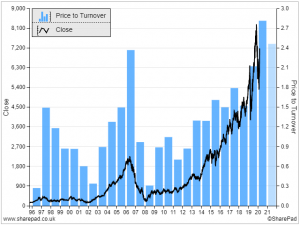

Oxford Metrics has an illustrious past, and judging by management’s targets it expects to augment it in future. Richard investigates the past, and ponders the future… I discovered Oxford Metrics while paging through SharePad’s list of the whole market (LSE shares, excluding Investment Trusts) skimming the summary pages of companies that had recently published annual […]