Richard builds a Fundsmith filter, taking it from concept to conclusion. The aim: To reduce the “junk” in our watchlists so we are fishing in a better-stocked pool of shares.

My editor wonders whether my obsession with Fundsmith Equity Fund is a ‘fatal attraction’ but he has permitted one more article.

It would be remiss not to build a Fundsmith filter since the highly regarded fund all but tells us how to do it in its annual letters and Owner’s Manual.

Essence of Fundsmith

Fundsmith is sceptical of fads and cycles, companies and industries that do extraordinarily well for a few years but crash and burn: “We would not own something because it is fashionable and might go up,” its Owner’s Manual says, because Fundsmith does not know how to work out when to buy and sell such shares, indeed it questions whether anyone does. It would rather buy and hold.

It thinks an important driver of sustainable returns is repeat business, which is why it favours companies that sell things to consumers. There are billions of us and we consume lots of things at regular and frequent intervals (think cosmetics, condoms, and cigarettes for example). When times are hard we might delay purchasing big things like houses, cars, and washing machines, but we are unlikely to stop buying life’s little essentials…

Fundsmith seeks to invest in businesses with intangible assets, brand names, market dominance, patents, large installed bases to service, distribution networks that give them more reach than their competitors, and deep relations with clients. It is often nigh-on impossible to value these assets, so accountants rarely bother.

The fund does not invest in companies that must borrow to earn high returns for shareholders, an effect known as leverage. High-interest payments can stymie profitability during times of financial stress when lenders also become much more cautious. Highly indebted business may look like high earners in the good times, but they are not, generally, reliable earners.

The companies Fundsmith holds must also be capable of growing by investing some of their profits to do more of what they do, so the fund favours firms in well-established industries that have already grown by developing new products and services.

According to its latest letter, the average Fundsmith company was founded in 1922.

A Fundsmith filter

It has probably occurred to you by now that not all the factors Fundsmith values are easily quantifiable. We will be able to capture some of them approximately, and others not at all. A filter is a starting point, eliminating some of the “junk”, a word I have heard Terry Smith, the fund’s founder, use to describe the many shares that fail his criteria.

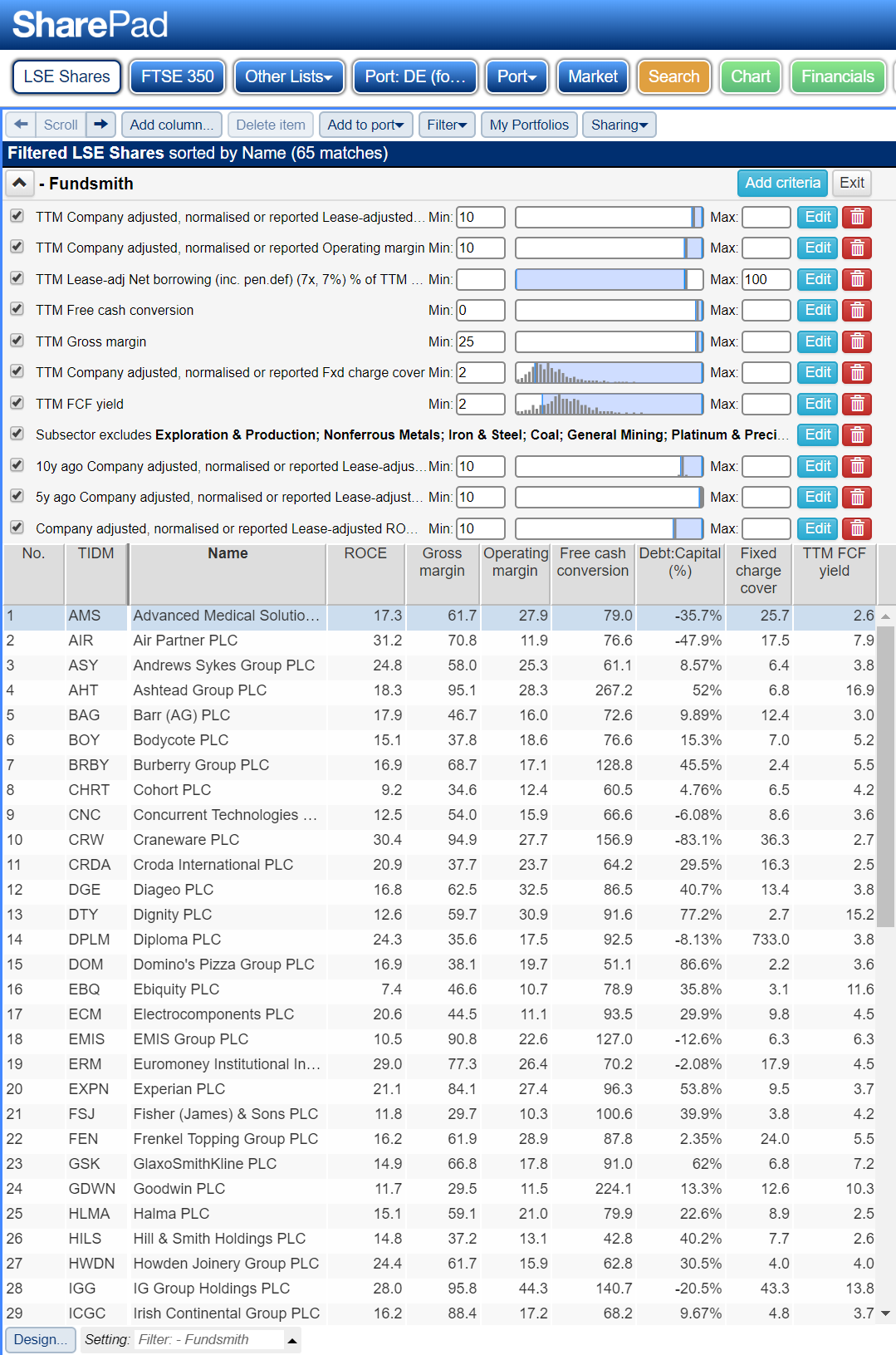

Fortunately, Fundsmith has given us a head start on the quantifiable factors, because it tells us which ones it uses to judge the quality of its portfolio (see my last article: Performance measurement for pros). I have taken my versions of those statistics, plugged them into a SharePad filter and applied it to all shares listed in London:

It is a bit of an eye-sore because I have chosen the latest Trailing Twelve Month data, ignored goodwill, and adjusted the figures for lease obligations to make them more comparable. By prefixing the criteria names with this information, there is no room to display the names of the actual ratios in some cases, so here they are in simplified form:

- ROCE (min. 10%)

- Gross margin (min. 25%)

- Operating margin (min. 10%)

- Free cash conversion (min. 0%)

- Debt : Capital (max. 100%)

- Fixed charge. (min 2x)

- Free cash flow yield: (min. 2%)

The first three items measure profitability, the fourth measures how much profit is earned in cash, factors five and six gauge how indebted the company is and the seventh is a measure of value. The Debt : Capital is a ratio I manufactured by combining Net borrowing “as a percentage of” Capital employed.

I explained these factors in my previous article, and if you go there, you may well come back to this one howling. The values I have chosen are nowhere near as demanding as the averages for Fundsmith.

There is a good reason for this. To pass a filter, a share must do better on every criterion but Fundsmith will contain shares that beat the averages on some statistics and not others. Together all the shares in the fund make the average, so to get a representative list of shares back from the filter we need to think in terms of minimums rather than averages.

On average, the list returned by my filter is much better than the minimums we set (sorry to keep sending you back there, but you can find out how to find out the averages for a list in SharePad, in my previous article):

| Fundsmith filter

(65 shares) |

Median | Mean |

| ROCE (%) | 19 | 19 |

| Gross margin (%) | 53 | 56 |

| Operating margin (%) | 19 | 20 |

| Free cash conversion (%) | 79 | 88 |

| Debt : Capital (%) | 21 | 16 |

| Fixed charge cover (x) | 9 | 27 |

| Free cash flow yield (%) | 5 | 6 |

There are four more criteria in the filter, which attempt to capture some of the less quantifiable factors. Fundsmith shuns certain types of companies, so I have excluded subsectors that I am confident contain them (banks, mining companies and housebuilders for example).

It also seeks companies that are already winning. They should have sustained our minimum level of profitability for years, so I have sampled previous years. The criteria are:

- ROCE (10 years ago) > 10%

- ROCE (5 years ago) > 10%

- ROCE (10 year average) > 10%

The eleven criteria cut the pool we are fishing in down from thousands, to 59.

You can see the filter exactly as I implemented it in the Filter Library in SharePad. Simply go to: Filter -> Apply filter -> Library -> “Richard Beddard 05/03/19: Fishing like Fundsmith”

Filtering the filter

But how do we decide which of the 65 shares to research? The obvious next step is to tighten the criteria, gingerly raising the minimums we have set until we get to a small group of shares.

I never do that. The criteria are set at arbitrary levels and there is a risk we will knock out a company on a technicality when it might be extraordinarily good in every other respect.

Instead, we can take inspiration from the Fundsmith Owner’s Manual, which says most companies can be excluded from its research pile…

“…Simply from a description of what they do or the sector they occupy, as most are cyclical, require leverage to get adequate returns, sell to other businesses, make capital goods or durable items, or some combination of these factors.”

Here are some options:

- Click around SharePad, and read the company information to see if the shares fit the bill

- Cast around a bit wider by visiting company websites and scrolling through annual reports

- Check out the financial histories of the companies in more detail in SharePad

- Choose a criterion we feel strongly about and sort the list by it, bringing the best candidates to the top.

Because I have a fatal attraction for spreadsheets, and I like all the criteria, I have knocked up a spreadsheet that promises to focus our attention on the shares that beat the criteria most convincingly. It ranks the shares in the list by each criterion, sums the ranks, and re-ranks the shares so those with the best overall rank are at the top. Here are the top 20 shares:

| Name | ROCE (%) | Gross margin (%) | Operating margin (%) | Free cash conversion (%) | Debt : Capital (%) | Fixed charge cover (x) | FCF yield (%) |

| IG Group Holdings PLC | 28 | 96 | 44 | 92 | -21 | 43 | 14 |

| PayPoint PLC | 79 | 47 | 25 | 52 | -73 | 92 | 8 |

| Victrex PLC | 25 | 64 | 39 | -11 | 118 | 6 | |

| Craneware PLC | 30 | 95 | 28 | 69 | -83 | 36 | 3 |

| Moneysupermarket.com Group PLC | 50 | 71 | 30 | 114 | -6 | 36 | 5 |

| M Winkworth PLC | 22 | 75 | 24 | 83 | -23 | 12 | 8 |

| Ashtead Group PLC | 18 | 95 | 28 | 224 | 52 | 7 | 17 |

| Euromoney Institutional Investor PLC | 29 | 77 | 26 | 67 | -2 | 18 | 5 |

| Air Partner PLC | 31 | 71 | 12 | 88 | -48 | 18 | 8 |

| Frenkel Topping Group PLC | 16 | 62 | 29 | 96 | 2 | 24 | 6 |

| Tracsis PLC | 19 | 58 | 15 | -36 | 17 | 5 | |

| London Security PLC | 17 | 77 | 17 | 66 | -3 | 10 | 6 |

| EMIS Group PLC | 11 | 91 | 23 | 69 | -13 | 6 | 6 |

| Sage Group (The) PLC | 19 | 93 | 27 | 34 | 9 | 5 | |

| Paddy Power Betfair PLC | 9 | 76 | 22 | 73 | 2 | 23 | 7 |

| Advanced Medical Solutions Group PLC | 17 | 62 | 28 | 101 | -36 | 26 | 3 |

| Nichols PLC | 28 | 46 | 22 | 81 | -26 | 54 | 4 |

| Diploma PLC | 24 | 36 | 18 | 93 | -8 | 733 | 4 |

| Experian PLC | 21 | 84 | 27 | 77 | 54 | 10 | 4 |

| Thorpe (F W) PLC | 17 | 47 | 18 | -18 | 77 | 4 |

If you would like to have a play with the spreadsheet, it is here.

Terry Smith would probably not be impressed with the list. Fundsmith Equity focuses on giant businesses listed in the USA and Europe as well as the UK, and I have aimed the filter at companies of all sizes listed in London.

But I see good quality names.

Readers’ filters

Imitation is the sincerest form of flattery. It is also a great way to learn from someone who has developed a winning strategy. Perhaps we will be able to adopt elements of the strategy to meet our own objectives and build on our own skills.

I am not even the first private investor to think of using Fundsmith’s criteria to develop a filter, probably not by a long way. John Jasper, a SharePad user who emailed me after I attempted to simulate Fundsmith a year ago emailed me his filter, which has inspired some of his investments. He says:

“I don’t just buy a share without looking at other things such as what kind of business it is, which sector, directors dealings, etc. The weekly RSI being above 50 is to try and capture shares with an upward momentum and avoiding those in a downtrend… [but that] is not something that Terry Smith would approve of!”

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.