Following the rescue of Silicon Valley Bank, Bruce looks at possible read across to recent IPOs and IP Group. Companies covered IPO, FRAN and Georgian Banks BGEO / TBCG.

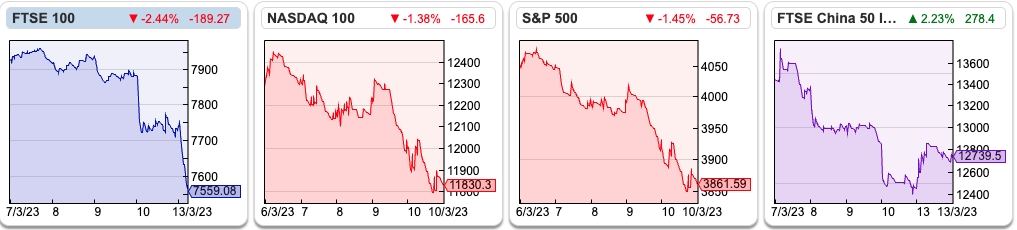

I suggested last week that the rally was running out of steam. I was not expecting a bank run in Silicon Valley though (SIVB total assets $211bn). The FTSE 100 was down -4.5% to 7559 in the last 5 days, as was the S&P500. The US Treasury said on Monday that SIVB deposit holders will be made whole, but no costs will be borne by the taxpayer. I’m not sure how they can square that circle, as the FT reports mark-to-market losses of $16bn exceeded the bank’s equity. HSBC has bought SVB’s UK ringfenced bank (deposit liabilities $6.7bn, tangible equity $1.4bn) for £1.

Over the weekend the US regulator has also closed Signature Bank (total assets $110bn). San Francisco based First Republic Bank (total assets $212bn) shares are off -33% in the last 5 days. The KBW US Regional Bank Index ETF (ticker KRE) down -14% YTD is worth paying attention to for signs of contagion.

At the end of 2021, there was $18 trillion of debt with a negative yield, according to analysis by Bloomberg. Someone still owns that debt and is sitting on large mark-to-market losses!

Profit warnings: Aside from SVB’s failure in California, in the UK we saw profit warnings from Wincanton (supply chain and logistics), IQE (semiconductor wafers), Aferian (B2B video streaming), Versarien (graphene) and Cenkos (stockbroking). WANdisco (cloud data) shares were suspended following ‘irregularities’ in the company’s cash position and revenue figures. Ironically WANdisco management had previously suggested that London investors undervalued their shares, and they would seek a dual listing in the US. Calnex (telcos network testing equipment) also warned. Maynard has raised some questions about the Calnex numbers pre-IPO, but also suggested that there might be some parallels with AB Dynamics.

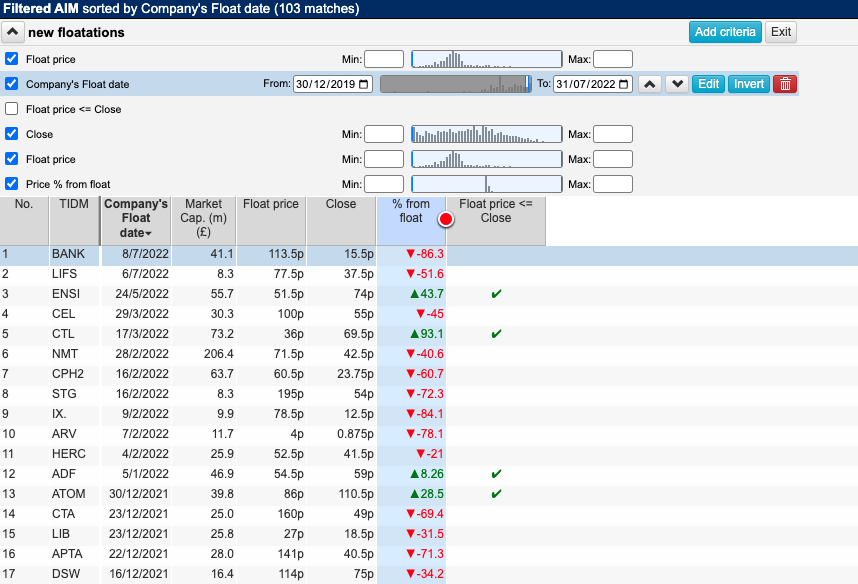

Out of curiosity, I have used Sharepad to create a filter to count the number of AIM listings between 1st Jan 2020 and July 2022 that are still trading above their floatation price. Despite last week’s warning CLX, which floated at 50p in October 2020, is one of the few (24 of the 103 total listings). A roughly 1 in 4 chance of a successful IPO seems poor odds to me though; so my filter backs up many private investors’ intuition that recent admissions to the stock market are best avoided. It has now become much more difficult for companies to IPO. In 2022 the amount of money raised on AIM fell to its lowest level since 2003, while the number of new issues was the lowest since 1995. It looks like 2023 will remain difficult.

The first London IPO was the Muscovy Joint Stock Company in the 1550s, which was an expedition around the Kola Peninsula in Northern Russia, to establish a trade route. 240 shares freely transferable shares were sold raising £6000 (ie £25 per share). See Merchant Adventurers for a full account. More recently the purpose of IPOs has changed from raising growth capital for speculative ventures to allowing wealthy individuals, Private Equity and Venture Capital to achieve exits at favourable prices. When I say favourable prices, I mean of course favourable to the sellers, not to the buyers, of IPOs.

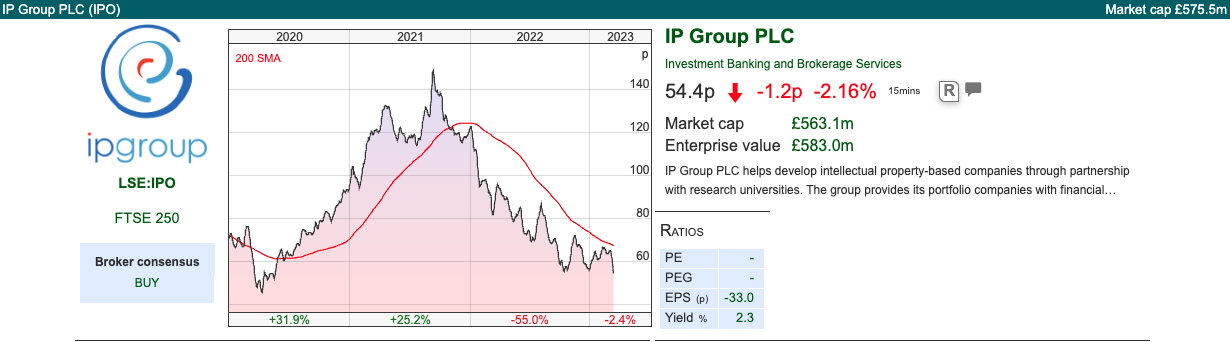

There is a joke that IPO doesn’t stand for “Initial Public Offering” but instead “It’s Probably Overpriced”. Some time ago I did think about buying shares in IP Group (ticker is IPO) on the basis that if IP Group sells speculative IPO’s to fund managers, then buying IP Group’s shares is a way of being on the right side of the over-hyped IPO trade.

Yet IP Group share price has been treading water for 20 years. One reason for this could that most successful innovation hasn’t come from universities, with the credentialled academic institutions crushing the creativity out of any new discovery. Instead, one of Peter Thiel’s venture capitalist friends has argued in Paper Belt on Fire that high-performing companies are more likely to be founded by university drop-outs, like Bill Gates, Mark Zuckerberg, Steve Jobs, Jack Dorsey and Patrick Collison. Elon Musk did complete a degree, but dropped out of doing a PhD at Stanford. Thiel has annoyed the academic establishment by giving $100K of funding to young founders as long as they promise NOT to go to university!

Thiel once said: “we wanted flying cars, instead we got 140 characters”, summing up that modern capitalism has failed to deliver meaningful improvements in productivity or quality of life. I can live without a flying car, but IPOs that didn’t sink would have been nice.

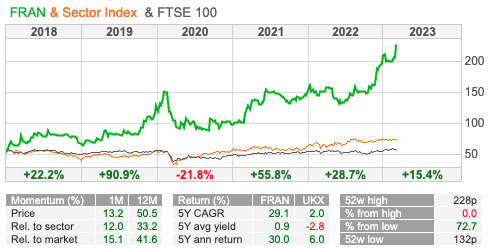

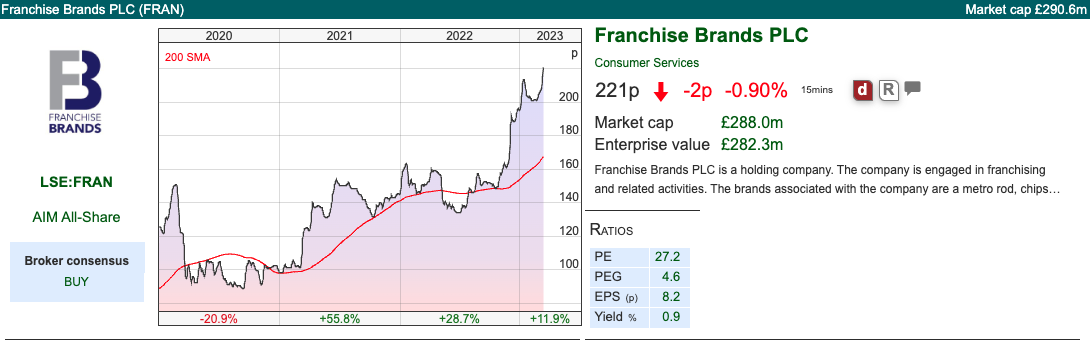

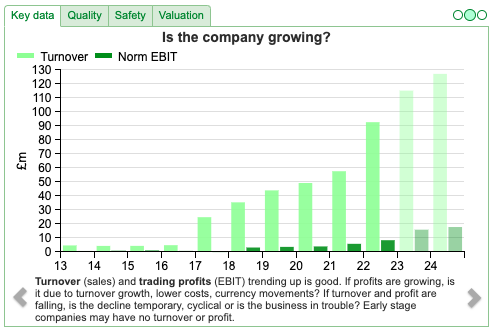

One management team that does have a strong track record of value creation since IPO’ing at 40p is Franchise Brands. I cover FRAN FY Dec results below. Rather than all the exciting ‘deep tech’ that IP Group has, Franchise Brands management have focused on essential services like plumbing, pumps, drain cleaning and cooking oil filtration. Perhaps there is a lesson there?

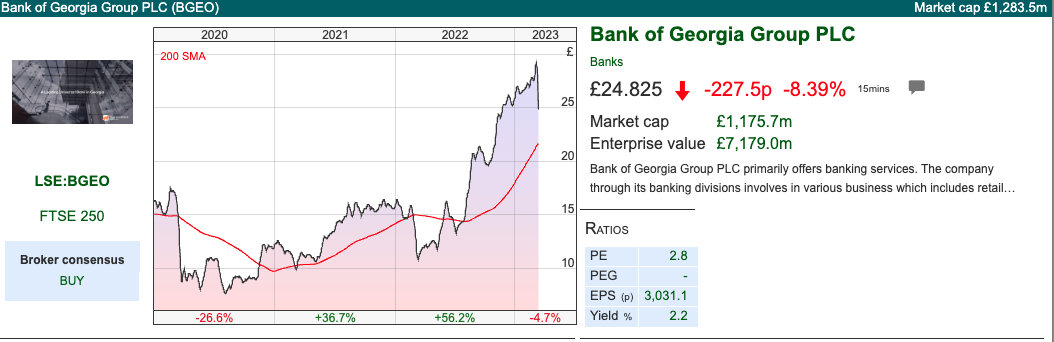

I finish with some comments on Georgian politics, and the implications for the banking sector share prices down 15-20% in the last 5 days (both Bank of Georgia and TBC Bank are listed in London).

IP Group FY Dec Results

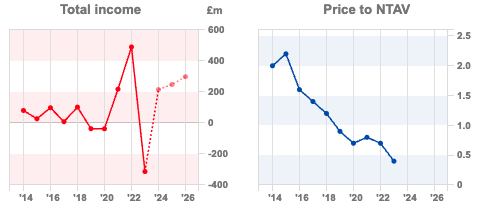

This intellectual property company which partners with academics and universities to commercialise their research announced FY Dec results. Woodford was a forced seller at just over 50p in 2019. The shares have de-rated from a Price/Book ratio above 2x to below 0.5x.

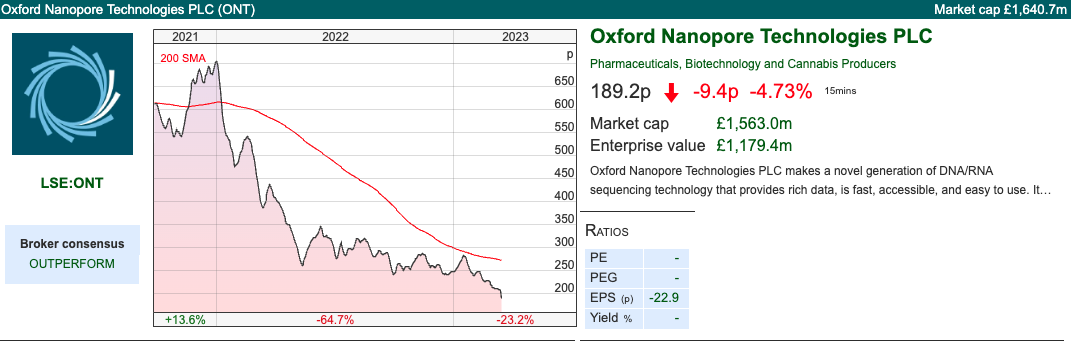

In 2021 IP made £297m gain on Oxford Nanopore, a spin-out which specialises in DNA sequencing. ONT’s gene-reading machines were used to track Covid variants during the pandemic, but the shares have been a poor performer since it’s 2021 IPO, and is down over -70% from its peak. Unfortunately, IP Group didn’t sell all of its Oxford Nanopore shares when the company listed in Sept 2021 at 425p. So last year’s £297m gain has reversed into a £370m write down by IP Group.

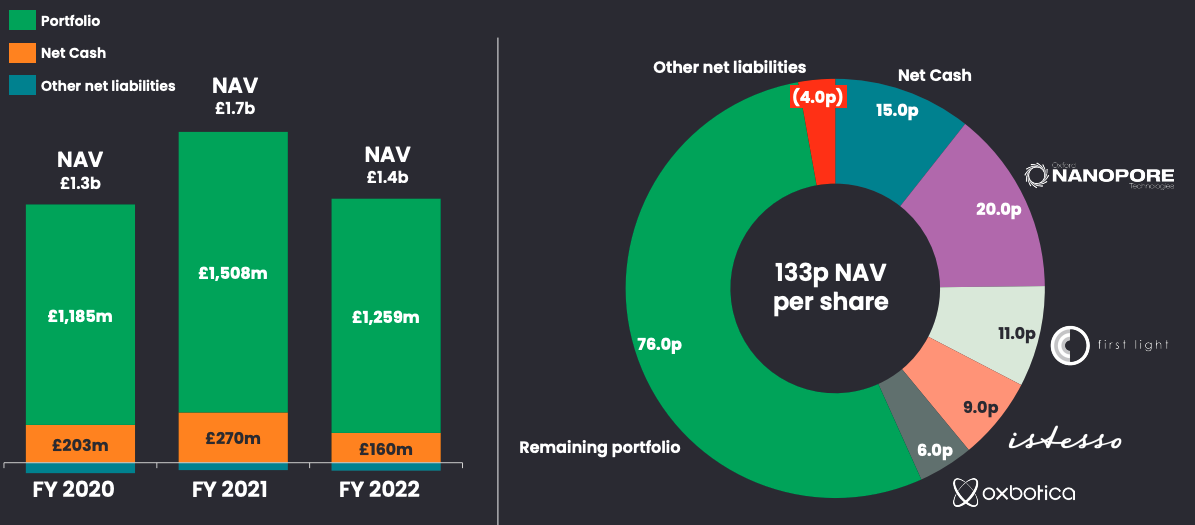

That explains the bulk of IP’s Net Asset Value (NAV) reduction to £1.4bn or 133p per share. ONT represents 20p per share, net cash is 15p per share, ‘first light’ a nuclear fusion company is 11p per share, as this slide which they put up shows. The whole £1.26bn portfolio (ex £160m of net cash) consists of 95 companies, of which the top 20 comprise 76% of the portfolio value. If you’re interested in exploring what the portfolio companies do, IP has links to their websites here.

Other companies that have been spun out of IPO in the past include Ceres, the hydrogen power company and Avacta, which benefited from developing a Covid diagnostic test.

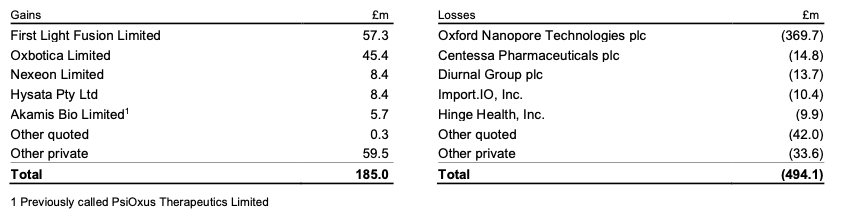

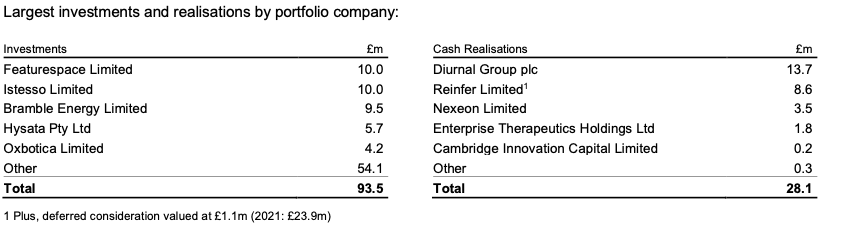

Results: As many of the businesses that IP Group invests in are pre-revenue, the best indicator of results are a breakdown of the gains £185m versus losses £494m over 2022.

Buoyant market conditions during the pandemic were obviously helpful, so in 2021 and 2020 IPO made £214m and £191m of divestments (mainly listings on the stock exchange, but some sales to other companies). In 2022 cash realisations (see below) have fallen to just £28m as Central Banks have removed the punch bowl from the party and there’s been a more sober risk appetite. The company invested £93.5m around 3.5x more than its cash realisations.

They have a gross cash position of £242m (or £160m net of debt that they raised last year), so they can maintain their level of investment spend this year and next if the exit conditions remain difficult, but not indefinitely.

Third Party funds: Similar to litigation finance companies, which invest in disputes, IPO also partners with external investors (Third Party Funds). They now manage or advise on £700m of funds under management. Unlike the litigation finance companies, it looks like this TPF arrangement is barely profitable though, with £6m of revenue versus £5.6m of administrative expenses.

Shareholders: The largest shareholder is the Railways Pension Trust, at 15.7%. BlackRock own 5.1% and LionTrust 5%. Baillie Gifford have sold down their stake to 4.5% and Lansdowne Partners, who used to be the third biggest shareholder with a 9.9% holding, now hold 2.6%. I would be interested to know what changed their minds on the investment case. It could be that they found the shares too illiquid if they were having redemption requests, which shouldn’t be an issue for retail investors.

Valuation: At 54p, this is now trading at 0.4x NAV, suggesting considerable scepticism towards the value of IP Group’s portfolio. If we back out the combined 35p of net cash and the marked-to-market Nanopore holding from the NAV calculation, then the market price is suggesting that the rest of the portfolio is worth just 19p per share.

Opinion: It’s good to see the stockmarket being used as a ‘socially useful’ mechanism to convert academic research into something productive. IPO have focused on three themes i) health ii) clean energy and iii) so-called “deep tech”. I am assuming that the next 20 years won’t look like the previous couple of decades, so might look to buy into this at some point. I think though I will wait, as we’re not at the point of maximum pessimism in my view. I’d also prefer it if IP Group funded some non-academic founders too.

I listened into the call and management are clearly frustrated with the steep discount to book value the shares trade at. They have scheduled a ‘valuation deep dive’ for 23rd March.

Franchise Brands FY Dec Results

This franchise company (Metro Rod plumbing, Ovenclean and Barking Mad) run by the former Domino’s Pizza UK management had already announced an ahead-of-expectations trading update, which I covered in January. They’ve now put out their FY results.

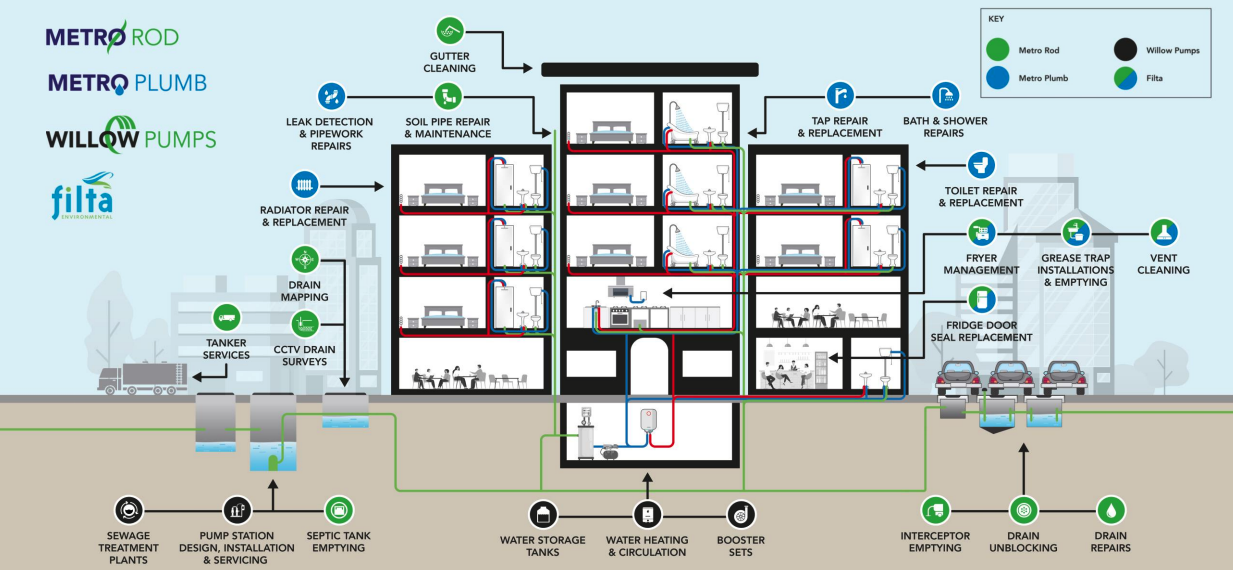

Following last year’s acquisition of Filta, the cooking oil recycling business, headline numbers are very strong: +72% revenue growth to £99m, statutory PBT +78% to £10m. The growth is not just driven by the acquisition though, they also say that their UK B2B plumbing franchise business has achieved record organic growth last year, +15% in revenues and +12% in EBITDA according to Allenby Capital, though I couldn’t find these figures in FRAN’s RNS. Net cash increased by £1.7m to £10.8m at the end of Dec 2022. Below is a graphic showing that management believes there are cross-selling opportunities between all four B2B business divisions.

On the other hand, B2C is going less well and management have appointed finnCap to put that division up for sale. That means B2C is now reported as ‘discontinued operations’. This includes ChipsAway, which repairs minor damage to cars, Ovenclean, Handyman Van and Barking Mad (dog hotels for when owners go on holiday). In financial terms this B2C division is £6m (ie 6% of group) revenue and £2.4m (ie 18% of group) adjusted profits. It’s possible that they fail to find a buyer, or that they have to write down goodwill. However, the B2C division amounts to £2m of intangibles, or just 2.3% of total intangible assets.

Outlook: Management point out that plumbing, pumps and drain clearing is an essential service, so ought to be resilient to the rising cost of living. They believe they have multiple opportunities to grow and suggest there’s relatively little competition for Filta in North America. They mention selective acquisitions of van-based B2B franchise businesses that provide essential services, and international expansion with a long-term goal of having equal amounts of income from the UK, North America and continental Europe. Certainly, the track record of profitable growth is impressive.

Valuation: Allenby, and their brokers, raised forecasts by +7% in FY Dec 2023F and introduced FY 2024F numbers, which imply +13% growth next year. Allenby’s numbers 9.3p EPS 2023F and 10.4p EPS 2024F imply PER of 24x and 21x respectively.

Opinion: This looks like a quality company, however, the above 20x PER valuation is also reflecting that. I am regretting not buying some 6 months ago, as the shares have risen +52% since then. Focusing on the B2B business makes sense to me, even if the disposal of the more pedestrian B2C division fails to attract a high premium, it’s clear the value is in the plumbing, pumps and Filta businesses. On my watchlist, I’m hoping that there will be more attractive levels to buy the shares.

Georgian Banks

BGEO’s share price fell -18% in the last 5 days. TBC, which is also listed in London, fell -12%. This seems to be driven by Bidzina Ivanishvili’s ruling Georgian Dream party in Tbilisi trying to pass a “Foreign Agent” law, similar to that introduced by Putin in 2012. Last week crowds came out onto the streets to protest and riot police in response.

Ivanishvili’s Georgian Dream political party did win elections which were widely regarded as fair in 2012. More recently there have been accusations of vote rigging following the 2020 parliamentary elections. Ivanishvili made billions in 1990’s Russia, so it’s widely believed that he has deep links to the Kremlin. However, even if he is an instrument of Russian influence, following Putin’s August 2008 invasion, the popular national feeling in Georgia is very much pro-West. Georgia’s head of state, President Salome Zourabichvili criticised the Foreign Agent bill, and sided with the protestors. Presumably, there was a conversation with Moscow on a secure phone line, saying “Извините Vladimir Vladimirovich, but your law is too unpopular, we had to reverse ferret.” There is a risk that if the former Georgian President, Mikheil Saakashvili, comes to harm in prison, more violence erupts.

Opinion: I suppose the Moscow-friendly government could target Georgia’s London-listed banks, as a show of fealty to Putin. However, expropriating TBC and BGEO would likely backfire on Ivanishvili. For instance, it would put an end to Foreign Direct Investment. According to GeoStat’s preliminary FDI figures, there was $2bn (equating to 8% of GDP) into Georgia in 2022.

Secondly, much of Ivanishvili’s own wealth is held in Europe (until recently, in Credit Suisse believe it or not!) and he presumably he wants to avoid being sanctioned.

TBCG is trading on 4x forecast earnings, and a dividend yield of 8.7%.

BGEO is trading on below 6x forecast earnings, and a dividend yield of 8.2%.

Rather than anything banking related (ie credit risk, interest rate duration) those Tbilisi headquartered bank valuations seem to be reflecting country risk.

Notes

The author owns shares in Bank of Georgia

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 14/03/23 | IPO, FRAN, BGEO / TBCG | We wanted flying cars…

Following the rescue of Silicon Valley Bank, Bruce looks at possible read across to recent IPOs and IP Group. Companies covered IPO, FRAN and Georgian Banks BGEO / TBCG.

I suggested last week that the rally was running out of steam. I was not expecting a bank run in Silicon Valley though (SIVB total assets $211bn). The FTSE 100 was down -4.5% to 7559 in the last 5 days, as was the S&P500. The US Treasury said on Monday that SIVB deposit holders will be made whole, but no costs will be borne by the taxpayer. I’m not sure how they can square that circle, as the FT reports mark-to-market losses of $16bn exceeded the bank’s equity. HSBC has bought SVB’s UK ringfenced bank (deposit liabilities $6.7bn, tangible equity $1.4bn) for £1.

Over the weekend the US regulator has also closed Signature Bank (total assets $110bn). San Francisco based First Republic Bank (total assets $212bn) shares are off -33% in the last 5 days. The KBW US Regional Bank Index ETF (ticker KRE) down -14% YTD is worth paying attention to for signs of contagion.

At the end of 2021, there was $18 trillion of debt with a negative yield, according to analysis by Bloomberg. Someone still owns that debt and is sitting on large mark-to-market losses!

Profit warnings: Aside from SVB’s failure in California, in the UK we saw profit warnings from Wincanton (supply chain and logistics), IQE (semiconductor wafers), Aferian (B2B video streaming), Versarien (graphene) and Cenkos (stockbroking). WANdisco (cloud data) shares were suspended following ‘irregularities’ in the company’s cash position and revenue figures. Ironically WANdisco management had previously suggested that London investors undervalued their shares, and they would seek a dual listing in the US. Calnex (telcos network testing equipment) also warned. Maynard has raised some questions about the Calnex numbers pre-IPO, but also suggested that there might be some parallels with AB Dynamics.

Out of curiosity, I have used Sharepad to create a filter to count the number of AIM listings between 1st Jan 2020 and July 2022 that are still trading above their floatation price. Despite last week’s warning CLX, which floated at 50p in October 2020, is one of the few (24 of the 103 total listings). A roughly 1 in 4 chance of a successful IPO seems poor odds to me though; so my filter backs up many private investors’ intuition that recent admissions to the stock market are best avoided. It has now become much more difficult for companies to IPO. In 2022 the amount of money raised on AIM fell to its lowest level since 2003, while the number of new issues was the lowest since 1995. It looks like 2023 will remain difficult.

The first London IPO was the Muscovy Joint Stock Company in the 1550s, which was an expedition around the Kola Peninsula in Northern Russia, to establish a trade route. 240 shares freely transferable shares were sold raising £6000 (ie £25 per share). See Merchant Adventurers for a full account. More recently the purpose of IPOs has changed from raising growth capital for speculative ventures to allowing wealthy individuals, Private Equity and Venture Capital to achieve exits at favourable prices. When I say favourable prices, I mean of course favourable to the sellers, not to the buyers, of IPOs.

There is a joke that IPO doesn’t stand for “Initial Public Offering” but instead “It’s Probably Overpriced”. Some time ago I did think about buying shares in IP Group (ticker is IPO) on the basis that if IP Group sells speculative IPO’s to fund managers, then buying IP Group’s shares is a way of being on the right side of the over-hyped IPO trade.

Yet IP Group share price has been treading water for 20 years. One reason for this could that most successful innovation hasn’t come from universities, with the credentialled academic institutions crushing the creativity out of any new discovery. Instead, one of Peter Thiel’s venture capitalist friends has argued in Paper Belt on Fire that high-performing companies are more likely to be founded by university drop-outs, like Bill Gates, Mark Zuckerberg, Steve Jobs, Jack Dorsey and Patrick Collison. Elon Musk did complete a degree, but dropped out of doing a PhD at Stanford. Thiel has annoyed the academic establishment by giving $100K of funding to young founders as long as they promise NOT to go to university!

Thiel once said: “we wanted flying cars, instead we got 140 characters”, summing up that modern capitalism has failed to deliver meaningful improvements in productivity or quality of life. I can live without a flying car, but IPOs that didn’t sink would have been nice.

One management team that does have a strong track record of value creation since IPO’ing at 40p is Franchise Brands. I cover FRAN FY Dec results below. Rather than all the exciting ‘deep tech’ that IP Group has, Franchise Brands management have focused on essential services like plumbing, pumps, drain cleaning and cooking oil filtration. Perhaps there is a lesson there?

I finish with some comments on Georgian politics, and the implications for the banking sector share prices down 15-20% in the last 5 days (both Bank of Georgia and TBC Bank are listed in London).

IP Group FY Dec Results

This intellectual property company which partners with academics and universities to commercialise their research announced FY Dec results. Woodford was a forced seller at just over 50p in 2019. The shares have de-rated from a Price/Book ratio above 2x to below 0.5x.

In 2021 IP made £297m gain on Oxford Nanopore, a spin-out which specialises in DNA sequencing. ONT’s gene-reading machines were used to track Covid variants during the pandemic, but the shares have been a poor performer since it’s 2021 IPO, and is down over -70% from its peak. Unfortunately, IP Group didn’t sell all of its Oxford Nanopore shares when the company listed in Sept 2021 at 425p. So last year’s £297m gain has reversed into a £370m write down by IP Group.

That explains the bulk of IP’s Net Asset Value (NAV) reduction to £1.4bn or 133p per share. ONT represents 20p per share, net cash is 15p per share, ‘first light’ a nuclear fusion company is 11p per share, as this slide which they put up shows. The whole £1.26bn portfolio (ex £160m of net cash) consists of 95 companies, of which the top 20 comprise 76% of the portfolio value. If you’re interested in exploring what the portfolio companies do, IP has links to their websites here.

Other companies that have been spun out of IPO in the past include Ceres, the hydrogen power company and Avacta, which benefited from developing a Covid diagnostic test.

Results: As many of the businesses that IP Group invests in are pre-revenue, the best indicator of results are a breakdown of the gains £185m versus losses £494m over 2022.

Buoyant market conditions during the pandemic were obviously helpful, so in 2021 and 2020 IPO made £214m and £191m of divestments (mainly listings on the stock exchange, but some sales to other companies). In 2022 cash realisations (see below) have fallen to just £28m as Central Banks have removed the punch bowl from the party and there’s been a more sober risk appetite. The company invested £93.5m around 3.5x more than its cash realisations.

They have a gross cash position of £242m (or £160m net of debt that they raised last year), so they can maintain their level of investment spend this year and next if the exit conditions remain difficult, but not indefinitely.

Third Party funds: Similar to litigation finance companies, which invest in disputes, IPO also partners with external investors (Third Party Funds). They now manage or advise on £700m of funds under management. Unlike the litigation finance companies, it looks like this TPF arrangement is barely profitable though, with £6m of revenue versus £5.6m of administrative expenses.

Shareholders: The largest shareholder is the Railways Pension Trust, at 15.7%. BlackRock own 5.1% and LionTrust 5%. Baillie Gifford have sold down their stake to 4.5% and Lansdowne Partners, who used to be the third biggest shareholder with a 9.9% holding, now hold 2.6%. I would be interested to know what changed their minds on the investment case. It could be that they found the shares too illiquid if they were having redemption requests, which shouldn’t be an issue for retail investors.

Valuation: At 54p, this is now trading at 0.4x NAV, suggesting considerable scepticism towards the value of IP Group’s portfolio. If we back out the combined 35p of net cash and the marked-to-market Nanopore holding from the NAV calculation, then the market price is suggesting that the rest of the portfolio is worth just 19p per share.

Opinion: It’s good to see the stockmarket being used as a ‘socially useful’ mechanism to convert academic research into something productive. IPO have focused on three themes i) health ii) clean energy and iii) so-called “deep tech”. I am assuming that the next 20 years won’t look like the previous couple of decades, so might look to buy into this at some point. I think though I will wait, as we’re not at the point of maximum pessimism in my view. I’d also prefer it if IP Group funded some non-academic founders too.

I listened into the call and management are clearly frustrated with the steep discount to book value the shares trade at. They have scheduled a ‘valuation deep dive’ for 23rd March.

Franchise Brands FY Dec Results

This franchise company (Metro Rod plumbing, Ovenclean and Barking Mad) run by the former Domino’s Pizza UK management had already announced an ahead-of-expectations trading update, which I covered in January. They’ve now put out their FY results.

Following last year’s acquisition of Filta, the cooking oil recycling business, headline numbers are very strong: +72% revenue growth to £99m, statutory PBT +78% to £10m. The growth is not just driven by the acquisition though, they also say that their UK B2B plumbing franchise business has achieved record organic growth last year, +15% in revenues and +12% in EBITDA according to Allenby Capital, though I couldn’t find these figures in FRAN’s RNS. Net cash increased by £1.7m to £10.8m at the end of Dec 2022. Below is a graphic showing that management believes there are cross-selling opportunities between all four B2B business divisions.

On the other hand, B2C is going less well and management have appointed finnCap to put that division up for sale. That means B2C is now reported as ‘discontinued operations’. This includes ChipsAway, which repairs minor damage to cars, Ovenclean, Handyman Van and Barking Mad (dog hotels for when owners go on holiday). In financial terms this B2C division is £6m (ie 6% of group) revenue and £2.4m (ie 18% of group) adjusted profits. It’s possible that they fail to find a buyer, or that they have to write down goodwill. However, the B2C division amounts to £2m of intangibles, or just 2.3% of total intangible assets.

Outlook: Management point out that plumbing, pumps and drain clearing is an essential service, so ought to be resilient to the rising cost of living. They believe they have multiple opportunities to grow and suggest there’s relatively little competition for Filta in North America. They mention selective acquisitions of van-based B2B franchise businesses that provide essential services, and international expansion with a long-term goal of having equal amounts of income from the UK, North America and continental Europe. Certainly, the track record of profitable growth is impressive.

Valuation: Allenby, and their brokers, raised forecasts by +7% in FY Dec 2023F and introduced FY 2024F numbers, which imply +13% growth next year. Allenby’s numbers 9.3p EPS 2023F and 10.4p EPS 2024F imply PER of 24x and 21x respectively.

Opinion: This looks like a quality company, however, the above 20x PER valuation is also reflecting that. I am regretting not buying some 6 months ago, as the shares have risen +52% since then. Focusing on the B2B business makes sense to me, even if the disposal of the more pedestrian B2C division fails to attract a high premium, it’s clear the value is in the plumbing, pumps and Filta businesses. On my watchlist, I’m hoping that there will be more attractive levels to buy the shares.

Georgian Banks

BGEO’s share price fell -18% in the last 5 days. TBC, which is also listed in London, fell -12%. This seems to be driven by Bidzina Ivanishvili’s ruling Georgian Dream party in Tbilisi trying to pass a “Foreign Agent” law, similar to that introduced by Putin in 2012. Last week crowds came out onto the streets to protest and riot police in response.

Ivanishvili’s Georgian Dream political party did win elections which were widely regarded as fair in 2012. More recently there have been accusations of vote rigging following the 2020 parliamentary elections. Ivanishvili made billions in 1990’s Russia, so it’s widely believed that he has deep links to the Kremlin. However, even if he is an instrument of Russian influence, following Putin’s August 2008 invasion, the popular national feeling in Georgia is very much pro-West. Georgia’s head of state, President Salome Zourabichvili criticised the Foreign Agent bill, and sided with the protestors. Presumably, there was a conversation with Moscow on a secure phone line, saying “Извините Vladimir Vladimirovich, but your law is too unpopular, we had to reverse ferret.” There is a risk that if the former Georgian President, Mikheil Saakashvili, comes to harm in prison, more violence erupts.

Opinion: I suppose the Moscow-friendly government could target Georgia’s London-listed banks, as a show of fealty to Putin. However, expropriating TBC and BGEO would likely backfire on Ivanishvili. For instance, it would put an end to Foreign Direct Investment. According to GeoStat’s preliminary FDI figures, there was $2bn (equating to 8% of GDP) into Georgia in 2022.

Secondly, much of Ivanishvili’s own wealth is held in Europe (until recently, in Credit Suisse believe it or not!) and he presumably he wants to avoid being sanctioned.

TBCG is trading on 4x forecast earnings, and a dividend yield of 8.7%.

BGEO is trading on below 6x forecast earnings, and a dividend yield of 8.2%.

Rather than anything banking related (ie credit risk, interest rate duration) those Tbilisi headquartered bank valuations seem to be reflecting country risk.

Notes

The author owns shares in Bank of Georgia

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.