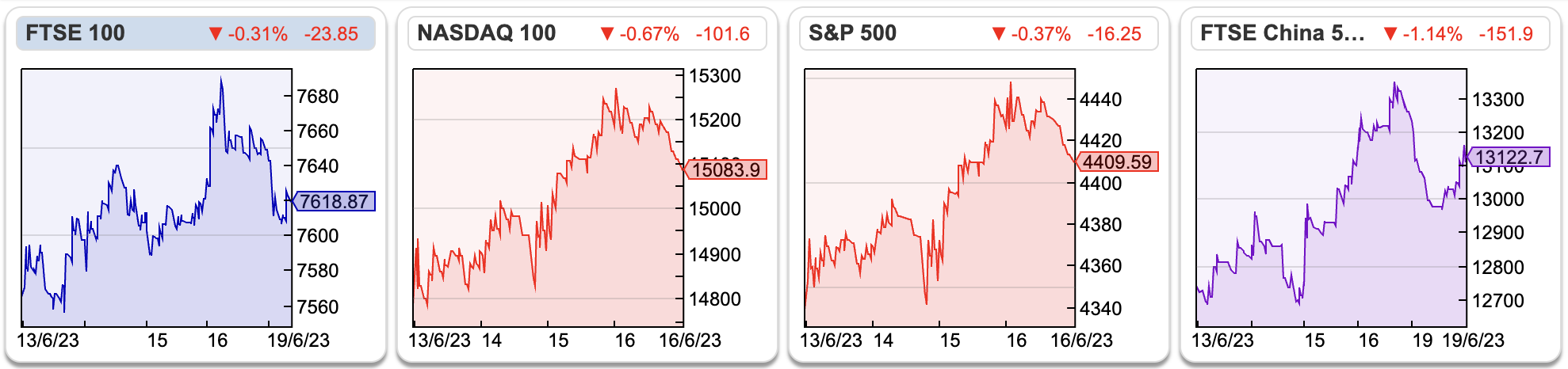

The FTSE 100 was up +0.5% to 7,618 over the last 5 days. The Nasdaq100 and S&P500 were up +3.8% and +2.6% respectively. At 4.44% the UK 10Y Govt bond yield has now risen back to the level of the Truss/Kwarteng mini-budget last October, however, sterling has risen +24% since then to 1.28 GBPUSD. For comparison, the US 10Y Govt bond is currently below 3.8%, versus 4.2% peak last October.

The FTSE 100 was up +0.5% to 7,618 over the last 5 days. The Nasdaq100 and S&P500 were up +3.8% and +2.6% respectively. At 4.44% the UK 10Y Govt bond yield has now risen back to the level of the Truss/Kwarteng mini-budget last October, however, sterling has risen +24% since then to 1.28 GBPUSD. For comparison, the US 10Y Govt bond is currently below 3.8%, versus 4.2% peak last October.

The FT reported that WE SodaAsh had cancelled its proposed IPO, which the newspaper (plus the Daily Mail, Evening Standard and Bloomberg) described as another “fresh blow” to London equity capital markets. I’m confident that even if the Turkish company had listed, then the shares performed badly in the secondary market, the newspapers would have enjoyed describing that as yet another fresh blow. One wonders how many “fresh blows” journalists can write about until they become “stale blows”.

There’s a much better write-up on the FT’s Alphaville site, by a former Equity Capital Markets banker who understands what he is writing about.

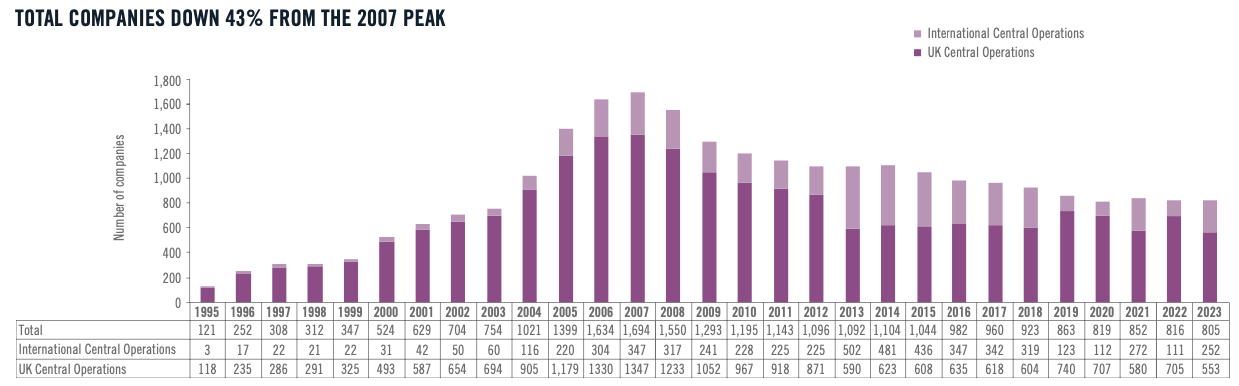

Allenby have published their monthly AIM market update, looking at the trend of fundraisings, IPOs, trading volumes etc using data from the London Stock Exchange. It doesn’t say much for the LSE that their website is so hard to navigate that we need a broker to put the data in a digestible format. Well done to Allenby for doing this though.

Currently, there are 807 companies listed on AIM with an average market cap of £114m. That is down -43% from its 2007 peak when there were almost 1,700 companies listed on AIM. 7 companies have joined AIM so far in 2023, offset by 18 departures. Just £39m has been raised through those 7 admissions, giving an average raise of £5.6m, significantly below the £42m average raise in 2021. If we exclude Onward Opportunities, which is a closed-end fund, that £39m figure falls by a third to £26m.

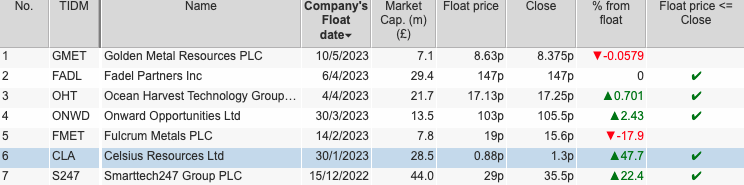

I am keeping track of them with my “Recent IPO’s versus current prices” filter. Interestingly three of them (Golden Metals, Fulcrum and Celsius) are mining companies.

According to Sharepad, the Industrial Metals and Mining Sector (Celsius, Fulcrum) contains 76 companies, or 9% of AIM also by number. Golden Metal, the most recent precious metals IPO, came to market in May after Allenby’s report cut-off date at the end. The Basic Resources sector on AIM has had a difficult 3 years, so I’m surprised that there is still investor appetite for mining companies.

This week I look at Warpaint’s encouraging Q2 update, Frontier Developments FY May trading update and Vianet’s FY March results.

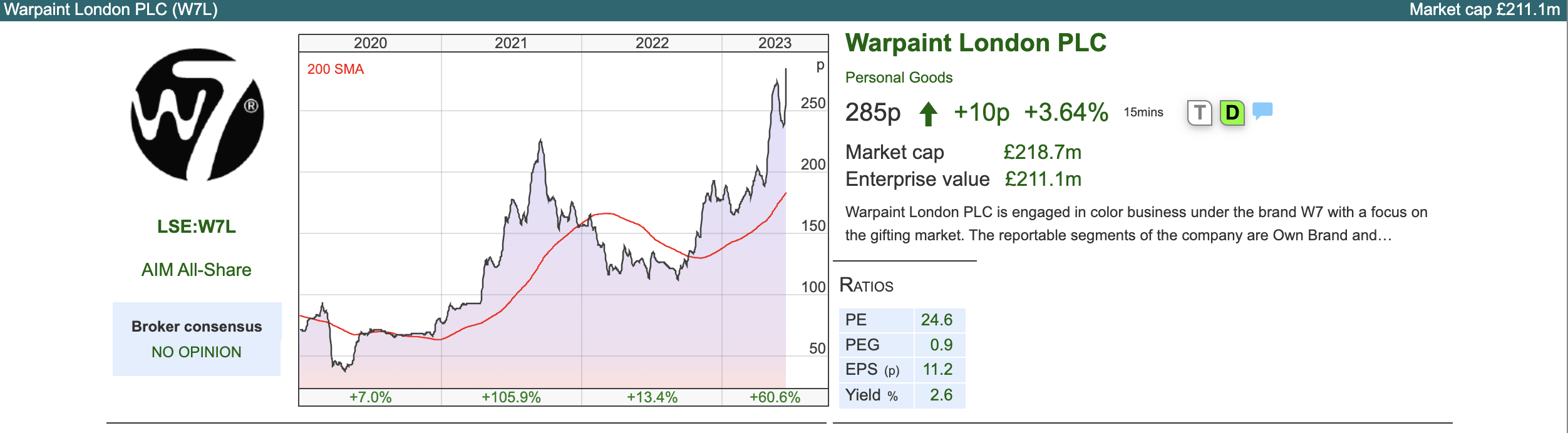

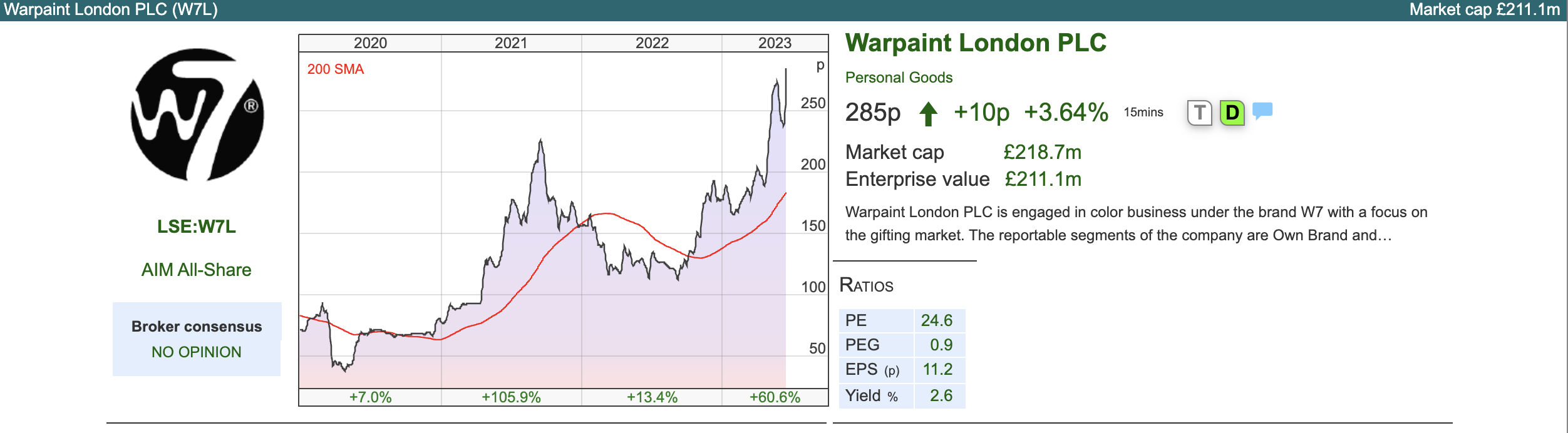

Warpaint London Q2 trading update

The Chief Exec of this affordable cosmetics brand with a Dec year end presented his Q1 update at Mello in May. It’s encouraging that last week’s RNS says trading has continued to be strong in Q2 and “2023 performance will be significantly ahead of its prior expectations”.

W7L’s positive RNS supports my theory that David has had trouble persuading management to physically look investors in the eye when presenting because there is currently a high level of uncertainty about the next 6-12 months.

Companies that David did persuade to present to investors either have i) a Chief Exec who is overconfident or needs to raise ii) are enjoying strong underlying momentum. Last week’s statement confirms W7L is the latter. Might other companies that presented at Mello be worth a closer look? For my part, I was impressed with Belvoir, who Maynard has just written up here. I also saw: Thruvision, Manolete, checkit, Inspiration Healthcare Group and NextEnergy Solar Fund (which reported this Monday), there’s a full list here. I can’t think of a Chief Exec who came across badly so have made a mental note to revisit these over the coming months.

Back to Warpaint London. The company has its roots in the early 1990’s when Sam Bazini (current Chief Exec) and Eoin Macleod (current Managing Director) sold excess cosmetics inventory from a small warehouse unit in Staines. Since then they developed their own flagship brand W7, of on-trend, short lead time product. This means that they look at what more expensive brands are promoting, and follow on with similar, more affordable product with eye-catching designs 3-6 months later. The company’s brands are below.

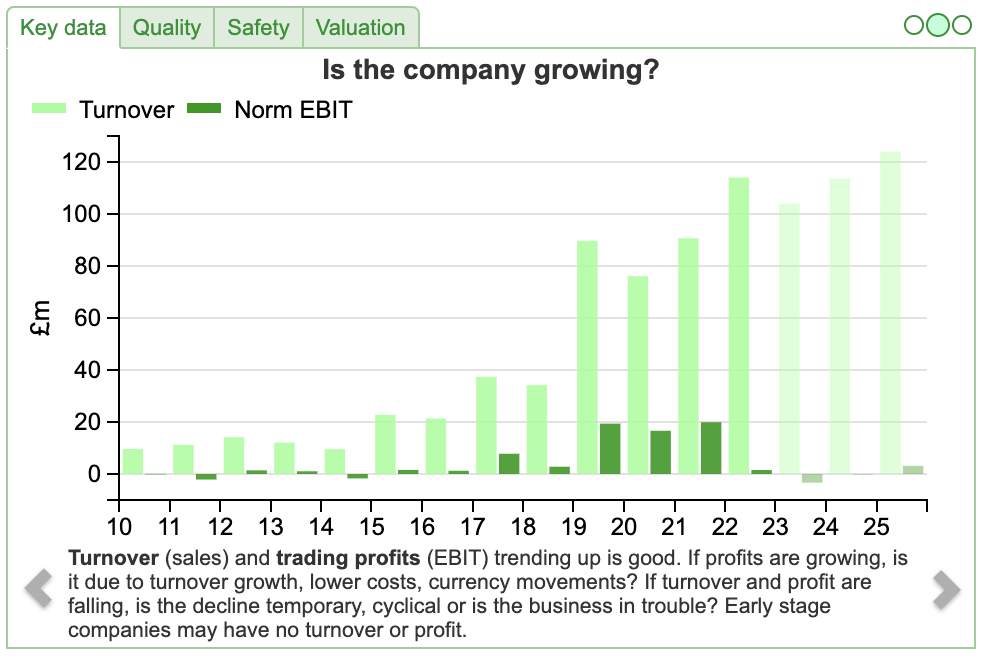

W7L raised £23m in a 2016 IPO, at 97p per share, valuing the company at £62m. The Chief Exec and MD both currently still own just over 25% of the shares. There was a nasty profit warning in October 2018, following the acquisition of Retra for £16m in November 2017. If you use Sharepad to look at the historic figures, FY Dec 2018 of £48.5m shows +49% of growth on the previous year. However, that includes the acquisition of Retra which generated sales of £19m and PBT of £1.8m. Management didn’t share an organic growth rate in their FY Dec 2018 results, but assuming flat sales at Retra, then W7L’s organic sales declined -7%. Maynard wrote it up in more detail here.

Valuation: Shore Capital are the broker, and they have raised EPS by +19% for FY Dec 2023F and +17% for FY Dec 2024. That puts the shares on a PER of 17x 2024F, or 2.3x sales the same year.

Opinion: Momentum is strong with W7L, so if I held then I would continue to do so. Well done to holders, particularly if you bought below 50p during the pandemic sell-off in H1 2020. I’m wary about opening a new position because I don’t think that this is “recession proof” and we could see disappointing organic sales again. In 2018 the company blamed BREXIT anxiety (a one-off) and a high street slow-down (part of the economic cycle) for their profit warning. I think that this is likely to be “late cycle”, and might hold up better than more interest rate-sensitive shares, but if the recession has merely been postponed then I would be cautious.

Frontier Developments FY May Results

This Cambridge-based computer games developer released an “inline” FY May trading update. In January, they gave a wide range for FY May 2023F revenue expectations: not less than £100m, but could beat previous year’s £114m, depending on whether their titles would be a conspicuous success in early 2023. That underlines the “Hollywood economics” nature of the computer games industry – most games lose money, but the ones that capture people’s imagination do disproportionately well.

Last week they updated this guidance, saying FY May 2023F revenue should be £104m (ie bottom half of the range), and adj EBITDA loss of £5m. For FY May 2024F they have guided to £108m adj EBITDA loss in the range of £5-10 million.

Foundry publishing label closed: Historically the computer games sector has been split between development studios (who make the games) and publishers (who fund the development, and whose expertise is marketing and distribution, Devolver Digital and tinyBuild are AIM listed examples). FDEV is a development studio, but they are large enough to self-publish their own games. They thought that could be an opportunity, so a few years ago they created their own third-party publishing label: Frontier Foundry. Publishing tends to be a lower gross margin because royalties are paid to the developers (DEVO’s gross margin is 35-40% versus FDEV’s 63%). It looks like the 8 Foundry titles released in 2022 and 2023 have been disappointing because in January they announced a review. This has concluded with last week’s RNS when they have stopped all third-party publishing and refocus on internally developed titles. They expect to take a £13m charge for the cost of closing this. In FY May 2015, FDEV recorded a gross margin above 90%, so we may see the shape of the p&l improve from that perspective, though obviously revenue will be lower than it otherwise would have been if Foundry had continued.

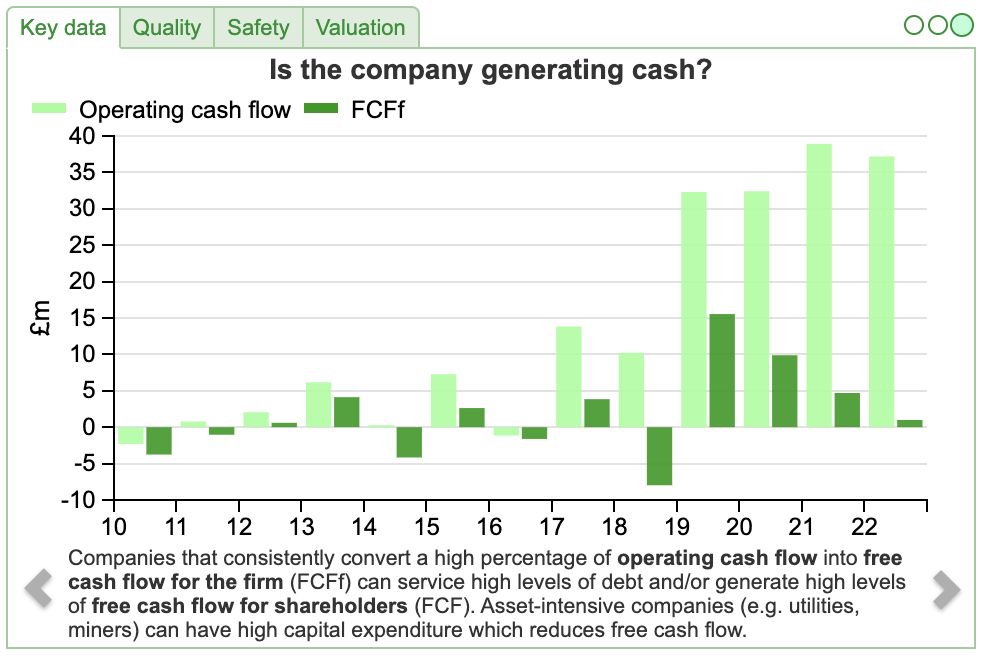

Cash: Computer games companies can add the cost of developing games to their balance sheet, as an intangible asset (£79m in the case of FDEV Nov 2022), then amortise over the life of the game. Last year FDEV’s cash from operations was £37m, but they spent £36m on intangible assets FY May 2022, which was captured as a cash outflow from investing. Management point investors towards adj EBITDA, £6.7m FY May 2022 versus £5m loss this year and £5-£10m loss next FY May 2024F expected.

NB Under management’s definition, the “A” in the EBITDA calculation does not include the amortisation charge related to developing computer games, but the cash investment in the games is deducted from the metric. Hence for FDEV, this number is closer to “cash” than many companies that tout adj EBITDA as a proxy for cash.

NB Under management’s definition, the “A” in the EBITDA calculation does not include the amortisation charge related to developing computer games, but the cash investment in the games is deducted from the metric. Hence for FDEV, this number is closer to “cash” than many companies that tout adj EBITDA as a proxy for cash.

The company has £28m of net cash at the end of May (falling from £42m Nov 2022, £39m May 2022). £11m of fall in cash was due to the acquisition of Complex Games Inc. The two companies had already collaborated to release Warhammer 40,000: Chaos Gate – Daemonhunters. I think that it’s likely management can fund losses for a few years without having to ask shareholders for more money. It’s also worth bearing in mind that although releases can be hit or miss, the backbook of games released in previous years contributed 72% of group revenue. That does provide some stability.

Valuation: The shares are trading on 2x revenues. Sharepad shows that revenue progression over the last decade has not been smooth, with declines in 2014, 2016, 2018 and this year. But overall since 2013 revenues have increased 9x.

Opinion: I bought the shares near this year’s lows, following the profit warning at the beginning of the year. My view is that FDEV is a good company, going through a difficult patch. Computer game companies have struggled following the pandemic when even hardcore gamers decided being out in the fresh air and sunshine was more fun than playing computer games indoors. Many good companies go through difficult times, but I think FDEV should rebound from a couple of loss-making years and continue to hold.

Vianet FY March Results

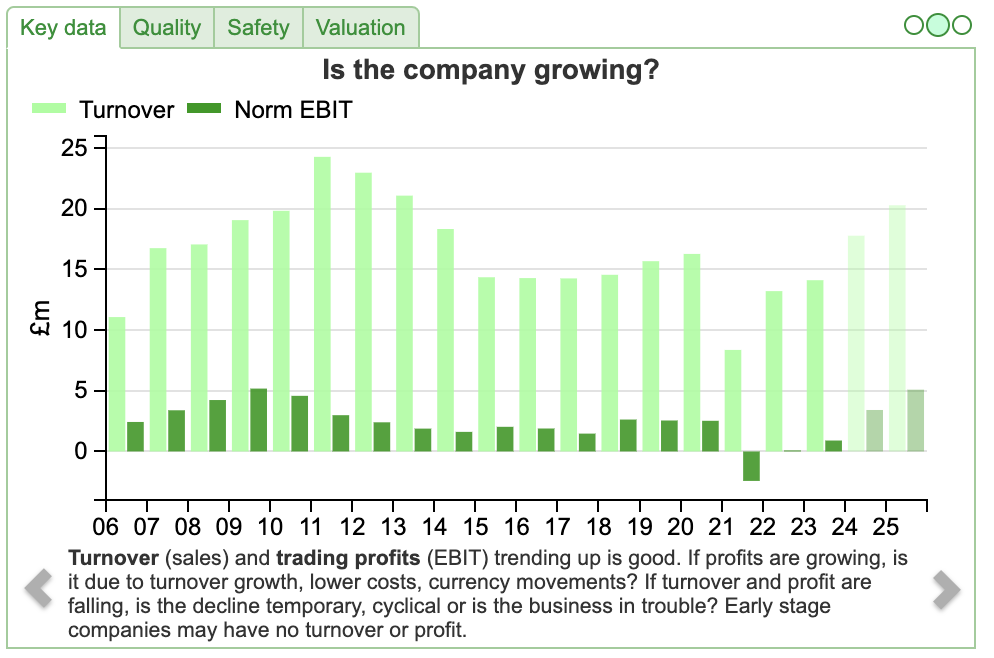

Revenues at this UK data company were up +14% to £14m, and the business returned to a small profit of £45K. Net debt rose +10% to £3.3m. Having cancelled their dividend over the pandemic, they have now reinstated it, paying 0.5p (as the final dividend) for FY March 2023.

Revenues at this UK data company were up +14% to £14m, and the business returned to a small profit of £45K. Net debt rose +10% to £3.3m. Having cancelled their dividend over the pandemic, they have now reinstated it, paying 0.5p (as the final dividend) for FY March 2023.

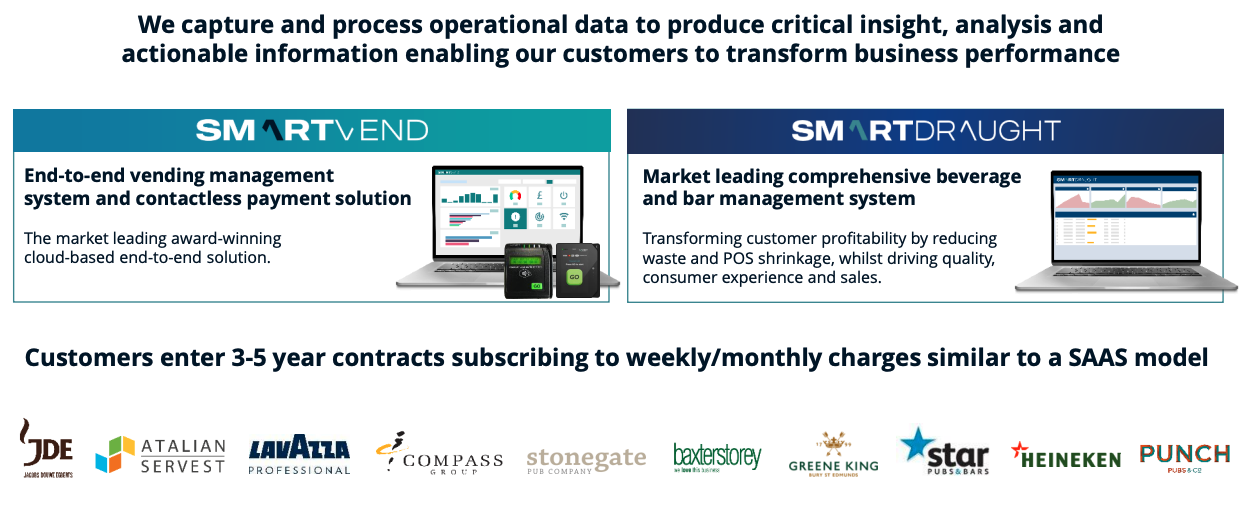

The business consists of two divisions i) Smart Machines, revenue rising +11% to £6m, adj PBT margin of 10%, this does cashless payments for vending machines, via the SmartVend brand ii) Smart Zones, revenues rising +4% to £8m, op PBT margin 46%, this does a point of sale data capture system for pubs and restaurants, via the SmartDraft brand. The latter obviously had a difficult pandemic, FY Mar 2019 Smart Zones reported revenues of £11m, and op PBT margin of 41%.

US acquisition: In mid-May, they announced that they had bought the trade assets of a US business, for £577K, payable in VNET shares (priced at 82.5p). Management point out that there are 382K premises in the USA (bars, restaurants, hotel and entertainment venues), versus 50K in the UK, so a huge Total Addressable Market, which they are looking to make gains in. This business is currently losing £600K a year, but management seem confident that if they grow the topline, then the profits will follow.

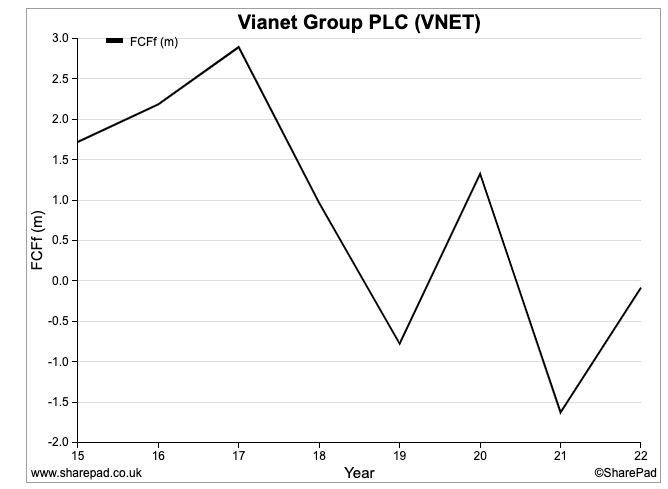

Cashflow: I’ve been in two minds about this stock, torn between seeing the shares as a recovery play with an attractive 65% gross margin; but had concerns about the lack of cashflow (see below) and the net debt rising from below £1m pre-pandemic to £3.3m currently. Last week’s RNS showed net cash generation pre-working capital £4.5m helped by a tax rebate of £0.92m. The company also negotiated a new RCF with HSBC following the year-end, which is reassuring.

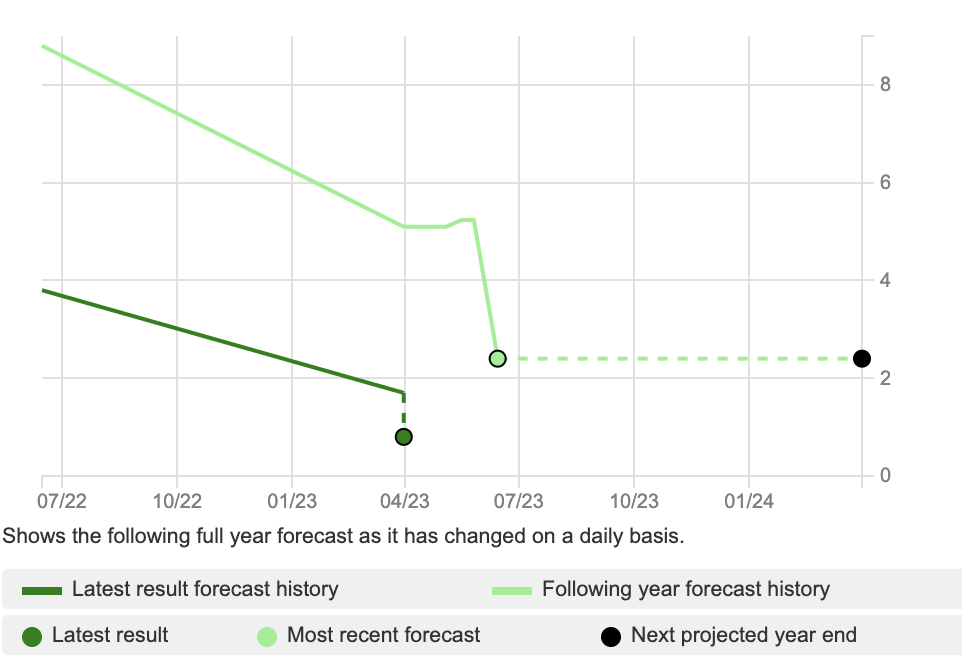

I haven’t seen any broker notes, but looking at Sharepad would suggest that they’ve been cutting estimates. That seems odd given the share price has rallied hard +55% in a bear market, so I imagine management have told a convincing story around investing for future growth.

Valuation: Having seen revenues halve over the pandemic, management now seem confident that they can deliver +26% organic growth forecast for FY Mar 2024F (or £17.6m in absolute terms) followed by +14% the following year. That implies a price to sales of 1.2x and a PER Mar 2025F of 13x.

Opinion: I’ve owned this since 2016, and held through the pandemic. I should have either sold in February 2020 at above 150p or bought more shares when the price troughed in October last year at 50p. If I had both sold early and bought it back 8 months ago, then I would have done very well indeed!

Opinion: I’ve owned this since 2016, and held through the pandemic. I should have either sold in February 2020 at above 150p or bought more shares when the price troughed in October last year at 50p. If I had both sold early and bought it back 8 months ago, then I would have done very well indeed!

I’ve now increased my position because having listened to management I think this has a lot of potential, and I’m also reassured by the cashflow. Similar to FDEV, declining revenues and lack of profits doesn’t automatically translate to a bad business. Even before the pandemic, pubs companies were shrinking their estates, as I wrote about last week, which has been a headwind for the Smart Zones division (which has fallen from 86% of revenue a couple of years before the pandemic to less than 60% currently). So many marginal pubs and restaurants have been closed down in the last few years; I find it hard to believe pub estates will continue to shrink. Conditions are not helpful, but they are probably past their worst.

Notes

The author owns shares in VNET and FDEV

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 20/06/23 | W7L, FDEV, VNET | Stale blows the London IPOs

Bruce looks at recent trends in the IPO market and questions whether attracting new listings at any price really is good news for investors in London’s equity capital markets. Companies covered W7L, FDEV and VNET.

The FT reported that WE SodaAsh had cancelled its proposed IPO, which the newspaper (plus the Daily Mail, Evening Standard and Bloomberg) described as another “fresh blow” to London equity capital markets. I’m confident that even if the Turkish company had listed, then the shares performed badly in the secondary market, the newspapers would have enjoyed describing that as yet another fresh blow. One wonders how many “fresh blows” journalists can write about until they become “stale blows”.

There’s a much better write-up on the FT’s Alphaville site, by a former Equity Capital Markets banker who understands what he is writing about.

Allenby have published their monthly AIM market update, looking at the trend of fundraisings, IPOs, trading volumes etc using data from the London Stock Exchange. It doesn’t say much for the LSE that their website is so hard to navigate that we need a broker to put the data in a digestible format. Well done to Allenby for doing this though.

Currently, there are 807 companies listed on AIM with an average market cap of £114m. That is down -43% from its 2007 peak when there were almost 1,700 companies listed on AIM. 7 companies have joined AIM so far in 2023, offset by 18 departures. Just £39m has been raised through those 7 admissions, giving an average raise of £5.6m, significantly below the £42m average raise in 2021. If we exclude Onward Opportunities, which is a closed-end fund, that £39m figure falls by a third to £26m.

I am keeping track of them with my “Recent IPO’s versus current prices” filter. Interestingly three of them (Golden Metals, Fulcrum and Celsius) are mining companies.

According to Sharepad, the Industrial Metals and Mining Sector (Celsius, Fulcrum) contains 76 companies, or 9% of AIM also by number. Golden Metal, the most recent precious metals IPO, came to market in May after Allenby’s report cut-off date at the end. The Basic Resources sector on AIM has had a difficult 3 years, so I’m surprised that there is still investor appetite for mining companies.

This week I look at Warpaint’s encouraging Q2 update, Frontier Developments FY May trading update and Vianet’s FY March results.

Warpaint London Q2 trading update

The Chief Exec of this affordable cosmetics brand with a Dec year end presented his Q1 update at Mello in May. It’s encouraging that last week’s RNS says trading has continued to be strong in Q2 and “2023 performance will be significantly ahead of its prior expectations”.

W7L’s positive RNS supports my theory that David has had trouble persuading management to physically look investors in the eye when presenting because there is currently a high level of uncertainty about the next 6-12 months.

Companies that David did persuade to present to investors either have i) a Chief Exec who is overconfident or needs to raise ii) are enjoying strong underlying momentum. Last week’s statement confirms W7L is the latter. Might other companies that presented at Mello be worth a closer look? For my part, I was impressed with Belvoir, who Maynard has just written up here. I also saw: Thruvision, Manolete, checkit, Inspiration Healthcare Group and NextEnergy Solar Fund (which reported this Monday), there’s a full list here. I can’t think of a Chief Exec who came across badly so have made a mental note to revisit these over the coming months.

Back to Warpaint London. The company has its roots in the early 1990’s when Sam Bazini (current Chief Exec) and Eoin Macleod (current Managing Director) sold excess cosmetics inventory from a small warehouse unit in Staines. Since then they developed their own flagship brand W7, of on-trend, short lead time product. This means that they look at what more expensive brands are promoting, and follow on with similar, more affordable product with eye-catching designs 3-6 months later. The company’s brands are below.

W7L raised £23m in a 2016 IPO, at 97p per share, valuing the company at £62m. The Chief Exec and MD both currently still own just over 25% of the shares. There was a nasty profit warning in October 2018, following the acquisition of Retra for £16m in November 2017. If you use Sharepad to look at the historic figures, FY Dec 2018 of £48.5m shows +49% of growth on the previous year. However, that includes the acquisition of Retra which generated sales of £19m and PBT of £1.8m. Management didn’t share an organic growth rate in their FY Dec 2018 results, but assuming flat sales at Retra, then W7L’s organic sales declined -7%. Maynard wrote it up in more detail here.

Valuation: Shore Capital are the broker, and they have raised EPS by +19% for FY Dec 2023F and +17% for FY Dec 2024. That puts the shares on a PER of 17x 2024F, or 2.3x sales the same year.

Opinion: Momentum is strong with W7L, so if I held then I would continue to do so. Well done to holders, particularly if you bought below 50p during the pandemic sell-off in H1 2020. I’m wary about opening a new position because I don’t think that this is “recession proof” and we could see disappointing organic sales again. In 2018 the company blamed BREXIT anxiety (a one-off) and a high street slow-down (part of the economic cycle) for their profit warning. I think that this is likely to be “late cycle”, and might hold up better than more interest rate-sensitive shares, but if the recession has merely been postponed then I would be cautious.

Frontier Developments FY May Results

This Cambridge-based computer games developer released an “inline” FY May trading update. In January, they gave a wide range for FY May 2023F revenue expectations: not less than £100m, but could beat previous year’s £114m, depending on whether their titles would be a conspicuous success in early 2023. That underlines the “Hollywood economics” nature of the computer games industry – most games lose money, but the ones that capture people’s imagination do disproportionately well.

Last week they updated this guidance, saying FY May 2023F revenue should be £104m (ie bottom half of the range), and adj EBITDA loss of £5m. For FY May 2024F they have guided to £108m adj EBITDA loss in the range of £5-10 million.

Foundry publishing label closed: Historically the computer games sector has been split between development studios (who make the games) and publishers (who fund the development, and whose expertise is marketing and distribution, Devolver Digital and tinyBuild are AIM listed examples). FDEV is a development studio, but they are large enough to self-publish their own games. They thought that could be an opportunity, so a few years ago they created their own third-party publishing label: Frontier Foundry. Publishing tends to be a lower gross margin because royalties are paid to the developers (DEVO’s gross margin is 35-40% versus FDEV’s 63%). It looks like the 8 Foundry titles released in 2022 and 2023 have been disappointing because in January they announced a review. This has concluded with last week’s RNS when they have stopped all third-party publishing and refocus on internally developed titles. They expect to take a £13m charge for the cost of closing this. In FY May 2015, FDEV recorded a gross margin above 90%, so we may see the shape of the p&l improve from that perspective, though obviously revenue will be lower than it otherwise would have been if Foundry had continued.

Cash: Computer games companies can add the cost of developing games to their balance sheet, as an intangible asset (£79m in the case of FDEV Nov 2022), then amortise over the life of the game. Last year FDEV’s cash from operations was £37m, but they spent £36m on intangible assets FY May 2022, which was captured as a cash outflow from investing. Management point investors towards adj EBITDA, £6.7m FY May 2022 versus £5m loss this year and £5-£10m loss next FY May 2024F expected.

The company has £28m of net cash at the end of May (falling from £42m Nov 2022, £39m May 2022). £11m of fall in cash was due to the acquisition of Complex Games Inc. The two companies had already collaborated to release Warhammer 40,000: Chaos Gate – Daemonhunters. I think that it’s likely management can fund losses for a few years without having to ask shareholders for more money. It’s also worth bearing in mind that although releases can be hit or miss, the backbook of games released in previous years contributed 72% of group revenue. That does provide some stability.

Valuation: The shares are trading on 2x revenues. Sharepad shows that revenue progression over the last decade has not been smooth, with declines in 2014, 2016, 2018 and this year. But overall since 2013 revenues have increased 9x.

Opinion: I bought the shares near this year’s lows, following the profit warning at the beginning of the year. My view is that FDEV is a good company, going through a difficult patch. Computer game companies have struggled following the pandemic when even hardcore gamers decided being out in the fresh air and sunshine was more fun than playing computer games indoors. Many good companies go through difficult times, but I think FDEV should rebound from a couple of loss-making years and continue to hold.

Vianet FY March Results

The business consists of two divisions i) Smart Machines, revenue rising +11% to £6m, adj PBT margin of 10%, this does cashless payments for vending machines, via the SmartVend brand ii) Smart Zones, revenues rising +4% to £8m, op PBT margin 46%, this does a point of sale data capture system for pubs and restaurants, via the SmartDraft brand. The latter obviously had a difficult pandemic, FY Mar 2019 Smart Zones reported revenues of £11m, and op PBT margin of 41%.

US acquisition: In mid-May, they announced that they had bought the trade assets of a US business, for £577K, payable in VNET shares (priced at 82.5p). Management point out that there are 382K premises in the USA (bars, restaurants, hotel and entertainment venues), versus 50K in the UK, so a huge Total Addressable Market, which they are looking to make gains in. This business is currently losing £600K a year, but management seem confident that if they grow the topline, then the profits will follow.

Cashflow: I’ve been in two minds about this stock, torn between seeing the shares as a recovery play with an attractive 65% gross margin; but had concerns about the lack of cashflow (see below) and the net debt rising from below £1m pre-pandemic to £3.3m currently. Last week’s RNS showed net cash generation pre-working capital £4.5m helped by a tax rebate of £0.92m. The company also negotiated a new RCF with HSBC following the year-end, which is reassuring.

I haven’t seen any broker notes, but looking at Sharepad would suggest that they’ve been cutting estimates. That seems odd given the share price has rallied hard +55% in a bear market, so I imagine management have told a convincing story around investing for future growth.

Valuation: Having seen revenues halve over the pandemic, management now seem confident that they can deliver +26% organic growth forecast for FY Mar 2024F (or £17.6m in absolute terms) followed by +14% the following year. That implies a price to sales of 1.2x and a PER Mar 2025F of 13x.

I’ve now increased my position because having listened to management I think this has a lot of potential, and I’m also reassured by the cashflow. Similar to FDEV, declining revenues and lack of profits doesn’t automatically translate to a bad business. Even before the pandemic, pubs companies were shrinking their estates, as I wrote about last week, which has been a headwind for the Smart Zones division (which has fallen from 86% of revenue a couple of years before the pandemic to less than 60% currently). So many marginal pubs and restaurants have been closed down in the last few years; I find it hard to believe pub estates will continue to shrink. Conditions are not helpful, but they are probably past their worst.

Notes

The author owns shares in VNET and FDEV

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.