This year has confirmed that most of the news is at best irrelevant to me as an investor.

Worse, the news stressed me out. It regularly fed my mind with impossible problems to solve. Companies I admired closed down, temporarily I hoped. They raised money in emergency fund-raisings. They furloughed staff.

So far, the determination and inventiveness of these companies, helped by government support, means none have shown any sign of going bust. Some have repaid the furlough money and business rates relief.

As a long-term investor I rely on the people working for the businesses I invest in to work out what to do in difficult times.

I specifically chose these businesses because they were prudent, well managed, inventive and should survive when things get tough so, on more than one occasion this year, I found myself questioning why I read the news in general, and specifically the company announcements in SharePad.

But I have not cancelled my subscription to The Times, and I still skim the news for the shares in my watchlist (see below) most days, at the end of the day, or at the end of the week if I am especially busy. To help me do it quickly I still filter out the irrelevant news.

That is because the news contains information useful to long-term investors, hints of strategy and culture, that can help us understand businesses better and what will drive prosperity in future.

I already had a collection of words that are indicative of long-term strategic thinking and people-focused cultures in my “Companies that speak my language” news filter, so when SharePad introduced a new feature to allow us to highlight words in news articles even if we had not searched for them, I dumped them into the News Design dialog.

This helps me to quickly find news I can use, when I am reading the news feed:

The News Design dialog allows us to select words to highlight in the news feed. *The full list of words is at the end of this article.

A strong balance sheet is not just for lockdown

In March and April, when the first lockdown confined many of us to our homes for all but one hour of exercise I turned to filtering for the most financially secure shares.

After a couple of experiments, I settled on a filter that retrieves companies that had more cash than debt at the time of their last published balance sheets.

Debt levels at some companies can fluctuate dramatically so the filter also incorporated interest cover to highlight companies that paid lots of interest during the year, even if they had little debt when they reported.

I also wanted to make sure that the companies that passed the filter had earned their strong balance sheets and not just raised money from shareholders, so I excluded companies that had issued lots of new shares in the previous five years.

The result was In search of the cash kings.

The companies that passed the filter in April had not prepared for a pandemic. They were probably just prudent, and the prudent thing for long-term investors is to invest in companies like them.

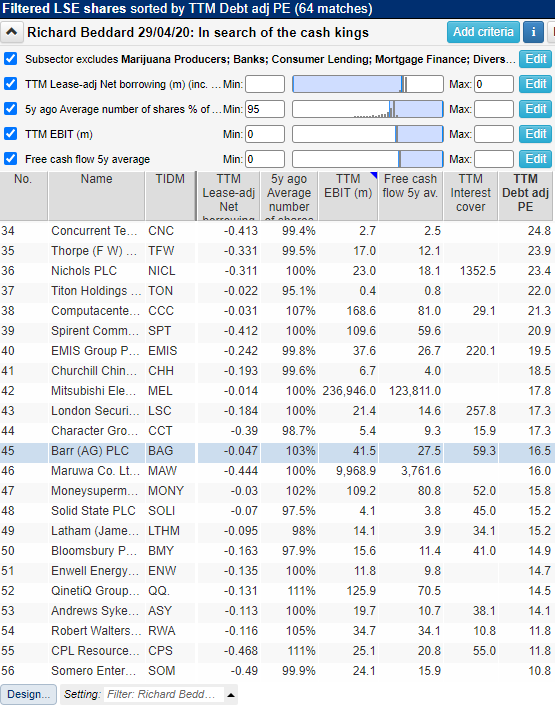

These are the companies that pass the filter in December 2020:

The table shows results 34 to 56, ordered by the debt adjusted price earnings ratio. Companies valued at more than 25 times earnings or less than 10 times earnings have been excluded.

It is an interesting list of strong companies at not unreasonable prices. I profiled QinetiQ, James Latham and Nichols in 2020, and plan to profile Barr early in 2021 as I extend my research into the soft drinks market.

It is intriguing to see Moneysupermarket in the list, and I confess to being a shareholder in FW Thorpe, Solid State and Bloomsbury Publishing.

Keep it simple

In last year’s edition of this article I celebrated a proliferation of watchlists, each one focused on companies in particular industries I follow, like holidays, or companies that share other qualities: staff-focused firms and owner-managed businesses, for example.

In practice many companies fitted in more than one watchlist and curating so many lists gave me a headache. To keep things simple, never a bad policy, I lumped them all back together and returned to being a one-watchlist guy.

The watchlist is a bit long for a screenshot, but just in case you are wondering what is in it, here is the list of stock identifiers:

ABC, AMS, ANCR, ANP, AVON, AVV, BAG, BMY, BNZL, BOWL, BOY, BVXP, CGS, CHH, CHRT, CRPR, D4T4, DIA, DOTD, DPLM, DSCV, DWHA, DWHT, ECM, FDEV, FOUR, GAW, GDWN, GRG, HOTC, HWDN, IGR, JDG, JET2, JHD, KETL, KNOS, LTHM, MOTR, NICL, NXT, OTB, PMP, PRV, PZC, QQ., QTX, RM., RSW, RWS, SCT, SDI, SOLI, SPX, TET, TFW, TRCS, TRI, TSTL, TUNE, VCT, VLX, VTC, XPP

To find out more about these shares, create a new portfolio and paste the identifiers into the Add multiple shares dialog and voila, you will have my watchlist in your SharePad.

Ideas that turned into investments

Only one of the shares I floated in this column in 2020 has made it all the way into my portfolio. D4t4 was the fourth software company I investigated and the first I bought as I sought to get to know the sector better.

This lack of activity does not reflect the quality of the shares I chose to investigate, it is because I have not added more money to my pension this year and it is fully invested in shares and funds.

Since I am a very reluctant seller, and dividend payouts have been scarce, I simply have not had the funds to invest in new ideas.

Most of the shares I wrote about in 2020 feature in my watchlist, which means I continue to evaluate them against the shares I already own.

I am following Bioventix, Volex, Porvair, James Latham, Bunzl, James Cropper, Advanced Medical Solutions, James Halstead, Hotel Chocolat, and Nichols with most intent.

Vitec and IG Designs intrigue me, but I have work to do before I understand Vitec fully and I am put off by the executives at IG Design’s apparent lack of interest in owning shares in the company they run.

Meanwhile I have ulterior motives for following On The Beach, Dialight, QinetiQ and DiscoverIE – an interest in companies that are similar but different (Jet2, FW Thorpe, Cohort and Solid State respectively).

Learning about listed analogues of companies we own is useful even if we do not intend to buy them. They tell us more about the industries we are invested in (holidays, lighting, defence, and electronics in the case of these shares). They might also turn out to be better investments .

I have yet to sell any of the SharePad babies delivered in these columns, including RM (part 1, part 2) and Bloomsbury Publishing (part 1, part 2) written up in 2019.

Next year, I will continue investigating industries I have up to now neglected, slowly growing my circle of competence. In December, I looked at soft drinks and have packaging in my sights.

A few special mentions

Closing an incredible year, I must doff my hat to two unheralded aspects of using and writing about SharePad.

First the portfolio tracking element. I have used SharePad, and before that, ShareScope, to track my portfolios since 2000 (ish). It works so well, it does not require explaining, but I rely on it to reconcile my brokerage accounts and (very occasionally) show me how I am doing.

The second is the other users, those that read these articles and send me emails. You have encouraged, inspired and corrected me in 2020, just like previous years.

Thank you, and Happy Christmas.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

*Words and phrases I look for in company announcements:

Competitive advantage

Employee engagement

Employee retention

Employee turnover

Founder

Installed base

Intellectual property

Long-term

Net-promoter score

Niche

Patent

Patented

Profitability

Repeat business

Return on capital

Return on total invested capital

ROIC

ROTIC

Specialist

Staff engagement

Staff retention

Staff turnover

Sustainable

Value chain

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.

Lessons from lockdown and other stories

This year has confirmed that most of the news is at best irrelevant to me as an investor.

Worse, the news stressed me out. It regularly fed my mind with impossible problems to solve. Companies I admired closed down, temporarily I hoped. They raised money in emergency fund-raisings. They furloughed staff.

So far, the determination and inventiveness of these companies, helped by government support, means none have shown any sign of going bust. Some have repaid the furlough money and business rates relief.

As a long-term investor I rely on the people working for the businesses I invest in to work out what to do in difficult times.

I specifically chose these businesses because they were prudent, well managed, inventive and should survive when things get tough so, on more than one occasion this year, I found myself questioning why I read the news in general, and specifically the company announcements in SharePad.

But I have not cancelled my subscription to The Times, and I still skim the news for the shares in my watchlist (see below) most days, at the end of the day, or at the end of the week if I am especially busy. To help me do it quickly I still filter out the irrelevant news.

That is because the news contains information useful to long-term investors, hints of strategy and culture, that can help us understand businesses better and what will drive prosperity in future.

I already had a collection of words that are indicative of long-term strategic thinking and people-focused cultures in my “Companies that speak my language” news filter, so when SharePad introduced a new feature to allow us to highlight words in news articles even if we had not searched for them, I dumped them into the News Design dialog.

This helps me to quickly find news I can use, when I am reading the news feed:

The News Design dialog allows us to select words to highlight in the news feed. *The full list of words is at the end of this article.

A strong balance sheet is not just for lockdown

In March and April, when the first lockdown confined many of us to our homes for all but one hour of exercise I turned to filtering for the most financially secure shares.

After a couple of experiments, I settled on a filter that retrieves companies that had more cash than debt at the time of their last published balance sheets.

Debt levels at some companies can fluctuate dramatically so the filter also incorporated interest cover to highlight companies that paid lots of interest during the year, even if they had little debt when they reported.

I also wanted to make sure that the companies that passed the filter had earned their strong balance sheets and not just raised money from shareholders, so I excluded companies that had issued lots of new shares in the previous five years.

The result was In search of the cash kings.

The companies that passed the filter in April had not prepared for a pandemic. They were probably just prudent, and the prudent thing for long-term investors is to invest in companies like them.

These are the companies that pass the filter in December 2020:

The table shows results 34 to 56, ordered by the debt adjusted price earnings ratio. Companies valued at more than 25 times earnings or less than 10 times earnings have been excluded.

It is an interesting list of strong companies at not unreasonable prices. I profiled QinetiQ, James Latham and Nichols in 2020, and plan to profile Barr early in 2021 as I extend my research into the soft drinks market.

It is intriguing to see Moneysupermarket in the list, and I confess to being a shareholder in FW Thorpe, Solid State and Bloomsbury Publishing.

Keep it simple

In last year’s edition of this article I celebrated a proliferation of watchlists, each one focused on companies in particular industries I follow, like holidays, or companies that share other qualities: staff-focused firms and owner-managed businesses, for example.

In practice many companies fitted in more than one watchlist and curating so many lists gave me a headache. To keep things simple, never a bad policy, I lumped them all back together and returned to being a one-watchlist guy.

The watchlist is a bit long for a screenshot, but just in case you are wondering what is in it, here is the list of stock identifiers:

ABC, AMS, ANCR, ANP, AVON, AVV, BAG, BMY, BNZL, BOWL, BOY, BVXP, CGS, CHH, CHRT, CRPR, D4T4, DIA, DOTD, DPLM, DSCV, DWHA, DWHT, ECM, FDEV, FOUR, GAW, GDWN, GRG, HOTC, HWDN, IGR, JDG, JET2, JHD, KETL, KNOS, LTHM, MOTR, NICL, NXT, OTB, PMP, PRV, PZC, QQ., QTX, RM., RSW, RWS, SCT, SDI, SOLI, SPX, TET, TFW, TRCS, TRI, TSTL, TUNE, VCT, VLX, VTC, XPP

To find out more about these shares, create a new portfolio and paste the identifiers into the Add multiple shares dialog and voila, you will have my watchlist in your SharePad.

Ideas that turned into investments

Only one of the shares I floated in this column in 2020 has made it all the way into my portfolio. D4t4 was the fourth software company I investigated and the first I bought as I sought to get to know the sector better.

This lack of activity does not reflect the quality of the shares I chose to investigate, it is because I have not added more money to my pension this year and it is fully invested in shares and funds.

Since I am a very reluctant seller, and dividend payouts have been scarce, I simply have not had the funds to invest in new ideas.

Most of the shares I wrote about in 2020 feature in my watchlist, which means I continue to evaluate them against the shares I already own.

I am following Bioventix, Volex, Porvair, James Latham, Bunzl, James Cropper, Advanced Medical Solutions, James Halstead, Hotel Chocolat, and Nichols with most intent.

Vitec and IG Designs intrigue me, but I have work to do before I understand Vitec fully and I am put off by the executives at IG Design’s apparent lack of interest in owning shares in the company they run.

Meanwhile I have ulterior motives for following On The Beach, Dialight, QinetiQ and DiscoverIE – an interest in companies that are similar but different (Jet2, FW Thorpe, Cohort and Solid State respectively).

Learning about listed analogues of companies we own is useful even if we do not intend to buy them. They tell us more about the industries we are invested in (holidays, lighting, defence, and electronics in the case of these shares). They might also turn out to be better investments .

I have yet to sell any of the SharePad babies delivered in these columns, including RM (part 1, part 2) and Bloomsbury Publishing (part 1, part 2) written up in 2019.

Next year, I will continue investigating industries I have up to now neglected, slowly growing my circle of competence. In December, I looked at soft drinks and have packaging in my sights.

A few special mentions

Closing an incredible year, I must doff my hat to two unheralded aspects of using and writing about SharePad.

First the portfolio tracking element. I have used SharePad, and before that, ShareScope, to track my portfolios since 2000 (ish). It works so well, it does not require explaining, but I rely on it to reconcile my brokerage accounts and (very occasionally) show me how I am doing.

The second is the other users, those that read these articles and send me emails. You have encouraged, inspired and corrected me in 2020, just like previous years.

Thank you, and Happy Christmas.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

*Words and phrases I look for in company announcements:

Competitive advantage

Employee engagement

Employee retention

Employee turnover

Founder

Installed base

Intellectual property

Long-term

Net-promoter score

Niche

Patent

Patented

Profitability

Repeat business

Return on capital

Return on total invested capital

ROIC

ROTIC

Specialist

Staff engagement

Staff retention

Staff turnover

Sustainable

Value chain

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.