Bruce remains in risk averse mode, keeping an open mind and updating beliefs to see how the conflict in Ukraine might resolve. He looks at Clarkson, which should benefit from high commodity prices, and also Bango and Funding Circle.

The FTSE 100 was up +2.7% to 7,178, having had a very volatile week. The S&P 500 was down -1.6%, and Nasdaq 100 fell -1.8% last week. Nasdaq100 is down -17% since the start of the year. The US 10 year bond yield rose back to 1.94% as concern over US inflation (CPI) 7.9% outweighed risk aversion. Brent Crude fell back to $107 per barrel having peaked at over $125 earlier in the week. Gold is now up +9% this year, trading at $1,988 per ounce.

The situation in Ukraine is still very fluid. I have found Bank of Georgia’s two scenarios a useful way of thinking about how events unfold, because it prevents you from getting too bogged down. On a humanitarian level it is very distressing to see scenes like the bombing of a childrens’ hospital. That makes it hard to think straight. The two scenarios help below filter out “noise” and focus on “signal”.

Scenario1, resolution of war in 1-2 months: EU/US sanctions on Russia throughout 2022 and assumes a cease-fire between Russia and Ukraine can be reached. The Russian invasion of Georgia only lasted a couple of weeks in August 2008.

Scenario 2, protracted war: this scenario assumes long term conflict. EU/US sanctions continue for longer, including oil & gas. Events in the Battle of Grozny in the Second Chechen War show Putin is unconcerned about urban warfare and civilian casualties. Let’s hope this doesn’t happen.

Just like the start of the pandemic, I think the key is to keep an open mind and update your beliefs as uncertainty resolves. One thing to consider is that resolution may be more important than who “declares victory”. Just because the war seems to be going badly for Putin, the correct interpretation may not be positive for markets. Putin is like a trader sitting on a losing position, he may take more risk to try and extricate himself.

I haven’t sold any shares but also haven’t been fully invested for a while. It could be that sitting on cash turns out to be wrong. That’s my approach which I’m sharing in case you find it helpful.

If you’re looking for other news to take your mind off Ukraine, the FT have made a fun 20 minute YouTube video about the collapse of Evergrande. There’s plenty of drone footage of cranes and half built buildings. So far there hasn’t been much contagion coming from this – but I do wonder if we are under-estimating the long term effects of China’s debt fuelled property growth coming to an end. The FTSE China 50 Index had a difficult year last year, and 2022 hasn’t started any better.

This week I look at Clarkson, Bango and Funding Circle FY results. Of the three, the current environment favours Clarkson, but I also think it’s worth keeping an eye on “story stocks” that have been sold off heavily. At the moment I am in risk aversion mode, but often find that most research I do earlier isn’t wasted. It comes in useful later and gives me higher conviction levels when I do think that it’s time to buy.

Clarkson FY Dec Results

This shipping services company founded in 1852 has done well from the supply chain disruption problems, with revenue up +24% to £44m and underlying PBT up +55%to £69m. Net cash was £122m +28% v last year. Performance on a statutory PBT basis was even better because CKN reported a £16m loss last year, following a £61m goodwill impairment charge. That was because they wrote down their Norwegian business Platou, bought in 2014 for £281m (75% in Clarkson shares).

Platou was an investment bank specialising in shipping. At the time the rationale for the deal was that banks had become reluctant to lend to the capitally intensive and cyclical shipping industry, while yield-hungry funds were looking for assets, hence there seemed to be an opportunity to make money. In retrospect the banks were right to be wary (it’s not often that I write that sentence!)

Although very profitable at the time of the acquisition (Platou revenues of £133m and operating PBT of £34m) Clarkson management clearly underestimated how cyclical the profits were. The Norwegian corporate financiers sold themselves at the top of the market, the deal completed in February 2015. There then followed a slowdown in the Chinese economy, and the oil price fell to below $30 per barrel in early 2016 which made it difficult to raise money in the shipping and commodities sector.

I noted last week how Nichols management had decided that their Out of Home brands had been permanently impaired, yet at the same time trading was now recovering from the pandemic and 2021 revenues were up +77%. It’s a similar story with Clarkson, where despite writing off £61m of goodwill last year, their “Financial” division (which includes Platou) reported revenue +65% to £56m and PBT in the division was up 5x to £13m. My experience is that bad management teams are reluctant to write off goodwill, I’m not sure that the opposite is true – good management are eager to make write downs – but I wouldn’t rule it out.

New Chair Earlier this month Sir Bill Thomas announced that he would not be seeking re-election as Chairman at the AGM in May, Laurence Hollingworth has been announced as his replacement. The new Chair has a background in investment banking (JP Morgan including Head of UK Investment Banking). Like former McKinsey consultants, I’m wary of corporate financiers becoming Chairmen, because they often want to do deals. The worst example of this was Victor Blank and Lloyd’s catastrophic acquisition of HBOS, but I’m sure that there are many others.

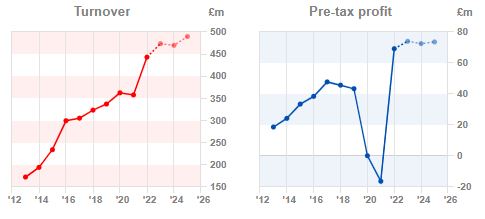

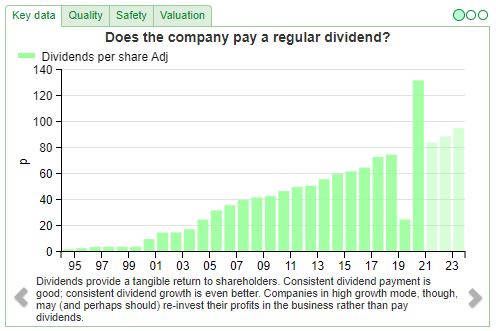

Valuation CKN shares are trading on 20x PER 2023F and 2024F. RoCE has been falling in recent years, but this still looks like a quality company. Management highlight their progressive dividend policy has 19 years of consecutive growth. The Sharepad dividend chart reveals that they deferred their 2019 final dividend of 53p and paid the amount as an interim dividend the following year. A minor point, but that explains why the chart looks the way it does.

Opinion The shares were up +8% on the morning of the RNS, performing well in a weak market. The exposure to oil, commodities and benefiting from rising shipping costs means that the shares are uncorrelated with the market as a whole. Clarkson strikes me as a good way to diversify portfolios.

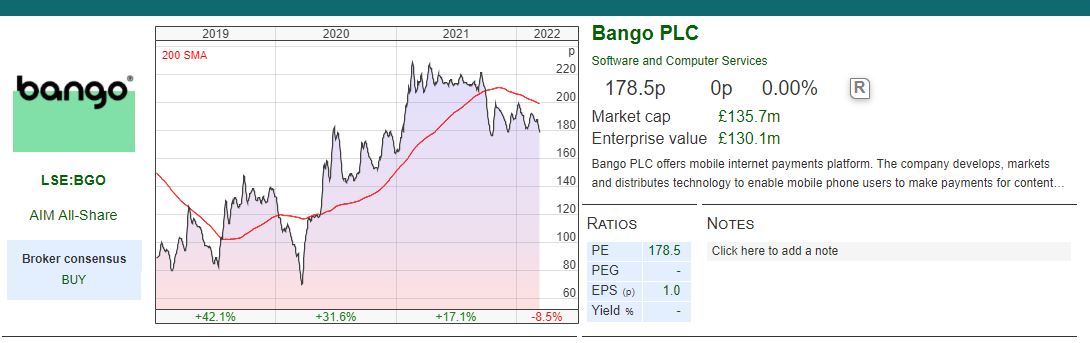

Bango FY Dec Results

This mobile payments company has changed its reporting currency to US dollars and has delivered revenue growth in that currency +32% to $21m. Having made a small (less than $1m) profit in 2020, the company has slipped back into reporting a $1.5m loss in 2021. Inevitably management highlight Adjusted EBITDA of $6.2m and fail to mention the statutory loss in the highlights.

Cash used in investing at $7.3m has outpaced cash generated from operating activities of $6m, but the company has raised $2.2m from issuing new shares. The number of shares outstanding has grown to 76m at the end of 2021, dilution of c. 5% each year for the last 3 years.

Management report that cash at the end of December was up +21% to $9.7m in the headlines on the front page. That figure contradicts the $8.7m of cash and cash equivalents given in the cashflow statement on page 56 of the Annual Report. I think the difference is $945K of cash in a 95 day notice account, which presumably the accountants didn’t let them include as cash equivalent because the notice period was too long. That’s not really significant for the investment case, but it does show how management are striving to present the company in the best possible light with their headlines. That attitude in turn implies to me that they could need to raise more money from shareholders.

Story Stock Bango should be an attractive business with operational gearing once scale is achieved. The gross margin is in the 90s, and 6 year revenue growth has been +47% CAGR. They also have a good “story” around providing advertisers and merchants data based on what phone users buy.

They recently announced a partnership with Digital Turbine ($APP) which is an online advertising platform that I’ve been rather sceptical of in the past.

As an aside: Digital Turbine bought Fyber (itself cobbled together from acquisitions like Berlin based RNTS, Israeli Inneractive, Falk Realtime and San Fransisco based Heyzap) for $600m – which seemed to me a high price for a business which had lost €15m in 2020 and €49m in 2019 and was being funded by a Lars Windhorst vehicle (Tennor) but said in the 2020 Annual Report it was not able to repay its convertible debt. The Digital Turbine share price is down -56% in the last 12 months and down -37% since the start of this year.

Digital Turbine and Bango’s agreement may mean more revenue so that both companies benefit. But so far Bango has not lacked revenue growth, instead BGO management have yet to deliver any evidence of operational gearing or network effects.

Ownership There are some high quality institutions on the BGO shareholder register. Liontrust own 11.6%, Herald IM the technology specialists 10.4%, NHN Corporation (a Korean IT company) 10%, Crispin Odey’s fund owns 8.5%. A couple of my former Credit Suisse colleagues who worked in telco and tech equity research also own it.

Valuation BGO is trading on 9x current sales, but the top line is forecast to grow at c. +30% per year, so that price to sales figure falls to 5x 2023F. The PER is 22x 2023F, which looks good if they can achieve the forecast, but I think there is potential to disappoint.

Opinion I’m sitting on the fence. Payments is a very difficult industry to analyse, loss making businesses can hit that tipping point and achieve billion dollar valuations (PayPal is a good example). There’s plenty of large, well-funded competition though: Stripe, Square and listed in Europe Adyen. If you can get comfortable with the investment case then sell off since the start of the year could present an opportunity to buy. I personally am feeling risk averse at the moment, so will avoid.

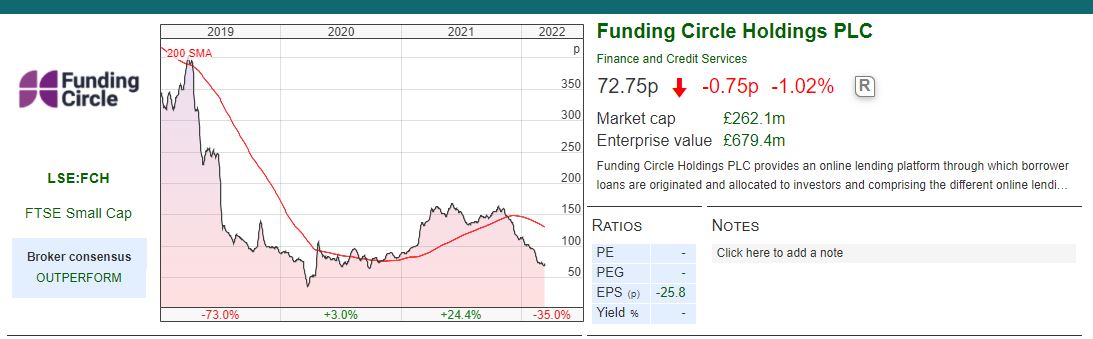

Funding Circle FY Dec Results

It’s worth keeping an eye on stocks that once traded on high expectations and have since fallen back to Earth. Purple Bricks and Boohoo also spring to mind. The latter also reported a positive trading update this week – but I remain cautious on the BOO investment case. I met up with a former colleague (equity analyst in the retail sector) over Christmas, who warned me that her conversations with institutional investors suggested that it would take a long time for the ESG mandates to be comfortable with the investment case on Boohoo again.

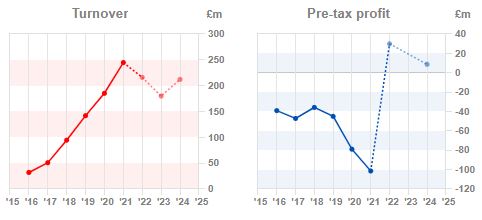

Instead I look at Funding Circle, the SME lender that announced FY results with total income down -7% to £207m and PBT of £64m versus a £108m loss last year. Originally FCH was a peer to peer lender, but that model hasn’t worked, they’ve cut back their European expansion and Samir Desai the co-founder stepped down at the start of the year. Unlike a traditional bank, FCH match borrowers with lenders (mainly institutional fund managers and banks) and charges both sides fees (80% of total income). FCH also has its own investment vehicles, which generate investment income (20% of total income) and that has caused swings in fair value (+14% 2021, -53% 2020) through the p&l.

SMEs often complain that banks’ decision making is very slow. SMEs fill in countless forms, wait many weeks and then banks say no. So an instant lending decision is something SME owners really value, FCH report a Net Promoter Score of 82 in the UK – well ahead of traditional banks. Funding Circle say that more than 70% of applications receive an instant decision in the UK. It’s hard to know if this is a genuine competitive advantage (ie whether banks can improve) – the original FCH “network effect” of having borrowers and savers on the same platform was illusory. Unlike a proper network effect (PayPal, eBay or Facebook) there wasn’t an obvious benefit as the business scaled. Marketing spend in 2021 was £47m, 28% of operating expenses suggesting that customer acquisition costs remain high relative to traditional lenders.

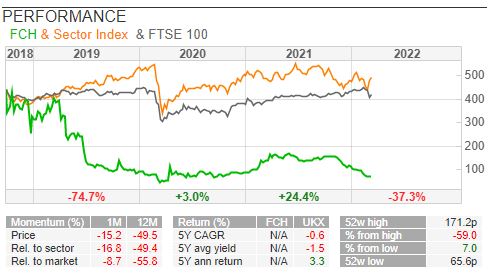

That said, I was impressed how strongly the shares participated in the initial Covid rally April 2020 rally from 20p per share to peak at over 170p a year later. More recently the share price has been floundering down -37% since the start of this year.

Outlook The outlook statement sounds very upbeat saying that having survived Covid they’re in the strongest position that they have ever been in. They give detailed 2022 FY guidance: operating income between £155-145m (implying a 6-12% fall from FY 2021). They say they will be Adjusted EBITDA positive, despite reporting a PBT this year. That, and a £224m cash pile, suggests to me that costs will rise, as they spend money to build out the business in the USA.

They also give 2025 guidance where they see UK total income of at least £220m (+8% CAGR on 2021) and Adjusted EBITDA margins at 30-35%. US total income of £70m (+12% CAGR on 2021) and maximum cumulative losses of c.£25m to get to profitability in the USA.

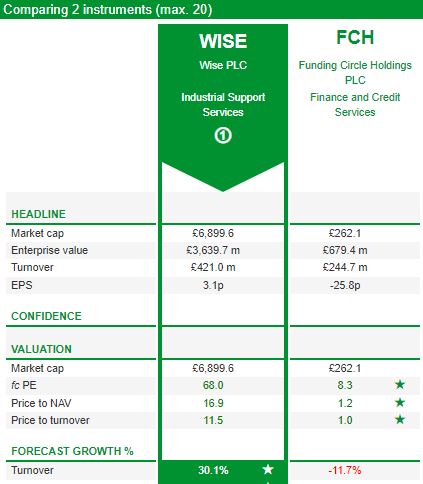

Valuation Despite not keeping most of the loans on its own balance sheet, FCH very much trades on bank like valuation multiple (1x historic sales, 1.2x NAV, 8x PER) rather than FinTech multiples like Wise (11.5x historic sales, 17x NAV and 68x PER). I use Sharepad’s “compare” feature to look at both companies.

Also worth noting is that FCH business has £224m of cash versus a market cap of £262m – though it’s unlikely that all the cash will be returned to shareholders. The outlook statement makes it clear that they will be investing for future growth.

Ownership Like Wise, there are some venture capital investors still on the shareholder register who’ve funded FCH from before the IPO. Index Ventures owns 16.4%, Accel Funds 7.5%, and Union Square 3.1%. There are more traditional institutions like T Rowe Price 6.75%, Jupiter 5.2% and Capital 4%.

Opinion I was an early customer and saw that some SMEs businesses received loans and then immediately defaulted – suggesting that Funding Circle’s early risk models were poor. It looks like they’ve fixed that now and the models have been tested through a downturn. FCH say that their 8th generation risk models significantly outperform traditional credit bureau scores. So the shares could be interesting at the right point in the cycle and an attractive valuation. As I say, I’m in risk aversion mode at the moment, but will re-assess the FCH investment case in H2.

Bruce Packard

brucepackard.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Weekly Market Commentary 14/03/22 | CKN, BGO, FCH | Frameworks for resolution

Bruce remains in risk averse mode, keeping an open mind and updating beliefs to see how the conflict in Ukraine might resolve. He looks at Clarkson, which should benefit from high commodity prices, and also Bango and Funding Circle.

The FTSE 100 was up +2.7% to 7,178, having had a very volatile week. The S&P 500 was down -1.6%, and Nasdaq 100 fell -1.8% last week. Nasdaq100 is down -17% since the start of the year. The US 10 year bond yield rose back to 1.94% as concern over US inflation (CPI) 7.9% outweighed risk aversion. Brent Crude fell back to $107 per barrel having peaked at over $125 earlier in the week. Gold is now up +9% this year, trading at $1,988 per ounce.

The situation in Ukraine is still very fluid. I have found Bank of Georgia’s two scenarios a useful way of thinking about how events unfold, because it prevents you from getting too bogged down. On a humanitarian level it is very distressing to see scenes like the bombing of a childrens’ hospital. That makes it hard to think straight. The two scenarios help below filter out “noise” and focus on “signal”.

Scenario1, resolution of war in 1-2 months: EU/US sanctions on Russia throughout 2022 and assumes a cease-fire between Russia and Ukraine can be reached. The Russian invasion of Georgia only lasted a couple of weeks in August 2008.

Scenario 2, protracted war: this scenario assumes long term conflict. EU/US sanctions continue for longer, including oil & gas. Events in the Battle of Grozny in the Second Chechen War show Putin is unconcerned about urban warfare and civilian casualties. Let’s hope this doesn’t happen.

Just like the start of the pandemic, I think the key is to keep an open mind and update your beliefs as uncertainty resolves. One thing to consider is that resolution may be more important than who “declares victory”. Just because the war seems to be going badly for Putin, the correct interpretation may not be positive for markets. Putin is like a trader sitting on a losing position, he may take more risk to try and extricate himself.

I haven’t sold any shares but also haven’t been fully invested for a while. It could be that sitting on cash turns out to be wrong. That’s my approach which I’m sharing in case you find it helpful.

If you’re looking for other news to take your mind off Ukraine, the FT have made a fun 20 minute YouTube video about the collapse of Evergrande. There’s plenty of drone footage of cranes and half built buildings. So far there hasn’t been much contagion coming from this – but I do wonder if we are under-estimating the long term effects of China’s debt fuelled property growth coming to an end. The FTSE China 50 Index had a difficult year last year, and 2022 hasn’t started any better.

This week I look at Clarkson, Bango and Funding Circle FY results. Of the three, the current environment favours Clarkson, but I also think it’s worth keeping an eye on “story stocks” that have been sold off heavily. At the moment I am in risk aversion mode, but often find that most research I do earlier isn’t wasted. It comes in useful later and gives me higher conviction levels when I do think that it’s time to buy.

Clarkson FY Dec Results

This shipping services company founded in 1852 has done well from the supply chain disruption problems, with revenue up +24% to £44m and underlying PBT up +55%to £69m. Net cash was £122m +28% v last year. Performance on a statutory PBT basis was even better because CKN reported a £16m loss last year, following a £61m goodwill impairment charge. That was because they wrote down their Norwegian business Platou, bought in 2014 for £281m (75% in Clarkson shares).

Platou was an investment bank specialising in shipping. At the time the rationale for the deal was that banks had become reluctant to lend to the capitally intensive and cyclical shipping industry, while yield-hungry funds were looking for assets, hence there seemed to be an opportunity to make money. In retrospect the banks were right to be wary (it’s not often that I write that sentence!)

Although very profitable at the time of the acquisition (Platou revenues of £133m and operating PBT of £34m) Clarkson management clearly underestimated how cyclical the profits were. The Norwegian corporate financiers sold themselves at the top of the market, the deal completed in February 2015. There then followed a slowdown in the Chinese economy, and the oil price fell to below $30 per barrel in early 2016 which made it difficult to raise money in the shipping and commodities sector.

I noted last week how Nichols management had decided that their Out of Home brands had been permanently impaired, yet at the same time trading was now recovering from the pandemic and 2021 revenues were up +77%. It’s a similar story with Clarkson, where despite writing off £61m of goodwill last year, their “Financial” division (which includes Platou) reported revenue +65% to £56m and PBT in the division was up 5x to £13m. My experience is that bad management teams are reluctant to write off goodwill, I’m not sure that the opposite is true – good management are eager to make write downs – but I wouldn’t rule it out.

New Chair Earlier this month Sir Bill Thomas announced that he would not be seeking re-election as Chairman at the AGM in May, Laurence Hollingworth has been announced as his replacement. The new Chair has a background in investment banking (JP Morgan including Head of UK Investment Banking). Like former McKinsey consultants, I’m wary of corporate financiers becoming Chairmen, because they often want to do deals. The worst example of this was Victor Blank and Lloyd’s catastrophic acquisition of HBOS, but I’m sure that there are many others.

Valuation CKN shares are trading on 20x PER 2023F and 2024F. RoCE has been falling in recent years, but this still looks like a quality company. Management highlight their progressive dividend policy has 19 years of consecutive growth. The Sharepad dividend chart reveals that they deferred their 2019 final dividend of 53p and paid the amount as an interim dividend the following year. A minor point, but that explains why the chart looks the way it does.

Opinion The shares were up +8% on the morning of the RNS, performing well in a weak market. The exposure to oil, commodities and benefiting from rising shipping costs means that the shares are uncorrelated with the market as a whole. Clarkson strikes me as a good way to diversify portfolios.

Bango FY Dec Results

This mobile payments company has changed its reporting currency to US dollars and has delivered revenue growth in that currency +32% to $21m. Having made a small (less than $1m) profit in 2020, the company has slipped back into reporting a $1.5m loss in 2021. Inevitably management highlight Adjusted EBITDA of $6.2m and fail to mention the statutory loss in the highlights.

Cash used in investing at $7.3m has outpaced cash generated from operating activities of $6m, but the company has raised $2.2m from issuing new shares. The number of shares outstanding has grown to 76m at the end of 2021, dilution of c. 5% each year for the last 3 years.

Management report that cash at the end of December was up +21% to $9.7m in the headlines on the front page. That figure contradicts the $8.7m of cash and cash equivalents given in the cashflow statement on page 56 of the Annual Report. I think the difference is $945K of cash in a 95 day notice account, which presumably the accountants didn’t let them include as cash equivalent because the notice period was too long. That’s not really significant for the investment case, but it does show how management are striving to present the company in the best possible light with their headlines. That attitude in turn implies to me that they could need to raise more money from shareholders.

Story Stock Bango should be an attractive business with operational gearing once scale is achieved. The gross margin is in the 90s, and 6 year revenue growth has been +47% CAGR. They also have a good “story” around providing advertisers and merchants data based on what phone users buy.

They recently announced a partnership with Digital Turbine ($APP) which is an online advertising platform that I’ve been rather sceptical of in the past.

As an aside: Digital Turbine bought Fyber (itself cobbled together from acquisitions like Berlin based RNTS, Israeli Inneractive, Falk Realtime and San Fransisco based Heyzap) for $600m – which seemed to me a high price for a business which had lost €15m in 2020 and €49m in 2019 and was being funded by a Lars Windhorst vehicle (Tennor) but said in the 2020 Annual Report it was not able to repay its convertible debt. The Digital Turbine share price is down -56% in the last 12 months and down -37% since the start of this year.

Digital Turbine and Bango’s agreement may mean more revenue so that both companies benefit. But so far Bango has not lacked revenue growth, instead BGO management have yet to deliver any evidence of operational gearing or network effects.

Ownership There are some high quality institutions on the BGO shareholder register. Liontrust own 11.6%, Herald IM the technology specialists 10.4%, NHN Corporation (a Korean IT company) 10%, Crispin Odey’s fund owns 8.5%. A couple of my former Credit Suisse colleagues who worked in telco and tech equity research also own it.

Valuation BGO is trading on 9x current sales, but the top line is forecast to grow at c. +30% per year, so that price to sales figure falls to 5x 2023F. The PER is 22x 2023F, which looks good if they can achieve the forecast, but I think there is potential to disappoint.

Opinion I’m sitting on the fence. Payments is a very difficult industry to analyse, loss making businesses can hit that tipping point and achieve billion dollar valuations (PayPal is a good example). There’s plenty of large, well-funded competition though: Stripe, Square and listed in Europe Adyen. If you can get comfortable with the investment case then sell off since the start of the year could present an opportunity to buy. I personally am feeling risk averse at the moment, so will avoid.

Funding Circle FY Dec Results

It’s worth keeping an eye on stocks that once traded on high expectations and have since fallen back to Earth. Purple Bricks and Boohoo also spring to mind. The latter also reported a positive trading update this week – but I remain cautious on the BOO investment case. I met up with a former colleague (equity analyst in the retail sector) over Christmas, who warned me that her conversations with institutional investors suggested that it would take a long time for the ESG mandates to be comfortable with the investment case on Boohoo again.

Instead I look at Funding Circle, the SME lender that announced FY results with total income down -7% to £207m and PBT of £64m versus a £108m loss last year. Originally FCH was a peer to peer lender, but that model hasn’t worked, they’ve cut back their European expansion and Samir Desai the co-founder stepped down at the start of the year. Unlike a traditional bank, FCH match borrowers with lenders (mainly institutional fund managers and banks) and charges both sides fees (80% of total income). FCH also has its own investment vehicles, which generate investment income (20% of total income) and that has caused swings in fair value (+14% 2021, -53% 2020) through the p&l.

SMEs often complain that banks’ decision making is very slow. SMEs fill in countless forms, wait many weeks and then banks say no. So an instant lending decision is something SME owners really value, FCH report a Net Promoter Score of 82 in the UK – well ahead of traditional banks. Funding Circle say that more than 70% of applications receive an instant decision in the UK. It’s hard to know if this is a genuine competitive advantage (ie whether banks can improve) – the original FCH “network effect” of having borrowers and savers on the same platform was illusory. Unlike a proper network effect (PayPal, eBay or Facebook) there wasn’t an obvious benefit as the business scaled. Marketing spend in 2021 was £47m, 28% of operating expenses suggesting that customer acquisition costs remain high relative to traditional lenders.

That said, I was impressed how strongly the shares participated in the initial Covid rally April 2020 rally from 20p per share to peak at over 170p a year later. More recently the share price has been floundering down -37% since the start of this year.

Outlook The outlook statement sounds very upbeat saying that having survived Covid they’re in the strongest position that they have ever been in. They give detailed 2022 FY guidance: operating income between £155-145m (implying a 6-12% fall from FY 2021). They say they will be Adjusted EBITDA positive, despite reporting a PBT this year. That, and a £224m cash pile, suggests to me that costs will rise, as they spend money to build out the business in the USA.

They also give 2025 guidance where they see UK total income of at least £220m (+8% CAGR on 2021) and Adjusted EBITDA margins at 30-35%. US total income of £70m (+12% CAGR on 2021) and maximum cumulative losses of c.£25m to get to profitability in the USA.

Valuation Despite not keeping most of the loans on its own balance sheet, FCH very much trades on bank like valuation multiple (1x historic sales, 1.2x NAV, 8x PER) rather than FinTech multiples like Wise (11.5x historic sales, 17x NAV and 68x PER). I use Sharepad’s “compare” feature to look at both companies.

Also worth noting is that FCH business has £224m of cash versus a market cap of £262m – though it’s unlikely that all the cash will be returned to shareholders. The outlook statement makes it clear that they will be investing for future growth.

Ownership Like Wise, there are some venture capital investors still on the shareholder register who’ve funded FCH from before the IPO. Index Ventures owns 16.4%, Accel Funds 7.5%, and Union Square 3.1%. There are more traditional institutions like T Rowe Price 6.75%, Jupiter 5.2% and Capital 4%.

Opinion I was an early customer and saw that some SMEs businesses received loans and then immediately defaulted – suggesting that Funding Circle’s early risk models were poor. It looks like they’ve fixed that now and the models have been tested through a downturn. FCH say that their 8th generation risk models significantly outperform traditional credit bureau scores. So the shares could be interesting at the right point in the cycle and an attractive valuation. As I say, I’m in risk aversion mode at the moment, but will re-assess the FCH investment case in H2.

Bruce Packard

brucepackard.com

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.