Bruce looks at Terry Smith’s 13th annual shareholder letter and compares what he’s now saying about his META investment to his commentary a couple of years ago. Companies covered GAW, TMG, FRAN, QTX

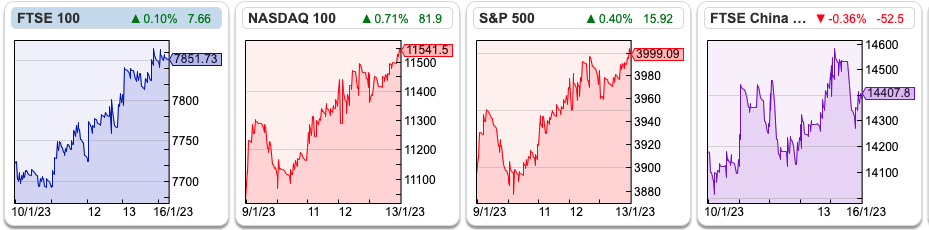

The strong start to the year continues, with the FTSE 100 +1.64% to 7,851 in the last 5 days, approaching an all-time high of 7,903 achieved on 22 May 2018. That’s a +17% bounce since Oct last year. In the US, the Nasdaq 100 was up +4.8% and the S&P500 +2.7% in the last 5 days. The US 10Y government bond yield was 3.51% and the UK 10Y government bond yield was 3.40%. Gold is up +4% since the start of the year to $1,882 per ounce.

Terry Smith, the former UK banks’ equity research analyst, has published his 13th Annual Letter, available here. I had to look up the word triskaidekaphobia in his first paragraph, which means fear of the number 13. The whole letter is worth reading in full, though it starts with some rather conventional criticism of Central Bankers creating easy money conditions (that doesn’t mean he is wrong!) Then more interesting observations on how investors fail to adjust the valuation multiples when companies report share base compensation differently and company managements’ engagement with activists versus long-term shareholders. He also points to Unilever’s voluntary disclosure (or lack of it) involving brands they acquired by paying large sums of money (eg. Dollar Shave Club) and then not mentioned in subsequent management commentary.

Two can play at that game, so I went back and looked at what Terry was saying about buying Facebook/Meta in 2020.

“We are not the sort of people who ever declare victory — we invest with a strong sense of paranoia — but it continues to be pleasing to note the contribution of Facebook which was certainly our most controversial stock purchase and led to more questions (and demands for its sale) from some of our investors than any other company.”

Meta fell -60% in 2022, and in his most recent letter, he mentions “well-publicised regulatory and competition problems”, without saying whether those problems were well-publicised a couple of years ago. I think they were! Richard has created a couple of Terry Smith-style filters, using measures like high RoCE and Free Cashflow Yield, which you can read about here (Terry Smith Algorithm) and here (Fishing Like Fundsmith).

Last week saw a couple of profit warnings from stocks that ought to have been defensive: general insurer Direct Line and cybersecurity firm Darktrace. ITM Power, the hydrogen power company also warned on Monday, despite the £318m of net cash on its balance sheet, I wouldn’t classify this company as defensive though. On the other hand, there were also positive updates from the likes of Marks Electrical (white goods), The Mission (marketing), IQGeo (software) and Franchise Brands (plumbing, oven cleaning and dog hotels) both of which I look at below. I also cover Games Workshop and Quartix, which both trade on valuation multiples in the mid-twenties, despite struggling with declining margins and lacklustre profit growth.

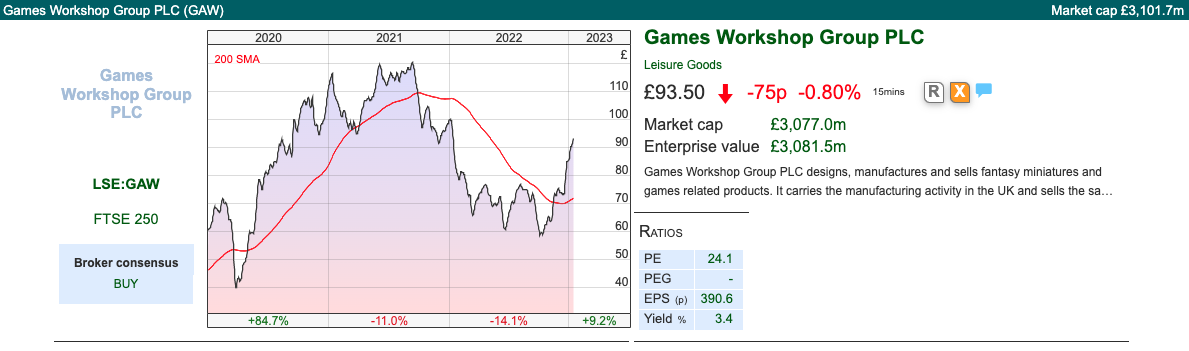

Games Workshop H1 to November

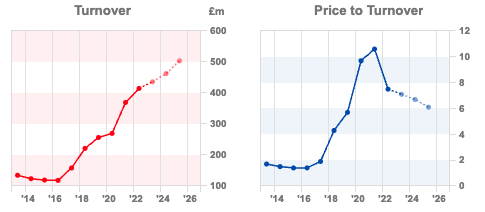

This miniatures and games company announced H1 revenue up +7%to £227m, or if you exclude the lumpy ‘licensing revenue’ H1 was up +11%. Statutory PBT is down -5% to £84m, mainly because licensing income fell from £20m H1 last year to £14m. This revenue stream from licensing out the brand to computer games developers has very little cost attached, so any decline drops straight through to profits.

Net cash was £85m, after a £54m (165p per share) declared dividend in the period (a +64% increase from £33m in H1 2021). Excluding dividends paid, net cash increased by £68m (up +64% from H1 2021).

Interestingly in the text management admit that while £227m is a record H1 revenue figure, “it isn’t where we wanted to be, particularly in the US, which was flat on a constant currency basis.” Followed up with the candid admission that “as a team, we need to scale with a little more nous.” I like this style of communication, as it helps investors to understand the company. Some people have suggested that GAW have disappointed on costs. My view is that often when a company disappoints on costs, in reality, they have invested for sales growth, that then has failed to come through. So the disappointment is actually the revenue line, in this case, the management commentary supports that view.

Sales through their own shops (Retail just under a 1/4 revenue) were up +10% and independent retailers +3% (Trade 3/5 of revenue), while Online was down -0.5%. Management say that this was part of their deliberate plan, to target a recovery in Retail through their physical stores. They then rather contradict this by saying that they have spent £4.9m on an updated webstore, which has been delayed due to project management issues. This project is now tentatively rescheduled for opening summer 2023.

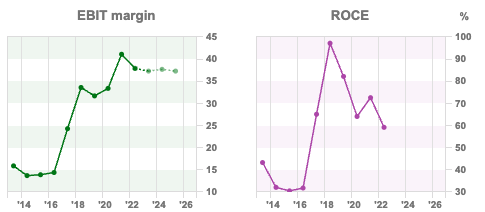

This could be a GAW-specific issue around technology and online order fulfilment. Possibly though it’s part of a wider trend of online retail is no longer taking market share, and whether that applies to fashion brands rather than just GAW. Core gross margins (ie gross margins ex licensing) were down -4.5% to 64%, due to increased materials and staff costs. They’ve increased the Recommended Retail Price (RRP) at broadly the same level as last year.

Although it sits somewhere between leisure and retail sectors, Games Workshop was seen as a pandemic winner, in my view, the investment case has really been about the community the games created. For the first time since the pandemic, they will be running UK Warhammer Fest over the 2023 April/May bank holiday weekend in Manchester, expecting to attract 10,000 fans.

Outlook: There tends to be an H2 weighting as the holiday season comes in the Dec-May half. They don’t say any more about the agreement in principle with Amazon studios.

Valuation: Edison are forecasting FY May 2023F revenue of £447m, implying +8% full-year growth (v +7% H1 v H1 just reported). The shares are trading on a PER 24x May 2023F and May 2024F of Edison’s numbers.

Opinion: The shares were up +25% following the Amazon agreement announcement. There doesn’t seem to be anything fundamentally wrong with the company, although sales have come in a bit light. Management are doing all the right things, in my view. I own this and believe that it is better to own a company with strong profitability but uncertain growth, than a company with uncertain profits but strong growth.

The Mission Trading Update FY Dec

This marketing and PR company rose +20% last week as it announced revenue +10% (slightly ahead of consensus) but has written off £6m of goodwill (6% of total intangible assets). Headline PBT should be not less than £7.6m, versus £7.5m FY Dec 2022. Net debt ended the year at £11.4m versus £10.3m Dec last year, but they do say that they expect net debt to reduce significantly in 2023F.

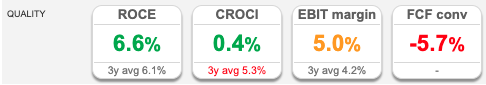

Historically there’s been an H2 weighting with this stock because marketing budgets tend to be spent in the second half of the year. However, it’s understandable given the deteriorating marketing environment (Sir Martin Sorrell’s S4 Capital fell almost -70% last year) that investors were nervous H2 would disappoint. RoCE has never traded above 8.5% for this stock. Hence the shares were trading on a mid-single-digit PER multiple.

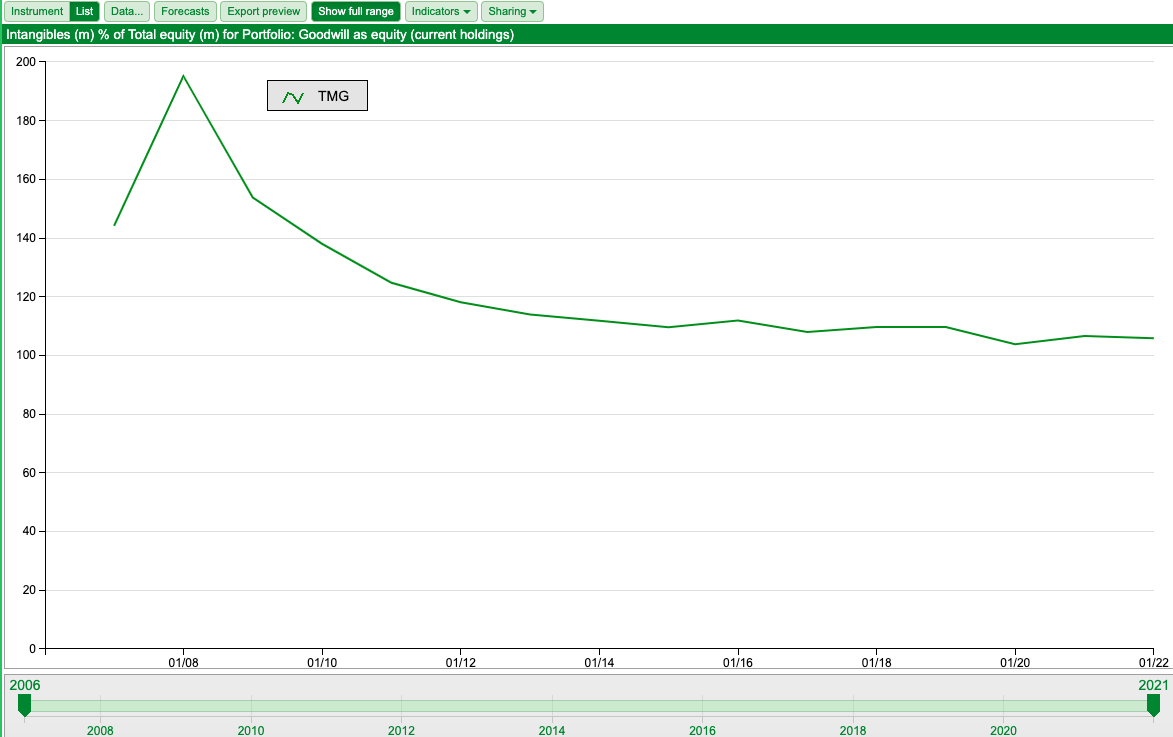

I think the +20% share price reaction was also a fascinating reaction to £6m goodwill writedown. As of H1 2022, TMG were carrying £100m of intangible assets on their balance sheet versus shareholders’ equity of £95m. Normally I would expect a company with negative tangible book value to react badly if management started writing down goodwill. However, I have also noted in the past that management of quality companies, like Clarkson and Nichols are not afraid to take goodwill writedowns when acquisitions don’t work out as intended. I’ve used Sharepad to show that TMG has operated with more intangibles than equity since it listed 15 years ago.

There’s a degree of subjectivity around writing off goodwill, but if management choose not to bite the bullet, it means that the capital base appears inflated, so that profitability measures like RoCE and CRoCI are suppressed. Finance theory suggests that a company earning a mid-single digit return (ie below its cost of capital) is worth a mid-single digit PER, even if it is growing the top line. That said, over the last 10 years revenue and headline PBT have grown at +54% and +52% respectively, while shareholders’ equity (following the goodwill writedown) is up c. +37% and number of shares is up +18%. Net debt is the same level at £11m. If revenue and profits are growing faster than the capital base, then that suggests the incremental RoCE on recent business is better than the group RoCE of 6.1% (3-year avg).

In order to drive multiple expansions, a company needs to show that it can grow revenue and profits while investing incrementally less capital. Writing off intangible assets that are not generating a decent return makes it easier for investors to form a view on future returns, rather than legacy acquisitions. Thus, the share price has reacted positively to the goodwill writedown.

Opinion: I bought this a decade ago on a low PER multiple when it was distressed following the financial crisis. Despite 10 years of growth, TMG is still trading on PER of 6.4x Dec 2024F. The investment hasn’t lost money but taught me to be unimpressed with growth if RoCE is below the cost of capital. Of course, I knew this from finance textbooks, but there’s nothing like owning an underperforming company in your portfolio to drive home theoretical knowledge.

Franchise Brands Trading Update FY Dec

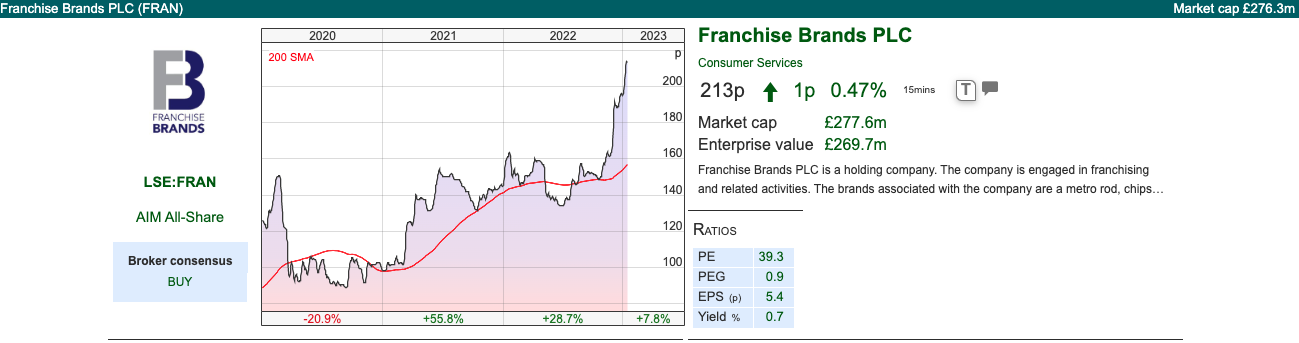

This franchise company (Metro Rod plumbing, Ovenclean and Barking Mad) run by the former Domino’s Pizza UK management announced Group revenue, adj EBITDA and adj EPS slightly ahead of expectations. Before the RNS, revenue was forecast to be £99m, adj EBITDA £15m and EPS of 7.7p according to the company. This follows a Q3 trading update in October when their broker (Allenby) raised EPS forecasts for 2022F and 2023F by +5% and +3% respectively. Revenue has doubled in 2 years from just below £50m in 2020 to £100m forecast for 2022F, and PBT is forecast to increase 2.6x over the same time period.

FRAN bought Filta in March 2022, which is an oil filtration service for restaurants to prevent them from throwing oil down the drain and clogging up everything. They paid £50m in FRAN shares, valuing the business at 2.5x then forecast sales. Filta has obviously benefited from the hospitality sector enjoying a better 2022 than 2021, but also the used cooking oil that they collect from customers is sold as biofuel, which has increased in value. As a result, Filta North America system sales increased +51% in 2022 from $61m to reach $92m and exited the year with a record run-rate of $100m per annum.

Their other B2B businesses are plumbing and drain cleaning. Metro Rod and Metro Plumb grew +19% to reach £60m. They also own Willow Pumps, which is reliant on housebuilding and construction, they say that this is benefitting from a recovery without giving any numbers.

On the B2C side (ChipsAway, Ovenclean and Barking Mad) continue to face headwinds, because of reduced levels of franchise recruitment and retention. Normally in a recession, people lose their jobs and decide that they would like to work for themselves. However, FRAN management point to a strong labour market, so this doesn’t seem to be happening at the moment. The Board is undertaking a strategic review and considering all options for the B2C businesses. There’s also a Capital Markets Day on the afternoon of Wednesday 25th January.

Valuation: Allenby, their broker, hasn’t raised 2023F EPS following the RNS, keeping their Oct forecast of 8.6p EPS. That puts the shares on 25x Dec 2023F, or 2.4x the same year’s sales. That seems expensive to me, given that RoCE and CRoCI has struggled to rise into double digits.

Opinion: I’ve followed this company for a couple of years, and it navigated the pandemic well. It’s been on my watchlist, it’s never really become cheap enough for me to be excited. Nigel Wray and Stephen Hemsley both own 17% each, so I wonder if at some point this will create an overhang. I am wondering whether this stock has a long future of growth ahead or if it has already gone ex-growth without the Filta acquisition and Metro Rod/Metro Plumb’s contribution, the other businesses look rather pedestrian.

Quartix Technologies Update FY Dec

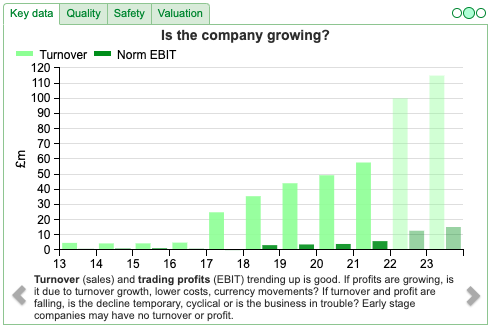

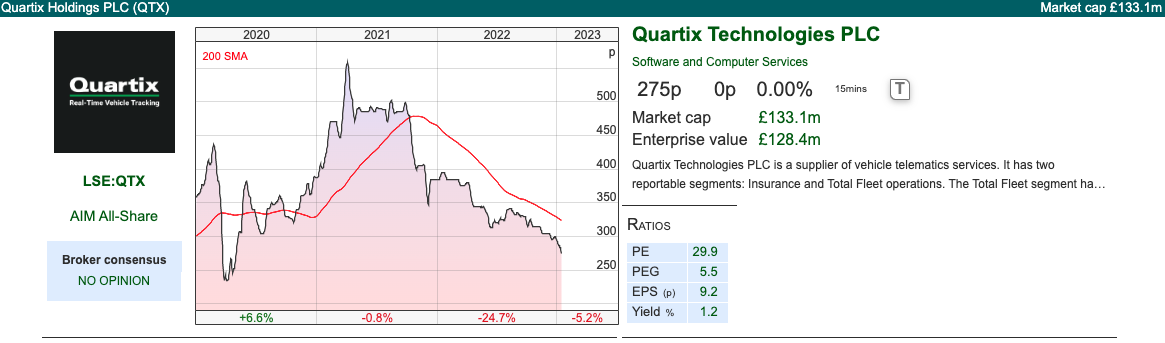

This vehicle tracking company announced an inline trading update (FY Dec 2022F revenue £28m, adj EBITDA £5.8m, underlying FCF £3.9m). That implies revenue growth of +9% and flat profits, according to their broker, FinnCap’s, numbers.

They have 235,000 vehicle subscriptions, +16% on the prior year (implying a slowdown in H2, as H1 v H1 growth was +26%). Although this is a niche business, they have expanded it successfully to France (around a quarter of revenue and growing at +25%) the USA (around 1/8 of revenue and growing at +7%). They have a small foothold in Spain, Italy and Germany which is growing +63% from a low base. They had £5.1m of cash at the end of December.

In the past the company has suffered from a lack of pricing power, explaining why revenue (+9%) has grown more slowly than new subscriptions (+16%). They say in the RNS that pricing is firming, though I would hope so in a c. +10% inflation environment. The customers tend to be owners of vehicle fleets, rather than individuals, so they are selling to large organisations. They’ve launched a couple of adjacent products: i) Evolve, aimed at organisations wishing to analyse the data on migrating to an Electric Vehicle (EV) fleet; ii) Quartix Check, a tool for monitoring vehicles by walking around and checking for damage. They will begin upselling in the UK first, followed by the other geographies.

They also announced an accounting change. Historically QTX have expensed all costs through the p&l, rather than capitalising Development spend on to their balance sheet, then amortising over the useful life. They claim that the change is more in line with the accounting standard IFRS 15 and make reported EBITDA more comparable with other companies with a similar business model. This change in accounting policy will add £0.4m to adj EBITDA – so given that FinnCap haven’t changed their 2022F adj EBITDA figure of £5.8m – doesn’t this then imply a 7% reduction in the bottom line?

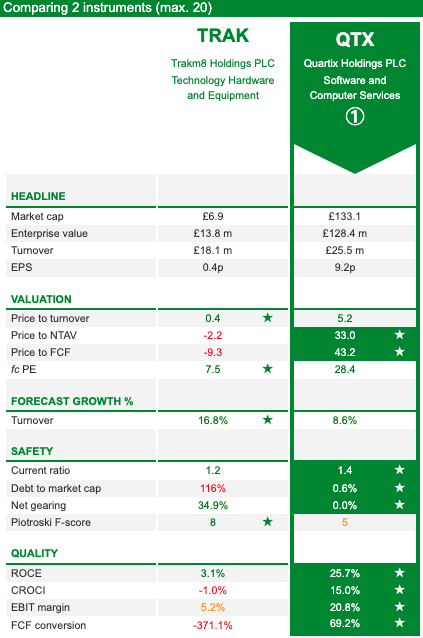

A couple of years ago I bought Trakm8, a competitor after it had fallen 75% from its peak of almost 400p. TRAK shares promptly fell another 75% after I had invested, and it now has a market cap of less than £10m. Trakm8 does capitalise Development spend on to their balance sheet, I’m unconvinced that QTX management should be trying to emulate TRAK. The latter certainly doesn’t trade at a premium valuation. See Sharepad’s comparison table below:

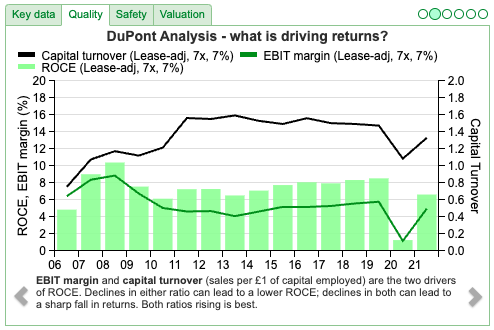

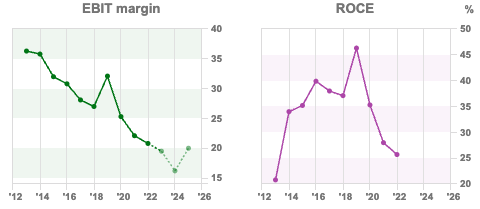

Valuation: Although they left 2022F QTX forecasts unchanged, FinnCap revised down FY Dec 2023F by -18% and 2024F EPS by -3%. That puts the shares on 30x PER 2023F and 21x PER 2024F. That seems expensive for me given the EBIT margin has been in long-term decline because of lack of pricing power, and RoCE has also been falling (albeit from a 45% high a couple of years ago).

Opinion: The top line has not risen much in the last 5 years, but that is now forecast by their broker to improve. Management say that pricing is stabilising, but they can’t point to anything specific to back this up. Thus, I think investors are putting a lot of faith in management’s track record, without much basis to see why the coming 5 years will look different to the previous 5 years. Longer term I am wondering if ‘driverless cars’ are likely to impact the business model. I would wait for firm evidence of stabilising margins and revenue growth before paying the high multiple to buy into the story.

Conclusion

The author owns shares in Games Workshop, Trakm8 and The Mission Group

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary | 17/01/23 | GAW, TMG, FRAN, QTX | Terry Smith’s Triskaidekaphobia

Bruce looks at Terry Smith’s 13th annual shareholder letter and compares what he’s now saying about his META investment to his commentary a couple of years ago. Companies covered GAW, TMG, FRAN, QTX

The strong start to the year continues, with the FTSE 100 +1.64% to 7,851 in the last 5 days, approaching an all-time high of 7,903 achieved on 22 May 2018. That’s a +17% bounce since Oct last year. In the US, the Nasdaq 100 was up +4.8% and the S&P500 +2.7% in the last 5 days. The US 10Y government bond yield was 3.51% and the UK 10Y government bond yield was 3.40%. Gold is up +4% since the start of the year to $1,882 per ounce.

Terry Smith, the former UK banks’ equity research analyst, has published his 13th Annual Letter, available here. I had to look up the word triskaidekaphobia in his first paragraph, which means fear of the number 13. The whole letter is worth reading in full, though it starts with some rather conventional criticism of Central Bankers creating easy money conditions (that doesn’t mean he is wrong!) Then more interesting observations on how investors fail to adjust the valuation multiples when companies report share base compensation differently and company managements’ engagement with activists versus long-term shareholders. He also points to Unilever’s voluntary disclosure (or lack of it) involving brands they acquired by paying large sums of money (eg. Dollar Shave Club) and then not mentioned in subsequent management commentary.

Two can play at that game, so I went back and looked at what Terry was saying about buying Facebook/Meta in 2020.

“We are not the sort of people who ever declare victory — we invest with a strong sense of paranoia — but it continues to be pleasing to note the contribution of Facebook which was certainly our most controversial stock purchase and led to more questions (and demands for its sale) from some of our investors than any other company.”

Meta fell -60% in 2022, and in his most recent letter, he mentions “well-publicised regulatory and competition problems”, without saying whether those problems were well-publicised a couple of years ago. I think they were! Richard has created a couple of Terry Smith-style filters, using measures like high RoCE and Free Cashflow Yield, which you can read about here (Terry Smith Algorithm) and here (Fishing Like Fundsmith).

Last week saw a couple of profit warnings from stocks that ought to have been defensive: general insurer Direct Line and cybersecurity firm Darktrace. ITM Power, the hydrogen power company also warned on Monday, despite the £318m of net cash on its balance sheet, I wouldn’t classify this company as defensive though. On the other hand, there were also positive updates from the likes of Marks Electrical (white goods), The Mission (marketing), IQGeo (software) and Franchise Brands (plumbing, oven cleaning and dog hotels) both of which I look at below. I also cover Games Workshop and Quartix, which both trade on valuation multiples in the mid-twenties, despite struggling with declining margins and lacklustre profit growth.

Games Workshop H1 to November

This miniatures and games company announced H1 revenue up +7%to £227m, or if you exclude the lumpy ‘licensing revenue’ H1 was up +11%. Statutory PBT is down -5% to £84m, mainly because licensing income fell from £20m H1 last year to £14m. This revenue stream from licensing out the brand to computer games developers has very little cost attached, so any decline drops straight through to profits.

Net cash was £85m, after a £54m (165p per share) declared dividend in the period (a +64% increase from £33m in H1 2021). Excluding dividends paid, net cash increased by £68m (up +64% from H1 2021).

Interestingly in the text management admit that while £227m is a record H1 revenue figure, “it isn’t where we wanted to be, particularly in the US, which was flat on a constant currency basis.” Followed up with the candid admission that “as a team, we need to scale with a little more nous.” I like this style of communication, as it helps investors to understand the company. Some people have suggested that GAW have disappointed on costs. My view is that often when a company disappoints on costs, in reality, they have invested for sales growth, that then has failed to come through. So the disappointment is actually the revenue line, in this case, the management commentary supports that view.

Sales through their own shops (Retail just under a 1/4 revenue) were up +10% and independent retailers +3% (Trade 3/5 of revenue), while Online was down -0.5%. Management say that this was part of their deliberate plan, to target a recovery in Retail through their physical stores. They then rather contradict this by saying that they have spent £4.9m on an updated webstore, which has been delayed due to project management issues. This project is now tentatively rescheduled for opening summer 2023.

This could be a GAW-specific issue around technology and online order fulfilment. Possibly though it’s part of a wider trend of online retail is no longer taking market share, and whether that applies to fashion brands rather than just GAW. Core gross margins (ie gross margins ex licensing) were down -4.5% to 64%, due to increased materials and staff costs. They’ve increased the Recommended Retail Price (RRP) at broadly the same level as last year.

Although it sits somewhere between leisure and retail sectors, Games Workshop was seen as a pandemic winner, in my view, the investment case has really been about the community the games created. For the first time since the pandemic, they will be running UK Warhammer Fest over the 2023 April/May bank holiday weekend in Manchester, expecting to attract 10,000 fans.

Outlook: There tends to be an H2 weighting as the holiday season comes in the Dec-May half. They don’t say any more about the agreement in principle with Amazon studios.

Valuation: Edison are forecasting FY May 2023F revenue of £447m, implying +8% full-year growth (v +7% H1 v H1 just reported). The shares are trading on a PER 24x May 2023F and May 2024F of Edison’s numbers.

Opinion: The shares were up +25% following the Amazon agreement announcement. There doesn’t seem to be anything fundamentally wrong with the company, although sales have come in a bit light. Management are doing all the right things, in my view. I own this and believe that it is better to own a company with strong profitability but uncertain growth, than a company with uncertain profits but strong growth.

The Mission Trading Update FY Dec

This marketing and PR company rose +20% last week as it announced revenue +10% (slightly ahead of consensus) but has written off £6m of goodwill (6% of total intangible assets). Headline PBT should be not less than £7.6m, versus £7.5m FY Dec 2022. Net debt ended the year at £11.4m versus £10.3m Dec last year, but they do say that they expect net debt to reduce significantly in 2023F.

Historically there’s been an H2 weighting with this stock because marketing budgets tend to be spent in the second half of the year. However, it’s understandable given the deteriorating marketing environment (Sir Martin Sorrell’s S4 Capital fell almost -70% last year) that investors were nervous H2 would disappoint. RoCE has never traded above 8.5% for this stock. Hence the shares were trading on a mid-single-digit PER multiple.

I think the +20% share price reaction was also a fascinating reaction to £6m goodwill writedown. As of H1 2022, TMG were carrying £100m of intangible assets on their balance sheet versus shareholders’ equity of £95m. Normally I would expect a company with negative tangible book value to react badly if management started writing down goodwill. However, I have also noted in the past that management of quality companies, like Clarkson and Nichols are not afraid to take goodwill writedowns when acquisitions don’t work out as intended. I’ve used Sharepad to show that TMG has operated with more intangibles than equity since it listed 15 years ago.

There’s a degree of subjectivity around writing off goodwill, but if management choose not to bite the bullet, it means that the capital base appears inflated, so that profitability measures like RoCE and CRoCI are suppressed. Finance theory suggests that a company earning a mid-single digit return (ie below its cost of capital) is worth a mid-single digit PER, even if it is growing the top line. That said, over the last 10 years revenue and headline PBT have grown at +54% and +52% respectively, while shareholders’ equity (following the goodwill writedown) is up c. +37% and number of shares is up +18%. Net debt is the same level at £11m. If revenue and profits are growing faster than the capital base, then that suggests the incremental RoCE on recent business is better than the group RoCE of 6.1% (3-year avg).

In order to drive multiple expansions, a company needs to show that it can grow revenue and profits while investing incrementally less capital. Writing off intangible assets that are not generating a decent return makes it easier for investors to form a view on future returns, rather than legacy acquisitions. Thus, the share price has reacted positively to the goodwill writedown.

Opinion: I bought this a decade ago on a low PER multiple when it was distressed following the financial crisis. Despite 10 years of growth, TMG is still trading on PER of 6.4x Dec 2024F. The investment hasn’t lost money but taught me to be unimpressed with growth if RoCE is below the cost of capital. Of course, I knew this from finance textbooks, but there’s nothing like owning an underperforming company in your portfolio to drive home theoretical knowledge.

Franchise Brands Trading Update FY Dec

This franchise company (Metro Rod plumbing, Ovenclean and Barking Mad) run by the former Domino’s Pizza UK management announced Group revenue, adj EBITDA and adj EPS slightly ahead of expectations. Before the RNS, revenue was forecast to be £99m, adj EBITDA £15m and EPS of 7.7p according to the company. This follows a Q3 trading update in October when their broker (Allenby) raised EPS forecasts for 2022F and 2023F by +5% and +3% respectively. Revenue has doubled in 2 years from just below £50m in 2020 to £100m forecast for 2022F, and PBT is forecast to increase 2.6x over the same time period.

FRAN bought Filta in March 2022, which is an oil filtration service for restaurants to prevent them from throwing oil down the drain and clogging up everything. They paid £50m in FRAN shares, valuing the business at 2.5x then forecast sales. Filta has obviously benefited from the hospitality sector enjoying a better 2022 than 2021, but also the used cooking oil that they collect from customers is sold as biofuel, which has increased in value. As a result, Filta North America system sales increased +51% in 2022 from $61m to reach $92m and exited the year with a record run-rate of $100m per annum.

Their other B2B businesses are plumbing and drain cleaning. Metro Rod and Metro Plumb grew +19% to reach £60m. They also own Willow Pumps, which is reliant on housebuilding and construction, they say that this is benefitting from a recovery without giving any numbers.

On the B2C side (ChipsAway, Ovenclean and Barking Mad) continue to face headwinds, because of reduced levels of franchise recruitment and retention. Normally in a recession, people lose their jobs and decide that they would like to work for themselves. However, FRAN management point to a strong labour market, so this doesn’t seem to be happening at the moment. The Board is undertaking a strategic review and considering all options for the B2C businesses. There’s also a Capital Markets Day on the afternoon of Wednesday 25th January.

Valuation: Allenby, their broker, hasn’t raised 2023F EPS following the RNS, keeping their Oct forecast of 8.6p EPS. That puts the shares on 25x Dec 2023F, or 2.4x the same year’s sales. That seems expensive to me, given that RoCE and CRoCI has struggled to rise into double digits.

Opinion: I’ve followed this company for a couple of years, and it navigated the pandemic well. It’s been on my watchlist, it’s never really become cheap enough for me to be excited. Nigel Wray and Stephen Hemsley both own 17% each, so I wonder if at some point this will create an overhang. I am wondering whether this stock has a long future of growth ahead or if it has already gone ex-growth without the Filta acquisition and Metro Rod/Metro Plumb’s contribution, the other businesses look rather pedestrian.

Quartix Technologies Update FY Dec

This vehicle tracking company announced an inline trading update (FY Dec 2022F revenue £28m, adj EBITDA £5.8m, underlying FCF £3.9m). That implies revenue growth of +9% and flat profits, according to their broker, FinnCap’s, numbers.

They have 235,000 vehicle subscriptions, +16% on the prior year (implying a slowdown in H2, as H1 v H1 growth was +26%). Although this is a niche business, they have expanded it successfully to France (around a quarter of revenue and growing at +25%) the USA (around 1/8 of revenue and growing at +7%). They have a small foothold in Spain, Italy and Germany which is growing +63% from a low base. They had £5.1m of cash at the end of December.

In the past the company has suffered from a lack of pricing power, explaining why revenue (+9%) has grown more slowly than new subscriptions (+16%). They say in the RNS that pricing is firming, though I would hope so in a c. +10% inflation environment. The customers tend to be owners of vehicle fleets, rather than individuals, so they are selling to large organisations. They’ve launched a couple of adjacent products: i) Evolve, aimed at organisations wishing to analyse the data on migrating to an Electric Vehicle (EV) fleet; ii) Quartix Check, a tool for monitoring vehicles by walking around and checking for damage. They will begin upselling in the UK first, followed by the other geographies.

They also announced an accounting change. Historically QTX have expensed all costs through the p&l, rather than capitalising Development spend on to their balance sheet, then amortising over the useful life. They claim that the change is more in line with the accounting standard IFRS 15 and make reported EBITDA more comparable with other companies with a similar business model. This change in accounting policy will add £0.4m to adj EBITDA – so given that FinnCap haven’t changed their 2022F adj EBITDA figure of £5.8m – doesn’t this then imply a 7% reduction in the bottom line?

A couple of years ago I bought Trakm8, a competitor after it had fallen 75% from its peak of almost 400p. TRAK shares promptly fell another 75% after I had invested, and it now has a market cap of less than £10m. Trakm8 does capitalise Development spend on to their balance sheet, I’m unconvinced that QTX management should be trying to emulate TRAK. The latter certainly doesn’t trade at a premium valuation. See Sharepad’s comparison table below:

Valuation: Although they left 2022F QTX forecasts unchanged, FinnCap revised down FY Dec 2023F by -18% and 2024F EPS by -3%. That puts the shares on 30x PER 2023F and 21x PER 2024F. That seems expensive for me given the EBIT margin has been in long-term decline because of lack of pricing power, and RoCE has also been falling (albeit from a 45% high a couple of years ago).

Opinion: The top line has not risen much in the last 5 years, but that is now forecast by their broker to improve. Management say that pricing is stabilising, but they can’t point to anything specific to back this up. Thus, I think investors are putting a lot of faith in management’s track record, without much basis to see why the coming 5 years will look different to the previous 5 years. Longer term I am wondering if ‘driverless cars’ are likely to impact the business model. I would wait for firm evidence of stabilising margins and revenue growth before paying the high multiple to buy into the story.

Conclusion

The author owns shares in Games Workshop, Trakm8 and The Mission Group

Bruce Packard

brucepackard.com

Got some thoughts on this week’s commentary from Bruce? Share these in the SharePad “Weekly Market Commentary” chat. Login to SharePad – click on the chat icon in the top right – select or search for “Weekly Market Commentary” chat.

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.