Bruce looks at the influence double-digit inflation is having on bank deposits. Companies covered MONY, KMK and THRU.

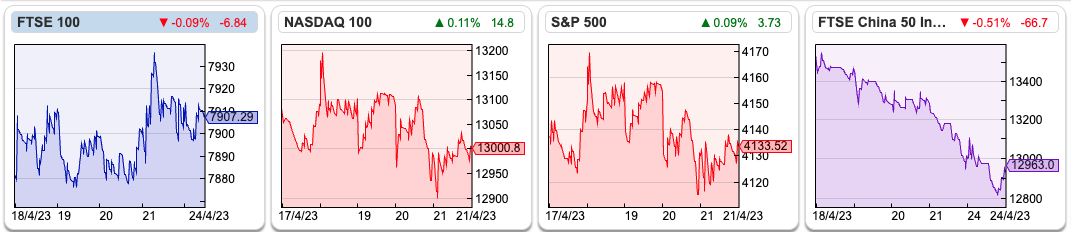

The FTSE 100 was up +0.4% to 7,907 over the last 5 days, while the Nasdaq 100 fell -0.6% and the S&P500 was flat. The Natural Gas contract (NG-MT) was up +31% in the last 5 days but is still down -36% YTD and the EU gas storage is half full which was an encouraging way to end the winter. The US 10Y bond yield was 3.54%, still well below its peak this year of almost 4% at the beginning of March.

UK inflation remained above +10%, though falling from +10.4% in February to +10.1% in March. For comparison in Germany, inflation was +7.8% and +6.6% in France in March. In the UK dairy products like milk +40%, cheddar cheese +49% and eggs were up +28%.

I’ve just come across Stephen King’s book We Need to Talk about Inflation. There’s also this Merryn Somerset Webb interview with James Ferguson from January, who suggests by June inflation should be falling sharply and Central Banks will declare inflation was transitory after all, only for those Central Bankers to be proved wrong (again!) later in 2023 or 2024 with another unexpected rise in prices.

Since the collapse of SVB, there has been too much focus on interest rates, in my view, when it is inflation that erodes the value of future cashflows. For instance, inflation (not higher interest rates) has caused savers to reassess whether keeping money in the banking system at a time of double-digit inflation continues to make sense. Credit Suisse Q1 results showed $69bn of deposit outflows this year. CS management had previously claimed that deposit outflows of c. $100bn in Q4 had “stabilised, but not reversed”. If $69bn of outflows was CS management’s definition of stable, no wonder the Swiss Central Bank panicked!

For comparison, the Federal Reserve’s H.8 indicator of US bank deposits showed $76bn of outflows in the week to 12th April. Since the start of the year US bank deposits have fallen by $629bn to $17.18 trillion, according to the same data table. Deposit outflows are likely to make banks more cautious about lending and tighter credit conditions which would then in turn reduce inflation (and interest rate expectations), acting as a natural stabiliser.

The FT says savers are also transferring deposits away from UK banks to better deals in cash and liquidity funds, so I contacted Hargreaves Lansdown Press Office. They confirmed that in March, 5 of their top 10 most popular funds were.

- ABDN Sterling Money Market Fund

- Fidelity Cash

- Legal & General Cash

- Royal London Short-Term Money Market

- Vanguard Sterling Short-Term Money Market

HL. wouldn’t give me the absolute numbers but said that they’d seen a staggering increase of 5,988% net flow into money market funds since the start of this year, albeit from a low base. There are likely similar trends at Interactive Investor and other platforms, while WISE is paying interest on customer balance by offering customers the BlackRock ICS Sterling Liquidity fund.

Harriet Baldwin MP on the Treasury Select Committee has asked the FCA what work the regulator has done to make sure banks pass on interest rate increases to their customers. The FCA has been thinking of demanding banks offer a Single Easy Access Rate (SEAR) intended to address concerns that banks charge a ‘loyalty penalty’ to customers who don’t switch accounts frequently. Instead, the FCA has decided to introduce a more nebulous “consumer duty” from 31st July, where banks have to provide fair value to their customers.

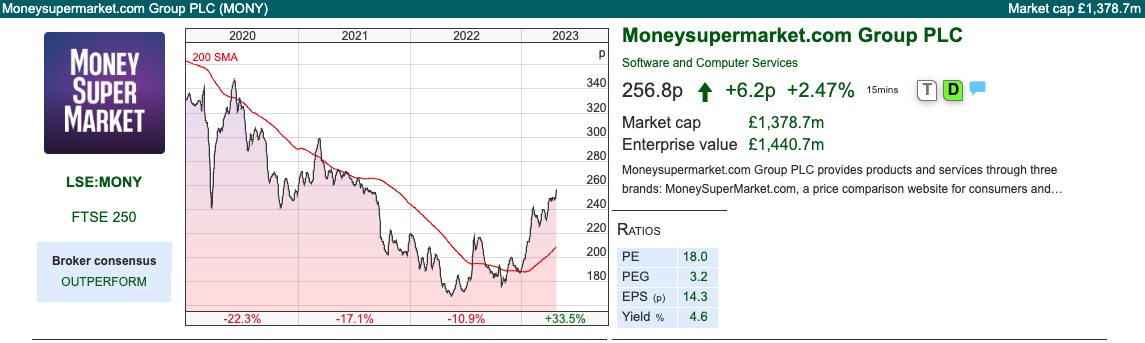

Below I look at Moneysupermarket, the numbers MONY reports are attractive, but I think there’s some regulatory risk if banks and insurers are forced to stop their “front book/back book” pricing strategy, and instead offer a fair deal to all customers. I also look at a couple of security detection businesses, Kromek and Thruvision. Both have a gross margin close to 50% and are seeing revenue growth of c. +50%. I don’t own either as they are loss-making but think they could be an interesting opportunity at some point.

Moneysupermarket Q1 March trading update

This price comparison website announced revenue growth up +15% to £106m in Q1 Mar 2023. That was driven by a strong recovery in insurance (just under half of group revenue) +23%. In Q1 last year the FCA introduced pricing regulations which forced insurance companies to offer the same price to loyal customers who were renewing their home or motor insurance, as new customers who were thinking of switching away from a competitor.

Banks do the same offering loyal customers a worse deal than people who are prepared to spend the time and effort switching. It’s called “front book” (new customers) versus “back book” pricing. The FCA has rightly tried to prevent this, but the response has had a negative effect on price comparison websites like MONY, and GoCompare (bought by FUTR).

Following the new rules, market switching volumes declined by double-digit rates in H1 2022, but competition for new customers has now increased. What seems to have happened is that claims inflation has led to insurance companies charging higher premiums, which in turn means more customers have been shopping around for better deals.

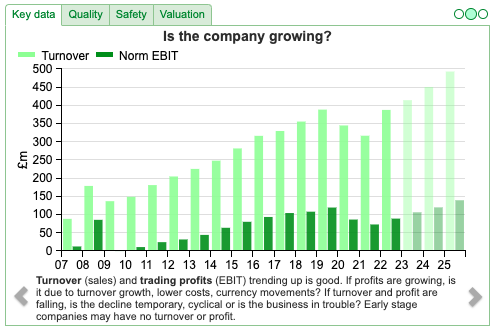

Even before the FCA changes, MONY revenues were under pressure, peaking at £388m in FY Dec 2019, then falling -18% in the following two years. That was caused by less shopping around for travel insurance and personal loans during the pandemic. Then last year high wholesale energy prices meant that there were no switchable deals being offered by utility companies from October 2021.

Outlook: conditions in the energy market mean it is unlikely that switching will return in 2023, however, MONY has said that they are still confident of meeting market expectations. The company has said that banks are now offering promotional offers, which has helped drive revenue in MONY’s Money division +9%.

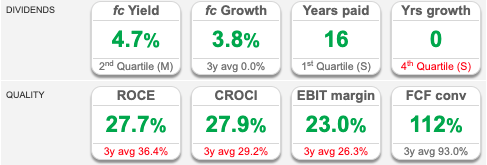

Valuation: Despite the falling revenue MONY has a 3-year average RoCE of 36% and a 3-year average EBIT margin of 26%, so the numbers are impressive. The shares trade on PER 15x Dec 2024F and 3.0x sales the same year. The dividend yield of 4.7% also looks attractive.

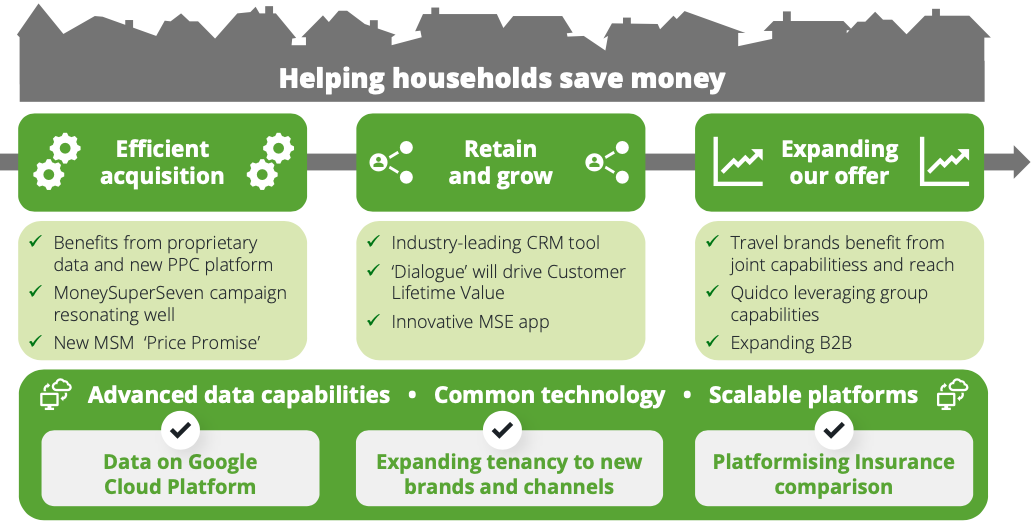

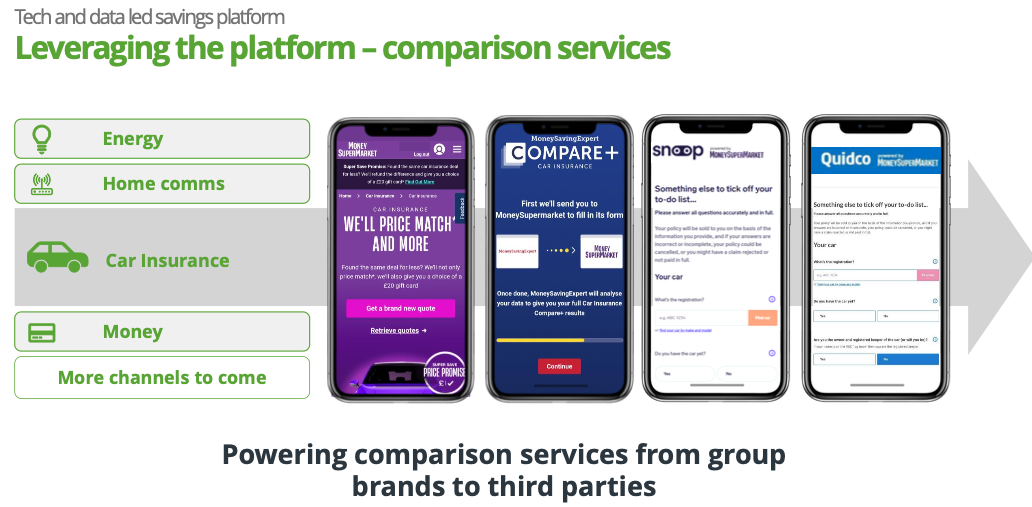

MONY investor presentation tries to position the investment case as a tech and data platform, implying operational gearing, network effects and a high valuation!

Opinion: Moneysupermarket believes it has saved customers £1.8bn across the group while receiving revenue per active user of £16.40. A few years ago Richard analysed MONY here, both of us dislike the idea we should spend our valuable time like hamsters endlessly scurrying around a wheel looking for cheaper alternatives for broadband, energy suppliers, personal loans and car insurance. That may seem odd, given we do spend our time reading company Annual Reports and using Sharepad to analyse the investment case on equities. But I think there’s something intrinsically satisfying about investing. Buffett could have retired years ago, but he enjoys the process. I would imagine he doesn’t spend much time on his utility bill and has been a loyal insurance customer of GEICO customer for decades.

So I prefer to trust brands like WISE or HL. to offer me a fair price that they can still make a decent margin on. I nearly bought MONY last year, but was put off by these qualitative concerns rather than the numbers. Then in October last year, Amazon suggested that they will enter the price comparison arena, which also put me off.

Kromek Q3 trading update

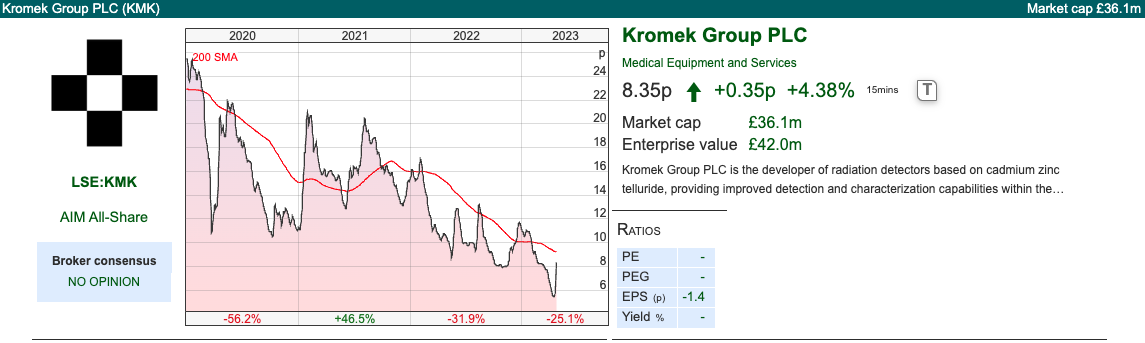

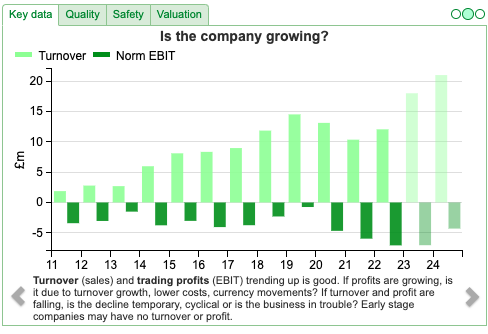

This radiation (gamma ray) detection business was originally a Durham University academic commercialisation spin-out (similar to IP Group’s investment portfolio which I wrote about here). KMK has been a “jam tomorrow” story since listing a decade ago. However, the shares were up +55% last week as they said Q3 revenues would be c. +50% ahead of Q3 last year. They are also experiencing improvements in the gross margin (expecting high 40% gm) and to be EBITDA positive in H2 2023. The company has an April year-end and believes it will be cash neutral in H2.

Their technology has three end markets: i) medical imaging, ii) nuclear detection, iii) security screening and they have manufacturing facilities in the UK and US.

The day after their Q3 update, they also announced a collaboration with Analogic Corp, based in Massachusetts, USA which is a leader in Computer Tomography. Analogic has installed 60,000 CT scan systems over the last 4 decades. finnCap, KMK’s broker, described this as ‘game changing’ as CT market is forecast to grow to $10bn a year by 2030. CT scans are medical imaging technology where radiology is used to create three-dimensional images, it is used for breast cancer and Alzheimer’s detection for example.

The company also has a hand-held radioisotope identification kit. That should be useful for defence and security applications.

History: The company was founded in 2003, to commercialise Cadmium Zinc Telluride (CZT) technology, that had been developed over the previous 20 years of research in Durham University’s physics department. Kromek listed on AIM at 51p per share in Oct 2013, raising £15m, and valuing the company at a market cap of £55m. Since then revenue has grown by roughly 7x to £18m forecast for FY April 2023F. However, they’ve never made a profit so losses have been funded by issuing more shares, the share count has increased by 4x to 432m over the last decade.

In January this year, KMK announced that they had received funding from the government’s Innovate UK fund, for two projects worth collectively £2.5m. In January they also released their H1 to October results, with revenue up +44% to £7m and a gross margin of 40%. However, cash had decreased by £4.1m over the previous six months leaving just £1m at the end of October. It seems likely that we will see another fundraising.

Shareholders: This looks like a retail investor favourite with Interactive Investors and Hargreaves Lansdown, Canaccord and Halifax Share Dealing the largest four shareholders (cumulatively 38% of the share base). Very little institutional backing, but Katy Pott’s Herald IT does own 4.4%.

Valuation: FinnCap, their broker, is forecasting losses this year and next. The shares are trading on 2.0x Mar 2023F revenue, following last week’s spike in the share price. That doesn’t seem a bargain, particularly in this market.

Opinion: One of my friends who is a shrewd (and wealthy) investor tipped this to me a few years ago. At the time I felt it was too speculative, but would see how progress developed. Fast forward a few years and they are further down the path to profitability, but not there yet. Over £130m has been invested since the company was founded, yet the market cap is now just £30m. A ‘story stock’ but worth keeping an eye on, in my view.

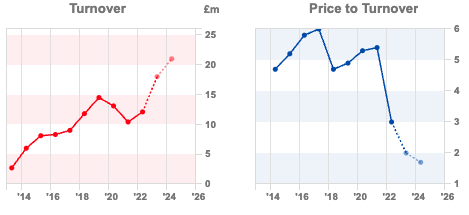

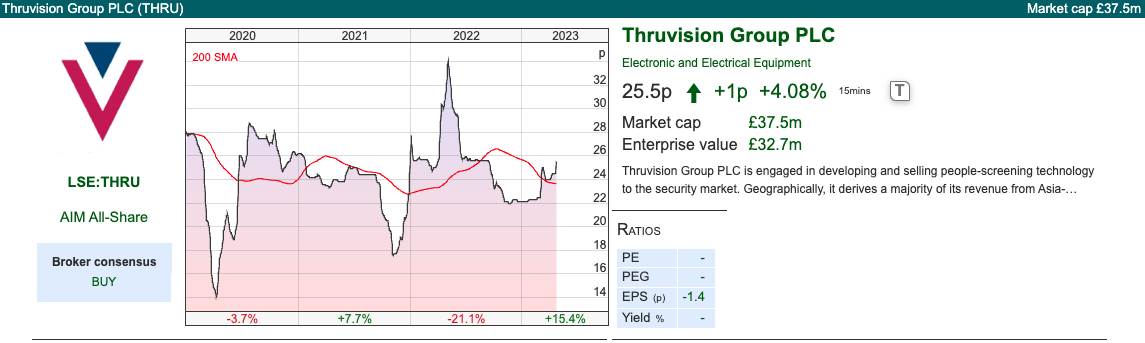

Thruvision FY March trading update

This ‘walk through security’ technology company was flagged by investor Leo, who highlighted some similarities with Wey Education, which was a 5-bagger for me. Thruvision’s security scanners are used in more than 20 countries around the world by governments and corporates and can detect concealed objects in real time. One use case is that employees who work at warehouses for Amazon or other retailers are scanned when they leave work to make sure that they haven’t pilfered any high-value items. The company has changed the name of this division from ‘Profit Protection’ to ‘Retail Distribution’. There’s a demonstration and company presentation on Progressive Research’s website.

Last Friday THRU announced revenues +48% to £12m for their FY to March. The company is just below break even on an Adj EBITDA level and they had £2.8m of cash at the end of March. They have 3 divisions: i) Customs which has two contracts with US Customs and Border Protection (CBP) worth £9m (58% of revenue); ii) Profit Protection (42% of revenue at H1) iii) Aviation – used for employee screening in US Airports iv) Entrance Security. The latter two divisions didn’t generate revenue in H1 to Sept last year.

Shareholders: Schroders own 17.5%, Herald IT own 10.4% and Henderson 6.9%, which is encouraging for a company this size.

Valuation: Progressive publish research on THRU, and the shares are trading on 3x Mar 2023F revenues. However, Progressive warn that due to high levels of macro uncertainty and lumpy revenues that they will not make FY Mar 2024F forecasts. That suggests management (who tell Progressive what to write) believes we should not extrapolate the reported +48% growth rates into the future.

Opinion: Investors appear to have taken last week’s RNS positively, with the shares up +4%. I like the company but am nervous we will see some disappointment in the next 6-12 months so wouldn’t look to buy until there’s more clarity on the outlook.

Notes

The author owns shares in Hargreaves Lansdown

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 25/04/23 | MONY, KMK, THRU | Inflation and banking deposits

Bruce looks at the influence double-digit inflation is having on bank deposits. Companies covered MONY, KMK and THRU.

The FTSE 100 was up +0.4% to 7,907 over the last 5 days, while the Nasdaq 100 fell -0.6% and the S&P500 was flat. The Natural Gas contract (NG-MT) was up +31% in the last 5 days but is still down -36% YTD and the EU gas storage is half full which was an encouraging way to end the winter. The US 10Y bond yield was 3.54%, still well below its peak this year of almost 4% at the beginning of March.

UK inflation remained above +10%, though falling from +10.4% in February to +10.1% in March. For comparison in Germany, inflation was +7.8% and +6.6% in France in March. In the UK dairy products like milk +40%, cheddar cheese +49% and eggs were up +28%.

I’ve just come across Stephen King’s book We Need to Talk about Inflation. There’s also this Merryn Somerset Webb interview with James Ferguson from January, who suggests by June inflation should be falling sharply and Central Banks will declare inflation was transitory after all, only for those Central Bankers to be proved wrong (again!) later in 2023 or 2024 with another unexpected rise in prices.

Since the collapse of SVB, there has been too much focus on interest rates, in my view, when it is inflation that erodes the value of future cashflows. For instance, inflation (not higher interest rates) has caused savers to reassess whether keeping money in the banking system at a time of double-digit inflation continues to make sense. Credit Suisse Q1 results showed $69bn of deposit outflows this year. CS management had previously claimed that deposit outflows of c. $100bn in Q4 had “stabilised, but not reversed”. If $69bn of outflows was CS management’s definition of stable, no wonder the Swiss Central Bank panicked!

For comparison, the Federal Reserve’s H.8 indicator of US bank deposits showed $76bn of outflows in the week to 12th April. Since the start of the year US bank deposits have fallen by $629bn to $17.18 trillion, according to the same data table. Deposit outflows are likely to make banks more cautious about lending and tighter credit conditions which would then in turn reduce inflation (and interest rate expectations), acting as a natural stabiliser.

The FT says savers are also transferring deposits away from UK banks to better deals in cash and liquidity funds, so I contacted Hargreaves Lansdown Press Office. They confirmed that in March, 5 of their top 10 most popular funds were.

HL. wouldn’t give me the absolute numbers but said that they’d seen a staggering increase of 5,988% net flow into money market funds since the start of this year, albeit from a low base. There are likely similar trends at Interactive Investor and other platforms, while WISE is paying interest on customer balance by offering customers the BlackRock ICS Sterling Liquidity fund.

Harriet Baldwin MP on the Treasury Select Committee has asked the FCA what work the regulator has done to make sure banks pass on interest rate increases to their customers. The FCA has been thinking of demanding banks offer a Single Easy Access Rate (SEAR) intended to address concerns that banks charge a ‘loyalty penalty’ to customers who don’t switch accounts frequently. Instead, the FCA has decided to introduce a more nebulous “consumer duty” from 31st July, where banks have to provide fair value to their customers.

Below I look at Moneysupermarket, the numbers MONY reports are attractive, but I think there’s some regulatory risk if banks and insurers are forced to stop their “front book/back book” pricing strategy, and instead offer a fair deal to all customers. I also look at a couple of security detection businesses, Kromek and Thruvision. Both have a gross margin close to 50% and are seeing revenue growth of c. +50%. I don’t own either as they are loss-making but think they could be an interesting opportunity at some point.

Moneysupermarket Q1 March trading update

This price comparison website announced revenue growth up +15% to £106m in Q1 Mar 2023. That was driven by a strong recovery in insurance (just under half of group revenue) +23%. In Q1 last year the FCA introduced pricing regulations which forced insurance companies to offer the same price to loyal customers who were renewing their home or motor insurance, as new customers who were thinking of switching away from a competitor.

Banks do the same offering loyal customers a worse deal than people who are prepared to spend the time and effort switching. It’s called “front book” (new customers) versus “back book” pricing. The FCA has rightly tried to prevent this, but the response has had a negative effect on price comparison websites like MONY, and GoCompare (bought by FUTR).

Following the new rules, market switching volumes declined by double-digit rates in H1 2022, but competition for new customers has now increased. What seems to have happened is that claims inflation has led to insurance companies charging higher premiums, which in turn means more customers have been shopping around for better deals.

Even before the FCA changes, MONY revenues were under pressure, peaking at £388m in FY Dec 2019, then falling -18% in the following two years. That was caused by less shopping around for travel insurance and personal loans during the pandemic. Then last year high wholesale energy prices meant that there were no switchable deals being offered by utility companies from October 2021.

Outlook: conditions in the energy market mean it is unlikely that switching will return in 2023, however, MONY has said that they are still confident of meeting market expectations. The company has said that banks are now offering promotional offers, which has helped drive revenue in MONY’s Money division +9%.

Valuation: Despite the falling revenue MONY has a 3-year average RoCE of 36% and a 3-year average EBIT margin of 26%, so the numbers are impressive. The shares trade on PER 15x Dec 2024F and 3.0x sales the same year. The dividend yield of 4.7% also looks attractive.

MONY investor presentation tries to position the investment case as a tech and data platform, implying operational gearing, network effects and a high valuation!

Opinion: Moneysupermarket believes it has saved customers £1.8bn across the group while receiving revenue per active user of £16.40. A few years ago Richard analysed MONY here, both of us dislike the idea we should spend our valuable time like hamsters endlessly scurrying around a wheel looking for cheaper alternatives for broadband, energy suppliers, personal loans and car insurance. That may seem odd, given we do spend our time reading company Annual Reports and using Sharepad to analyse the investment case on equities. But I think there’s something intrinsically satisfying about investing. Buffett could have retired years ago, but he enjoys the process. I would imagine he doesn’t spend much time on his utility bill and has been a loyal insurance customer of GEICO customer for decades.

So I prefer to trust brands like WISE or HL. to offer me a fair price that they can still make a decent margin on. I nearly bought MONY last year, but was put off by these qualitative concerns rather than the numbers. Then in October last year, Amazon suggested that they will enter the price comparison arena, which also put me off.

Kromek Q3 trading update

This radiation (gamma ray) detection business was originally a Durham University academic commercialisation spin-out (similar to IP Group’s investment portfolio which I wrote about here). KMK has been a “jam tomorrow” story since listing a decade ago. However, the shares were up +55% last week as they said Q3 revenues would be c. +50% ahead of Q3 last year. They are also experiencing improvements in the gross margin (expecting high 40% gm) and to be EBITDA positive in H2 2023. The company has an April year-end and believes it will be cash neutral in H2.

Their technology has three end markets: i) medical imaging, ii) nuclear detection, iii) security screening and they have manufacturing facilities in the UK and US.

The day after their Q3 update, they also announced a collaboration with Analogic Corp, based in Massachusetts, USA which is a leader in Computer Tomography. Analogic has installed 60,000 CT scan systems over the last 4 decades. finnCap, KMK’s broker, described this as ‘game changing’ as CT market is forecast to grow to $10bn a year by 2030. CT scans are medical imaging technology where radiology is used to create three-dimensional images, it is used for breast cancer and Alzheimer’s detection for example.

The company also has a hand-held radioisotope identification kit. That should be useful for defence and security applications.

History: The company was founded in 2003, to commercialise Cadmium Zinc Telluride (CZT) technology, that had been developed over the previous 20 years of research in Durham University’s physics department. Kromek listed on AIM at 51p per share in Oct 2013, raising £15m, and valuing the company at a market cap of £55m. Since then revenue has grown by roughly 7x to £18m forecast for FY April 2023F. However, they’ve never made a profit so losses have been funded by issuing more shares, the share count has increased by 4x to 432m over the last decade.

In January this year, KMK announced that they had received funding from the government’s Innovate UK fund, for two projects worth collectively £2.5m. In January they also released their H1 to October results, with revenue up +44% to £7m and a gross margin of 40%. However, cash had decreased by £4.1m over the previous six months leaving just £1m at the end of October. It seems likely that we will see another fundraising.

Shareholders: This looks like a retail investor favourite with Interactive Investors and Hargreaves Lansdown, Canaccord and Halifax Share Dealing the largest four shareholders (cumulatively 38% of the share base). Very little institutional backing, but Katy Pott’s Herald IT does own 4.4%.

Valuation: FinnCap, their broker, is forecasting losses this year and next. The shares are trading on 2.0x Mar 2023F revenue, following last week’s spike in the share price. That doesn’t seem a bargain, particularly in this market.

Opinion: One of my friends who is a shrewd (and wealthy) investor tipped this to me a few years ago. At the time I felt it was too speculative, but would see how progress developed. Fast forward a few years and they are further down the path to profitability, but not there yet. Over £130m has been invested since the company was founded, yet the market cap is now just £30m. A ‘story stock’ but worth keeping an eye on, in my view.

Thruvision FY March trading update

This ‘walk through security’ technology company was flagged by investor Leo, who highlighted some similarities with Wey Education, which was a 5-bagger for me. Thruvision’s security scanners are used in more than 20 countries around the world by governments and corporates and can detect concealed objects in real time. One use case is that employees who work at warehouses for Amazon or other retailers are scanned when they leave work to make sure that they haven’t pilfered any high-value items. The company has changed the name of this division from ‘Profit Protection’ to ‘Retail Distribution’. There’s a demonstration and company presentation on Progressive Research’s website.

Last Friday THRU announced revenues +48% to £12m for their FY to March. The company is just below break even on an Adj EBITDA level and they had £2.8m of cash at the end of March. They have 3 divisions: i) Customs which has two contracts with US Customs and Border Protection (CBP) worth £9m (58% of revenue); ii) Profit Protection (42% of revenue at H1) iii) Aviation – used for employee screening in US Airports iv) Entrance Security. The latter two divisions didn’t generate revenue in H1 to Sept last year.

Shareholders: Schroders own 17.5%, Herald IT own 10.4% and Henderson 6.9%, which is encouraging for a company this size.

Valuation: Progressive publish research on THRU, and the shares are trading on 3x Mar 2023F revenues. However, Progressive warn that due to high levels of macro uncertainty and lumpy revenues that they will not make FY Mar 2024F forecasts. That suggests management (who tell Progressive what to write) believes we should not extrapolate the reported +48% growth rates into the future.

Opinion: Investors appear to have taken last week’s RNS positively, with the shares up +4%. I like the company but am nervous we will see some disappointment in the next 6-12 months so wouldn’t look to buy until there’s more clarity on the outlook.

Notes

The author owns shares in Hargreaves Lansdown

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.