While the stock market and the pandemic may have stabilised, I’m still thinking about financially strong firms. We never know when the next shock will happen, and a cash cushion gives us confidence a company will make it through when revenue melts away.

I spent the last two articles experimenting with filters to find financially strong firms. This time I have lashed the concepts in those articles together into one filter, to help find cash kings. Companies that had more cash than debt at the year end as a result of their profitable businesses.

We have put the filter in SharePad’s filter library [Simply go to: Filter -> Apply filter -> Library -> ‘Richard Beddard 29/04/20: In search of the cash kings’] for you to experiment with. Here’s a brief explanation:

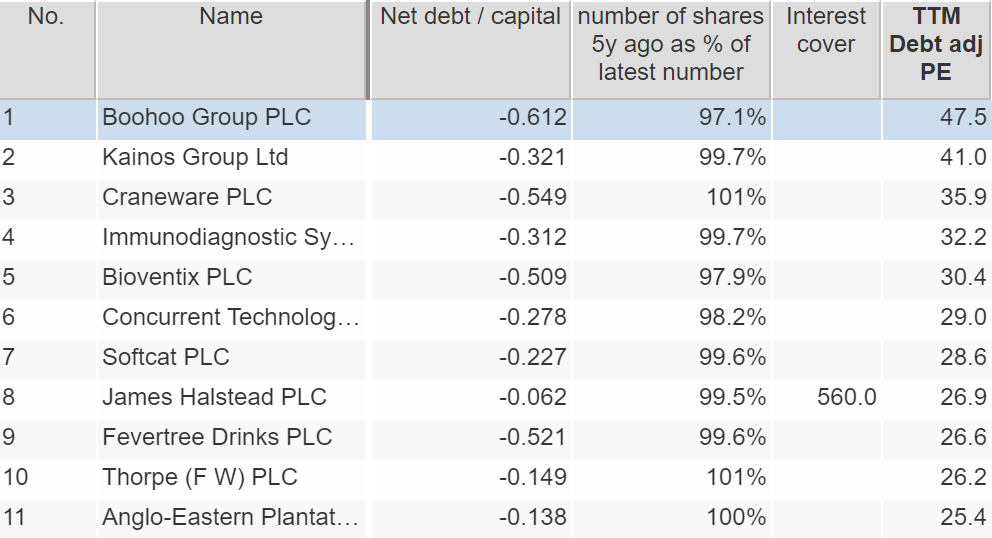

Net debt/capital – All of the companies that pass the filter have negative net debt to capital because they had more cash than debt on the date of their last published balance sheet. Multiply net debt/capital by 100 and we get debt as a percentage of capital, a measure of surplus cash against the size of the business.

Number of shares five years ago as a percentage of the latest number – This is a way of weeding out companies that may have achieved their cash surpluses by raising substantial sums from investors rather than earning it.

The filter also requires companies to have earned a profit over the latest reported twelve month period, and positive free cash flow over the last five years. The results table excludes these columns but includes two additional columns to help us decided which of the shares returned by the filter to investigate first:

Interest cover – Interest cover compares interest and profit to measure the affordability of a company’s debt. Low interest cover (less than say 10 times profit) implies one of two things, neither desirable. Either the company isn’t earning much, or it had substantial debt at some point in the last reported year, even though it had none at the end of it.

Debt-adjusted PE – This compares the value of the enterprise to its profit. Companies that have high debt-adjusted price earnings ratios don’t earn much profit compared to the price we must pay for the business. To justify the valuation, they must grow and earn more profit in future.

The filter brings back 45 results, which I have sorted by debt-adjusted PE and arranged into three categories:

Too hot to handle

These are the most highly rated companies, the ones traders expect to grow most, with PEs above 25:

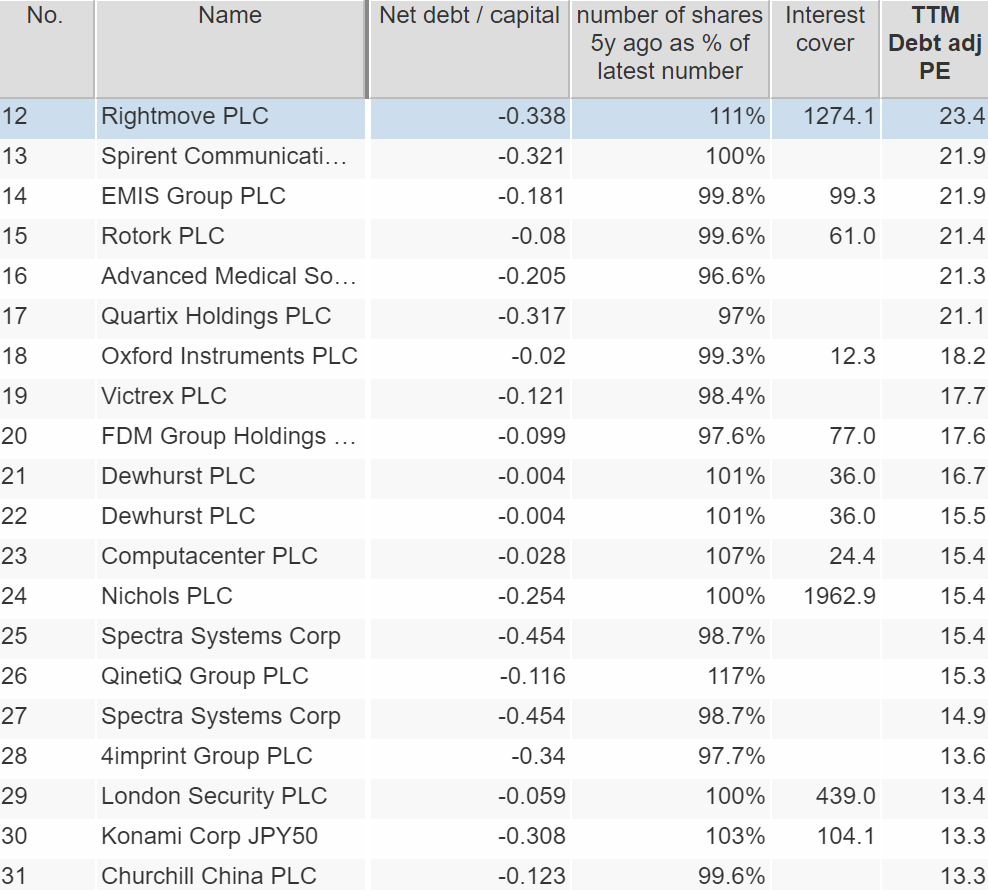

Too risky to touch

These are the lowest rated companies, with PEs of less than 10, the ones traders expect to contract most:

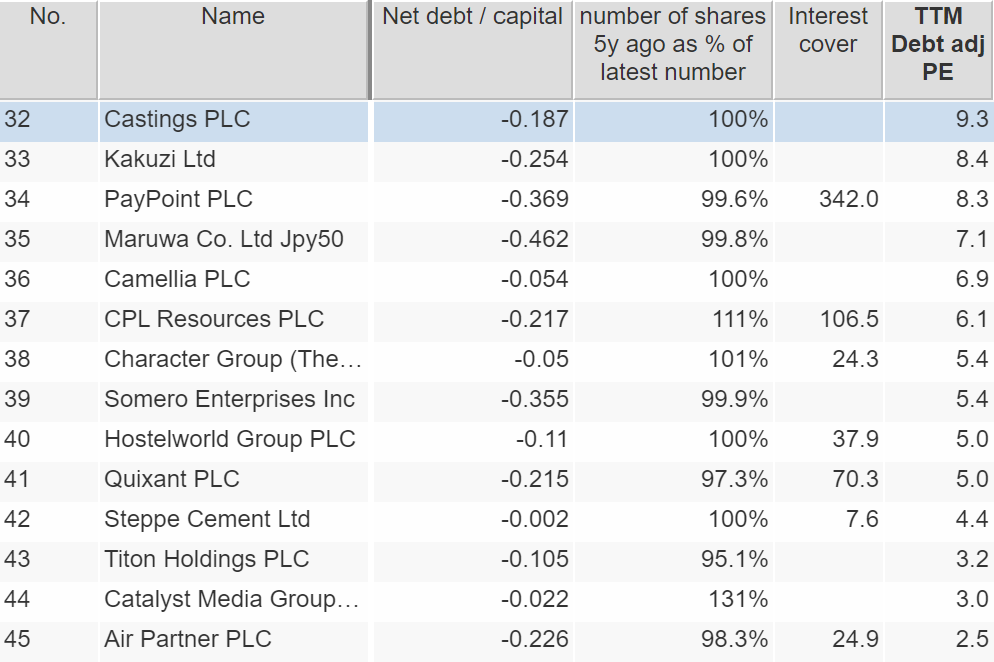

Goldilocks zone

Like goldilocks and the porridge, I’ve left the shares that are just about right until last:

Dividing this group of shares into three brings to mind Jeremy Grime’s commentary earlier this month in which he described a wall of money searching for valuable assets (gold, and unique companies). Jeremy said investors have favoured unique companies for a long time, and hence their share prices are already expensive. I sensed a preference for what he called “impaired assets”, companies that have low share prices compared to their profits, the ones I have dubbed too risky to touch.

Jeremy used the analogy of a barbell to describe where the market may be going, with companies bunched up at the ends: very cheap, or very expensive depending on whether they are companies special or impaired.

In my sample the bar is thicker than the bells, and my preference is to pick shares from the bar.

Buy what you know

There’s money to be made from all segments of the barbell, whether we succeed or not depends on whether we are any good at buying and selling the kind of shares we find there.

Being a long-term investor I tend to leave too risky to touch shares alone because companies that are not unique or special cannot be relied upon to survive and prosper for ten years or more. If I buy them during this crisis, I will have to sell them before the next one.

I can illustrate how badly I do this, by showing you my experience trading one of the too risky to touch shares, Titon, in the aftermath of the great financial crisis:

More by luck than judgement I made some money, but if I’d held the shares longer I’d have made much more. I didn’t have the confidence to hold them for at least ten years despite Titon’s financial strength, because the company manufactures and sells window and door furniture (handles and latches) and ventilation systems, and as far as I could tell they, and the company, were not particularly remarkable.

I am more positive about the other end of the barbell. It’s worth investigating shares that are too hot to handle, because their share prices may come down.

As always though, I’m most interested in the Goldilocks zone or the bar of the barbell because it is more likely to contain unique businesses than the too risky to touch segment and they’re more likely to be priced reasonably than the too hot to handle segment. Casting my eye over the list, there are a few candidates just among the companies I already know reasonably well, all of them impacted by the pandemic:

- 4Imprint supplies promotional materials, and during the pandemic it’s winning about 20% of the orders it would normally expect to

- Churchill China manufactures tableware, principally for restaurants, caterers, and hotels, which are mostly closed

- Computacenter supplies hardware and software to big companies. The surge in home workers, and a need for better networks is replacing much of the business it has lost due to the pandemic

- Dewhurst manufactures and distributes lift components. Supplies are restricted and its UK manufacturing site is closed

- Quartix reports a reduction in new orders and that some customers are taking vehicles off the road. It supplies small businesses with vehicle tracking systems

- Rightmove, an online listing site for estate agents, is discounting listings while estate agents are unable to sell or rent out homes

- Victrex manufactures a specialised polymer used across industries that will be impacted to various degrees by the virus.

The other companies in the Goldilocks zone are also interesting, but of the ones I know well, 4Imprint and Victrex catch my eye.

4Imprint

I considered buying shares in 4Imprint in November 2018, when I raved about the quality of the business. Promotional tee-shirts and mugs are usually handed out when people meet, at conferences, exhibitions, tradeshows and so on or face to face in offices, and the pandemic has shut down this activity. The products are not special. 4Imprint sells in the USA, and it’s not currently in the US national interest to produce more marketing tat. I suspect a tee-shirt with a slogan on it from one supplier is much like one from another. What makes 4Imprint special is its culture, which is devoted to 100% customer satisfaction, the systems it has built to deliver satisfaction, and the goodwill this creates.

Here’s Kevin, the company’s long-serving ceo to explain:

Living up to these promises turned 4Imprint into the biggest direct supplier of promotional materials in the US and a feted place to work.

I don’t think 4Imprint is a Titon. Both companies have cash buffers, but 4Imprint is far more profitable in the good times and hitherto at least, it’s been less unprofitable in the bad times. It’s the big fish, not the little competitor, which gives me something to hang my confidence on.

Victrex

Victrex does make something special, PEEK, the highest grade polymer there is. Victrex, then part of ICI, invented PEEK, and it has over half of the world’s manufacturing capacity. Its UK facilities are operational and PEEK is used in essential products like medical implants and, the company says, by a number of companies making ventilators. PEEK is so light and tough it is useful in a vast array of products including anti-locking brakes, aircraft fuel tanks, speakers, and the impellers in Dyson vacuum cleaners.

Like 4Imprint, profits contract at Victrex when businesses do. But also like 4Imprint, I have something to hang my confidence in addition to the cash surplus. It’s a big fish, and it’s unique in its ability to produce specific grades of PEEK, meet new demand, and form components for industry.

Richard Beddard

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for educational purposes only. It is not a recommendation to buy or sell shares or other investments. Do your own research before buying or selling any investment or seek professional financial advice.